Infineon (IFX): Lower Sales Projections Due To Tariff Uncertainty

Table of Contents

Reasons for Lowered Sales Projections

The downward revision of Infineon's sales projections stems from a confluence of factors, primarily driven by external forces beyond the company's immediate control.

Impact of Tariffs and Trade Wars

Escalating tariffs, particularly the ongoing trade tensions between the US and China, are significantly disrupting Infineon's operations. These tariffs directly increase production costs, impacting the price competitiveness of Infineon's products in key markets. Furthermore, export restrictions and supply chain disruptions caused by trade wars create significant uncertainty and logistical challenges.

- Increased Production Costs: Tariffs on imported components raise the cost of manufacturing, squeezing profit margins.

- Reduced Export Opportunities: Tariffs imposed on Infineon's products in certain markets reduce export volumes and revenue.

- Supply Chain Disruptions: Trade wars lead to delays and uncertainties in the supply chain, potentially causing production bottlenecks.

- Example: Tariffs on certain automotive semiconductors, a key market for Infineon, have directly impacted profitability and forced price adjustments.

The resulting volatility in the global semiconductor market, fueled by these trade wars and tariffs, makes accurate sales forecasting incredibly challenging.

Weakening Global Demand

Beyond tariffs, a broader economic slowdown is impacting the demand for semiconductors. Reduced consumer spending and decreased industrial investment are leading to lower-than-anticipated orders for Infineon's products. This weakening global demand is a significant factor contributing to the lowered sales projections.

- Reduced Consumer Spending: Economic uncertainty leads to decreased consumer spending on electronics, impacting demand for Infineon's components in consumer products.

- Decreased Industrial Investment: Businesses are delaying or reducing investments in new projects due to economic headwinds, lowering demand for industrial semiconductors.

- Industry Data: Reports from leading market research firms show a general slowdown in the semiconductor industry, corroborating Infineon's assessment of weakening demand.

Competition and Market Saturation

The semiconductor industry is fiercely competitive. Infineon faces pressure from established players and emerging competitors, impacting its ability to maintain market share and achieve its sales targets. Market saturation in certain sectors further complicates the situation.

- Intense Competition: Companies like STMicroelectronics, NXP Semiconductors, and Texas Instruments are major competitors vying for market share.

- Market Saturation: In some segments, particularly mature markets, competition is intensifying, resulting in price pressure and reduced margins.

- Aggressive Pricing Strategies: Competitors are employing aggressive pricing strategies, putting further pressure on Infineon's profitability.

Impact on Infineon's Financial Performance

The lowered sales projections have a direct and significant impact on Infineon's financial performance.

