Investment Opportunities: Mapping The Country's Best Business Locations

Table of Contents

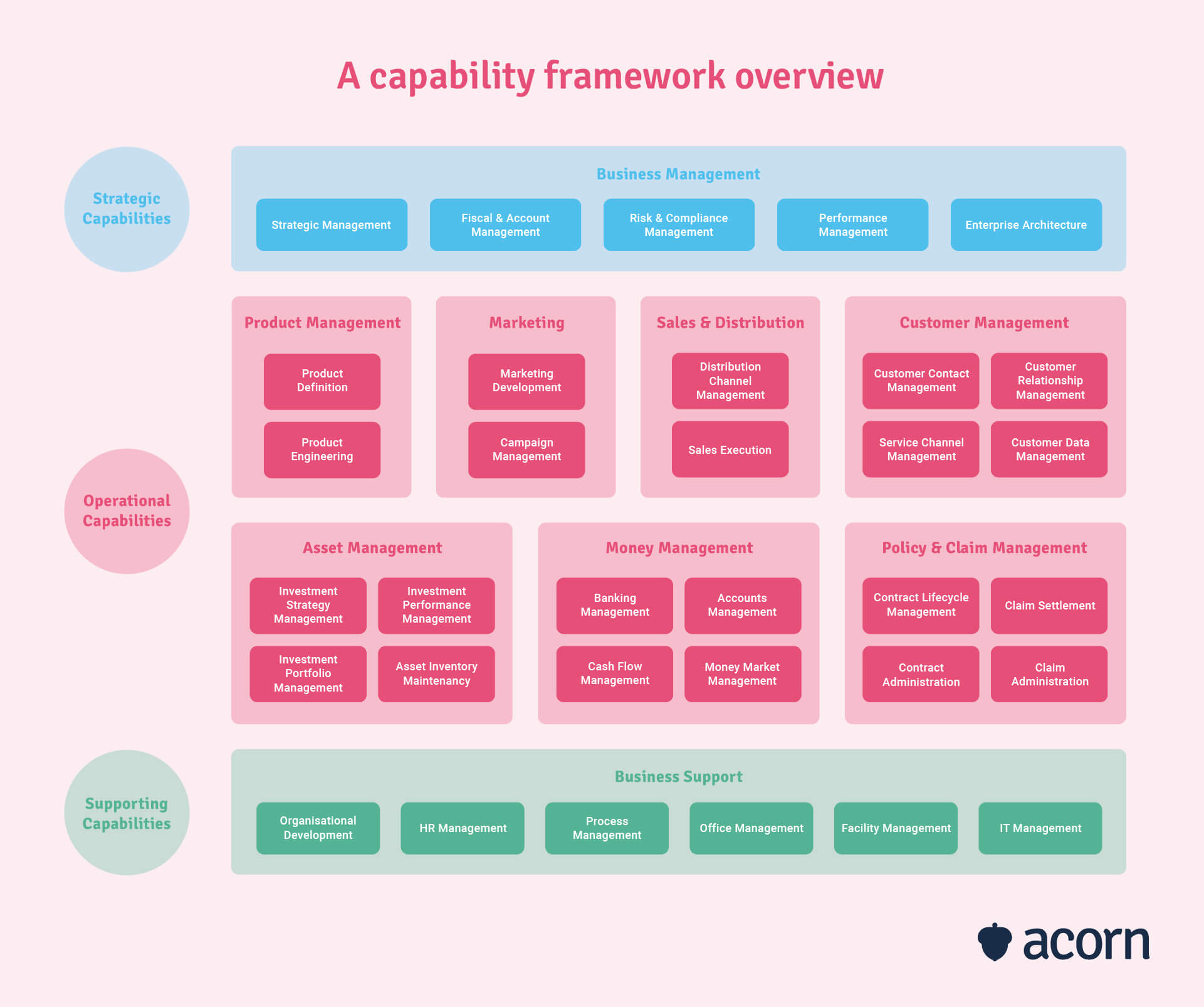

Analyzing Key Economic Indicators for Investment Decisions

Making sound investment decisions requires a thorough analysis of key economic indicators. Understanding the economic landscape is crucial for evaluating the potential profitability of your business venture.

GDP Growth and Sectoral Performance: A region's GDP growth rate provides a clear picture of its overall economic health. Focusing on high-growth sectors within those regions can further refine your investment strategy.

- Examples of regions with strong growth: The coastal regions have seen significant growth in the technology sector, while the central provinces are experiencing a boom in renewable energy investments. The southern region showcases strong tourism growth.

- Data sources: Reliable economic data can be found on the Ministry of Finance website, the Central Bank's publications, and reports from reputable international financial institutions like the World Bank and IMF.

Infrastructure and Logistics: Robust infrastructure – encompassing transportation networks, communication systems, and reliable energy supply – is paramount for business efficiency and profitability.

- Regions with well-developed infrastructure: Major metropolitan areas generally boast superior infrastructure, facilitating smooth logistics and operations.

- Challenges of inadequate infrastructure: Some rural areas face challenges related to limited transportation options and unreliable electricity, potentially increasing operational costs.

Tax Incentives and Government Support: Government policies significantly influence the attractiveness of a location for investment. Tax breaks, subsidies, and other incentives can dramatically impact profitability.

