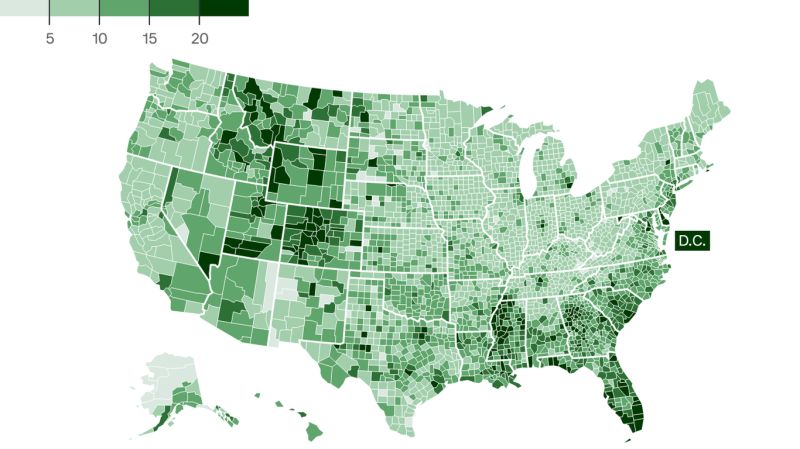

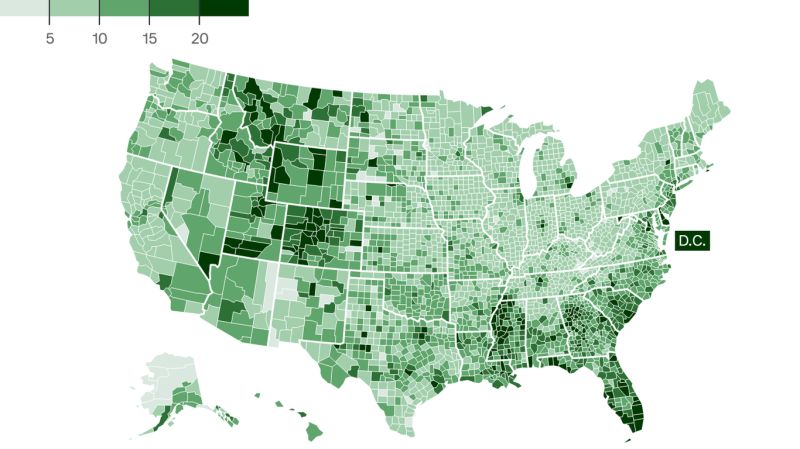

Investing In The Future: Identifying The Country's Top Business Hot Spots

Table of Contents

Analyzing Key Economic Indicators for Identifying Business Hot Spots

Understanding the underlying economic health of a region is paramount when searching for business hot spots. Several key economic indicators provide valuable insights into a location's investment potential. These indicators offer a data-driven approach to identifying areas ripe for growth and offering strong investment opportunities.

-

Examination of GDP growth rates in different regions: Consistent and substantial GDP growth signifies a healthy and expanding economy, indicating strong potential for business success. Regions with consistently high GDP growth rates are more likely to offer profitable investment opportunities.

-

Analysis of employment rates and job creation across the country: High employment rates and robust job creation indicate a dynamic economy attracting businesses and skilled labor, creating a supportive environment for investment. A location with strong job creation offers a greater likelihood of a strong customer base.

-

Assessment of infrastructure development (transportation, communication, energy): Well-developed infrastructure – including efficient transportation networks, reliable communication systems, and a stable energy supply – is crucial for business operations. Areas investing heavily in infrastructure are often attractive locations for businesses seeking smooth operations and cost efficiency.

-

Evaluation of government policies, including tax incentives and business support programs: Government policies, such as tax incentives and business support programs, play a significant role in creating a favorable investment climate. Regions with proactive government support often attract more businesses and foster quicker economic growth.

-

Review of levels of foreign direct investment (FDI) in various sectors and regions: High levels of FDI signal confidence in a region's economic potential, attracting further investment and driving economic expansion. This is an important indicator of long-term viability for businesses and investors alike.

-

Consideration of the overall economic stability and risk factors: Economic stability and the management of risk factors are essential for long-term investment success. A location with a history of economic stability is typically seen as a safer, more attractive investment opportunity.

By carefully analyzing these indicators, you can gain a clear understanding of which regions are experiencing the most robust economic performance, making them prime locations for your business investments.

