Investing In Uber: A Practical Guide To UBER Stock

Table of Contents

Understanding Uber's Business Model and Revenue Streams

Uber's success hinges on its diverse revenue streams, extending far beyond its initial ride-sharing service. Understanding these revenue generators is critical for any UBER stock investment strategy.

Ride-Sharing Dominance

Uber's ride-hailing service remains a cornerstone of its business. However, its market dominance is constantly challenged.

- Global market share statistics: While Uber holds a significant global market share in ride-hailing, precise figures fluctuate and vary by region. Competition is fierce, especially from regional players.

- Regional market leadership: Uber enjoys strong market leadership in North America and many European cities. However, its presence in Asia is more fragmented, facing strong competition from local rivals.

- Competitive landscape analysis: Lyft is a major competitor in the US, while other international players pose significant challenges in different markets. This competitive pressure impacts pricing strategies and profitability.

- Impact of regulatory changes on revenue: Government regulations regarding driver classification, licensing, and pricing significantly affect Uber's revenue and operational costs. Changes in regulations in key markets can dramatically influence its profitability and UBER stock performance.

Uber Eats and Delivery Services

Uber Eats, Uber's food delivery service, has emerged as a major revenue driver. Its success depends on adapting to the ever-evolving food delivery landscape.

- Market share in food delivery: Uber Eats holds a considerable but contested share of the food delivery market, competing with giants like DoorDash and Grubhub.

- Growth trajectory and profitability: The growth of Uber Eats has been impressive, but profitability remains a challenge due to high operational costs and intense competition.

- Competitive analysis (DoorDash, Grubhub, etc.): Uber Eats faces stiff competition from established players with strong brand recognition and optimized delivery networks. This necessitates continuous innovation and marketing efforts.

- Impact of changing consumer preferences: Shifts in consumer demand, such as preferences for specific cuisines or delivery options, can influence Uber Eats' market share and overall performance, directly affecting UBER stock value.

Freight and Other Emerging Businesses

Uber's diversification strategy extends to freight transportation and other emerging ventures, presenting both opportunities and challenges.

- Description of Uber Freight and other new ventures: Uber Freight connects shippers with truckers, leveraging Uber's technology platform to streamline logistics. Other emerging businesses may focus on micromobility or other transportation solutions.

- Market potential and competitive advantages: These emerging businesses tap into large, growing markets. Uber's technological expertise and established brand recognition provide potential competitive advantages.

- Risks and challenges associated with expansion: Expanding into new markets involves significant risks, including regulatory hurdles, competition from established players, and unforeseen operational challenges.

- Long-term growth projections: The long-term growth potential of these diversified businesses is significant, but success depends on effective execution and adapting to market dynamics. This impacts the long-term outlook of UBER stock.

Analyzing UBER Stock Performance and Valuation

A thorough assessment of UBER stock requires analyzing its historical performance, key financial metrics, and future growth prospects.

Historical Stock Price Trends

Analyzing UBER's historical stock price reveals important insights into its performance and market sentiment.

- Chart showing historical stock price: (Note: An actual chart would be included here in a published article.) The stock price chart should illustrate significant highs and lows, revealing periods of strong growth and volatility.

- Key events affecting stock price (e.g., IPO, regulatory changes, earnings reports): Major events like the initial public offering (IPO), significant regulatory changes, and earnings announcements have all significantly impacted UBER stock price.

- Long-term and short-term performance analysis: Analyzing both long-term and short-term trends can help investors understand the overall trajectory of UBER stock and identify potential patterns.

Key Financial Metrics

Understanding Uber's financial health is essential for informed investment decisions.

