Impact Of UK Wind Auction Reform: Vestas Highlights Investment Risks

Table of Contents

Changes to the UK's Contract for Difference (CfD) Auction System

The UK's Contract for Difference (CfD) auction system, designed to support renewable energy projects, has undergone significant reform. These changes, while intended to drive innovation and efficiency, have introduced considerable uncertainty for investors.

Reduced Contract Lengths

One of the most significant changes is the reduction in contract lengths. Shorter contract durations introduce increased financial risk for developers.

- Increased financial risk: The shorter timeframe limits the period over which investors can recoup their investment, making projects less attractive.

- Difficulty securing long-term debt: Financial institutions are less likely to provide long-term loans for projects with shortened revenue streams.

- Potential for project delays due to financing hurdles: The difficulty in securing financing can lead to delays or even cancellations of projects.

Increased Competition

The reformed system has witnessed a surge in bids, resulting in lower strike prices – the guaranteed price paid to renewable energy generators. This heightened competition puts immense pressure on profit margins.

- Higher competition for limited contracts: More developers are vying for a smaller number of available contracts, driving down prices.

- Pressure on margins: Lower strike prices combined with potentially rising construction and operational costs can squeeze profit margins, potentially leading to losses.

- Potential for loss-making projects if costs escalate: Unforeseen cost increases during construction or operation could render projects unprofitable.

Shifting Emphasis on Technology

The auctions now prioritize technological innovation. While encouraging advancements, this shift creates risks for established technologies and new market entrants.

- Risk for established technologies: Projects using mature, well-understood technologies might be less competitive against newer, potentially riskier technologies.

- Barriers to entry for new entrants: The focus on innovation could disadvantage smaller companies or those with less established technologies.

- Potential for reduced diversity in the UK's energy mix: An over-emphasis on specific technologies could limit the diversity of the UK's energy portfolio.

Vestas' Perspective and Investment Concerns

Vestas, a global leader in wind turbine technology, has been outspoken about the challenges posed by the UK Wind Auction Reform. Their concerns highlight the broader implications for the industry.

Impact on Vestas' UK Operations

The auction changes are directly affecting Vestas' investment strategies in the UK.

- Reduced order backlog: Fewer projects awarded contracts could lead to a reduction in orders for Vestas turbines.

- Potential job losses: A decline in project activity might necessitate workforce reductions within Vestas' UK operations and its supply chain.

- Impact on supply chain partnerships: Reduced demand from projects could negatively impact Vestas' UK supply chain partners.

Calls for Policy Clarity and Stability

Vestas has publicly advocated for greater clarity and stability in UK renewable energy policy.

- Need for longer-term contracts: Longer contract terms would reduce financial risks and encourage long-term investment.

- Improved transparency in the auction process: A more transparent process would build investor confidence and promote fair competition.

- Greater support for the offshore wind sector: Offshore wind projects, often more complex and expensive, require stronger policy support.

Wider Implications for the UK Renewable Energy Sector

The implications of the UK Wind Auction Reform extend far beyond individual companies, impacting the broader UK renewable energy landscape.

Impact on Renewable Energy Targets

The reforms could hinder the UK's ability to achieve its ambitious renewable energy targets.

- Potential delays in project development: Increased investment risks could delay or even prevent projects from reaching completion.

- Reduced investment in renewable energy infrastructure: Uncertainty and reduced profitability may discourage future investments in renewable energy.

- Impact on carbon reduction goals: Delays in renewable energy deployment will slow the transition to a low-carbon energy system.

Attracting Foreign Investment

The changes to the auction system could negatively affect the UK's ability to attract vital foreign investment.

- Reduced investor confidence: The increased uncertainty and risks associated with the reformed system may deter foreign investors.

- Increased risk aversion: Foreign investors are likely to prioritize countries with more stable and predictable renewable energy policies.

- Competition from other countries with more stable regulatory environments: The UK faces competition from other countries offering more attractive investment conditions for renewable energy projects.

Conclusion

The reform of the UK wind auction system, as evidenced by Vestas' concerns, presents significant challenges for the future of wind energy development. Reduced contract lengths, intensified competition, and the altered focus on technology introduce substantial investment risks, potentially impacting project viability, job creation, and the UK's progress towards its renewable energy goals. The need for greater policy clarity, stability, and long-term support for the industry is undeniable. Understanding the implications of this UK wind auction reform is crucial for all stakeholders. To stay informed on this dynamic landscape, continue following developments in UK wind auction policy and its effects on the industry.

