Investment Opportunities: Supporting Sustainability In Small Businesses

Table of Contents

Identifying Sustainable Small Businesses with High Growth Potential

Identifying promising sustainable businesses requires a multifaceted approach. This involves assessing their environmental and social impact, analyzing market trends, and conducting thorough financial projections.

Assessing Environmental and Social Impact

Measuring a business's sustainability efforts is crucial. Key metrics include:

- Carbon footprint reduction: Analyze their greenhouse gas emissions and strategies for minimizing them.

- Ethical sourcing: Evaluate their supply chains for fair labor practices and responsible resource extraction.

- Waste management: Assess their recycling, composting, and waste reduction programs.

- Water conservation: Examine their water usage and strategies for efficient water management.

Certifications like B Corp and LEED provide valuable indicators of a company's commitment to sustainability. Conducting thorough due diligence, potentially using resources like sustainability reports and third-party audits, is vital.

Market Analysis and Future Trends

The market for sustainable goods and services is booming. High-growth sectors include:

- Renewable energy: Solar power, wind energy, and other renewable energy technologies.

- Organic food: Demand for organically grown food and beverages continues to rise.

- Sustainable fashion: Consumers are increasingly seeking clothing made from sustainable materials and with ethical labor practices.

- Eco-tourism: Experiences that minimize environmental impact while supporting local communities.

Utilize market research tools, analyze competitor landscapes, and identify emerging niches within the sustainable business landscape to pinpoint high-potential investments.

Financial Projections and Risk Assessment

A thorough financial analysis is non-negotiable. This includes:

- Revenue projections: Forecast future revenue based on market demand and business growth plans.

- Profitability analysis: Evaluate the business's profitability and potential for return on investment.

- Risk assessment: Identify potential risks, including market volatility, regulatory changes, and competition.

Access professional financial advice to ensure a comprehensive understanding of the business's financial health and potential risks. Key financial indicators like EBITDA, cash flow, and debt-to-equity ratio should be carefully analyzed.

Investment Vehicles for Sustainable Small Businesses

Several investment vehicles cater to supporting sustainable small businesses:

Angel Investing and Venture Capital

Angel investors and venture capitalists provide crucial funding for early-stage sustainable businesses.

- Angel Investing: Often involves individual investors providing capital in exchange for equity.

- Venture Capital: Involves firms investing in high-growth potential companies.

Finding relevant networks and platforms is key, as is conducting rigorous due diligence before investing. While offering high potential returns, these options also carry higher risk.

Impact Investing and Socially Responsible Investing (SRI)

Impact investing prioritizes both financial returns and positive social and environmental impact. SRI aligns investments with ethical and environmental criteria.

- Impact Investment Funds: Focus on generating measurable social and environmental impact alongside financial returns.

- SRI Criteria: Consider factors like environmental performance, social responsibility, and corporate governance.

Aligning investment goals with social and environmental objectives is paramount in this approach.

Crowdfunding and Community Investing

Crowdfunding platforms and community-based investment models offer alternative avenues for supporting sustainable SMEs.

- Crowdfunding Platforms: Platforms like Kickstarter and Indiegogo allow individuals to invest small amounts in exchange for rewards or equity.

- Community Investment Initiatives: Local initiatives provide funding and support for businesses within a specific community.

These models offer a more accessible entry point for investors while fostering community engagement.

Green Bonds and Sustainable Loans

Green bonds and loans provide financing specifically designed for environmentally friendly projects.

- Green Bonds: Debt securities issued to finance green projects, offering fixed income with positive environmental impact.

- Sustainable Loans: Loans provided by banks and other financial institutions with favorable terms for sustainable businesses.

Eligibility criteria and interest rates vary, but these options can offer attractive financing solutions for eligible businesses.

Due Diligence and Risk Management in Sustainable Investments

Thorough due diligence and robust risk management are essential for successful sustainable investments.

Assessing Environmental and Social Risks

Identifying and mitigating potential risks is crucial:

- Regulatory Changes: Changes in environmental regulations can significantly impact a business.

- Supply Chain Disruptions: Disruptions in sustainable supply chains can affect production and profitability.

- Reputational Damage: Negative publicity related to environmental or social issues can harm a business's reputation.

Employing risk assessment frameworks and developing mitigation strategies are vital.

Legal and Regulatory Compliance

Understanding the legal and regulatory landscape is essential:

- Environmental Legislation: Compliance with relevant environmental laws and regulations is crucial.

- Sustainability Certifications: Obtaining relevant certifications can enhance credibility and reduce risks.

- Legal Counsel: Seeking legal advice can ensure compliance and mitigate legal risks.

Staying abreast of changes in legislation and regulations is crucial for long-term success.