Identifying Emerging Industries and Sectors Driving Growth

Focusing on emerging industries is crucial for maximizing investment returns. Certain sectors are experiencing exponential growth, presenting significant opportunities for forward-thinking investors.

-

Identifying rapidly growing sectors within the national economy: Research into sectors such as technology, renewable energy, or healthcare will highlight regions concentrating in these areas. Understanding industry trends helps investors align with areas of high-growth potential.

-

Focusing on regions with a high concentration of innovative businesses and startups: Tech hubs and innovation clusters often attract venture capital and talent, creating a dynamic environment for growth. This is where early-stage investment can yield exceptional returns.

-

Analyzing the potential for growth in emerging industries like renewable energy or agritech: Investing in sectors like renewable energy and agricultural technology (agritech) presents unique opportunities for both financial gains and societal impact. These fields often receive substantial government support and attract considerable private investment.

-

Evaluating the strength of the tourism sector in different regions: Regions with thriving tourism industries offer lucrative investment opportunities in hospitality, leisure, and related services. This sector is highly sensitive to economic factors but presents high-growth potential in strategically located areas.

-

Assessing manufacturing clusters and their potential for future expansion: Manufacturing clusters benefit from economies of scale and a specialized workforce. Investing in well-established manufacturing regions can provide a stable and predictable return on investment.

Identifying these emerging sectors and focusing your investment efforts on regions leading in these fields can significantly enhance your chances of success.

Assessing Real Estate and Infrastructure as Key Investment Factors

Real estate and infrastructure are fundamental components of any successful business location. Their quality and accessibility significantly impact a business's operational efficiency and long-term profitability.

-

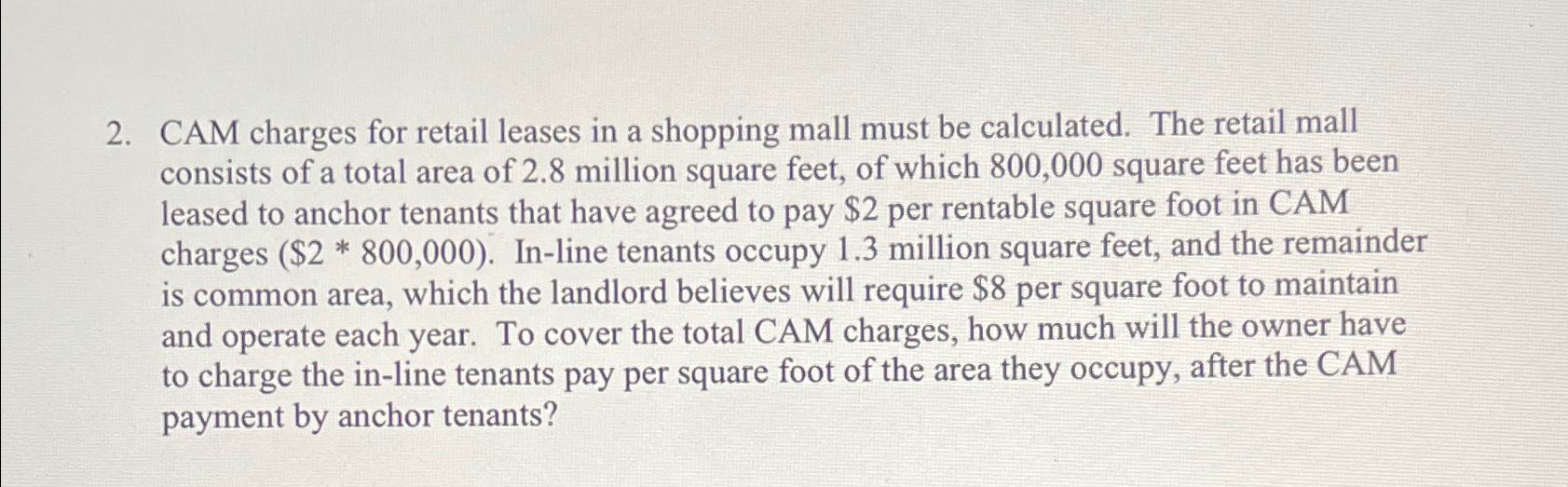

Analysis of commercial real estate markets in different regions: Examining factors like property prices, rental yields, and vacancy rates helps determine the financial feasibility of real estate investments in different regions. This is crucial for long-term investment planning and success.

