Inflation Persists: ECB Links Rise To Continued Fiscal Support

Table of Contents

The Persistent Inflation Problem in the Eurozone

Eurozone inflation remains stubbornly high, far exceeding the ECB's target of 2%. Several factors contribute to this persistent inflation. Supply chain disruptions stemming from the pandemic and the war in Ukraine continue to constrain the availability of goods, driving up prices. Soaring energy prices, fueled by geopolitical instability and reduced energy supplies, have significantly impacted inflation across the board. Finally, strong demand-pull inflation, resulting from increased consumer spending and robust economic growth in certain sectors, is also contributing to the overall inflationary pressure.

- Headline Inflation: This measures the overall rate of inflation, including volatile components like energy and food prices. Recent data shows headline inflation remaining significantly above the ECB's target.

- Core Inflation: This excludes volatile components, providing a clearer picture of underlying inflationary pressures. While core inflation has shown some signs of easing, it remains elevated, indicating that inflationary pressures are not solely driven by energy and food costs.

- Statistics and Data: (Insert relevant statistics and data on Eurozone inflation rates, core inflation, and energy prices from reputable sources like Eurostat or the ECB website. For example: "In October 2023, Eurozone headline inflation stood at X%, while core inflation reached Y%.")

The ECB's Response: Interest Rate Hikes

In response to persistent inflation, the ECB has implemented a series of interest rate hikes. These increases aim to curb inflation by reducing borrowing costs for businesses and consumers. Higher interest rates make borrowing more expensive, thus dampening investment and consumer spending, ultimately slowing down economic activity and reducing demand-pull inflation.

- Mechanism: The ECB’s interest rate hikes directly influence market interest rates, making loans more expensive for banks and subsequently for businesses and households. This reduced borrowing leads to decreased investment and consumption, cooling down the economy and easing price pressures.

- Quantitative Tightening: Alongside interest rate hikes, the ECB has also undertaken quantitative tightening (QT), reducing its holdings of government bonds. This further restricts the money supply, reinforcing the anti-inflationary effect of higher interest rates.

- Potential Downsides: While necessary to combat inflation, interest rate hikes carry potential risks. They can slow economic growth, potentially leading to a recession, and increase unemployment. A delicate balancing act is required to control inflation without triggering a significant economic downturn.

The Role of Fiscal Policy in Fueling Inflation

Government fiscal policies, including stimulus packages and subsidies, can significantly impact inflation. While necessary to support economies during crises, prolonged and substantial fiscal support can fuel inflationary pressures by increasing aggregate demand. This is especially true when supply-side constraints limit the economy's capacity to meet the increased demand.

- Fiscal Stimulus and Inflation: Government spending injections, while boosting economic activity in the short term, can lead to increased demand, exacerbating existing inflationary pressures if the supply of goods and services cannot keep pace.

- Subsidies and Energy Prices: Subsidies aimed at mitigating the impact of high energy prices can also contribute to inflation if they artificially inflate demand without addressing the underlying supply-side issues.

- Monetary-Fiscal Policy Mix: The optimal balance between fiscal and monetary policy remains a subject of ongoing debate. Effective coordination between fiscal and monetary authorities is crucial to ensure that policies work in tandem, rather than counteracting each other.

The Interplay Between Fiscal Support and ECB Actions

The relationship between the ECB's monetary policy and continued government fiscal support is complex and often characterized by potential conflicts. Fiscal stimulus can counteract the ECB's efforts to control inflation by boosting demand, while higher interest rates can increase the cost of government borrowing and potentially constrain fiscal spending. Effective coordination between fiscal and monetary authorities is essential to ensure policy coherence and effectiveness.

- Conflicting Objectives: The ECB aims to control inflation through monetary policy, while governments may prioritize economic growth and social support through fiscal policies. These objectives can sometimes clash, making coordinated policy-making challenging.

- Coordination Challenges: Effective coordination requires open communication, shared understanding of objectives, and flexibility in policy responses. Lack of coordination can lead to ineffective policy outcomes and increased economic uncertainty.

- Potential Solutions: Improved communication channels, joint policy assessments, and the development of shared frameworks for policy decision-making are crucial for effective coordination.

Potential Risks and Outlook for the Eurozone Economy

Persistent inflation and the ECB's response pose several risks to the Eurozone economy. Prolonged high inflation can erode purchasing power, hurt consumer confidence, and potentially destabilize financial markets. The ECB's interest rate hikes, while aiming to curb inflation, also risk slowing economic growth and increasing unemployment.

- Economic Risks: The primary risks include a prolonged period of high inflation, a significant economic slowdown, or even a recession, and increased unemployment.

- Financial Stability: High interest rates can increase the burden on highly indebted entities, potentially leading to financial instability.

- Eurozone Economic Outlook: The short-term outlook for the Eurozone economy depends largely on the effectiveness of the ECB's monetary policy, the evolution of global geopolitical factors and the success of measures taken to mitigate energy price shocks. The long-term outlook hinges on the ability of the Eurozone to address structural issues and implement sustainable economic growth strategies.

