Is A 1,500% Bitcoin Price Surge Realistic? Expert Analysis

Table of Contents

Historical Bitcoin Price Performance and Volatility

Past Price Surges and Their Drivers

Bitcoin's history is punctuated by periods of remarkable price appreciation. Analyzing these past surges helps us understand potential catalysts for future growth, though it's crucial to remember past performance is not indicative of future results.

- 2010-2011: Early adoption and increased awareness led to a significant price increase, though from a very low base.

- 2013: The price surged due to increasing media attention and the first significant institutional investment.

- 2017: The "Bitcoin bubble" saw a massive price increase fueled by FOMO (fear of missing out), increasing media coverage, and speculation.

- 2020-2021: Institutional adoption and macroeconomic factors like quantitative easing contributed to another significant price rally.

These surges were driven by a combination of factors:

- Regulatory changes: Positive regulatory developments in certain jurisdictions can boost investor confidence.

- Institutional adoption: Large-scale investments by corporations and institutional investors increase demand.

- Technological upgrades: Halving events (reducing the rate of Bitcoin creation) and network upgrades can positively impact price.

- Market sentiment: Positive news, media hype, and overall investor sentiment significantly influence price.

Understanding Bitcoin's Volatility

Bitcoin is famously volatile. Price fluctuations are common, and even dramatic swings are not unprecedented. Several factors contribute to this:

- News events: Positive or negative news about Bitcoin or the broader crypto market can cause significant price swings.

- Regulatory uncertainty: Uncertainty surrounding government regulations can lead to volatility.

- Market manipulation: While difficult to prove, potential market manipulation by large players can influence prices.

- FOMO (Fear Of Missing Out): Rapid price increases can trigger a wave of FOMO, driving further price appreciation until a correction occurs.

Factors That Could Contribute to a 1,500% Bitcoin Price Surge

Widespread Institutional Adoption

Increased institutional adoption is a key factor potentially driving a significant Bitcoin price surge. Large financial institutions and corporations are increasingly recognizing Bitcoin's potential as a store of value and an asset class.

- MicroStrategy: A prime example of a company holding significant Bitcoin reserves.

- Tesla: Elon Musk's company's initial investment further boosted Bitcoin's profile.

- Other Institutional Investors: Numerous hedge funds and investment firms are allocating assets to Bitcoin.

This influx of institutional capital can significantly increase demand, pushing prices higher.

