Investing In Palantir: Evaluating The Recent 30% Price Drop

Table of Contents

Understanding the 30% Price Drop in Palantir Stock

The recent 30% decline in Palantir stock price is a complex issue stemming from a combination of macroeconomic and company-specific factors. Understanding these elements is crucial before deciding whether to buy PLTR stock.

Macroeconomic Factors

The recent downturn in Palantir stock price isn't isolated; it reflects broader anxieties within the technology sector.

- Rising Interest Rates: The Federal Reserve's interest rate hikes significantly impact growth stocks like Palantir. Higher rates increase borrowing costs, making future earnings less valuable, thus decreasing valuations.

- Inflation and Recessionary Fears: High inflation erodes purchasing power and slows economic growth, impacting demand for Palantir's data analytics services, particularly in the commercial sector. Recessionary fears further dampen investor sentiment towards growth-oriented companies.

- Market Volatility: The overall stock market volatility contributes to the price fluctuations of even fundamentally sound companies like Palantir. Investor confidence plays a significant role in driving short-term price movements.

In short: Macroeconomic headwinds, including rising interest rates, inflation, and recessionary fears, have created a challenging environment for growth stocks such as Palantir, contributing to the recent price drop.

Company-Specific Factors

While macroeconomic factors played a role, company-specific events also contributed to the Palantir price drop.

- Financial Performance: While Palantir has demonstrated revenue growth, investors may have been disappointed by the pace of profitability or slower-than-expected growth in specific sectors. Analyzing quarterly earnings reports and guidance is crucial.

- Negative News or Announcements: Any negative news, such as disappointing earnings reports, reduced revenue guidance, or setbacks in major contracts, can negatively impact investor sentiment and lead to a stock price decline. Careful scrutiny of Palantir's press releases and investor updates is vital.

- Increased Competition: The data analytics market is fiercely competitive. The emergence of new players or aggressive strategies from established competitors can put pressure on Palantir's market share and profitability.

In summary: Analyzing Palantir's financial performance, news announcements, and competitive landscape offers a deeper understanding of company-specific factors driving the recent price decline.

Evaluating Palantir's Long-Term Potential

Despite the recent setback, Palantir's long-term potential remains a key factor in determining whether it's a worthwhile investment.

Growth Prospects in Government and Commercial Markets

Palantir operates in two primary markets: government and commercial.

- Government Sector: The demand for advanced data analytics solutions within government agencies remains strong, offering significant growth opportunities for Palantir. Government contracts often provide stable and recurring revenue streams.

- Commercial Sector: Expanding its presence in the commercial sector presents both challenges and opportunities. Increased competition exists, but the vast potential market for data-driven decision-making could lead to significant future growth.

- Strategic Partnerships: Palantir's strategic partnerships with major technology companies and its expanding client base demonstrate its market relevance and growth potential.

In essence: Palantir's substantial presence in the government sector, coupled with its strategic push into the commercial market, indicates promising long-term growth prospects.

Assessing Palantir's Financial Health and Valuation

Analyzing Palantir's financials is vital for any investment decision.

- Balance Sheet and Cash Flow: A strong balance sheet and healthy cash flow are crucial for long-term sustainability. Examining Palantir's financial statements provides insights into its financial health and its ability to weather economic downturns.

- Valuation Compared to Peers: Comparing Palantir's valuation metrics (e.g., Price-to-Sales ratio) to its competitors allows for a relative assessment of its attractiveness as an investment.

- Future Profitability and Revenue Growth: Projecting future profitability and revenue growth is essential for valuing a growth stock like Palantir. Analyzing historical growth trends and considering future market opportunities can provide a basis for valuation.

In short: A thorough analysis of Palantir's financial health and valuation, in comparison to its peers, is necessary to determine its investment potential.

Risk Assessment for Investing in Palantir

Investing in Palantir, like any stock, involves risks.

Volatility and Market Sentiment

Palantir stock is known for its volatility.

- Price Fluctuations: The price of Palantir stock can fluctuate significantly in response to market sentiment, news events, and overall economic conditions. This inherent volatility presents a risk for investors with low risk tolerance.

- Investor Sentiment: Market sentiment plays a significant role in driving short-term price movements. Negative news or general market downturns can disproportionately affect growth stocks like Palantir.

- Growth Stock Risks: Growth stocks, by their nature, are inherently riskier than more established, stable companies. The potential for high rewards is often accompanied by higher risks.

In brief: The volatility inherent in Palantir stock, amplified by shifts in market sentiment, represents a considerable risk for potential investors.

Competition and Technological Disruption

The data analytics industry is dynamic and competitive.

- Competitive Landscape: Palantir faces competition from both established tech giants and emerging startups. This competition can pressure pricing and market share.

- Technological Disruption: Rapid technological advancements can quickly render existing technologies obsolete. Palantir's ability to adapt and innovate will be crucial for its long-term success.

- Maintaining a Competitive Edge: Palantir's ongoing investment in research and development, and its focus on innovation, are key factors in determining its ability to maintain a competitive edge.

In conclusion: The competitive landscape and the potential for technological disruption represent significant risks for Palantir.

