Investor Uncertainty In Japan: Navigating The Steep Bond Yield Curve

Table of Contents

The Steepening Japanese Bond Yield Curve: Causes and Consequences

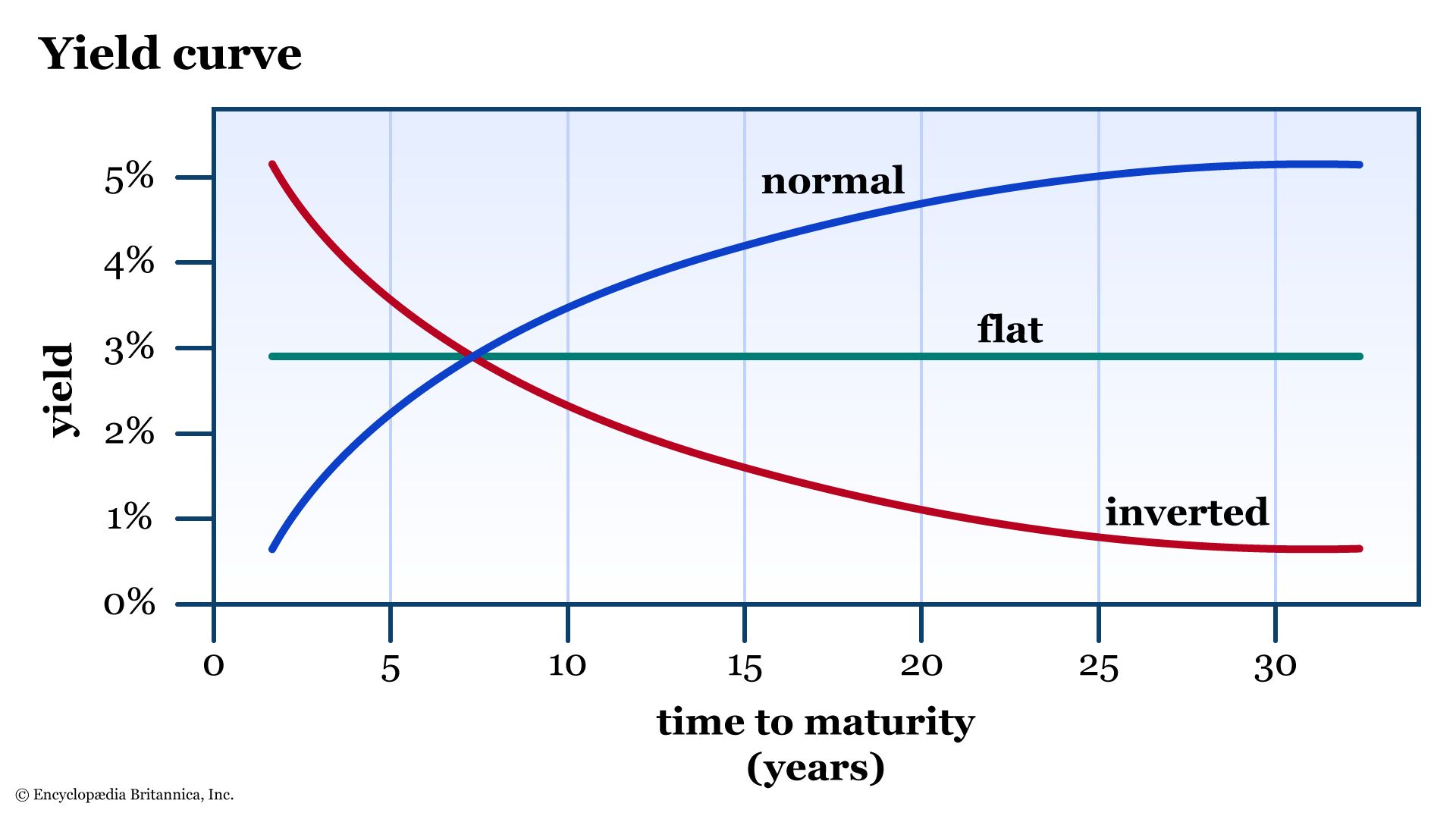

A steep yield curve refers to a significant difference between short-term and long-term bond yields. In a steepening curve, long-term yields rise faster than short-term yields, often indicating expectations of future economic growth and higher inflation. However, in the context of Japan, the steepening curve reflects a complex interplay of factors, presenting both challenges and opportunities.