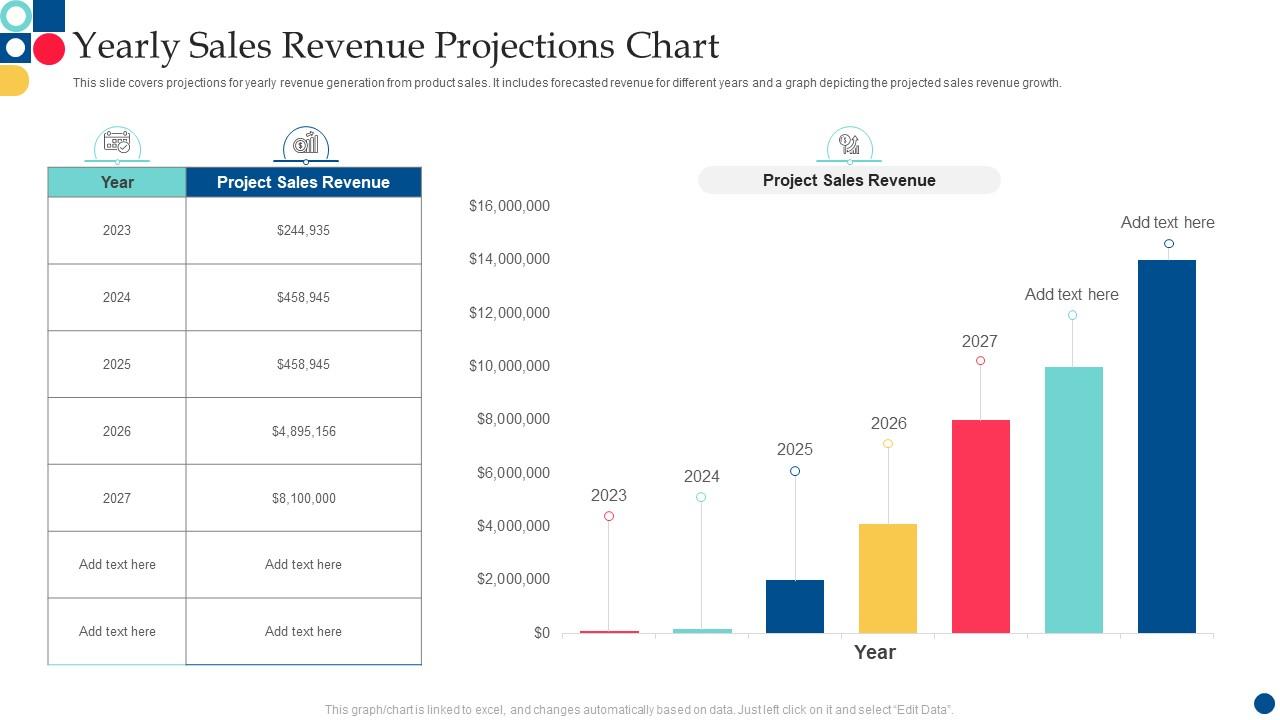

Revised Earnings Guidance

Infineon has revised its earnings guidance downward, reflecting the challenges described above. The specific percentage changes in projected revenue and earnings should be consulted in Infineon's official financial statements. This revised guidance represents a notable departure from previous forecasts, highlighting the severity of the current market conditions.

Stock Market Reaction

The announcement of lowered sales projections triggered a negative reaction in the stock market. The IFX stock price experienced a decline following the announcement, reflecting investor concern about the company's near-term prospects. Analyst ratings and investor sentiment have also been affected, with some expressing caution while others maintain a more optimistic long-term outlook.

Future Implications for Infineon

While the current situation presents challenges, Infineon is actively working to mitigate the negative impact of tariff uncertainty and the weakening global demand.

Strategies for Mitigation

Infineon is implementing several strategies to navigate these difficult times.

- Supply Chain Diversification: Reducing reliance on single-source suppliers to enhance resilience against disruptions.

- Market Expansion: Exploring new and emerging markets to offset weaknesses in existing regions.

- R&D Investment: Continuing to invest in research and development to maintain a technological edge and develop new, innovative products.

Long-Term Outlook

Despite the short-term headwinds, Infineon's long-term prospects remain relatively positive. The company’s strong technological capabilities, diverse product portfolio, and established customer base provide a solid foundation for future growth. The semiconductor industry is expected to experience a recovery in the coming years, presenting opportunities for Infineon to regain momentum. However, the ongoing impact of global trade policies and economic factors remains a key uncertainty.

Conclusion: Infineon (IFX) and the Ongoing Impact of Tariff Uncertainty

Infineon's lowered sales projections are a direct consequence of tariff uncertainty, weakening global demand, and intense competition. This has resulted in revised earnings guidance and a negative stock market reaction. However, Infineon is actively employing strategies to mitigate these challenges and maintain its position in the long term. To make informed investment decisions regarding Infineon (IFX), stay informed about the evolving landscape of global trade and tariff policies, paying close attention to Infineon's future prospects and their ability to manage tariff risks in the semiconductor market.