Conclusion

This article examined the recent 30% price drop in Palantir stock, considering both macroeconomic factors and company-specific issues. While the drop presents risks, Palantir's long-term potential in the rapidly growing data analytics market remains significant. A careful assessment of its financial health, competitive landscape, and growth prospects is crucial before making any investment decisions.

Call to Action: Investing in Palantir requires thorough due diligence. Consider your risk tolerance and conduct further research before making any decisions regarding Palantir stock or other technology stocks. Remember to consult with a financial advisor for personalized advice on investing in Palantir.

Featured Posts

-

Elon Musks Net Worth How Us Power Dynamics Impact Teslas Ceo Fortune

May 09, 2025

Elon Musks Net Worth How Us Power Dynamics Impact Teslas Ceo Fortune

May 09, 2025 -

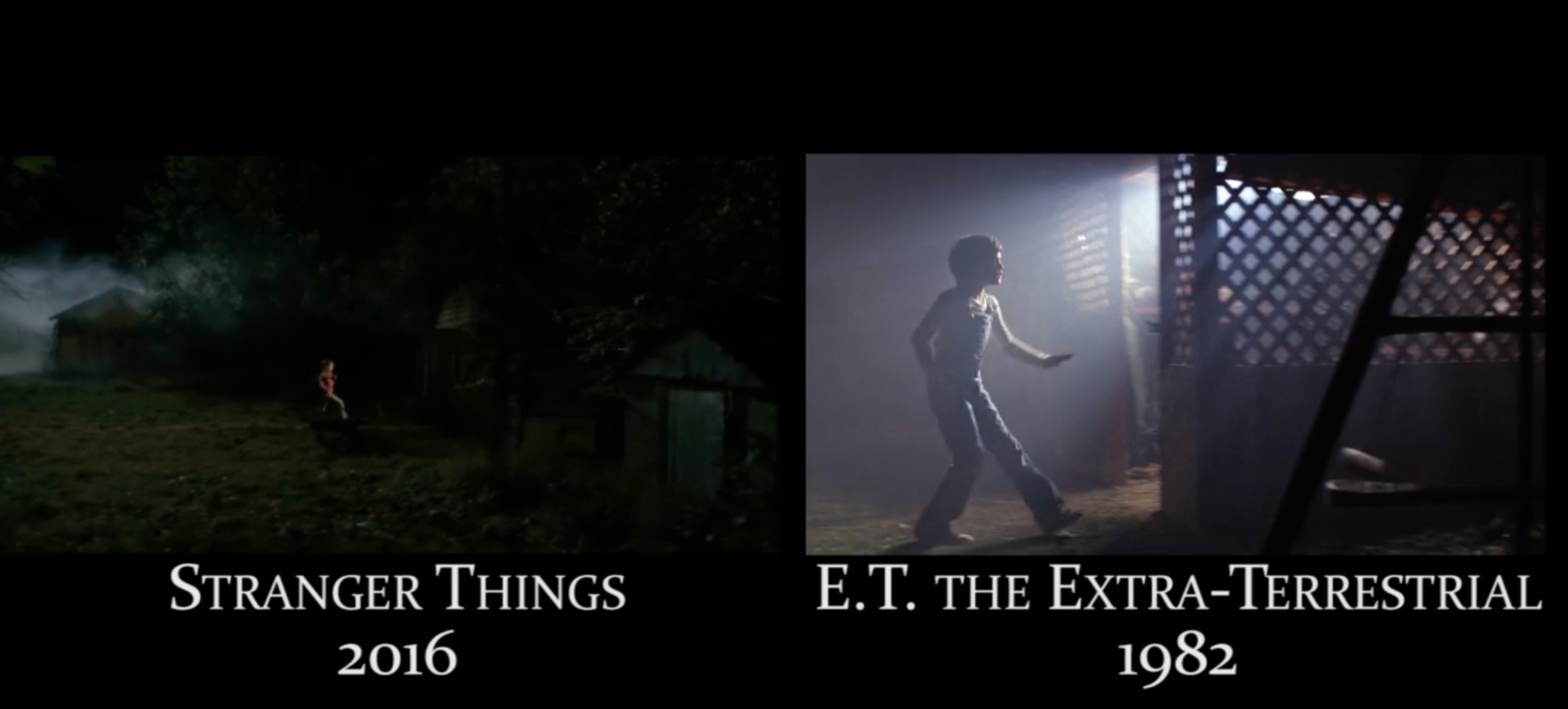

Stephen Kings Thoughts On Stranger Things And It A Comparison

May 09, 2025

Stephen Kings Thoughts On Stranger Things And It A Comparison

May 09, 2025 -

Hoe Brekelmans India Zo Veel Mogelijk Aan Zijn Zijde Wil Houden

May 09, 2025

Hoe Brekelmans India Zo Veel Mogelijk Aan Zijn Zijde Wil Houden

May 09, 2025 -

Naujos Detales Apie Dakota Johnson Ir Kraujingas Plintos Nuotraukas

May 09, 2025

Naujos Detales Apie Dakota Johnson Ir Kraujingas Plintos Nuotraukas

May 09, 2025 -

Palantir Stock Prediction To Buy Or Not To Buy Before May 5th

May 09, 2025

Palantir Stock Prediction To Buy Or Not To Buy Before May 5th

May 09, 2025