Bank of Japan Policy Shift

The Bank of Japan's (BOJ) recent policy adjustments have significantly impacted Japanese bond yields. The BOJ's previous yield curve control (YCC) policy aimed to keep long-term interest rates low. However, recent adjustments have allowed for greater flexibility, leading to a rise in long-term yields.

- Changes in yield curve control: The BOJ has widened the acceptable range for 10-year Japanese government bond (JGB) yields, signaling a potential shift away from its ultra-loose monetary policy.

- Potential for further adjustments: Further adjustments to the BOJ's monetary policy remain a possibility, depending on future economic data and inflation trends. Market participants are closely watching for any signals of additional policy changes.

- Market reaction: The market has reacted to these changes with increased volatility, as investors adjust their portfolios to account for the changing landscape of Japanese interest rates.

Global Inflationary Pressures

Global inflationary pressures, particularly in the US, have exerted considerable influence on Japanese bond yields. Rising US interest rates have strengthened the US dollar against the yen, increasing the attractiveness of US bonds and putting downward pressure on the yen.

- Impact of rising US interest rates: Higher US interest rates draw capital away from Japan, impacting the demand for JGBs and increasing their yields.

- Inflation expectations in Japan: While inflation in Japan remains relatively subdued compared to other developed economies, rising global inflation has increased expectations of future inflation within Japan, pushing up long-term bond yields.

- Safe-haven status of the yen: The yen's traditional safe-haven status has been challenged by the widening interest rate differential between Japan and other major economies, reducing its appeal as a safe investment.

Increased Government Borrowing

Japan's substantial and growing government debt plays a significant role in the steepening yield curve. The government's increased borrowing needs lead to a larger supply of JGBs in the market, potentially putting upward pressure on yields.

- Japan's fiscal situation: Japan's high level of public debt necessitates continuous government borrowing to finance its spending commitments.

- Increased bond issuance: The increased issuance of JGBs to finance government spending contributes to the overall supply of bonds in the market.

- Impact on market liquidity: The sheer volume of JGB issuance can impact market liquidity, potentially leading to greater price volatility and higher yields.

Risk Assessment and Opportunities in the Japanese Bond Market

Investing in Japanese bonds currently presents both risks and opportunities. A thorough understanding of these factors is crucial for making informed investment decisions.

Identifying Potential Risks

Investors should carefully assess several potential risks associated with investing in the Japanese bond market:

- Interest rate risk: Rising interest rates can decrease the value of existing bonds, especially those with longer maturities.

- Inflation risk: Unexpected increases in inflation can erode the purchasing power of bond returns.

- Currency risk: Fluctuations in the yen's exchange rate can impact the returns for international investors.

- Credit risk (for corporate bonds): Corporate bonds carry the risk of default, meaning the issuer may fail to make interest payments or repay principal.

Exploring Investment Opportunities

Despite the risks, the current market environment also presents several investment opportunities:

- Diversification strategies: Diversifying across different maturities and credit ratings can help mitigate some risks.

- Hedging techniques: Using hedging strategies can help protect against currency fluctuations and interest rate changes.

- Sector-specific opportunities: Focusing on specific sectors with strong fundamentals can offer attractive returns.

- Focusing on specific maturities: Investors can strategically choose bond maturities to align with their investment horizons and risk tolerance.

Strategies for Navigating Investor Uncertainty

Navigating the uncertainties in the Japanese bond market requires a well-defined investment strategy and diligent risk management.

Due Diligence and Research

Thorough research is essential before investing in Japanese bonds. Investors should carefully analyze macroeconomic trends, the BOJ's monetary policy stance, and the creditworthiness of individual issuers.