Building a Sustainable Investment Portfolio

Diversifying investments across various sustainable businesses and sectors reduces overall portfolio risk:

- Portfolio Diversification: Spreading investments across different sectors and business models mitigates risk.

- Risk Tolerance Assessment: Understanding your risk tolerance informs investment decisions.

- Long-Term Investment Horizons: Sustainable investments often require a longer-term perspective.

A well-diversified portfolio can offer both financial stability and significant positive impact.

Conclusion

Investing in sustainable small businesses presents compelling investment opportunities offering the potential for both financial returns and positive social and environmental impact. By carefully identifying promising ventures, utilizing diverse investment vehicles, and managing risks effectively, investors can contribute to a more sustainable future while building a profitable investment portfolio. Start exploring the world of investment opportunities supporting sustainability in small businesses today. Identify promising ventures and contribute to a more sustainable future while building a profitable investment portfolio. [Link to relevant resource 1] [Link to relevant resource 2]

Featured Posts

-

Ufc Vegas 106 Morales Knockout Victory Over Burns A New Era Begins

May 19, 2025

Ufc Vegas 106 Morales Knockout Victory Over Burns A New Era Begins

May 19, 2025 -

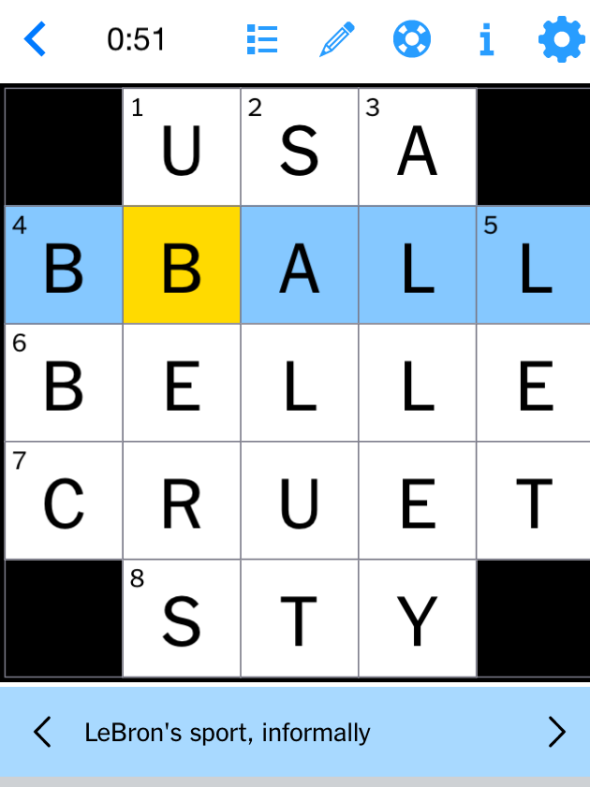

Nyt Mini Crossword Today February 27 2025 Hints And Answers

May 19, 2025

Nyt Mini Crossword Today February 27 2025 Hints And Answers

May 19, 2025 -

Ubers Self Driving Gamble Etf Investing Strategies For The Autonomous Vehicle Revolution

May 19, 2025

Ubers Self Driving Gamble Etf Investing Strategies For The Autonomous Vehicle Revolution

May 19, 2025 -

Libya Pms Pledge To Dismantle Militias Amidst Tripoli Unrest

May 19, 2025

Libya Pms Pledge To Dismantle Militias Amidst Tripoli Unrest

May 19, 2025 -

Uber One Arrives In Kenya Get More For Less With Membership Benefits

May 19, 2025

Uber One Arrives In Kenya Get More For Less With Membership Benefits

May 19, 2025

Latest Posts

-

Federal Investigation Office365 Breach Nets Millions For Hacker

May 19, 2025

Federal Investigation Office365 Breach Nets Millions For Hacker

May 19, 2025 -

Millions Stolen After Office365 Hack Of Executive Inboxes Fbi Alleges

May 19, 2025

Millions Stolen After Office365 Hack Of Executive Inboxes Fbi Alleges

May 19, 2025 -

Severe Storms And Tornadoes 25 Fatalities Extensive Damage In Central Us

May 19, 2025

Severe Storms And Tornadoes 25 Fatalities Extensive Damage In Central Us

May 19, 2025 -

25 Killed As Powerful Tornadoes Slam Central Us Causing Catastrophic Damage

May 19, 2025

25 Killed As Powerful Tornadoes Slam Central Us Causing Catastrophic Damage

May 19, 2025 -

Central Us Tornadoes Death Toll Rises To 25 Significant Damage Reported

May 19, 2025

Central Us Tornadoes Death Toll Rises To 25 Significant Damage Reported

May 19, 2025