-

Evaluation of the quality and accessibility of transportation networks: Efficient transportation networks, including roads, railways, and airports, are crucial for efficient logistics and accessibility for both employees and customers. Areas with well-developed transportation infrastructure generally attract more businesses.

-

Assessment of the strength of the logistics infrastructure: A robust logistics infrastructure, encompassing warehousing, distribution, and supply chain management, is essential for businesses relying on efficient movement of goods. A strong logistics infrastructure is a key advantage for businesses looking to reduce costs and boost efficiency.

-

Consideration of projected property value appreciation and rental yields: Understanding the potential for property value appreciation and rental yield growth helps assess the long-term financial returns of real estate investments. These factors are often directly correlated with economic and demographic trends in a given area.

-

Identifying areas with ongoing or planned major infrastructure projects: Investing in areas with ongoing or planned major infrastructure projects often leads to increased property values and improved business opportunities in the future. These projects can act as significant catalysts for economic growth in the area.

Understanding the interplay between real estate and infrastructure is critical for making informed investment decisions. By carefully assessing these factors, you can identify locations offering a strong foundation for future business success.

Conclusion

This article has explored several key factors to consider when identifying the country's top business hot spots, focusing on economic indicators, emerging industries, and the crucial role of real estate and infrastructure. By analyzing these elements, investors can make more informed decisions and maximize their returns. Understanding the interplay between these factors is critical for identifying truly lucrative investment opportunities.

Ready to invest in the future? Start your search for the country's top business hot spots today by conducting thorough research based on the factors discussed. Identify the optimal location for your business investment and unlock exceptional opportunities for growth and prosperity. Don't miss out on the potential of these thriving business hot spots! Begin your analysis of key economic indicators and emerging industries to discover the perfect location for your next profitable business venture.

Featured Posts

-

B C Billionaires Pursuit Of Hudsons Bay Leases A Shopping Mall Expansion

May 27, 2025

B C Billionaires Pursuit Of Hudsons Bay Leases A Shopping Mall Expansion

May 27, 2025 -

Googles Veo 3 Ai Video Generator A Review

May 27, 2025

Googles Veo 3 Ai Video Generator A Review

May 27, 2025 -

Chelsea Eye Strasbourg Striker Emegha

May 27, 2025

Chelsea Eye Strasbourg Striker Emegha

May 27, 2025 -

Free 1923 Season 2 Episode 4 Streaming Options Tonight

May 27, 2025

Free 1923 Season 2 Episode 4 Streaming Options Tonight

May 27, 2025 -

Office 365 Security Flaw Millions Lost In Corporate Data Breach

May 27, 2025

Office 365 Security Flaw Millions Lost In Corporate Data Breach

May 27, 2025

Latest Posts

-

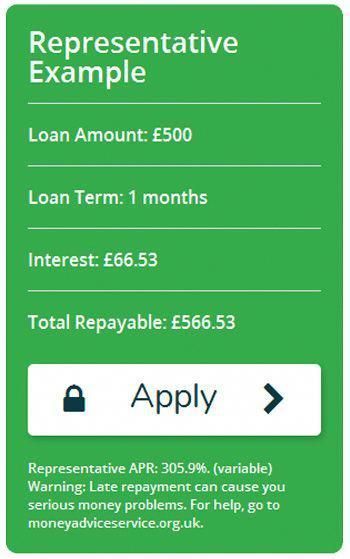

Personal Loans For Bad Credit Direct Lender Comparison

May 28, 2025

Personal Loans For Bad Credit Direct Lender Comparison

May 28, 2025 -

Meilleur Prix Samsung Galaxy S25 128 Go Comparatif Et Offres

May 28, 2025

Meilleur Prix Samsung Galaxy S25 128 Go Comparatif Et Offres

May 28, 2025 -

Secure A Personal Loan With Bad Credit Up To 5000

May 28, 2025

Secure A Personal Loan With Bad Credit Up To 5000

May 28, 2025 -

Find The Best Personal Loan For Bad Credit Direct Lender Options

May 28, 2025

Find The Best Personal Loan For Bad Credit Direct Lender Options

May 28, 2025 -

Smartphone Samsung Galaxy S25 128 Go Avis Prix Et Bon Plan

May 28, 2025

Smartphone Samsung Galaxy S25 128 Go Avis Prix Et Bon Plan

May 28, 2025