Expert Advice

Seeking professional guidance from financial advisors specializing in Japanese markets is highly recommended. Experienced advisors can provide valuable insights and help develop a tailored investment strategy.

Diversification

Diversifying across different asset classes and maturities is crucial for mitigating risks and optimizing returns. A well-diversified portfolio can better withstand market fluctuations.

Monitoring Market Trends

Consistent monitoring of market developments and economic indicators is critical. Staying informed about shifts in BOJ policy, inflation trends, and government borrowing is essential for making timely adjustments to investment strategies.

Conclusion

The steepening Japanese bond yield curve presents both challenges and opportunities for investors. Understanding the underlying factors driving this shift—including the Bank of Japan's policy changes, global inflationary pressures, and increasing government borrowing—is crucial for making informed investment decisions. By carefully assessing risks, employing suitable Japanese bond investment strategies, and seeking professional advice, investors can effectively navigate the complexities of the Japanese bond market and potentially capitalize on its evolving dynamics. Don't hesitate to conduct thorough research and understand the intricacies of the Japanese Bond Yield Curve before making any investment decisions.

Featured Posts

-

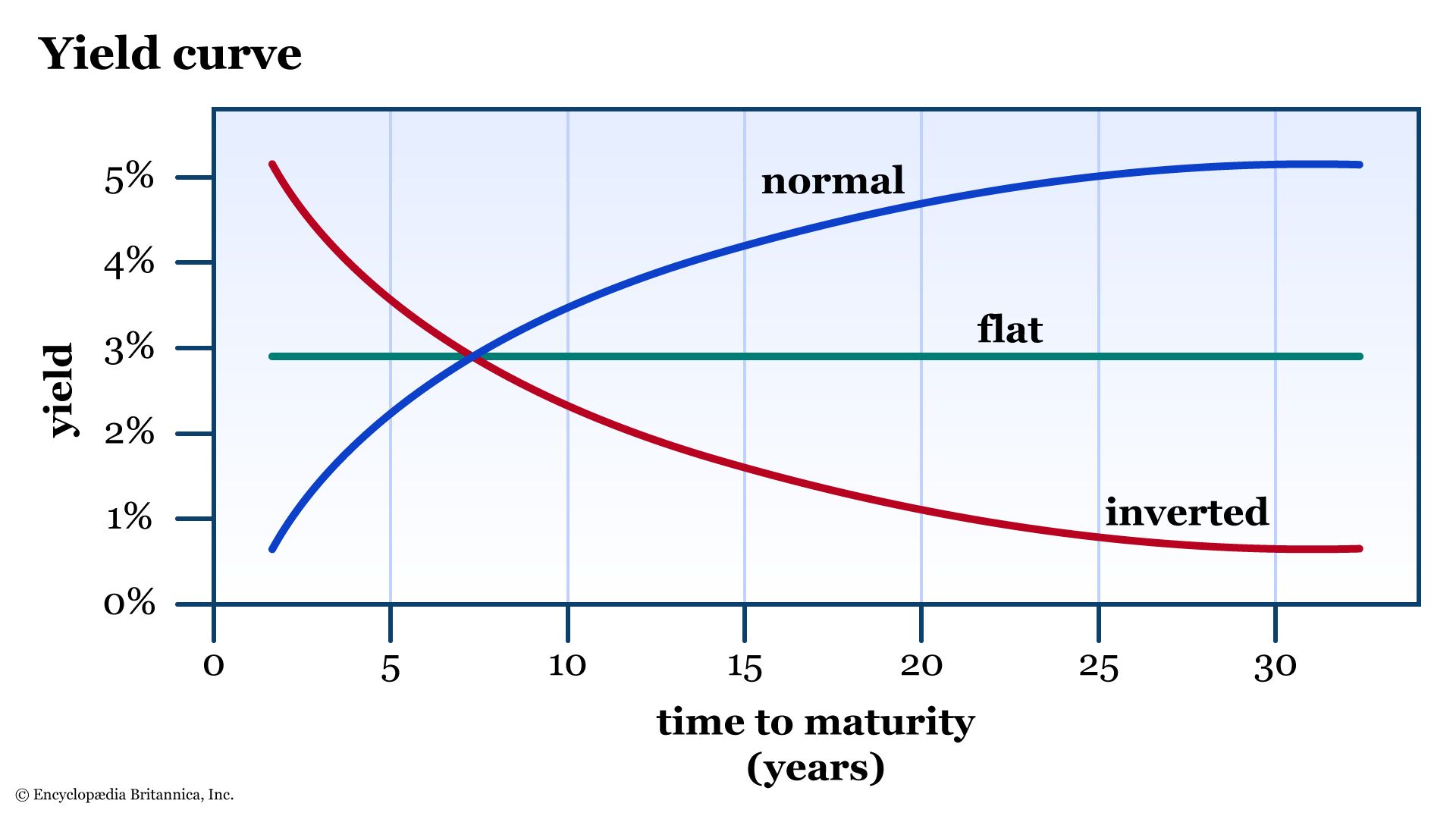

Potential Hhs Shift On Covid 19 Vaccination Recommendations An Exclusive Report

May 17, 2025

Potential Hhs Shift On Covid 19 Vaccination Recommendations An Exclusive Report

