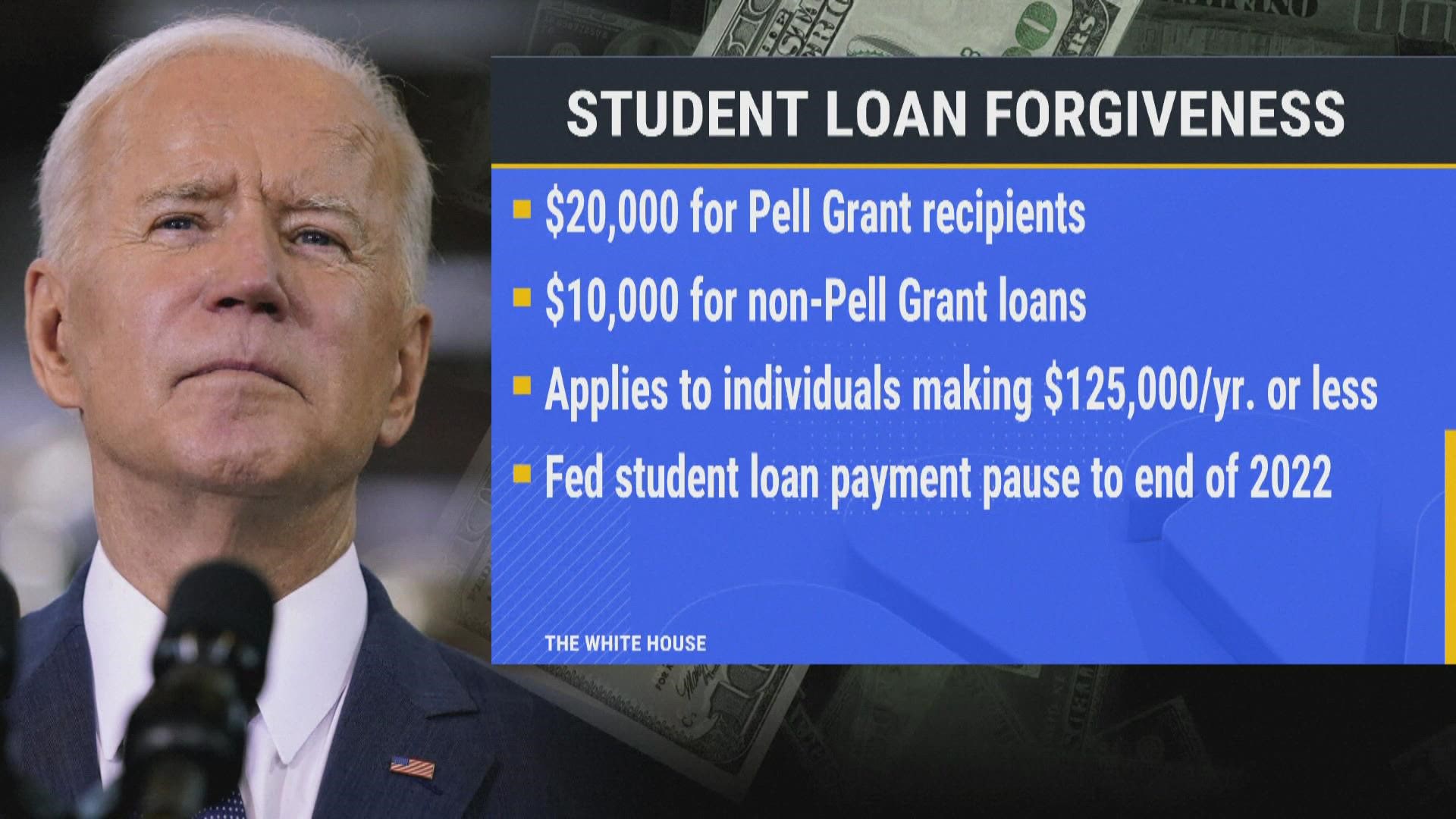

Privatizing Federal Student Loans: A Look At Trump's Potential Plan

Table of Contents

Potential Benefits of Privatizing Federal Student Loans

While the idea of privatizing federal student loans is controversial, proponents argue it could lead to increased efficiency and reduced government burden.

Increased Efficiency and Innovation

Private lenders, operating in a competitive market, might offer more competitive interest rates and flexible repayment options to attract borrowers. This competition could incentivize innovation in loan servicing and management.

- Lower interest rates: Market forces could drive down interest rates compared to government-set rates.

- Flexible repayment plans: Private lenders might offer a wider range of repayment options tailored to individual borrower needs, such as income-based repayment plans with greater flexibility.

- Faster processing: Streamlined application processes could lead to quicker loan approvals and disbursement.

- Technological advancements: Private companies often invest heavily in technology, potentially leading to improved online platforms and more efficient loan management systems. This contrasts with sometimes cumbersome government bureaucracy. Examples from the private banking sector demonstrate the efficacy of such investments.

Reduced Government Burden

Privatization could significantly reduce the administrative overhead for the federal government. This could free up resources and personnel to focus on other crucial areas.

- Reduced administrative costs: The government would no longer be responsible for loan origination, servicing, and collection, saving substantial taxpayer dollars.

- Risk transfer: The financial risk associated with loan defaults would shift from the government to private lenders.

- Focus on other priorities: The government could redirect resources toward other pressing social and economic programs.

Potential Drawbacks of Privatizing Federal Student Loans

Despite potential benefits, the privatization of federal student loans presents significant risks and drawbacks for borrowers and the overall higher education landscape.