Conclusion: Navigating Persistent Inflation: The ECB's Ongoing Challenge

The Eurozone continues to grapple with persistent inflation, forcing the ECB to take decisive action through interest rate hikes. However, the effectiveness of these measures is complicated by continued government fiscal support, which can counteract the ECB's efforts to curb inflation. Effective coordination between fiscal and monetary policies is crucial to navigate this complex situation and to achieve sustainable economic growth while controlling inflation. The interplay between these policies presents a significant challenge for the Eurozone economy, requiring careful monitoring and adaptive policy responses. Stay informed about the ECB's ongoing efforts to control inflation and its impact on the Eurozone economy by following our regular updates and consulting reputable economic news sources.

Featured Posts

-

Is Ai Truly Thinking Examining The Cognitive Processes Of Artificial Intelligence

Apr 29, 2025

Is Ai Truly Thinking Examining The Cognitive Processes Of Artificial Intelligence

Apr 29, 2025 -

Open Ai 2024 Streamlined Voice Assistant Development

Apr 29, 2025

Open Ai 2024 Streamlined Voice Assistant Development

Apr 29, 2025 -

Exploring The Cognitive Architecture Of Ai Current Limitations And Future Directions

Apr 29, 2025

Exploring The Cognitive Architecture Of Ai Current Limitations And Future Directions

Apr 29, 2025 -

Mlb Scores Twins 6 Mets 3 Minnesota Takes Series Lead

Apr 29, 2025

Mlb Scores Twins 6 Mets 3 Minnesota Takes Series Lead

Apr 29, 2025 -

Trumps Next 100 Days A Deep Dive Into Trade Deregulation And Executive Actions

Apr 29, 2025

Trumps Next 100 Days A Deep Dive Into Trade Deregulation And Executive Actions

Apr 29, 2025

Latest Posts

-

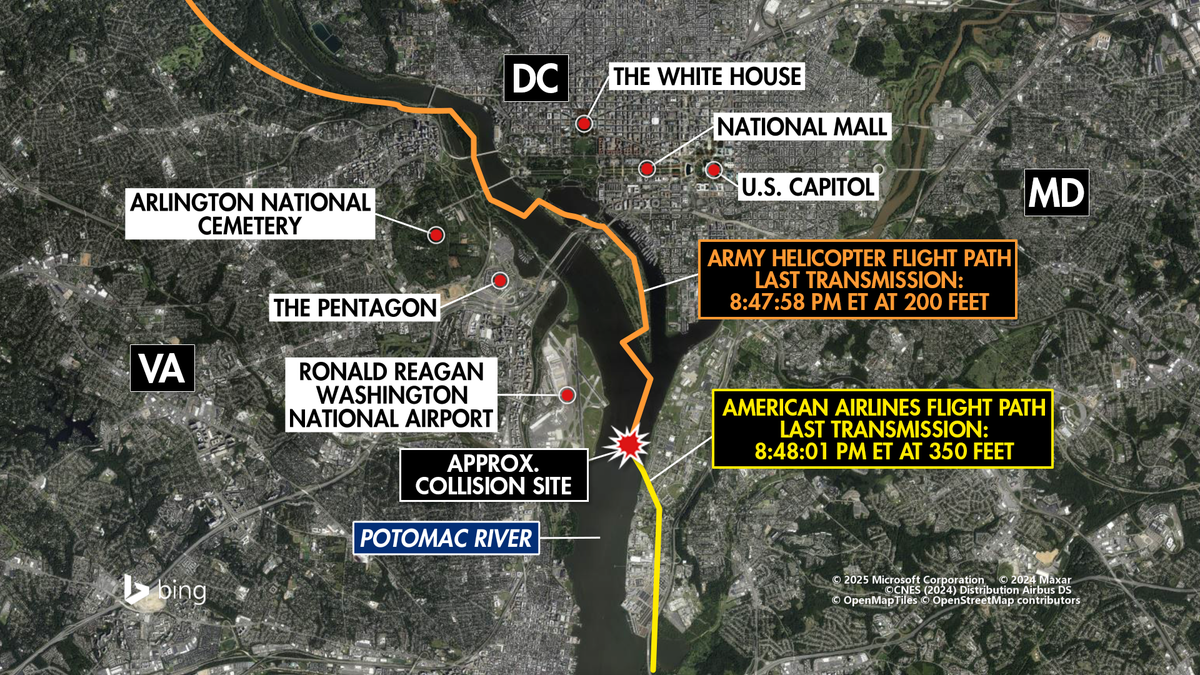

Helicopter Plane Collision Investigation Pilot Error Takes Center Stage Near Reagan Airport

Apr 29, 2025

Helicopter Plane Collision Investigation Pilot Error Takes Center Stage Near Reagan Airport

Apr 29, 2025 -

From American Dream To Spanish Reality Two Expats Journeys

Apr 29, 2025

From American Dream To Spanish Reality Two Expats Journeys

Apr 29, 2025 -

Arne Slots Liverpool A Premier League Contenders Story

Apr 29, 2025

Arne Slots Liverpool A Premier League Contenders Story

Apr 29, 2025 -

Spain Vs Usa Why One American Returned Home And Another Didnt

Apr 29, 2025

Spain Vs Usa Why One American Returned Home And Another Didnt

Apr 29, 2025 -

Life In Spain A Tale Of Two American Expats

Apr 29, 2025

Life In Spain A Tale Of Two American Expats

Apr 29, 2025