Uber Stock And Recession: Why Analysts See Resilience

Table of Contents

Uber's Diversified Revenue Streams

Uber's revenue isn't solely dependent on its rideshare business. Its diverse portfolio provides a safety net during economic uncertainty. This diversification is a key factor in analyst's bullish predictions for Uber stock.

Beyond Ridesharing

Uber's strategic diversification significantly reduces its vulnerability to economic downturns. The company's multiple revenue streams create a resilient business model.

- Uber Eats: Uber Eats experienced significant growth during previous economic downturns, demonstrating the resilience of food delivery services. People often cut back on dining out but still rely on convenient food delivery options. This consistent demand provides a crucial buffer during economic uncertainty, impacting positively on Uber stock price.

- Uber Freight: Uber Freight benefits from consistent demand even during recessions. Businesses need to maintain their supply chains regardless of the economic climate, ensuring a steady stream of revenue for this segment, contributing to Uber stock resilience.

- Other Mobility Options: Uber's continued investment in other mobility options like scooter rentals and micromobility further diversifies its revenue streams, mitigating the risk associated with a potential decline in rideshare usage. This strategy directly influences the Uber stock price outlook. Keywords: Uber Eats, Uber Freight, diversified revenue, revenue streams, economic resilience

Cost-Cutting Measures and Operational Efficiency

Uber has implemented various cost-cutting measures to improve profitability and withstand economic headwinds. These strategic adjustments enhance its resilience and are reflected in analyst predictions for Uber stock.

Strategic Adjustments

Operational efficiency is a key component of Uber's strategy to navigate an economic downturn.

- Increased Automation: Increased automation in operations, such as algorithmic dispatch and driver management, reduces labor costs and improves efficiency.

- Dynamic Pricing Strategies: Uber utilizes dynamic pricing strategies to optimize pricing based on demand, maximizing revenue during peak periods and maintaining profitability during slower times. This strategy contributes to Uber stock resilience.

- Technological Investments: Strategic investments in technology improve efficiency and reduce operational expenses, allowing Uber to maintain a competitive edge even during a recession, further supporting a positive Uber stock price outlook. Keywords: cost-cutting, operational efficiency, profitability, automation, dynamic pricing

Strong Network Effects and Brand Recognition

Uber boasts a massive user base and a strong brand reputation, creating powerful network effects. This significant advantage over competitors is a key reason for analysts' positive Uber stock predictions.

Unmatched Scale and Reach

Uber's scale and brand recognition translate into significant resilience during economic downturns.

- Large Customer Base: A vast customer base ensures a consistent stream of demand, even during economic slowdowns. This large and loyal user base is a major asset that buffers the impact of a recession on Uber stock.

- High Brand Recognition: High brand recognition and customer loyalty provide a competitive edge, making it harder for competitors to gain market share during challenging times. This brand strength directly impacts the Uber stock price.

- Extensive Driver Network: The extensive network of drivers ensures service availability even during periods of decreased demand, maintaining operational capabilities and customer satisfaction. This operational resilience influences the analyst's view on Uber stock. Keywords: network effects, brand recognition, market share, competitive advantage, customer loyalty

Potential for Growth in Emerging Markets

Uber's expansion into emerging markets presents significant long-term growth potential, offsetting potential slowdowns in mature markets. This factor significantly contributes to the positive analyst sentiment surrounding Uber stock.

Expansion Opportunities

Emerging markets offer substantial opportunities for Uber's future growth.

- Untapped Potential: Untapped potential in developing economies with growing middle classes presents significant opportunities for expansion and revenue growth. This potential growth offsets the risk of a recession in established markets, providing a boost to Uber stock.

- Strategic Partnerships: Strategic partnerships and acquisitions accelerate market penetration and establish a strong presence in new regions, further enhancing the company's resilience.

- Service Adaptation: Adapting services to the unique needs of different regions ensures relevance and maximizes market penetration in diverse environments. This adaptability is crucial for long-term growth and positive impacts on Uber stock. Keywords: emerging markets, international expansion, growth potential, market penetration

Conclusion

While recessionary concerns are valid, Uber's diversified revenue streams, cost-cutting initiatives, strong network effects, and expansion into emerging markets suggest a considerable degree of resilience. Analysts see reasons for optimism, viewing Uber as a relatively strong performer even during an economic downturn. Understanding these factors is crucial for anyone considering investing in or tracking Uber stock. Therefore, carefully consider these points before making any investment decisions concerning Uber stock and the impact of a potential recession. The future performance of Uber stock will depend on a multitude of factors, so thorough research is recommended.

