Indian Bourse BSE Sees Share Price Surge On Positive Earnings

Table of Contents

Positive Earnings Drive BSE Share Price Upward

The recent surge in the BSE share price is directly attributable to its impressive financial performance. The BSE earnings report showcased several key positive indicators, highlighting a strong upward trend. This robust performance reflects increased investor participation, successful strategic initiatives, and favorable market conditions.

- Net profit increased by 15% compared to the same period last year. This significant jump in profitability demonstrates the BSE's ability to capitalize on market opportunities and effectively manage its operations.

- Trading volume showed a 20% increase. Higher trading volumes indicate increased investor activity and confidence in the market, directly benefiting the BSE.

- Revenue growth reached 12%. This steady revenue growth underscores the BSE's sustainable business model and its potential for further expansion.

The factors contributing to this positive performance are multifaceted. Increased participation from both domestic and international investors fueled higher trading activity. The successful implementation of new trading technologies and initiatives to attract more listed companies also played a significant role. Favorable macroeconomic conditions within India further enhanced the overall market sentiment, boosting the BSE's performance. Keywords: BSE earnings report, financial performance, profit increase, trading volume, revenue growth.

Impact of the Surge on Indian Investors and the Market

The BSE share price surge has significant implications for both individual and institutional investors. The increased share price translates to higher returns for existing shareholders, boosting investor confidence in the Indian stock market.

- Increased investor confidence in the Indian stock market: The positive performance of the BSE acts as a catalyst, potentially encouraging further investment in other Indian companies and sectors.

- Potential for further investment in BSE-listed companies: The surge reflects a positive outlook on the overall health of the Indian economy and its listed companies.

- Ripple effect on related sectors and indices: The BSE's success often influences other sectors and indices, leading to a broader positive market sentiment.

Market analysts have largely expressed optimism, citing the BSE's robust performance as a sign of overall market strength. The surge has been interpreted as a vote of confidence in the Indian economy's growth trajectory. This positive sentiment is likely to attract further foreign investment, adding to the momentum. Keywords: Indian investors, market impact, investor confidence, stock market trends, BSE index.

Future Outlook for BSE Share Price and the Indian Stock Market

While the current trend is positive, a cautious yet optimistic outlook is warranted for the future performance of the BSE share price. Sustained growth is possible, but several factors could influence its trajectory.

- Potential for sustained growth based on current trends: The strong earnings and increased investor confidence suggest potential for continued growth.

- Challenges that could impact future performance: Global economic uncertainties, shifts in government policy, and unexpected market events could pose challenges.

- Predictions and forecasts from financial analysts: While many analysts are positive, it’s crucial to consult various forecasts and consider diverse perspectives.

[Insert relevant chart/graph showing BSE share price trend here, if available.]

The future of the BSE, and the Indian stock market as a whole, will depend on several interconnected factors. Maintaining a stable regulatory environment, managing economic volatility, and continuous adaptation to global market trends will be crucial for sustained growth. Keywords: BSE future outlook, stock market prediction, market forecast, economic factors, government policy.

Conclusion: BSE Share Price Surge Signals Positive Growth – Invest Wisely

The recent BSE share price surge, driven by strong earnings, signals positive growth within the Indian stock market. This surge has boosted investor confidence and is likely to have a ripple effect across various sectors. While the outlook is optimistic, it's crucial to remember that investing always carries risks. It's essential to conduct thorough research, understand your risk tolerance, and diversify your portfolio before making any investment decisions. The BSE share price represents an intriguing opportunity, but careful consideration is key. The BSE share price surge offers exciting potential; seize the opportunity to research and invest wisely in the Indian stock market. Keywords: BSE share price, investment opportunities, Indian stock market, BSE investment.

