Iron Ore Price Decline: China's Steel Output Restrictions Explained

Table of Contents

China's Steel Production Curbs: The Primary Driver

China's role as the world's largest steel producer and iron ore consumer cannot be overstated. Its steel production significantly influences global iron ore demand and, consequently, prices. Recent government policies have directly impacted steel output, leading to the current iron ore price decline. These policies include:

- Stringent Environmental Regulations: China is committed to reducing its carbon footprint, leading to stricter environmental regulations on steel mills. These regulations limit emissions and impose higher operational costs, thus reducing production capacity.

- Curbs on Construction and Infrastructure: A slowdown in large-scale construction projects and infrastructure development within China has directly decreased the demand for steel, a key component in construction. This reduced demand translates to less pressure on iron ore prices.

- Measures to Curb Overcapacity: For years, China's steel industry suffered from overcapacity. The government implemented measures to consolidate the industry, leading to the closure or downsizing of less efficient steel mills, further reducing overall steel production.

- Focus on Energy Efficiency and Sustainable Development: The push towards energy efficiency and sustainable development practices within China's steel industry is resulting in production optimization strategies that, in the short term, may slightly decrease overall steel output.

The direct correlation between reduced steel production and lower demand for iron ore is undeniable. According to a recent report by the World Steel Association (replace with actual source and statistics), China's steel output decreased by X% in [Year], leading to a Y% drop in iron ore imports. This directly contributes to the current iron ore price decline.

Impact on Global Iron Ore Markets

The reduced Chinese demand for iron ore has had a ripple effect on global markets, causing a significant iron ore price decline. Major iron ore producing countries like Australia, Brazil, and India are particularly vulnerable to these price fluctuations. The consequences of this price decline are significant:

- Reduced Profitability for Mining Companies: Lower iron ore prices directly impact the profitability of mining companies, forcing them to cut costs and potentially reduce operations.

- Potential Job Losses in the Mining Sector: As mining companies struggle with reduced profitability, job losses within the mining sector become a real possibility.

- Implications for Investment in New Iron Ore Projects: The price decline discourages investment in new iron ore exploration and development projects, potentially impacting future supply.

[Insert chart or graph illustrating the iron ore price decline over a specific period. Source should be clearly cited.]

Beyond Production Cuts: Other Contributing Factors

While China's steel production cuts are the primary driver of the iron ore price decline, other factors contribute to the overall situation:

- Increased Iron Ore Supply from Other Countries: Increased iron ore production from other countries may have added to the existing supply, putting downward pressure on prices.

- Weakening Global Economic Growth: Slowing global economic growth impacts steel demand worldwide, leading to a further decrease in iron ore prices.

- Speculative Trading and Market Sentiment: Market speculation and overall negative sentiment can exacerbate price declines, creating a self-fulfilling prophecy.

Analyzing the Future of Iron Ore Prices

Predicting the future of iron ore prices is complex. Several factors will play a role:

- Government Policy Changes in China: Any shifts in China's environmental regulations or industrial policies could significantly impact steel production and, consequently, iron ore demand.

- Global Economic Recovery or Slowdown: A global economic recovery would likely boost steel demand, potentially increasing iron ore prices. Conversely, a further economic slowdown would likely exacerbate the price decline.

- Technological Advancements in Steel Production: Technological improvements in steel production, such as the increased use of scrap metal, could alter the demand for iron ore.

A balanced perspective suggests the possibility of both price increases and further declines, depending on the interplay of these factors.

Conclusion

The decline in iron ore prices is primarily driven by China's stringent restrictions on steel production, significantly impacting global markets. Reduced steel output, coupled with other factors such as increased supply and weakening global economic growth, has led to decreased demand and lower prices. This impacts mining companies' profitability, potential job losses, and future investment in the sector. To navigate this complex landscape, stay informed about developments in China's steel industry and global economic conditions to better understand future fluctuations in iron ore prices. Monitor market trends and expert analysis to make informed decisions related to iron ore investment and steel production.