May 17, 2025 -

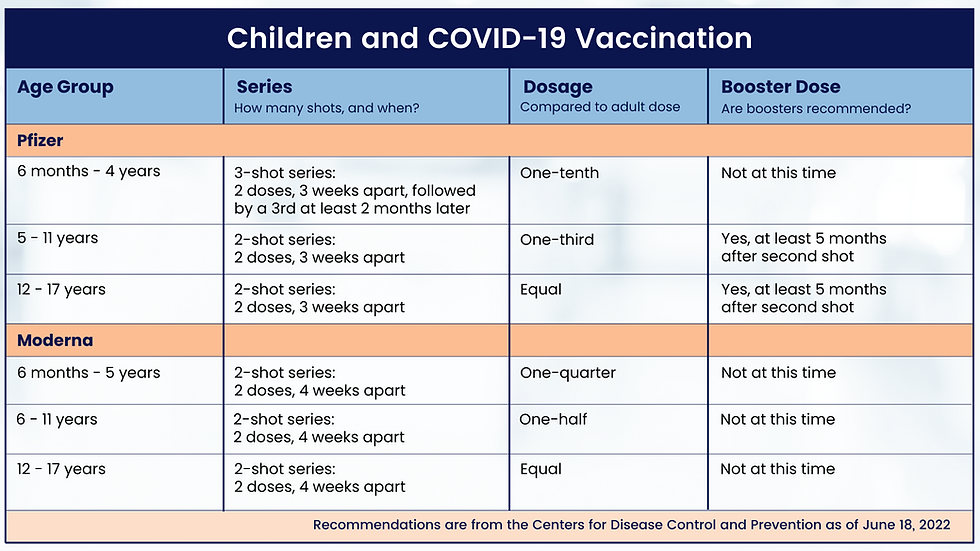

Hondas Us Tariff Impact A Boon For Canadian Auto Exports

May 17, 2025

Hondas Us Tariff Impact A Boon For Canadian Auto Exports

May 17, 2025 -

Thibodeaus Frustration Knicks Game 2 Defeat And Referee Controversy

May 17, 2025

Thibodeaus Frustration Knicks Game 2 Defeat And Referee Controversy

May 17, 2025 -

Jalen Brunson Injury Update Will He Play Knicks Fans React

May 17, 2025

Jalen Brunson Injury Update Will He Play Knicks Fans React

May 17, 2025 -

Mlb Betting Mariners Vs Reds Game Predictions And Best Odds

May 17, 2025

Mlb Betting Mariners Vs Reds Game Predictions And Best Odds

May 17, 2025

Latest Posts

-

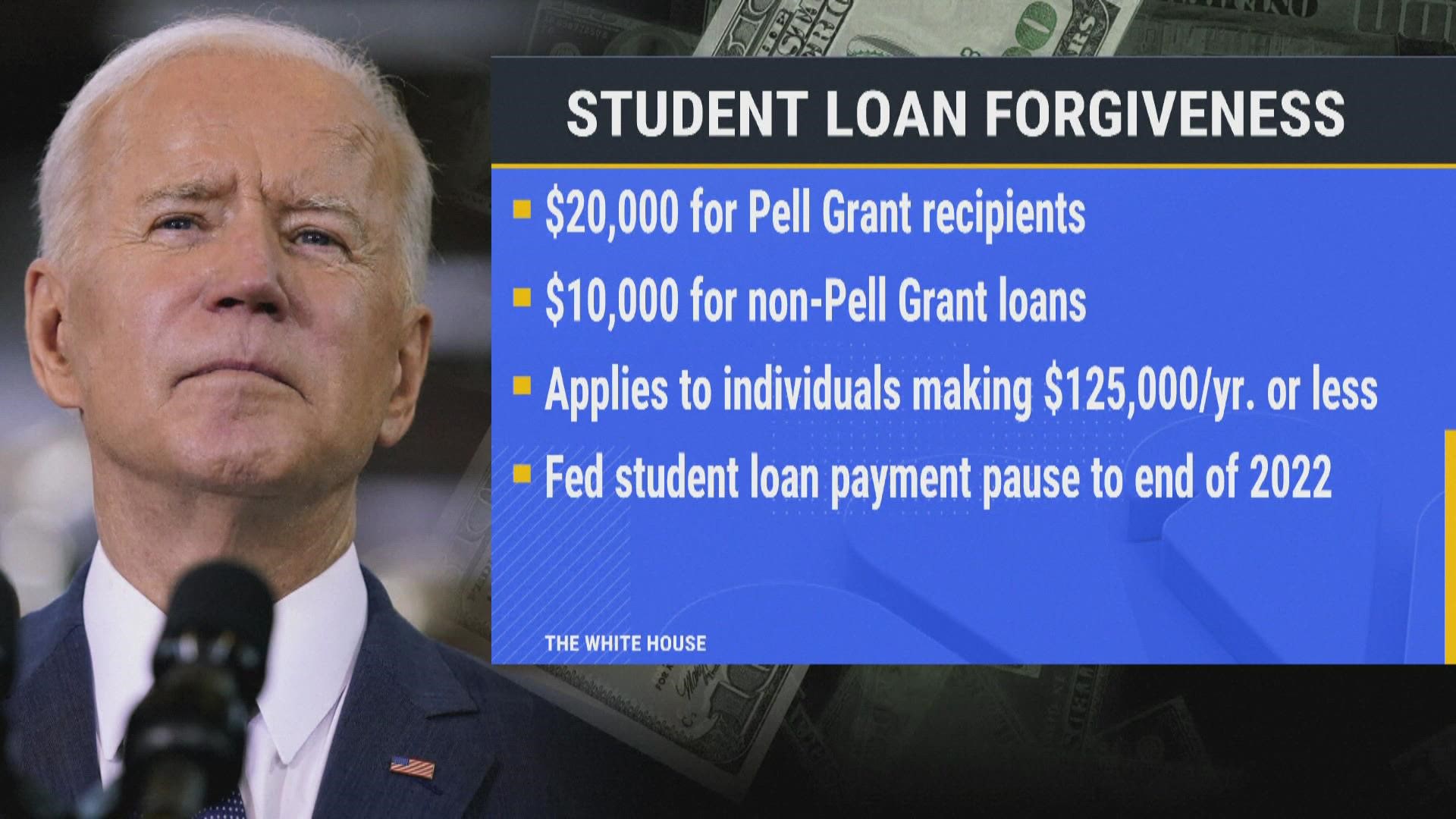

El Impacto De Trump En Los Deudores De Prestamos Estudiantiles Analisis Y Perspectivas