Featured Posts

-

Eight Year Sentence For Driver In Fatal San Carlos Street Race

May 07, 2025

Eight Year Sentence For Driver In Fatal San Carlos Street Race

May 07, 2025 -

Investigative Journalism Triumphs Pulitzer Prizes For The Wall Street Journal Pro Publica And Reuters

May 07, 2025

Investigative Journalism Triumphs Pulitzer Prizes For The Wall Street Journal Pro Publica And Reuters

May 07, 2025 -

Minnesotas Randle A Success Story The Knicks Couldnt Achieve

May 07, 2025

Minnesotas Randle A Success Story The Knicks Couldnt Achieve

May 07, 2025 -

El Futuro Olimpico De Simone Biles Los Angeles 2028 En La Balanza

May 07, 2025

El Futuro Olimpico De Simone Biles Los Angeles 2028 En La Balanza

May 07, 2025 -

Rihannas Pregnancy Announcement Baby 3 On The Way

May 07, 2025

Rihannas Pregnancy Announcement Baby 3 On The Way

May 07, 2025

Latest Posts

-

Currys Injury Steve Kerr Offers Encouraging Update For Warriors Fans

May 07, 2025

Currys Injury Steve Kerr Offers Encouraging Update For Warriors Fans

May 07, 2025 -

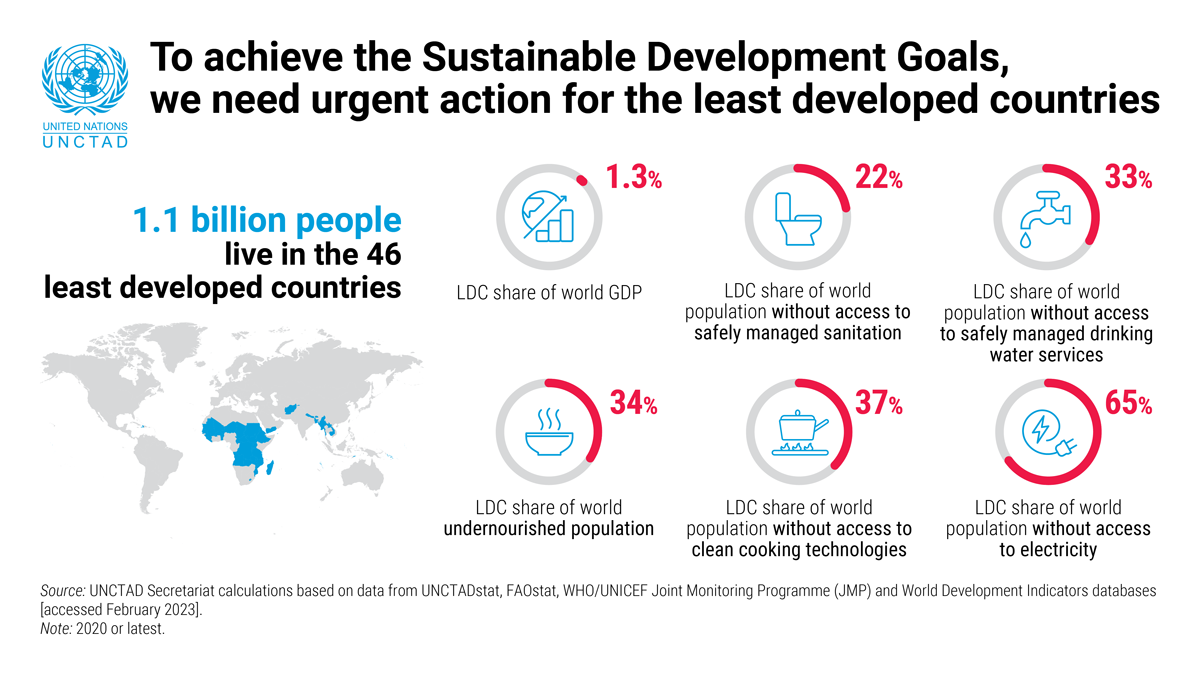

A Framework For Building Resilience And Promoting Sustainable Growth In Ldcs

May 07, 2025

A Framework For Building Resilience And Promoting Sustainable Growth In Ldcs

May 07, 2025 -

Steve Kerrs Positive Outlook On Stephen Currys Injury

May 07, 2025

Steve Kerrs Positive Outlook On Stephen Currys Injury

May 07, 2025 -

Enhancing Resilience And Sustainable Development In Least Developed Countries

May 07, 2025

Enhancing Resilience And Sustainable Development In Least Developed Countries

May 07, 2025 -

Golden State Warriors Coach Kerr On Currys Injury Return

May 07, 2025

Golden State Warriors Coach Kerr On Currys Injury Return

May 07, 2025