Investing In BigBear.ai: A Current Market Perspective

Table of Contents

BigBear.ai's Business Model and Revenue Streams

BigBear.ai offers a comprehensive suite of AI-powered solutions, primarily focusing on advanced analytics, data solutions, and mission-critical software development. Their core offerings leverage cutting-edge AI technologies to provide clients with actionable insights and innovative solutions. BigBear.ai's revenue streams are primarily derived from government and commercial contracts, often involving long-term service agreements and subscriptions for ongoing support and maintenance.

Analyzing BigBear.ai's financial performance requires reviewing their financial reports to identify revenue growth, profitability margins, and overall financial health. While specific financial data fluctuates, assessing key trends – such as year-over-year revenue growth and contract wins – provides valuable insights into the company's performance.

- Key clients and industries served: BigBear.ai serves clients in diverse sectors, including defense, intelligence, and commercial industries, demonstrating a diversified customer base and mitigating risk associated with over-reliance on a single sector.

- Competitive advantages in the market: BigBear.ai’s competitive advantages stem from its specialized expertise, proprietary AI algorithms, and established relationships within key government and commercial sectors.

- Recent contract wins or losses: Tracking recent contract wins and losses provides a real-time indication of the company's success in securing new business and retaining existing clients. This data is crucial for understanding the near-term outlook for BigBear.ai.

- Growth projections and market analysis: Various market research firms offer projections on the AI market’s overall growth and BigBear.ai's potential within this space. It’s crucial to review these reports from credible sources to gain a comprehensive perspective.

Market Analysis and Competitive Landscape

The AI stock market is highly competitive, with numerous established players and emerging startups vying for market share. The overall AI market trajectory shows consistent, robust growth, fueled by increasing demand for AI-driven solutions across industries. BigBear.ai faces competition from both large multinational technology companies and smaller, specialized AI firms. A thorough competitive analysis is essential.

- Key competitors and their market capitalization: Identifying key competitors, analyzing their market capitalization, and comparing their respective market positions allows for a relative assessment of BigBear.ai's standing within the industry.

- Analysis of BigBear.ai's competitive advantages: BigBear.ai needs to demonstrate a sustainable competitive advantage to thrive. This might involve proprietary technology, superior customer service, or strong relationships with key clients.

- Discussion of potential market disruption or threats: The AI landscape is dynamic. Emerging technologies, changes in government regulations, and shifts in customer preferences could pose threats to BigBear.ai's market position.

Risk Assessment and Potential Returns

Investing in BigBear.ai, or any AI stock, involves inherent risks. Market volatility in the technology sector can significantly impact stock prices. Competition is fierce, and BigBear.ai's financial performance will directly influence investor confidence and return on investment (ROI). Analyzing the stock's valuation using metrics such as the price-to-earnings ratio (P/E) helps determine if the stock is overvalued or undervalued.

- Key financial risks and mitigation strategies: Understanding the financial risks (e.g., debt levels, cash flow) and potential mitigation strategies is crucial for informed investment decisions.

- Potential upside and downside scenarios for investment: Developing potential scenarios helps assess both the potential gains and losses associated with investing in BigBear.ai.

- Comparison to similar companies and their performance: Benchmarking BigBear.ai against similar companies in the AI sector provides context and helps assess its relative performance.

BigBear.ai Stock Performance and Future Outlook

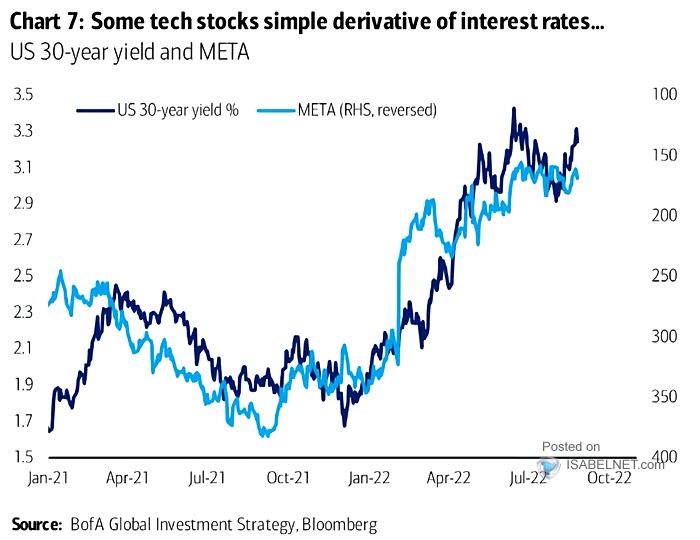

Analyzing BigBear.ai's historical stock performance, using charts and graphs, helps identify trends and patterns. This analysis provides insights into the stock's volatility and historical returns. The future outlook for BigBear.ai stock depends on various factors, including the company's success in securing new contracts, launching innovative products, and navigating the competitive landscape. Analyst ratings and price targets, when available from reputable sources, offer additional perspectives.

- Key factors influencing future stock performance: Factors such as new product launches, market share gains, and overall economic conditions will influence future stock performance.

- Analyst ratings and price targets: Analyst ratings and price targets offer valuable insights, but should be considered alongside other factors in investment decision-making.

- Potential catalysts for future growth: Potential catalysts, such as strategic partnerships or technological breakthroughs, could positively impact future growth.