May 17, 2025

El Impacto De Trump En Los Deudores De Prestamos Estudiantiles Analisis Y Perspectivas

May 17, 2025 -

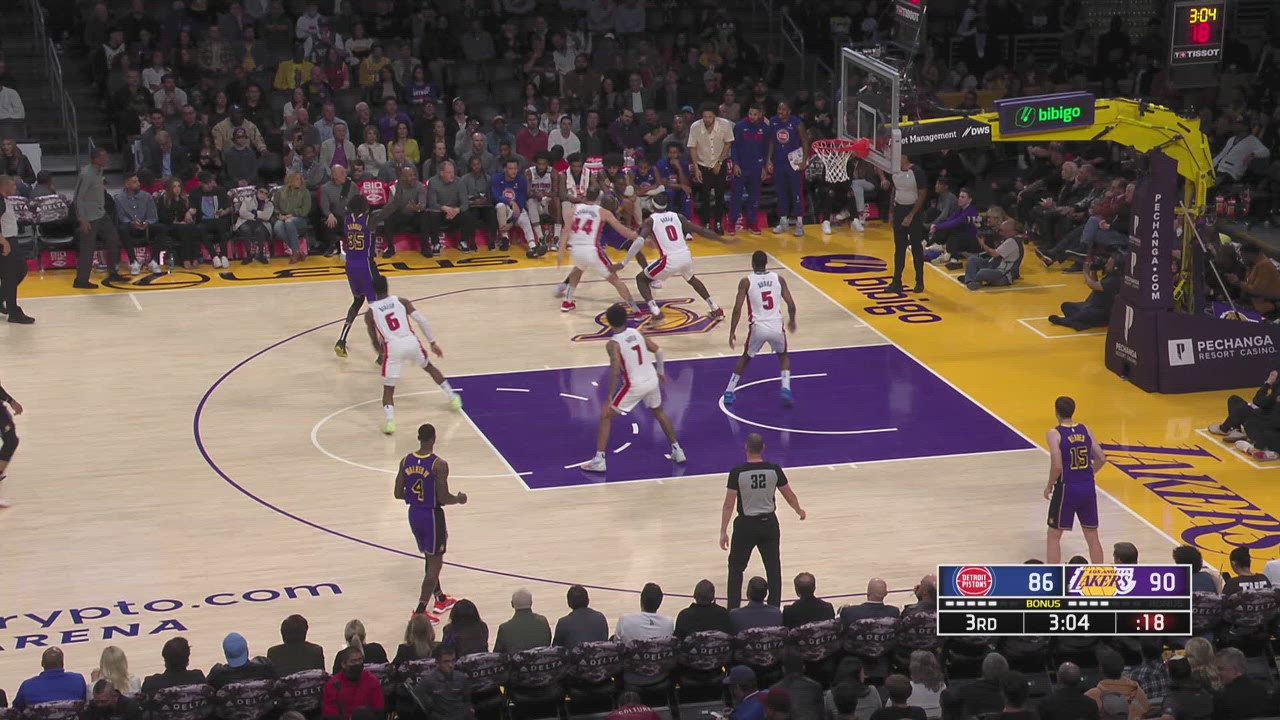

Pistons Season On The Line After Disputed Foul Call In Game 4

May 17, 2025

Pistons Season On The Line After Disputed Foul Call In Game 4

May 17, 2025 -

Privatizing Federal Student Loans A Look At Trumps Potential Plan

May 17, 2025

Privatizing Federal Student Loans A Look At Trumps Potential Plan

May 17, 2025 -

Segundo Mandato De Trump El Futuro De Los Prestamos Estudiantiles En Riesgo

May 17, 2025

Segundo Mandato De Trump El Futuro De Los Prestamos Estudiantiles En Riesgo

May 17, 2025 -

Missed Foul Call Fuels Pistons Anger After Game 4 Defeat

May 17, 2025

Missed Foul Call Fuels Pistons Anger After Game 4 Defeat

May 17, 2025