Featured Posts

-

Mission Impossible Dead Reckoning Part Two Behind The Scenes Of Svalbard Filming

Apr 26, 2025

Mission Impossible Dead Reckoning Part Two Behind The Scenes Of Svalbard Filming

Apr 26, 2025 -

Exclusive Hegseth Reacts To Pentagon Leaks And Growing Internal Conflict

Apr 26, 2025

Exclusive Hegseth Reacts To Pentagon Leaks And Growing Internal Conflict

Apr 26, 2025 -

Open Ai Facing Ftc Investigation Understanding The Regulatory Landscape For Ai

Apr 26, 2025

Open Ai Facing Ftc Investigation Understanding The Regulatory Landscape For Ai

Apr 26, 2025 -

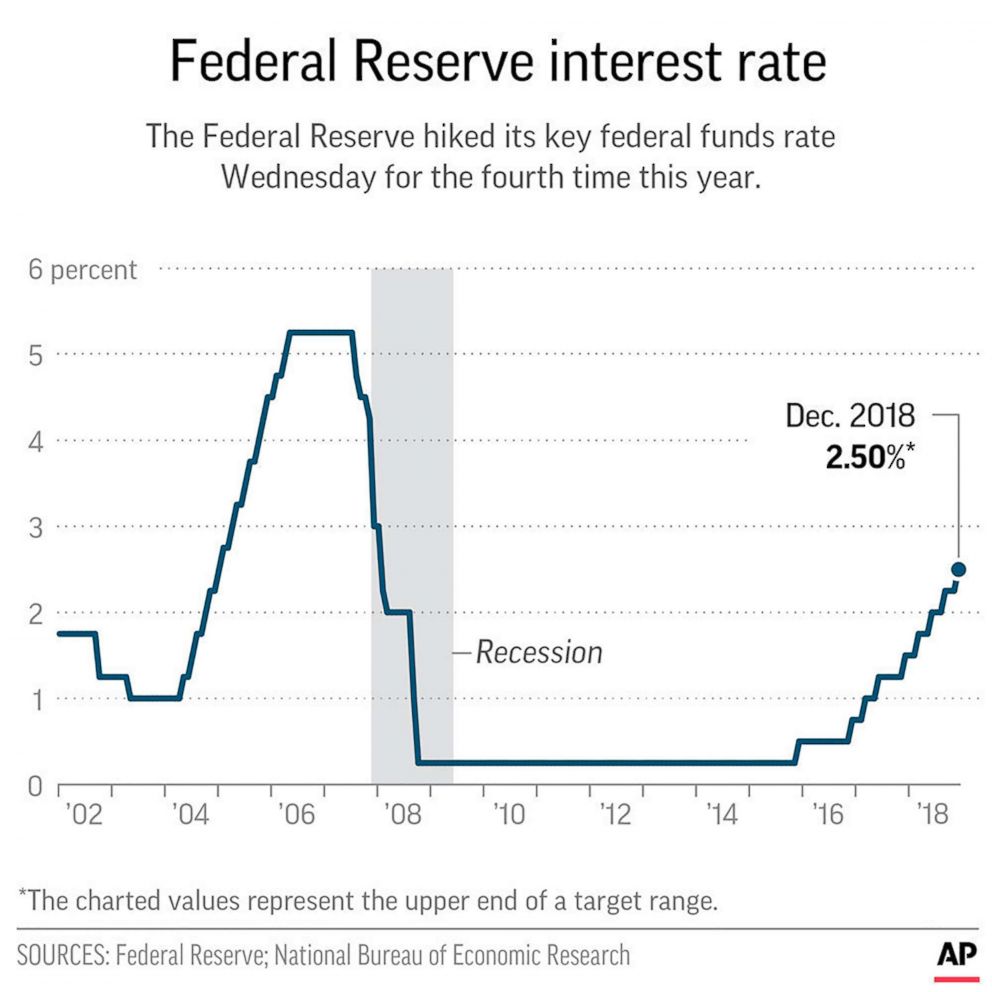

Economic Uncertainty The Next Fed Chairs Trump Sized Problem

Apr 26, 2025

Economic Uncertainty The Next Fed Chairs Trump Sized Problem

Apr 26, 2025 -

Turkey To Get New Tug Damen And Icdas Collaboration

Apr 26, 2025

Turkey To Get New Tug Damen And Icdas Collaboration

Apr 26, 2025