Conclusion: Making Informed Decisions About Investing in BigBear.ai

Investing in BigBear.ai requires a thorough understanding of its business model, market position, competitive landscape, and associated risks. While the potential returns in the AI sector are significant, investors must carefully assess the potential downsides. This analysis highlights the importance of diligent research before investing in BigBear.ai stock. The information provided in this article should serve as a starting point for your own in-depth research. Remember to consult with a qualified financial advisor before making any investment decisions and explore other AI investment opportunities to diversify your portfolio. Consider the risks and potential returns carefully before investing in BigBear.ai stock or similar AI-related ventures.

Featured Posts

-

Fastest Ever Man Runs Across Australia In Record Time

May 21, 2025

Fastest Ever Man Runs Across Australia In Record Time

May 21, 2025 -

Femicide A Deep Dive Into The Problem And Its Growing Prevalence

May 21, 2025

Femicide A Deep Dive Into The Problem And Its Growing Prevalence

May 21, 2025 -

Is The Sell America Trade Back Moodys 30 Year Yield Hits 5

May 21, 2025

Is The Sell America Trade Back Moodys 30 Year Yield Hits 5

May 21, 2025 -

Carlo Ancelotti Nin Yerine Juergen Klopp Bir Karsilastirma

May 21, 2025

Carlo Ancelotti Nin Yerine Juergen Klopp Bir Karsilastirma

May 21, 2025 -

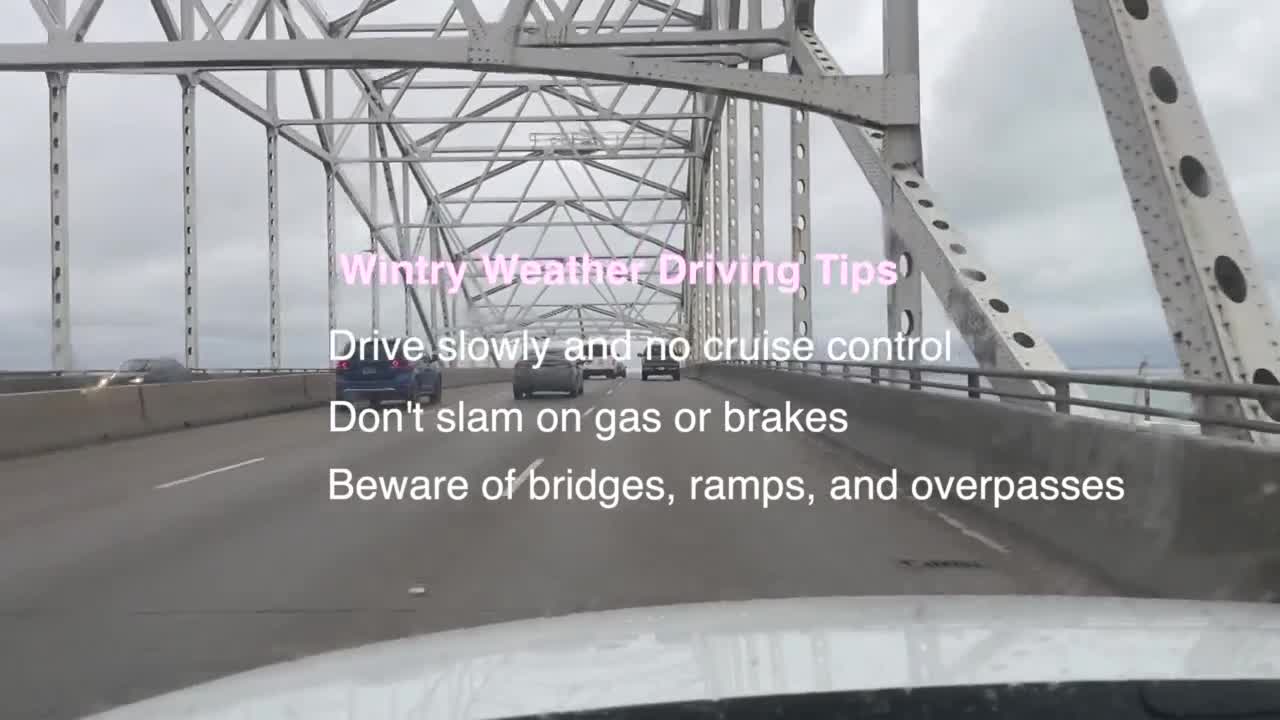

Driving In A Wintry Mix Of Rain And Snow Safety Tips

May 21, 2025

Driving In A Wintry Mix Of Rain And Snow Safety Tips

May 21, 2025

Latest Posts

-

Exploring The Kartel Rum Culture Connection In Stabroek News Reports

May 22, 2025

Exploring The Kartel Rum Culture Connection In Stabroek News Reports

May 22, 2025 -

Vybz Kartel Electrifies Brooklyn With Sold Out Concerts

May 22, 2025

Vybz Kartel Electrifies Brooklyn With Sold Out Concerts

May 22, 2025 -

Kartel And The Evolution Of Rum Culture Insights From Stabroek News

May 22, 2025

Kartel And The Evolution Of Rum Culture Insights From Stabroek News

May 22, 2025 -

Trinidad Trip Curtailed Dancehall Artist Accepts Restrictions Receives Kartels Backing

May 22, 2025

Trinidad Trip Curtailed Dancehall Artist Accepts Restrictions Receives Kartels Backing

May 22, 2025 -

Dancehall Star Faces Travel Restrictions To Trinidad Show Of Support From Vybz Kartel

May 22, 2025

Dancehall Star Faces Travel Restrictions To Trinidad Show Of Support From Vybz Kartel

May 22, 2025