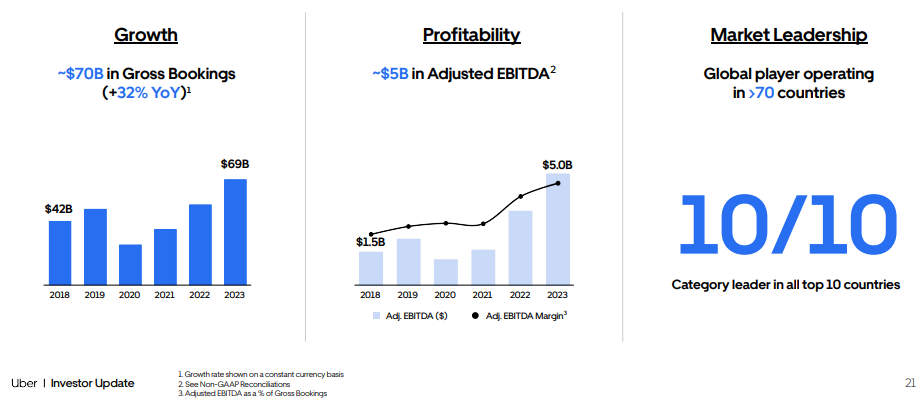

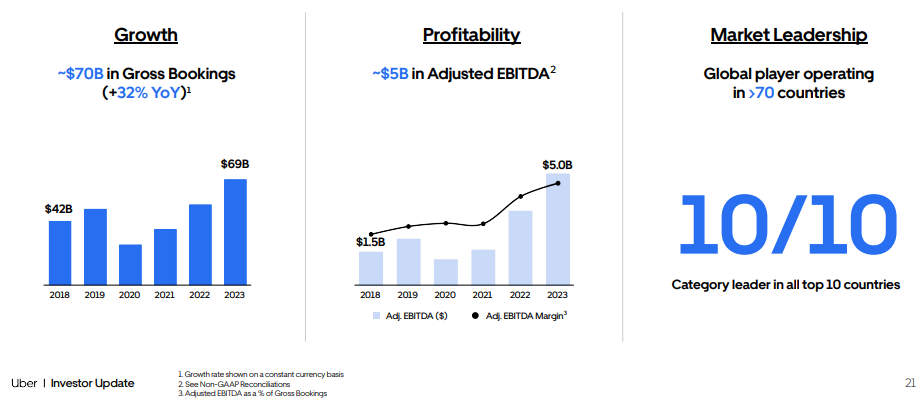

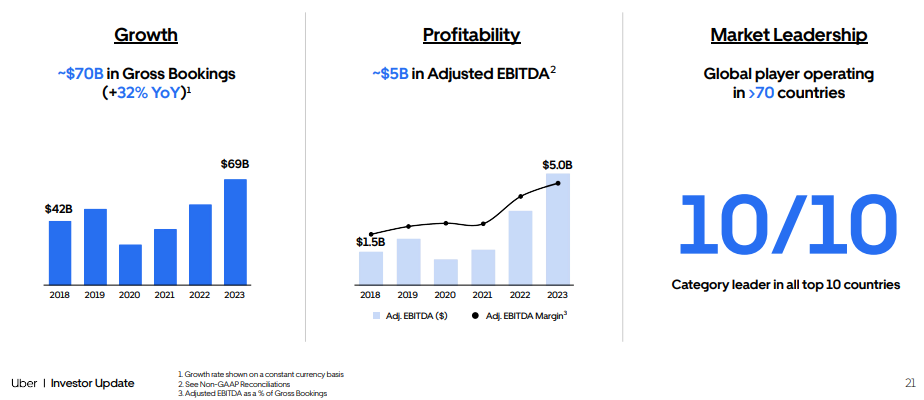

- Revenue growth rate: A consistently high revenue growth rate is a positive indicator, signaling strong market demand and business expansion.

- Profitability margins (gross, operating, net): Analyzing profitability margins provides insights into Uber's efficiency and ability to generate profits from its operations.

- Debt-to-equity ratio: This ratio indicates Uber's financial leverage and its ability to manage its debt burden. A high debt-to-equity ratio can be a cause for concern.

- Free cash flow: Free cash flow indicates the cash generated by Uber's operations after accounting for capital expenditures. Positive free cash flow is generally a positive sign.

