Palantir Stock Prediction: To Buy Or Not To Buy Before May 5th

Table of Contents

Palantir's Recent Financial Performance and Future Outlook

Q4 2022 Earnings Report Analysis

Palantir's Q4 2022 earnings report offers crucial insights into the company's current financial health and future trajectory. Analyzing key metrics is essential for any Palantir stock prediction. We need to examine revenue growth, profitability, and cash flow to understand the company's financial strength. The impact of government contracts and commercial partnerships also plays a significant role. A decrease in operating expenses or a reduction in debt would positively influence the stock price.

- Revenue growth percentage: Analyzing the year-over-year and quarter-over-quarter revenue growth provides a clear picture of Palantir's sales performance. A strong growth percentage indicates positive momentum.

- Net income or loss: Profitability is a critical factor. A positive net income shows that Palantir is generating more revenue than expenses.

- Key partnerships announced: New partnerships with significant players in the government or commercial sectors can significantly boost revenue and investor confidence, impacting the Palantir stock prediction.

Growth Projections and Market Share

Palantir operates in the rapidly expanding big data analytics market. Understanding industry trends and Palantir's position within this market is crucial for predicting its future performance. The company's potential for future growth is substantial, particularly in the government and commercial sectors. However, it's important to analyze the competitive landscape and Palantir's competitive advantages to assess its ability to maintain and expand its market share.

- Market size projections: The projected growth of the big data analytics market will directly impact Palantir's potential for expansion.

- Palantir's estimated market share: Maintaining or increasing its market share against competitors will be a key driver of stock price.

- Major competitors: Analyzing competitors such as AWS, Microsoft Azure, and Google Cloud will help gauge Palantir's position and future prospects.

Factors Influencing Palantir Stock Price

Geopolitical Events and Market Sentiment

Global events significantly impact investor sentiment towards technology stocks, including Palantir. Geopolitical instability, economic uncertainty, and inflation can all affect stock prices. News and media coverage also influence public perception, creating market volatility. Understanding these factors is vital for accurate Palantir stock prediction.

- Relevant geopolitical events: Events like international conflicts or shifts in global trade policies can dramatically influence investor confidence.

- Impact on investor confidence: Negative news can lead to sell-offs, while positive news can trigger buying, impacting the Palantir stock price.

- Recent news headlines: Keeping abreast of current news and media coverage provides valuable insights into market sentiment.

Technological Advancements and Innovation

Palantir's continued investment in R&D and its ability to innovate are essential for long-term success. New product releases and technological advancements can drive future growth. However, potential disruptions from competitors or emerging technologies pose a risk. Assessing Palantir's capacity to adapt and innovate is critical for any stock prediction.

- Key technological advancements: Tracking Palantir's advancements in AI, machine learning, and data analytics is crucial.

- New product launches: Successful new product introductions can boost revenue and investor confidence.

- Potential disruptions: Identifying potential disruptions from competitive technologies is essential for risk assessment.

Risk Assessment and Potential Downsides

Financial Risks and Uncertainties

Palantir's financial position presents both opportunities and risks. Analyzing its debt levels and profitability is crucial. Challenges related to future growth projections and market competition must also be considered. Reliance on government contracts carries inherent risks, as contract renewals are never guaranteed.

- Debt-to-equity ratio: A high debt-to-equity ratio indicates higher financial risk.

- Profit margin analysis: Analyzing profit margins helps assess the company's ability to generate profit from its operations.

- Contract renewal risks: The potential loss of government contracts could negatively impact revenue and stock price.

Market Volatility and Investment Risks

The stock market is inherently volatile. Investing in a high-growth company like Palantir carries a higher degree of risk. Understanding market volatility and diversification strategies is critical for responsible investment.

- Beta coefficient: A high beta coefficient indicates higher volatility compared to the overall market.