- Government programs: Several regions offer tax holidays for businesses in specific sectors, while others provide grants for infrastructure development. Check the Invest [Country Name] website for details.

- Researching government incentives: Official government websites, chambers of commerce, and business development agencies are excellent resources for detailed information on available incentives.

Evaluating Demographic and Market Factors

Beyond economic indicators, demographic and market factors play a crucial role in investment success. Understanding the local population and market dynamics is crucial for your business's viability.

Population Demographics and Consumer Spending: Analyzing population size, age distribution, and spending habits can help you identify regions with high consumer demand.

- Regions with strong consumer markets: Major cities generally exhibit higher consumer spending due to a larger and more affluent population.

- Data sources: Demographic data and consumer spending patterns can be found in reports from market research firms, government statistical agencies, and industry associations.

Local Workforce and Talent Pool: Access to a skilled and readily available workforce is vital for efficient operations.

- Regions with a skilled workforce: Areas with strong universities and vocational training centers typically boast a skilled workforce.

- Workforce shortages: Certain sectors in some regions might face challenges with workforce shortages, requiring investment in training and development programs.

Market Competition and Customer Base: Assessing the level of competition and the size of the target market is essential for identifying opportunities with growth potential.

- Less saturated markets: Emerging markets or regions with niche industries might offer lower competition.

- Market research: Conduct thorough market research to understand customer needs, preferences, and buying behaviors.

Exploring Emerging Investment Hotspots

Identifying emerging investment hotspots requires careful analysis and forward-thinking. These regions often present high-growth potential but may also involve higher risks.

Case Studies of Successful Investments: Learning from past successes can provide valuable insights.

- Successful investment examples: [Insert examples of companies successfully establishing businesses in specific regions, highlighting their strategies and achievements.]

- Factors contributing to success: Access to raw materials, skilled labor, supportive government policies, and strategic location are key elements for successful investment.

Identifying Up-and-Coming Areas with High Growth Potential: Certain regions are poised for significant growth due to infrastructure development or strategic government initiatives.

- Regions with promising infrastructure: Areas with ongoing infrastructure projects, such as new transportation networks or industrial parks, are likely to attract investment.

- Regions attracting FDI: Monitor regions receiving significant foreign direct investment as this indicates confidence in their future economic prospects.

Minimizing Risks and Mitigating Challenges: No investment is without risk. Proactive risk assessment and mitigation strategies are crucial for success.

- Potential risks: Political instability, economic downturns, and regulatory changes are some of the potential risks.

- Risk mitigation strategies: Conduct thorough due diligence, diversify investments, and develop contingency plans to mitigate potential risks.

Conclusion

Choosing the right location for your investment is a critical decision demanding careful consideration of economic indicators, demographic factors, and emerging trends. By thoroughly analyzing Investment Opportunities: Mapping the Country's Best Business Locations, you can significantly enhance your chances of success. Remember to conduct thorough research using the resources mentioned above. Consider consulting with business advisors specializing in investment location analysis to further refine your strategy and identify the optimal location for your investment needs. Unlock the potential of your investment by strategically mapping your path to success within the country's diverse and dynamic business landscape.

Featured Posts

-

China Weighs Trade Talks Copper Prices React

May 06, 2025

China Weighs Trade Talks Copper Prices React

May 06, 2025 -

Schwarzeneggers White Lotus Role Dispelling Nepotism Rumors

May 06, 2025

Schwarzeneggers White Lotus Role Dispelling Nepotism Rumors

May 06, 2025 -

Mindy Kaling Quebra O Silencio Anos De Idas E Vindas Com Ex Colega De The Office

May 06, 2025

Mindy Kaling Quebra O Silencio Anos De Idas E Vindas Com Ex Colega De The Office

May 06, 2025 -

Ddg And Halle Bailey The Dont Take My Son Diss Track Explained

May 06, 2025

Ddg And Halle Bailey The Dont Take My Son Diss Track Explained

May 06, 2025 -

Following In Giant Footsteps Evaluating The Sequel Website

May 06, 2025

Following In Giant Footsteps Evaluating The Sequel Website

May 06, 2025

Latest Posts

-

Breaking Barriers And Boundaries Black Women Athletes Impact On Fashion

May 06, 2025

Breaking Barriers And Boundaries Black Women Athletes Impact On Fashion

May 06, 2025 -

Mahers Criticism Nikes Super Bowl 2025 Ad And The Patriarchy Debate

May 06, 2025

Mahers Criticism Nikes Super Bowl 2025 Ad And The Patriarchy Debate

May 06, 2025 -

Style Icons How Black Women Athletes Are Changing The Fashion Game

May 06, 2025

Style Icons How Black Women Athletes Are Changing The Fashion Game

May 06, 2025 -

2025 Met Gala Livestream Accessing The Event From Latin America Mexico And The U S

May 06, 2025

2025 Met Gala Livestream Accessing The Event From Latin America Mexico And The U S

May 06, 2025 -

Livestreaming The 2025 Met Gala A Guide For Viewers In Latin America Mexico And The U S

May 06, 2025

Livestreaming The 2025 Met Gala A Guide For Viewers In Latin America Mexico And The U S

May 06, 2025