Investing In BigBear.ai: A Practical Guide

Table of Contents

Understanding BigBear.ai's Business Model and Offerings

BigBear.ai's core business revolves around providing cutting-edge AI-powered solutions, data analytics solutions, and cybersecurity solutions to government and commercial clients. Their offerings are designed to address complex challenges across various sectors, leveraging the power of advanced analytics and machine learning.

- Key Products and Services: BigBear.ai offers a suite of products and services, including advanced data analytics platforms, AI-driven decision support tools, and robust cybersecurity solutions tailored for critical infrastructure protection. They also provide consulting services, helping clients implement and integrate their technologies effectively.

- Target Market Segments: BigBear.ai primarily serves government agencies (defense, intelligence, and civilian) and large commercial enterprises seeking to enhance their operational efficiency, improve decision-making processes, and strengthen their cybersecurity posture.

- Competitive Advantages: The company's competitive edge lies in its deep expertise in data analytics, AI, and cybersecurity, coupled with its strong partnerships and a track record of delivering impactful solutions for complex challenges. Their ability to integrate multiple technologies and provide comprehensive solutions differentiates them in the market.

BigBear.ai's revenue streams are diversified, with contributions from both government and commercial contracts. Their revenue growth strategy focuses on expanding into new market segments, forging strategic partnerships, and continuously developing innovative AI-powered solutions. This dedication to innovation and strategic partnerships allows for significant potential for market share expansion.

Analyzing BigBear.ai's Financial Performance and Future Prospects

To assess the viability of investing in BigBear.ai, a thorough examination of their financial statements is crucial. This includes analyzing key financial metrics such as revenue, earnings, debt levels, and cash flow.

- Review of Historical Financial Performance: Examining past financial performance reveals trends in revenue growth, profitability, and operational efficiency. This historical data provides a foundation for projecting future performance.

- Analysis of Key Financial Ratios: Analyzing key financial ratios like the Price-to-Earnings (P/E) ratio and debt-to-equity ratio offers valuable insights into the company's valuation, profitability, and financial health.

- Future Growth Potential and Projections: Analyzing future growth potential requires considering market trends, technological advancements, and the company's strategic initiatives. While specific projections are subject to change, the overall growth potential within the burgeoning AI and cybersecurity sectors is substantial.

Several factors will impact BigBear.ai's future performance. Positive market trends in AI and cybersecurity, continuous technological innovation, and successful navigation of the regulatory landscape will contribute to growth. Conversely, increased competition, economic downturns, and unforeseen regulatory changes pose potential challenges.

Assessing the Risks and Rewards of Investing in BigBear.ai

Like any investment, investing in BigBear.ai involves both risks and rewards. It is crucial to carefully assess these factors before making any investment decisions.

- Key Risks: Potential risks include intense competition in the AI and cybersecurity sectors, the risk of technological disruption by newer innovations, and market volatility impacting stock prices. Government contract dependence also carries inherent risk.

- Mitigation Strategies: Diversifying one's investment portfolio, conducting thorough due diligence, and carefully monitoring market conditions can help mitigate some of these risks.

- Return on Investment (ROI): The potential return on investment depends on several factors, including the company's future growth, market conditions, and the investor's entry and exit points.

While risks exist, the potential rewards are significant. BigBear.ai operates within high-growth sectors with substantial long-term growth potential. The company's focus on innovation and its strong position in the government and commercial sectors suggest a promising outlook for investment strategy.

Practical Steps for Investing in BigBear.ai

For those interested in investing in BigBear.ai, several practical steps are involved. This may involve stock investment through a brokerage account.

- Choosing a Brokerage Account: Select a reputable brokerage account that offers access to the relevant stock exchange.

- Researching Before Investing: Thorough research is paramount. Review financial statements, industry reports, and analyst opinions before committing funds.

- Diversification Strategies: Diversifying your investment portfolio reduces risk by spreading investments across various assets.

- Setting Investment Goals: Define your investment goals and risk tolerance before making any investment decisions.

Once invested, consistent investment monitoring is essential. Regularly review performance, assess market conditions, and adjust your investment strategy as needed. Effective portfolio management and risk management are critical to achieving long-term success.