Valuation and Future Growth Potential

Evaluating UBER stock's valuation and projecting its future growth are crucial for determining its investment potential.

- Different valuation methods and their results: Several valuation methods, such as Price-to-Earnings (P/E) ratio and Discounted Cash Flow (DCF) analysis, can be used to determine whether UBER stock is undervalued or overvalued.

- Projected revenue and earnings growth: Analyzing future revenue and earnings growth projections is crucial for estimating the potential returns on investment.

- Discounted cash flow analysis: DCF analysis considers the time value of money to estimate the present value of future cash flows, providing a more comprehensive valuation.

- Potential risks to future growth: Factors like increased competition, regulatory changes, and economic downturns can significantly impact Uber's future growth and the value of UBER stock.

Risks and Considerations Before Investing in UBER Stock

Before investing in UBER stock, it's crucial to understand the inherent risks.

Regulatory and Legal Risks

Uber operates in a heavily regulated industry, facing ongoing legal and regulatory challenges.

- Ongoing legal battles and their potential impact: Uber faces numerous legal battles concerning driver classification, labor laws, and data privacy, which could significantly impact its profitability and stock price.

- Regulatory changes in different regions: Changes in regulations across various regions can affect Uber's operations and profitability.

- Labor relations and driver classification issues: The classification of Uber drivers as independent contractors versus employees is a major legal and regulatory concern with significant implications for Uber's costs and liability.

Competitive Risks

The ride-hailing and delivery markets are fiercely competitive, posing a significant risk to Uber's market share and profitability.

- Key competitors and their strengths: Lyft, DoorDash, Grubhub, and other players pose significant competition, each with its own strengths and market strategies.

- Market share dynamics and competitive pressures: The constant competition leads to pricing pressures and the need for continuous innovation to maintain market share.

- Potential for disruptive technologies: The emergence of new technologies and business models could disrupt Uber's existing markets.

Economic and Market Risks

Macroeconomic factors and broader market trends significantly impact Uber's stock performance.

- Sensitivity to economic downturns: During economic downturns, consumer spending on ride-hailing and food delivery services may decrease, negatively impacting Uber's revenue.

- Impact of inflation on costs and pricing: Inflation can increase Uber's operational costs, potentially squeezing its profit margins.

- Overall market sentiment and investor confidence: Negative market sentiment or a decline in investor confidence can lead to a decrease in UBER stock price.

Conclusion

Investing in UBER stock requires careful consideration of its business model, financial performance, and the inherent risks. This guide provides a framework for analysis, but thorough due diligence is crucial. Remember to conduct your own comprehensive research and, if necessary, consult with a financial advisor before investing in UBER stock or any other stock. Start your journey towards informed investing in UBER shares today!