Featured Posts

-

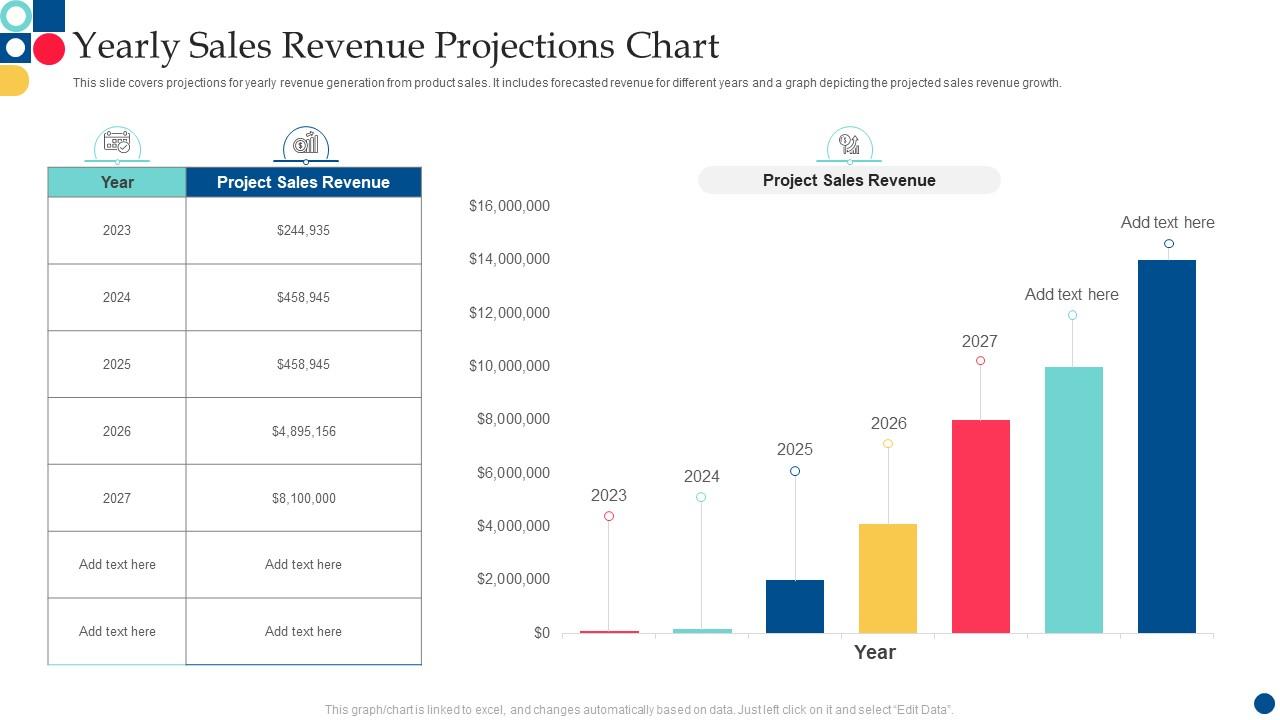

2023 Nl Federal Election Candidate Comparison Guide

May 10, 2025

2023 Nl Federal Election Candidate Comparison Guide

May 10, 2025 -

Oilers Fall To Lightning 4 1 Kucherovs Impact Decisive

May 10, 2025

Oilers Fall To Lightning 4 1 Kucherovs Impact Decisive

May 10, 2025 -

Ajaxs Brobbey Physical Prowess Poised To Dominate Europa League

May 10, 2025

Ajaxs Brobbey Physical Prowess Poised To Dominate Europa League

May 10, 2025 -

Wynne Evans Responds To Allegations I Promise I Have Done Nothing Wrong

May 10, 2025

Wynne Evans Responds To Allegations I Promise I Have Done Nothing Wrong

May 10, 2025 -

Stock Market Valuations Bof As Reasons For Investor Calm

May 10, 2025

Stock Market Valuations Bof As Reasons For Investor Calm

May 10, 2025