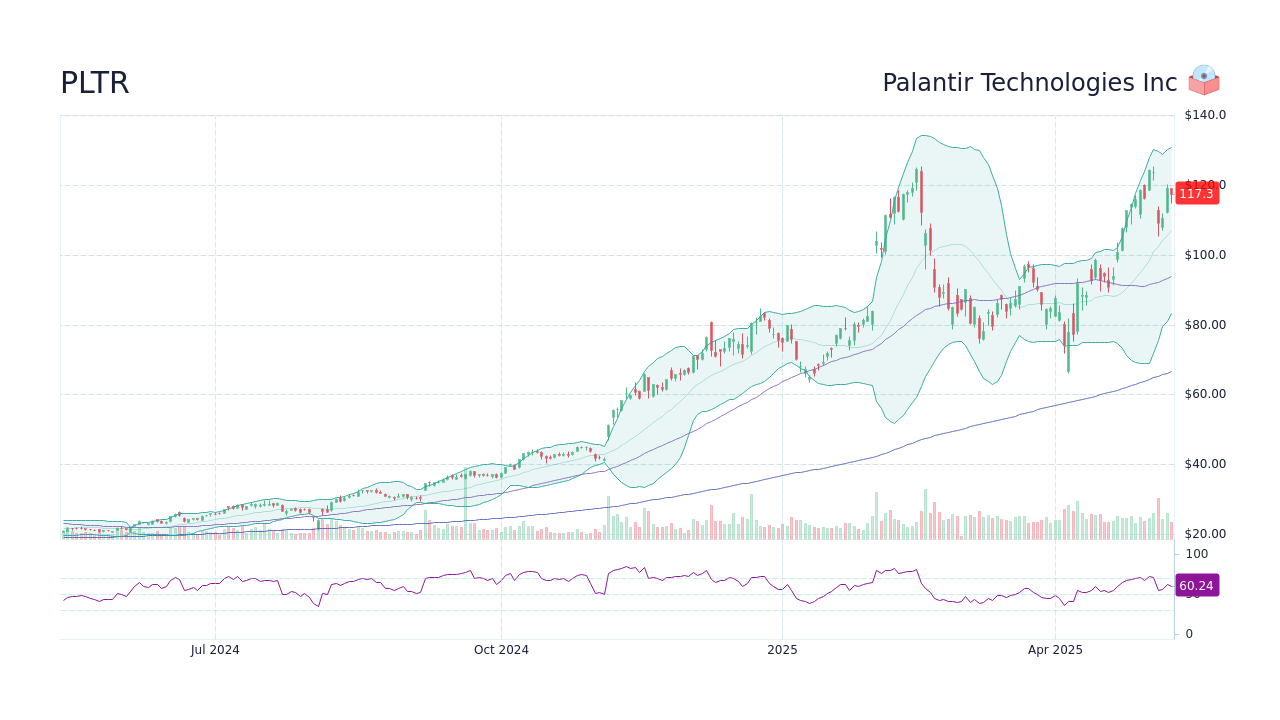

- Historical price volatility: Reviewing past price fluctuations can help assess future potential volatility.

- Investment diversification strategies: Diversifying your portfolio reduces the overall risk associated with investing in individual stocks.

Conclusion

This analysis of Palantir stock before May 5th provides insights into its recent performance, future growth potential, and associated risks. While Palantir displays promising advancements and opportunities, investors should carefully consider the inherent market volatility and financial uncertainties before making any investment decisions. Thoroughly research and understand your risk tolerance before deciding whether to buy or not to buy Palantir stock. Remember to consult a financial advisor for personalized investment advice. The ultimate decision on whether to buy or sell Palantir shares rests solely with you.

Featured Posts

-

Revised Palantir Stock Predictions Analyzing The Current Market Trend

May 09, 2025

Revised Palantir Stock Predictions Analyzing The Current Market Trend

May 09, 2025 -

Handhaven Van De Relatie Brekelmans India Uitdagingen En Oplossingen

May 09, 2025

Handhaven Van De Relatie Brekelmans India Uitdagingen En Oplossingen

May 09, 2025 -

Ray Epps V Fox News A Defamation Lawsuit Over January 6th Narratives

May 09, 2025

Ray Epps V Fox News A Defamation Lawsuit Over January 6th Narratives

May 09, 2025 -

Wynne Evans Go Compare Future Uncertain Following Sex Slur Allegations

May 09, 2025

Wynne Evans Go Compare Future Uncertain Following Sex Slur Allegations

May 09, 2025 -

Elizabeth Line Strike Dates Planned Action And Route Impacts Feb Mar

May 09, 2025

Elizabeth Line Strike Dates Planned Action And Route Impacts Feb Mar

May 09, 2025