Featured Posts

-

Panstwowa Spolka Vs Onet Pozew O 100 Tys Zl

May 18, 2025

Panstwowa Spolka Vs Onet Pozew O 100 Tys Zl

May 18, 2025 -

Top Us Online Casino Bonuses 2025 Wild Casino Bonus Codes And Reviews

May 18, 2025

Top Us Online Casino Bonuses 2025 Wild Casino Bonus Codes And Reviews

May 18, 2025 -

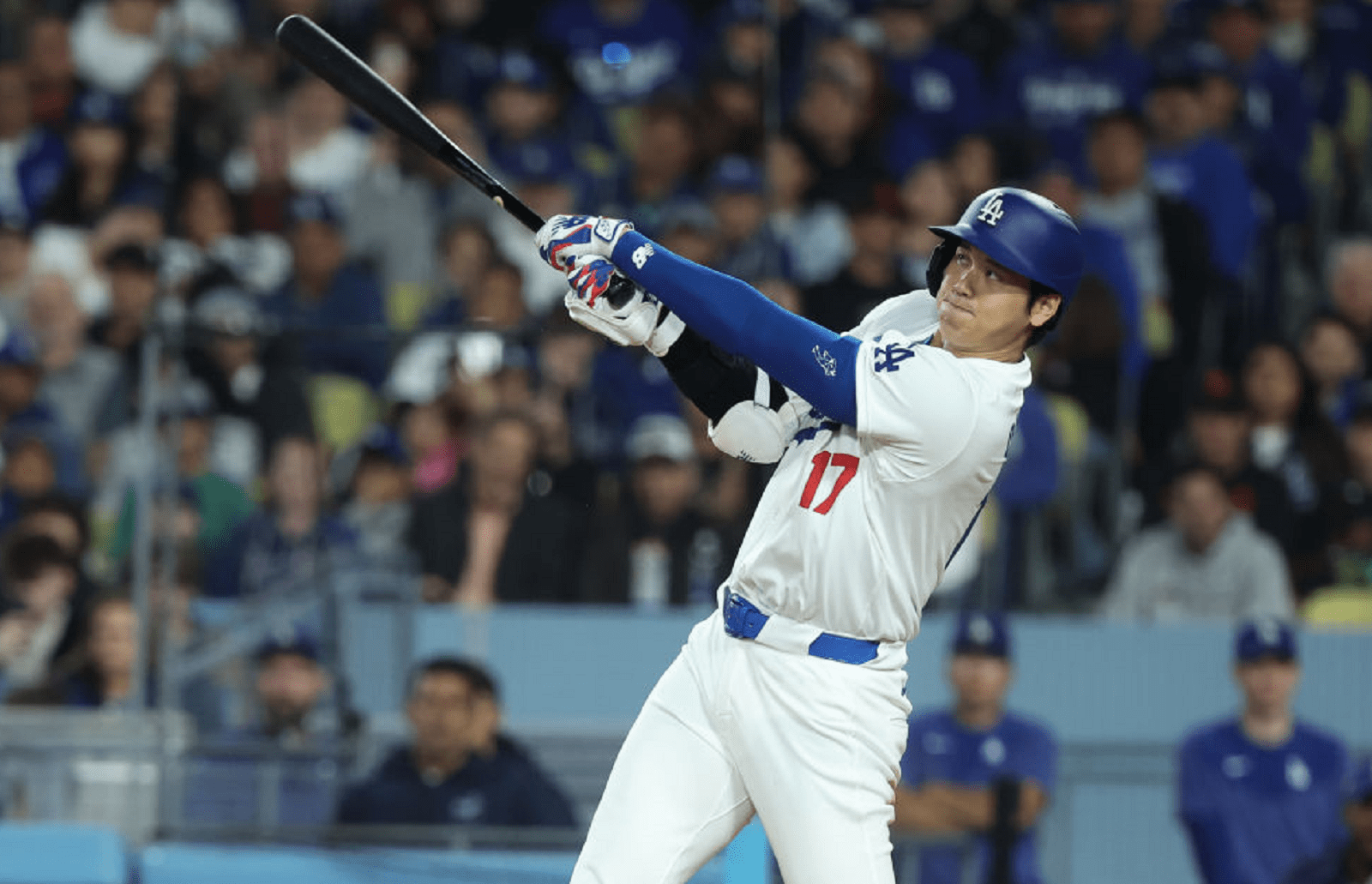

Dodgers Beat Mariners 6 4 Confortos First Home Run For La

May 18, 2025

Dodgers Beat Mariners 6 4 Confortos First Home Run For La

May 18, 2025 -

9 Nyc Bridges Under Urgent Scrutiny Following Baltimore Collapse

May 18, 2025

9 Nyc Bridges Under Urgent Scrutiny Following Baltimore Collapse

May 18, 2025 -

Investing In Uber A Practical Guide To Uber Stock

May 18, 2025

Investing In Uber A Practical Guide To Uber Stock

May 18, 2025

Latest Posts

-