Increased Costs for Borrowers

Private lenders, seeking to maximize profits, might charge significantly higher interest rates than the government currently offers to compensate for increased risk. This could leave borrowers with substantially larger debt burdens.

- Higher interest rates: Increased risk for private lenders may translate directly into higher interest rates for borrowers, especially those with lower credit scores.

- Predatory lending practices: Less stringent regulations could lead to predatory lending practices targeting vulnerable students.

- Fewer borrower protections: Government-backed loans often come with consumer protections that might be absent in a privatized system. Examples include income-driven repayment plans which might be limited or unavailable.

- Increased overall loan costs: Borrowers could end up paying considerably more over the life of their loan due to a combination of higher interest rates and fees.

Reduced Access to Loans

Private lenders are profit-driven entities. They may be less willing to lend to students with lower credit scores, limited income, or those attending less prestigious institutions. This could exacerbate existing inequalities in access to higher education.

- Credit score limitations: Borrowers with less-than-perfect credit might be denied loans or offered loans with extremely unfavorable terms.

- Income limitations: Students from lower-income backgrounds could face significant barriers to accessing loans.

- Impact on underserved communities: Privatization could disproportionately harm students from minority groups and those from disadvantaged backgrounds.

Political Ramifications and Public Backlash

Privatizing federal student loans is highly controversial and likely to generate substantial political opposition.

- Student advocacy groups: Organizations representing students and borrowers would almost certainly oppose privatization, citing potential negative impacts.

- Public concerns: Widespread public concern regarding increased costs and reduced access to education is highly probable.

- Legal challenges: The legality and fairness of such a policy shift could face legal challenges.

Analyzing the Current Stance on Privatization

[Insert analysis of the current administration's stance on student loan reform and privatization. Include specific quotes, policy proposals, and relevant news articles. Analyze the potential political motivations behind the administration's approach to higher education and student debt.]

Conclusion: Weighing the Future of Federal Student Loans and Privatization

The decision to privatize federal student loans carries significant implications. While proponents highlight potential efficiency gains and reduced government burden, critics raise serious concerns about increased costs for borrowers, reduced access to loans, and the potential for predatory lending practices. A balanced assessment requires careful consideration of these competing arguments. The debate surrounding privatizing federal student loans is complex and multifaceted, with far-reaching consequences for individuals and society. Further research is crucial to fully understand the potential impacts of this policy shift. Engage in the ongoing dialogue; visit relevant government websites and advocacy groups to learn more and participate in shaping the future of student loan policy.

Featured Posts

-

Uber Calls Off Foodpanda Taiwan Purchase Amid Regulatory Hurdles

May 17, 2025

Uber Calls Off Foodpanda Taiwan Purchase Amid Regulatory Hurdles

May 17, 2025 -

Are Those Angel Reese Quotes Real A Fact Check

May 17, 2025

Are Those Angel Reese Quotes Real A Fact Check

May 17, 2025 -

Apple Tv 3 Month Discount 3 Offer Ending Soon

May 17, 2025

Apple Tv 3 Month Discount 3 Offer Ending Soon

May 17, 2025 -

Analiz Bolee 200 Raket I Dronov V Atake Rf Na Ukrainu

May 17, 2025

Analiz Bolee 200 Raket I Dronov V Atake Rf Na Ukrainu

May 17, 2025 -

Arenda Ploschadey V Industrialnykh Parkakh Kak Nayti Mesto Dlya Biznesa

May 17, 2025

Arenda Ploschadey V Industrialnykh Parkakh Kak Nayti Mesto Dlya Biznesa

May 17, 2025

Latest Posts

-

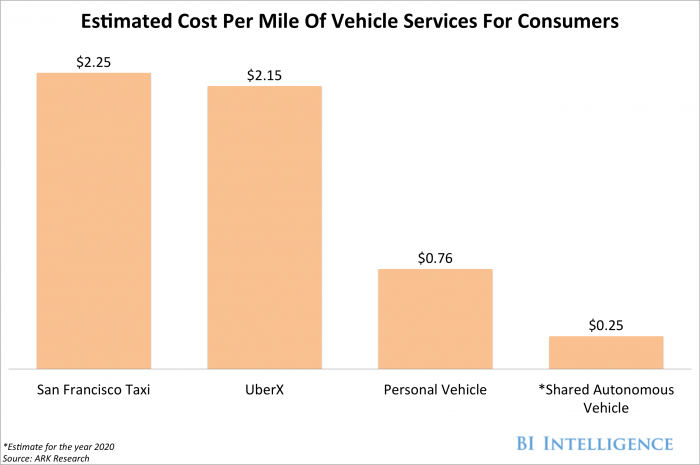

Ubers Self Driving Cars Are These Etfs A Smart Investment

May 17, 2025

Ubers Self Driving Cars Are These Etfs A Smart Investment

May 17, 2025 -

New Zealands Best Online Casinos A Comprehensive Guide Featuring 7 Bit Casino

May 17, 2025

New Zealands Best Online Casinos A Comprehensive Guide Featuring 7 Bit Casino

May 17, 2025 -

Uber Stock And Recession Why Analysts See Resilience

May 17, 2025

Uber Stock And Recession Why Analysts See Resilience

May 17, 2025 -

Investing In Ubers Autonomous Vehicle Future An Etf Analysis

May 17, 2025

Investing In Ubers Autonomous Vehicle Future An Etf Analysis

May 17, 2025 -

Could Driverless Uber Pay Off Etf Investing In Autonomous Vehicle Technology

May 17, 2025

Could Driverless Uber Pay Off Etf Investing In Autonomous Vehicle Technology

May 17, 2025