Investing In Palantir Technologies: A Practical Guide For 2024

Table of Contents

Understanding Palantir Technologies' Business Model

Palantir Technologies operates primarily through two platforms: Gotham and Foundry. Understanding these platforms is crucial to grasping Palantir's overall business model and its potential for future growth.

-

Palantir Gotham: This platform is tailored for government agencies and focuses on national security and defense applications. It leverages advanced data analytics to help organizations tackle complex challenges, including counterterrorism, cybersecurity, and intelligence gathering. Large government contracts form a significant portion of Palantir's revenue, providing a stable, albeit sometimes unpredictable, revenue stream.

-

Palantir Foundry: This platform serves commercial clients across various industries, including finance, healthcare, and energy. Foundry offers similar data integration and analytics capabilities as Gotham but is designed for a wider range of applications. The growth of Foundry is a key indicator of Palantir's ability to expand beyond its government client base and tap into the broader commercial market for data analytics solutions.

-

Key features of both platforms:

- Sophisticated data integration: Both platforms excel at integrating data from diverse sources, providing a unified view for improved decision-making.

- Advanced analytics capabilities: Palantir's platforms offer a wide array of analytical tools, enabling users to uncover valuable insights from complex datasets.

- Scalability and adaptability: These platforms are designed to handle massive datasets and adapt to the specific needs of different clients and industries. This adaptability is critical for long-term success in a rapidly evolving market.

