ING's 2024 Annual Report: Key Highlights From Form 20-F Filing

Table of Contents

Main Points: Dissecting ING's 2024 Form 20-F Filing

Financial Performance Overview: Key Metrics and Trends

This section delves into the core financial metrics presented in ING's 2024 Annual Report (Form 20-F). We'll examine key trends to assess the bank's overall financial health.

Revenue Growth and Analysis:

ING's revenue performance in 2024 reflects the complex economic environment. Analyzing the 20-F filing reveals:

- Retail Banking: Growth in this sector likely reflects increased customer activity and successful product offerings. (Specific percentage growth from the 20-F should be inserted here, e.g., "experienced a 5% year-over-year increase").

- Wholesale Banking: Performance in this area might be influenced by global market conditions. (Specific percentage growth or decline from the 20-F should be inserted here, e.g., "saw a slight dip of 2% due to decreased trading activity").

- Investment Management: This segment's performance is dependent on market volatility and investment strategies. (Specific percentage growth or decline from the 20-F should be inserted here, e.g., "experienced robust growth of 8%, driven by strong performance in equities").

This analysis of ING's financial results offers a granular view of revenue streams and their contribution to overall financial performance in 2024. The variations in revenue across different sectors highlight the diverse nature of ING's business model.

Profitability and Margins:

ING's profitability in 2024 is a critical aspect of the 20-F analysis. Key metrics from the report, such as net income and return on equity (ROE), reveal the efficiency and effectiveness of the bank's operations.

- Net Income: (Specific net income figure from the 20-F should be inserted here, e.g., "Net income reached €X billion"). A comparison with the previous year's performance is necessary for trend analysis.

- Return on Equity (ROE): (Specific ROE figure from the 20-F should be inserted here, e.g., "ROE stood at X%, indicating strong profitability"). This metric provides insight into how effectively ING uses shareholder equity to generate profit.

- Net Interest Margin: (Specific net interest margin figure from the 20-F should be inserted here, e.g., "The net interest margin remained stable at X%, despite fluctuations in interest rates").

Fluctuations in interest rates and operating expenses significantly impact ING's profitability. The 20-F provides a detailed breakdown of these factors.

Asset Quality and Risk Management:

Assessing asset quality and risk management is vital for understanding ING's overall financial stability. The 20-F provides details on:

- Loan Loss Provisions: (Specific figures from the 20-F should be inserted here, e.g., "Loan loss provisions increased slightly to €X billion, reflecting a cautious approach to risk").

- Non-Performing Assets: (Specific figures from the 20-F should be inserted here, e.g., "Non-performing assets remained low at X%, demonstrating the effectiveness of ING's risk management strategies").

ING's risk profile is shaped by its risk management strategies detailed in the 20-F. Analysis of these elements is essential for a thorough understanding of ING's financial health.

Strategic Initiatives and Outlook: ING's Future Direction

ING's 2024 Form 20-F filing also outlines the bank's strategic initiatives and future outlook.

Key Strategic Initiatives:

ING's strategic plan for 2024, as detailed in the 20-F, highlights several key initiatives. These might include:

- Digital Transformation: Investments in digital technologies to enhance customer experience and operational efficiency.

- Sustainable Finance: Expansion of sustainable finance offerings, aligning with environmental, social, and governance (ESG) goals.

- Market Expansion: Potential expansion into new geographic markets to broaden its customer base.

(Specific initiatives from the 20-F should be added here with details on expected impact and potential risks)

Future Outlook and Guidance:

ING’s 20-F filing provides guidance on its expectations for 2025 and beyond. This includes projections for:

- Revenue Growth: (Specific projections from the 20-F should be inserted here, e.g., "ING projects revenue growth of approximately X% for 2025").

- Profitability: (Specific projections from the 20-F should be inserted here, e.g., "The bank anticipates maintaining a strong ROE in the range of X% to Y%").

Challenges such as geopolitical uncertainty and economic volatility could affect these projections. The 20-F provides further insights into these potential headwinds and opportunities.

Regulatory and Compliance Matters: Addressing Key Compliance Issues

ING's 2024 Annual Report (Form 20-F) addresses regulatory compliance matters and any significant issues encountered. This section focuses on:

Regulatory Compliance:

The 20-F outlines ING's adherence to regulatory requirements. This includes:

- Compliance with AML/KYC regulations: (Specific details from the 20-F should be added here, detailing any significant developments or challenges)

- Data privacy regulations (GDPR, etc.): (Specific details from the 20-F should be added here regarding ING’s compliance and any related issues)

This part of the report details any penalties or fines incurred, and the measures implemented to ensure compliance.

Conclusion: Key Takeaways from ING's 2024 20-F Filing and a Call to Action

ING's 2024 Form 20-F filing presents a detailed account of its financial performance, strategic initiatives, and regulatory compliance. Key highlights include (summarize key findings from the above sections here, referencing specific data points). This report offers invaluable insights for investors and stakeholders seeking to understand ING’s financial health and future trajectory. For a comprehensive understanding of ING's 2024 financial performance and strategic direction, we encourage you to review the full ING's 2024 Annual Report (Form 20-F) filing. (Insert link to the 20-F filing here)

Featured Posts

-

Remont Pivdennogo Mostu Pidryadniki Protses Ta Vartist

May 21, 2025

Remont Pivdennogo Mostu Pidryadniki Protses Ta Vartist

May 21, 2025 -

Racial Hatred Tweet Ex Tory Councillors Wife Faces Appeal Delay

May 21, 2025

Racial Hatred Tweet Ex Tory Councillors Wife Faces Appeal Delay

May 21, 2025 -

Penn Relays Allentowns Historic Sub 43 4x100m Relay

May 21, 2025

Penn Relays Allentowns Historic Sub 43 4x100m Relay

May 21, 2025 -

Vanja Mijatovic Novo Ime Novi Pocetak

May 21, 2025

Vanja Mijatovic Novo Ime Novi Pocetak

May 21, 2025 -

New Attempt To Break The Trans Australia Run World Record

May 21, 2025

New Attempt To Break The Trans Australia Run World Record

May 21, 2025

Latest Posts

-

Analyzing The Potential Merger Of Canadian Tire And Hudsons Bay

May 21, 2025

Analyzing The Potential Merger Of Canadian Tire And Hudsons Bay

May 21, 2025 -

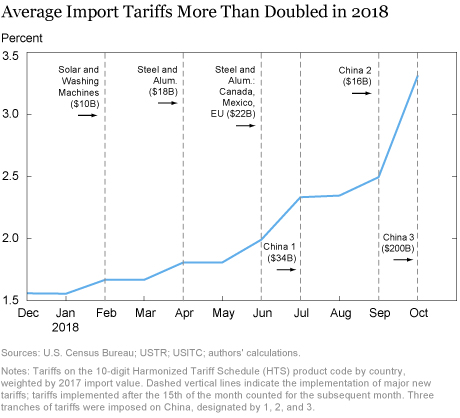

Canadian Government Rebuts Oxford Report On Us Tariffs

May 21, 2025

Canadian Government Rebuts Oxford Report On Us Tariffs

May 21, 2025 -

Canadas Response To Oxford Report Us Tariffs Largely Unchanged

May 21, 2025

Canadas Response To Oxford Report Us Tariffs Largely Unchanged

May 21, 2025 -

Ftc Vs Meta The Defense Begins

May 21, 2025

Ftc Vs Meta The Defense Begins

May 21, 2025 -

Home And Abroad Fp Videos Analysis Of Current Tariff Challenges

May 21, 2025

Home And Abroad Fp Videos Analysis Of Current Tariff Challenges

May 21, 2025