Investing In Apple Stock: Q2 Performance And Market Implications

Table of Contents

Apple's Q2 2024 Financial Performance: A Detailed Look

Apple's Q2 2024 financial results offer a compelling snapshot of the company's current position and future trajectory. Analyzing key figures provides crucial insights for anyone considering investing in Apple stock.

Revenue and Earnings Analysis

Apple reported [insert actual Q2 2024 revenue figures here]. This represents a [insert percentage]% change compared to Q1 2024 and a [insert percentage]% year-over-year growth. While analysts predicted [insert analyst prediction], the actual results [insert whether it exceeded, met, or fell short of expectations]. Let's break down the revenue streams:

- iPhone: [Insert revenue and growth percentage for iPhone sales]. This indicates [explain the significance of the iPhone's performance].

- Services: [Insert revenue and growth percentage for Services]. The continued growth in this sector highlights [explain the importance of the services segment].

- Mac: [Insert revenue and growth percentage for Mac sales]. The performance of the Mac segment reflects [explain the factors influencing Mac sales].

- Wearables, Home, and Accessories: [Insert revenue and growth percentage for this category]. This segment’s performance demonstrates [explain the trends observed in this category].

- iPad: [Insert revenue and growth percentage for iPad sales]. The iPad’s performance shows [explain the trends and their implications].

Key Performance Indicators (KPIs)

Beyond headline revenue and earnings, several KPIs offer a deeper understanding of Apple's financial health:

- Gross Margin: [Insert gross margin percentage and comparison to previous quarters]. This indicates [explain what the gross margin reveals about Apple's profitability].

- Operating Expenses: [Insert operating expenses and comparison to previous quarters]. This reflects [explain the trends in operating expenses].

- Diluted Earnings Per Share (EPS): [Insert EPS and comparison to previous quarters]. This metric shows [explain what EPS means for shareholders].

Comparing these KPIs against industry benchmarks and previous performance provides a complete picture of Apple's financial strength.

Impact of External Factors

Several external factors influenced Apple's Q2 2024 performance:

- Global Economic Slowdown: The ongoing concerns about a potential recession impacted consumer spending, potentially affecting demand for Apple products.

- Inflationary Pressures: Rising prices for components and manufacturing impacted Apple's production costs.

- Supply Chain Disruptions: While less severe than in previous years, lingering supply chain issues might have slightly affected production and delivery timelines.

- [Add any other relevant geopolitical or industry-specific factors].

Market Implications of Apple's Q2 Results

Apple's Q2 earnings announcement sent ripples through the market. Understanding this impact is crucial for anyone considering investing in Apple stock.

Stock Price Reaction

Following the Q2 earnings release, Apple's stock price [insert description of the stock price movement, e.g., rose by X%, fell by Y%]. [Insert a chart illustrating the stock price movement]. This reaction was largely attributed to [explain the reasons behind the stock price movement]. Analyst ratings [mention analyst upgrades or downgrades and their reasoning]. Investor sentiment appears to be [explain the overall sentiment].

Future Outlook and Predictions

Predicting Apple's future performance involves considering several factors:

- Upcoming Product Launches: The anticipated launch of [mention upcoming products] could significantly impact future revenue streams.

- Competition: Increasing competition from [mention key competitors] presents a challenge for maintaining market share.

- Technological Innovation: Apple's ability to continue innovating and introducing groundbreaking products is crucial for long-term growth.

- Macroeconomic Conditions: The overall economic climate will significantly influence consumer spending and demand.

Apple Stock Valuation

Determining whether Apple stock is currently overvalued, undervalued, or fairly valued requires a thorough analysis of its Q2 performance and future prospects. Several valuation methods can be employed:

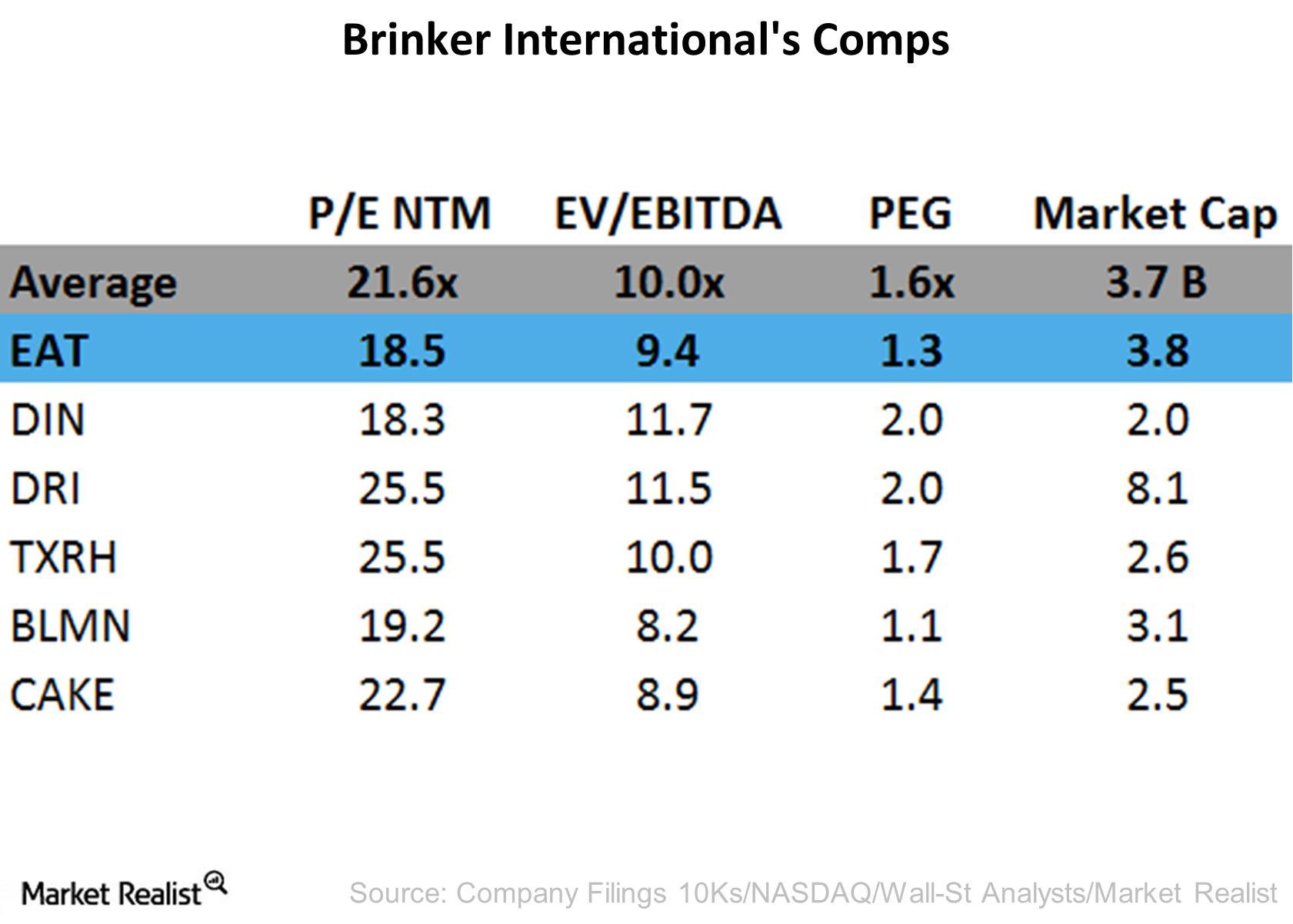

- Price-to-Earnings Ratio (P/E): [Insert P/E ratio and analysis].

- Price/Earnings to Growth Ratio (PEG): [Insert PEG ratio and analysis].

- [Add other relevant valuation metrics].

Based on these valuations and the factors discussed, Apple stock may be considered a [buy/sell/hold] for [mention specific investor profiles, e.g., long-term investors, short-term traders].

Strategic Considerations for Investing in Apple Stock

Making sound investment decisions requires a well-defined strategy.