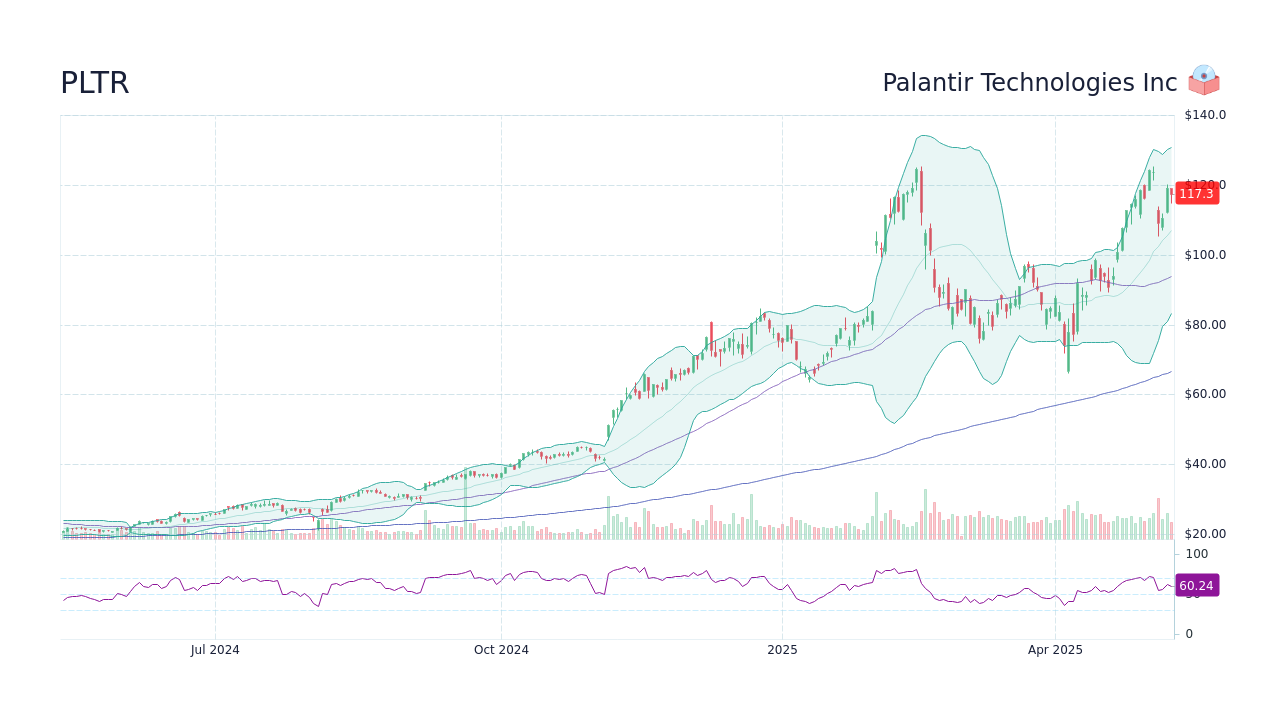

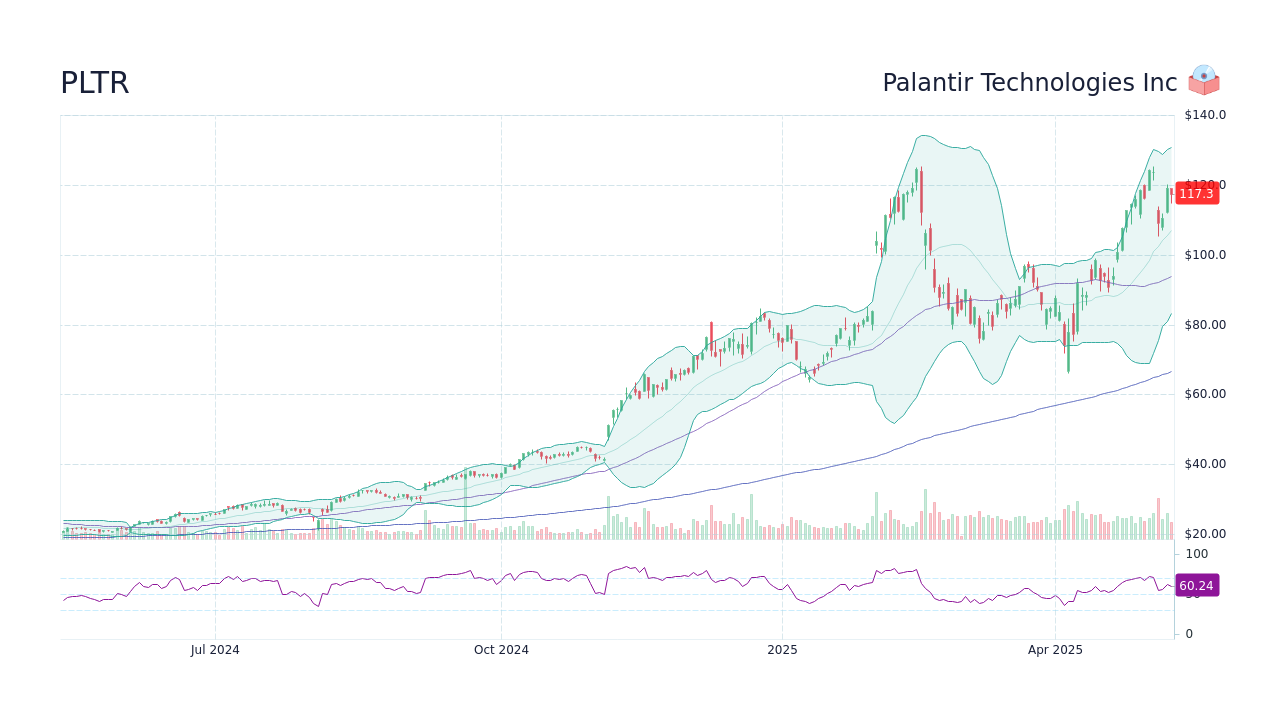

Analyzing Palantir's Financial Performance and Growth Potential

Analyzing Palantir's financial performance requires careful consideration of several key metrics. While the company has demonstrated significant revenue growth, profitability remains a key area of focus for investors.

-

Revenue Growth: Palantir has experienced substantial revenue growth in recent years, driven by both its government and commercial contracts. However, understanding the composition of this growth (government vs. commercial) is vital for assessing long-term sustainability.

-

Profitability: Palantir's profitability has been variable, with periods of losses and periods of increasing profits. Investors should analyze the factors driving profitability, including the mix of government and commercial contracts, operating expenses, and pricing strategies.

-

Key Financial Metrics: Analyzing metrics such as revenue growth rate, operating margin, net income, and free cash flow provides a comprehensive picture of Palantir’s financial health and growth potential. Examining historical trends and comparing them to industry benchmarks is crucial.

-

Future Projections: While predicting future performance is inherently uncertain, analyzing Palantir's revenue projections and growth opportunities, considering factors such as government spending and commercial adoption, offers insights into its potential trajectory.