5 Uber Shuttle Service Launches For United Center Event Attendees

May 19, 2025

5 Uber Shuttle Service Launches For United Center Event Attendees

May 19, 2025 -

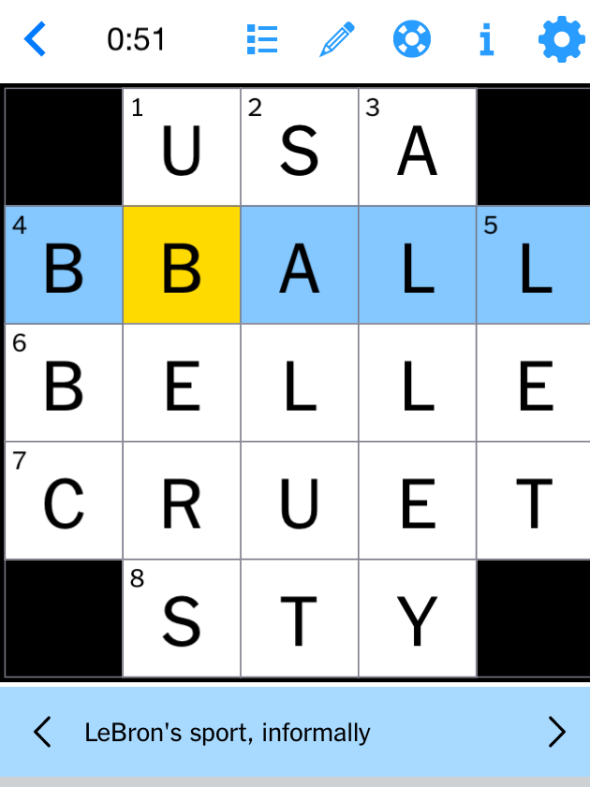

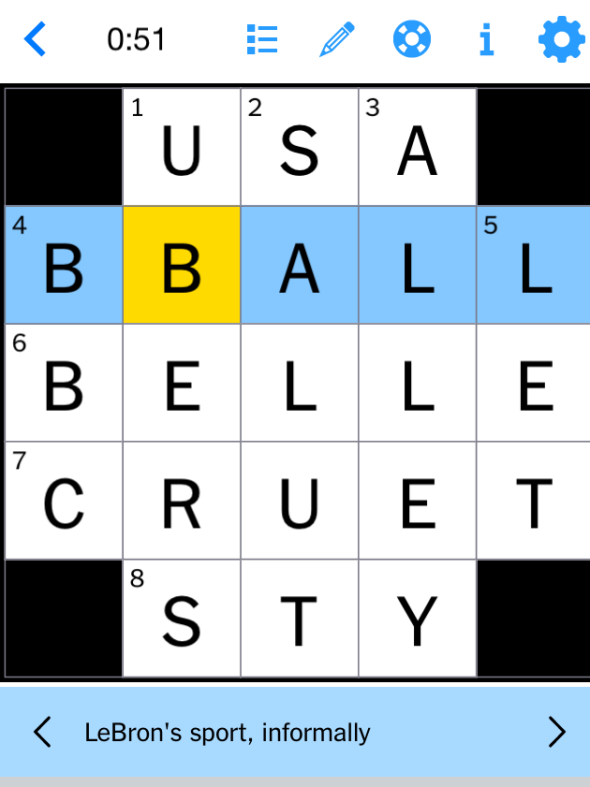

Nyt Mini Crossword March 12 2025 Hints And Solutions

May 19, 2025

Nyt Mini Crossword March 12 2025 Hints And Solutions

May 19, 2025 -

Get Cashback With Uber Kenya Good News For Riders Drivers And Couriers

May 19, 2025

Get Cashback With Uber Kenya Good News For Riders Drivers And Couriers

May 19, 2025 -

Find The Answers Nyt Mini Crossword March 12 2025

May 19, 2025

Find The Answers Nyt Mini Crossword March 12 2025

May 19, 2025 -

Uber Kenya Announces Cashback Program And Increased Order Volume For Partners

May 19, 2025

Uber Kenya Announces Cashback Program And Increased Order Volume For Partners

May 19, 2025