Featured Posts

-

Mapping The Countrys Hottest New Business Hubs

May 17, 2025

Mapping The Countrys Hottest New Business Hubs

May 17, 2025 -

Analyzing The Detroit Pistons And New York Knicks Key Factors For Success

May 17, 2025

Analyzing The Detroit Pistons And New York Knicks Key Factors For Success

May 17, 2025 -

Impact Of The Gops Plan On Student Loan Borrowers And Pell Grants

May 17, 2025

Impact Of The Gops Plan On Student Loan Borrowers And Pell Grants

May 17, 2025 -

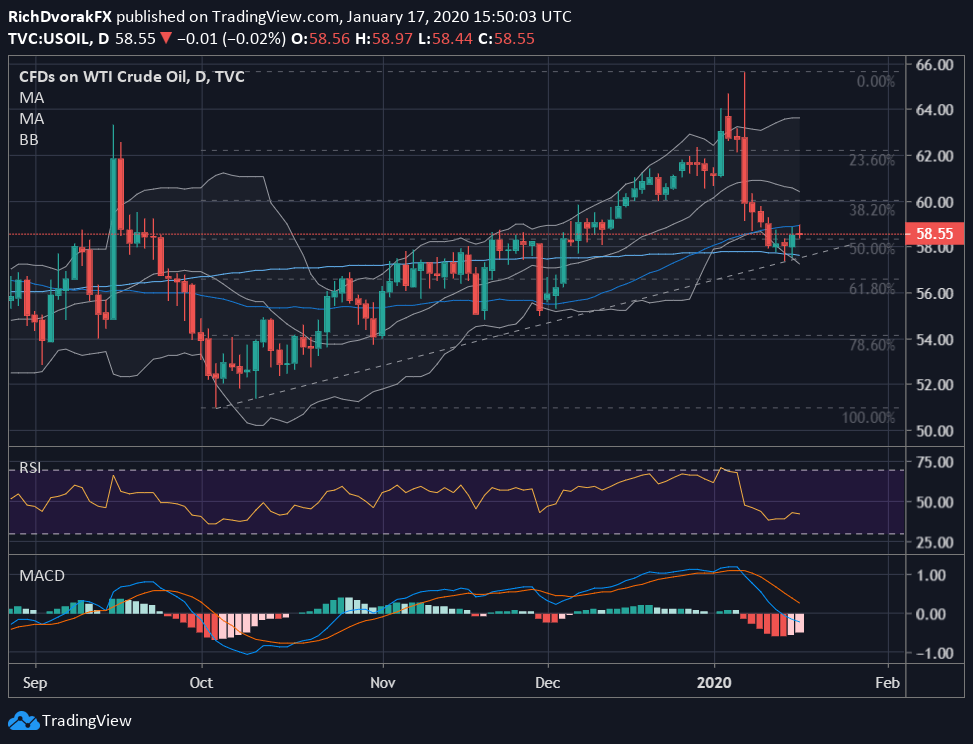

Crude Oil Price Analysis Market News For May 16

May 17, 2025

Crude Oil Price Analysis Market News For May 16

May 17, 2025 -

La Lakers In Depth Analysis And News From Vavel

May 17, 2025

La Lakers In Depth Analysis And News From Vavel

May 17, 2025

Latest Posts

-

New Emirates Id Card Fee For Newborn Babies In Uae March 2025

May 17, 2025

New Emirates Id Card Fee For Newborn Babies In Uae March 2025

May 17, 2025 -

Ot Moskvy Do Dubaya Prakticheskoe Rukovodstvo Po Poisku Raboty

May 17, 2025

Ot Moskvy Do Dubaya Prakticheskoe Rukovodstvo Po Poisku Raboty

May 17, 2025 -

Detroit Pistons Vs New York Knicks Head To Head Analysis And Season Predictions

May 17, 2025

Detroit Pistons Vs New York Knicks Head To Head Analysis And Season Predictions

May 17, 2025 -

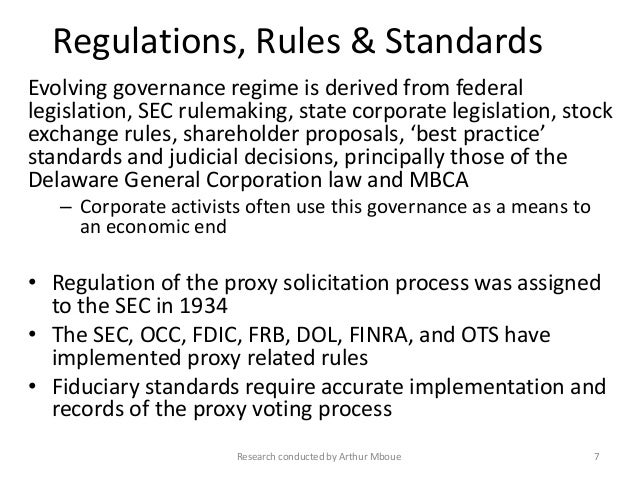

Proxy Statement Form Def 14 A Compliance And Disclosure Requirements

May 17, 2025

Proxy Statement Form Def 14 A Compliance And Disclosure Requirements

May 17, 2025 -

Dubay Dlya Rossiyan Rynok Truda I Adaptatsiya

May 17, 2025

Dubay Dlya Rossiyan Rynok Truda I Adaptatsiya

May 17, 2025