-

Debt and Cash Flow: Assessing the company's debt levels and its ability to generate positive free cash flow is critical for understanding its financial stability and long-term viability.

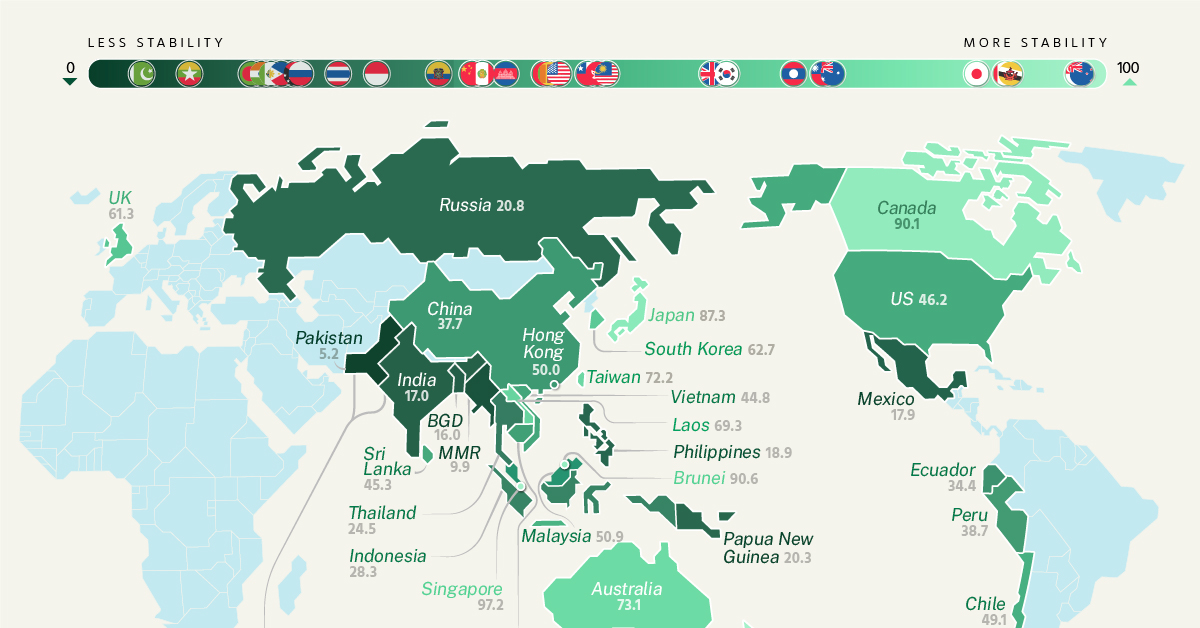

Assessing the Competitive Landscape and Market Share

Palantir operates in a competitive market, facing established players and emerging competitors in both the data analytics and government contracting sectors.

-

Key Competitors: Palantir's competitors include companies like AWS, Microsoft, Google Cloud, and various specialized data analytics firms. Understanding the strengths and weaknesses of these competitors is vital for evaluating Palantir's market position.

-

Market Growth Potential: The overall data analytics market is experiencing significant growth, driven by increasing data volumes and the need for advanced analytical capabilities. Palantir's ability to capture a substantial share of this growth is a critical factor in its future success.

-

Competitive Advantages: Palantir's strengths lie in its proprietary technology, deep expertise in data analytics, and its strong relationships with government agencies. However, it faces challenges from competitors with broader market reach and extensive cloud infrastructure.

-

Emerging Technologies: The rapid evolution of technologies like artificial intelligence (AI) and machine learning (ML) will significantly impact the data analytics market. Palantir's ability to adapt and integrate these technologies into its platforms will be crucial for maintaining its competitive edge.

Evaluating the Risks and Rewards of Investing in Palantir

Investing in Palantir involves considering both significant potential rewards and substantial risks.

Potential Risks:

- High Valuation: Palantir's stock valuation has historically been high relative to its profitability, posing a risk if the company fails to meet market expectations.

- Government Contract Dependence: A significant portion of Palantir's revenue comes from government contracts, which can be subject to budgetary constraints and political changes.

- Intense Competition: The data analytics market is highly competitive, posing a risk to Palantir's market share and profitability.