Featured Posts

-

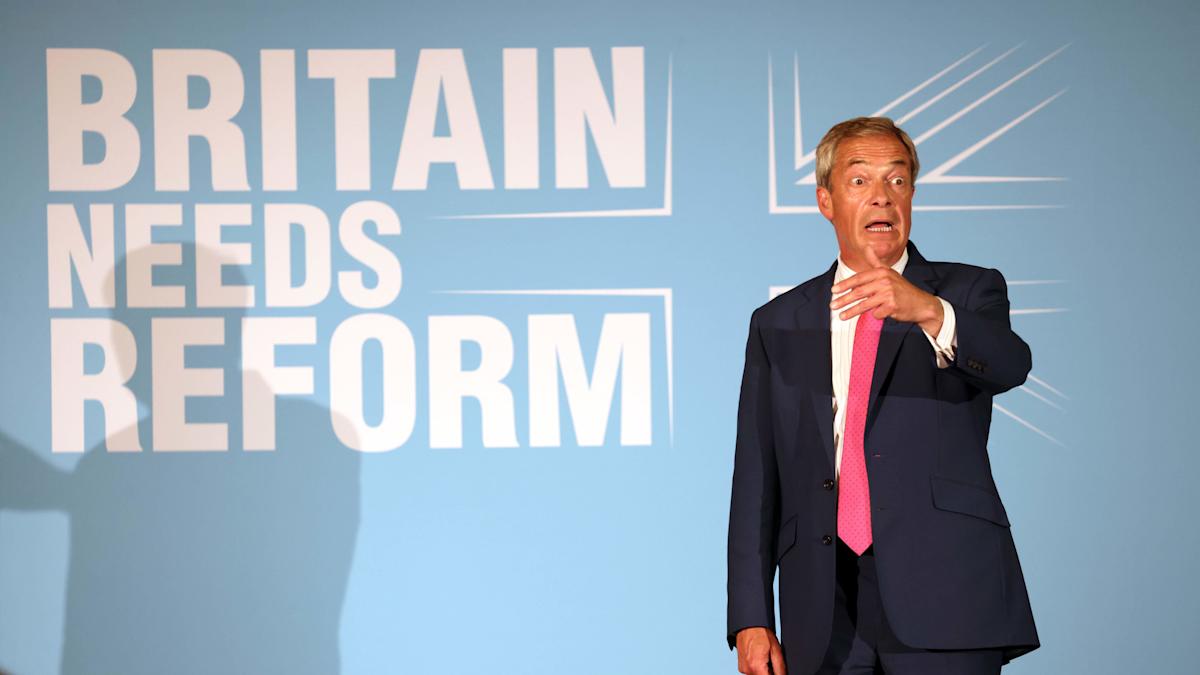

Can Nigel Farages Reform Party Deliver A Realistic Assessment

May 10, 2025

Can Nigel Farages Reform Party Deliver A Realistic Assessment

May 10, 2025 -

Roberts Shares Experience Of Being Confused For Former Gop House Leader

May 10, 2025

Roberts Shares Experience Of Being Confused For Former Gop House Leader

May 10, 2025 -

Understanding Jeanine Pirro Education Net Worth And Public Profile

May 10, 2025

Understanding Jeanine Pirro Education Net Worth And Public Profile

May 10, 2025 -

Palantir Technologies Stock A Detailed Investment Analysis For 2024 And Beyond

May 10, 2025

Palantir Technologies Stock A Detailed Investment Analysis For 2024 And Beyond

May 10, 2025 -

Lynk Lee Tu Truoc Den Nay Hanh Trinh Chuyen Gioi Va Nguoi Yeu Luon Sat Canh

May 10, 2025

Lynk Lee Tu Truoc Den Nay Hanh Trinh Chuyen Gioi Va Nguoi Yeu Luon Sat Canh

May 10, 2025