Conclusion: Making Informed Decisions on Investing in BigBear.ai

This guide provides a framework for understanding the opportunities and challenges associated with investing in BigBear.ai. We've explored BigBear.ai's business model, its financial performance, the inherent risks, and practical steps for making an investment. Remember, thorough research and due diligence are paramount before committing funds. Consider your individual risk tolerance and financial goals when assessing BigBear.ai investment opportunities. Conduct further research and make informed decisions about investing in BigBear.ai stock based on your own assessment of the company's prospects and your personal investment strategy. Consider seeking advice from a qualified financial advisor before making any investment decisions.

Featured Posts

-

Manchester United Transfer News Matheus Cunha Update And Potential Alternatives

May 20, 2025

Manchester United Transfer News Matheus Cunha Update And Potential Alternatives

May 20, 2025 -

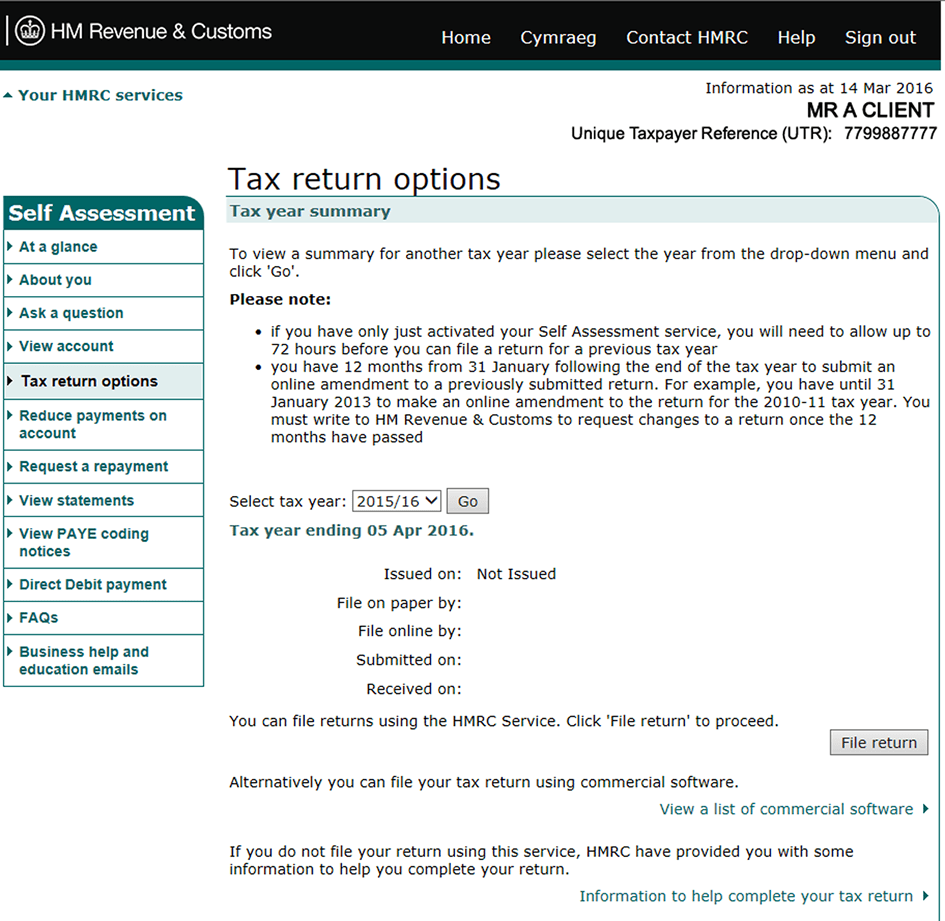

Hmrc Website Crash Hundreds Unable To Access Accounts Across Uk

May 20, 2025

Hmrc Website Crash Hundreds Unable To Access Accounts Across Uk

May 20, 2025 -

Baggelis Giakoymakis Mia Aneipoti Istoria Bullying Kai Vasanismon

May 20, 2025

Baggelis Giakoymakis Mia Aneipoti Istoria Bullying Kai Vasanismon

May 20, 2025 -

April 18th 2025 Nyt Mini Crossword Answers And Solution Hints

May 20, 2025

April 18th 2025 Nyt Mini Crossword Answers And Solution Hints

May 20, 2025 -

Aghatha Krysty Fy Esr Aldhkae Alastnaey Imkanyat La Hdwd Lha

May 20, 2025

Aghatha Krysty Fy Esr Aldhkae Alastnaey Imkanyat La Hdwd Lha

May 20, 2025