- Technological Disruption: Rapid technological advancements could render Palantir's technology obsolete or less competitive.

Potential Rewards:

- Significant Long-Term Growth Potential: The growth potential of the data analytics market and Palantir's expansion into the commercial sector offer significant long-term growth opportunities.

- First-Mover Advantage: Palantir's early entry into the government and commercial data analytics markets gives it a first-mover advantage in certain segments.

- Strong Intellectual Property: Palantir's strong intellectual property portfolio protects its technology and provides a competitive moat.

- Increased Market Share and Profitability: Successful execution of its growth strategy could lead to significant increases in market share and profitability.

Conclusion

Investing in Palantir Technologies presents both significant opportunities and considerable risks. A thorough understanding of its business model, financial performance, competitive landscape, and future prospects is crucial before making any investment decisions. While Palantir's innovative data analytics platform shows considerable promise in the government and commercial sectors, potential investors should carefully weigh the potential rewards against the inherent risks, conducting thorough due diligence and seeking professional financial advice before investing in Palantir stock. Remember to research Palantir Technologies thoroughly before making any investment decisions.

Featured Posts

-

Us Tariffs French Minister Advocates For Stronger Eu Retaliation

May 09, 2025

Us Tariffs French Minister Advocates For Stronger Eu Retaliation

May 09, 2025 -

Geopolitical Implications Trumps Influence On Greenland And Denmark

May 09, 2025

Geopolitical Implications Trumps Influence On Greenland And Denmark

May 09, 2025 -

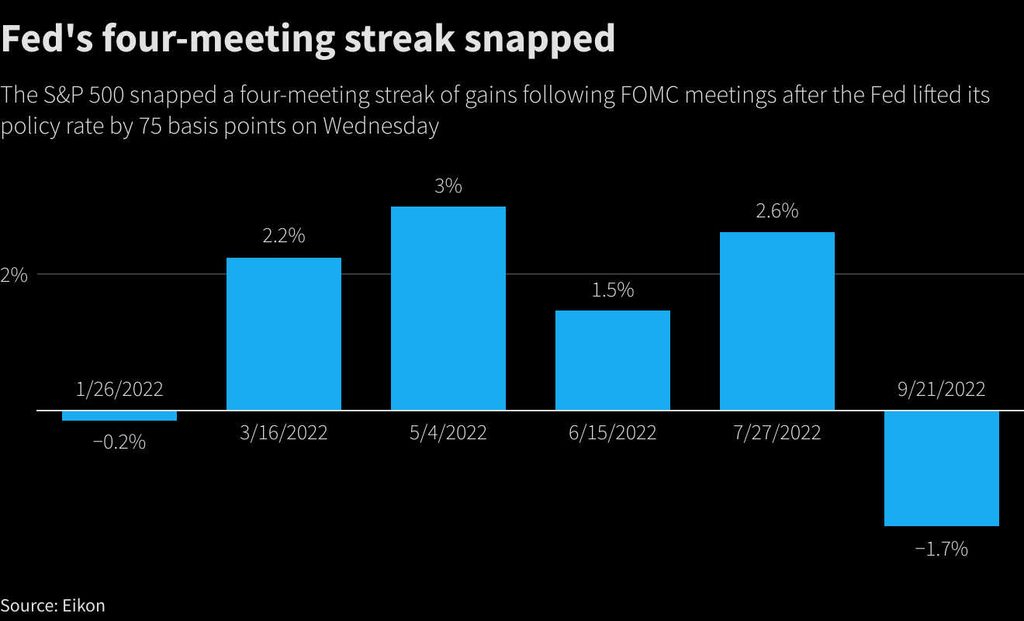

Will The Fed Hold Rates Analyzing Economic Pressures On Monetary Policy

May 09, 2025

Will The Fed Hold Rates Analyzing Economic Pressures On Monetary Policy

May 09, 2025 -

Nottingham Attacks Inquiry Retired Judge Appointed To Chair Investigation

May 09, 2025

Nottingham Attacks Inquiry Retired Judge Appointed To Chair Investigation

May 09, 2025 -

Understanding Wynne And Joanna All At Sea Themes And Symbolism

May 09, 2025

Understanding Wynne And Joanna All At Sea Themes And Symbolism

May 09, 2025