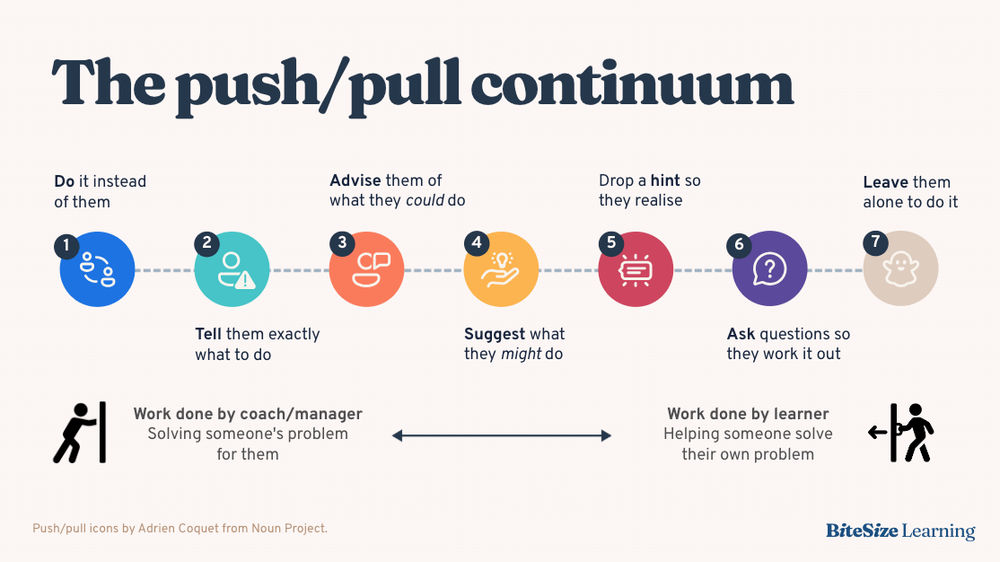

Long-Term vs. Short-Term Investment

Investing in Apple stock offers different strategies depending on your investment horizon:

- Long-Term Investment: A long-term approach leverages Apple's history of consistent growth and innovation. It mitigates the impact of short-term market fluctuations.

- Short-Term Trading: Short-term trading focuses on capitalizing on short-term price movements. It involves higher risk and requires close market monitoring.

Diversification and Risk Management

Diversification is key to mitigating risk when investing in Apple stock or any individual stock. It involves spreading investments across various asset classes to reduce the impact of any single investment's underperformance. Risk management strategies include:

- Setting stop-loss orders to limit potential losses.

- Regularly reviewing your investment portfolio and adjusting your strategy as needed.

Alternative Investment Strategies

Beyond buying Apple shares directly, investors can explore:

- Options Trading: Options contracts offer leveraged opportunities, but they also involve higher risk.

- Exchange-Traded Funds (ETFs): ETFs that track the technology sector or the S&P 500 provide diversified exposure to Apple and other companies.

Conclusion: Making Informed Decisions on Investing in Apple Stock

Apple's Q2 2024 performance offers valuable insights for anyone considering investing in Apple stock. While the company demonstrated [summarize key positive aspects], potential challenges remain [mention key challenges]. Careful consideration of long-term versus short-term strategies, diversification, and risk management is crucial. Remember, conducting thorough research and potentially consulting with a financial advisor is paramount before making any investment decisions regarding investing in Apple stock. Only invest what you can afford to lose, and remember that past performance is not indicative of future results.

Featured Posts

-

Europese And Amerikaanse Aandelen Zal De Recente Marktdraai Aanhouden

May 25, 2025

Europese And Amerikaanse Aandelen Zal De Recente Marktdraai Aanhouden

May 25, 2025 -

The Short Lived Black Lives Matter Plaza A Case Study In Urban Politics

May 25, 2025

The Short Lived Black Lives Matter Plaza A Case Study In Urban Politics

May 25, 2025 -

Re Evaluating News Corp Is It Undervalued By The Market

May 25, 2025

Re Evaluating News Corp Is It Undervalued By The Market

May 25, 2025 -

Open Ai Facing Ftc Investigation A Deep Dive Into The Potential Consequences

May 25, 2025

Open Ai Facing Ftc Investigation A Deep Dive Into The Potential Consequences

May 25, 2025 -

Royal Philips 2025 Agm Agenda And Shareholder Participation

May 25, 2025

Royal Philips 2025 Agm Agenda And Shareholder Participation

May 25, 2025

Latest Posts

-

Trumps Influence The Push For A Republican Agreement

May 25, 2025

Trumps Influence The Push For A Republican Agreement

May 25, 2025 -

Investigating Presidential Expenditures Luxury Items Events And The Use Of Official Seals

May 25, 2025

Investigating Presidential Expenditures Luxury Items Events And The Use Of Official Seals

May 25, 2025 -

Trumps Hardball Tactics The Republican Response

May 25, 2025

Trumps Hardball Tactics The Republican Response

May 25, 2025 -

Presidential Seals And Lavish Spending Transparency And Accountability In Government

May 25, 2025

Presidential Seals And Lavish Spending Transparency And Accountability In Government

May 25, 2025 -

How Trump Is Leveraging Power To Push A Republican Agenda

May 25, 2025

How Trump Is Leveraging Power To Push A Republican Agenda

May 25, 2025