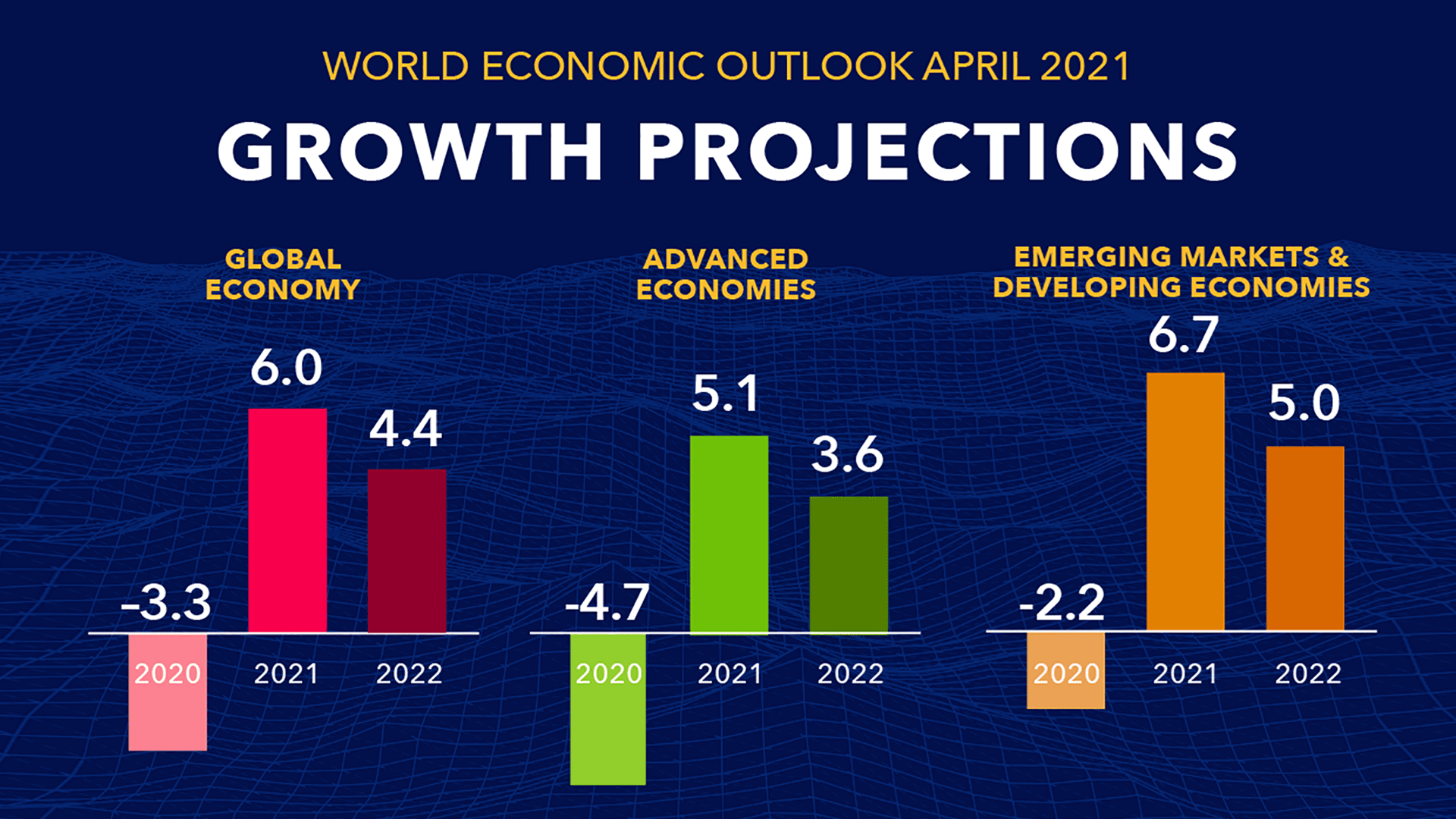

Global Macroeconomic Factors

Global macroeconomic factors play a crucial role. Inflation, fiat currency devaluation, and geopolitical uncertainty can drive investors towards Bitcoin as a hedge against inflation and a safe-haven asset.

- Inflationary pressures: High inflation erodes the purchasing power of fiat currencies, making Bitcoin an attractive alternative.

- Geopolitical instability: Global uncertainties can push investors towards Bitcoin's decentralized and borderless nature.

- Declining trust in traditional financial systems: Concerns about the stability of traditional financial systems can boost Bitcoin's appeal.

Technological Advancements

Technological improvements enhance Bitcoin's scalability, usability, and overall appeal.

- The Lightning Network: This second-layer scaling solution improves transaction speeds and reduces fees.

- Improved scalability solutions: Ongoing developments aim to increase Bitcoin's capacity to handle more transactions.

- Increased usability: Simpler user interfaces and improved accessibility make Bitcoin more appealing to a broader audience.

Factors That Could Hinder a 1,500% Bitcoin Price Surge

Regulatory Uncertainty and Government Intervention

Government regulations significantly impact Bitcoin's price. Varying approaches worldwide create uncertainty.

- China's Bitcoin ban: Demonstrated the impact of government actions on price.

- US regulatory scrutiny: The ongoing debate about Bitcoin regulation creates uncertainty.

- EU regulatory frameworks: The development of comprehensive regulatory frameworks in the EU will shape Bitcoin's future.

Regulatory uncertainty can suppress price growth and even trigger sharp corrections.

Market Manipulation and Security Concerns

Market manipulation and security breaches can erode investor confidence.

- Past instances of manipulation: Allegations of market manipulation have surfaced periodically.

- Exchange hacks: High-profile exchange hacks have highlighted security risks.

- 51% attacks: Though unlikely, the theoretical possibility of a 51% attack remains a concern.

Competition from Alternative Cryptocurrencies

The emergence of alternative cryptocurrencies poses a challenge to Bitcoin's dominance.

- Ethereum's rise: Ethereum's success as a platform for decentralized applications (dApps) offers competition.

- Other altcoins: Numerous other cryptocurrencies compete for market share and investor attention.

- Market share dynamics: The shifting landscape of cryptocurrency market capitalization impacts Bitcoin's price.

Conclusion

A 1,500% Bitcoin price surge is highly speculative. While institutional adoption, macroeconomic trends, and technological improvements could fuel substantial price gains, significant obstacles remain, including regulatory uncertainty, market manipulation risks, and competition from altcoins. Predicting Bitcoin's price trajectory is challenging. However, understanding the key factors influencing its price allows for more informed investment decisions. Continue your research on the potential for a Bitcoin price surge and stay informed about market developments to effectively navigate this volatile market. Remember to always conduct thorough due diligence before investing in Bitcoin or any cryptocurrency.

Featured Posts

-

Lahwr Ky Edlyh Ke Jjz Ke Lye Nyy Tby Bymh Askym Ka Aelan

May 08, 2025

Lahwr Ky Edlyh Ke Jjz Ke Lye Nyy Tby Bymh Askym Ka Aelan

May 08, 2025 -

Texas Longhorns Spring Football Sarkisian Provides Injury Report

May 08, 2025

Texas Longhorns Spring Football Sarkisian Provides Injury Report

May 08, 2025 -

Uber Stock Forecast Will Autonomous Vehicles Drive Growth

May 08, 2025

Uber Stock Forecast Will Autonomous Vehicles Drive Growth

May 08, 2025 -

Xrps 400 Rise A Realistic Look At Potential Future Growth

May 08, 2025

Xrps 400 Rise A Realistic Look At Potential Future Growth

May 08, 2025 -

Steve Sarkisians Texas Longhorns Spring Football Injury Update

May 08, 2025

Steve Sarkisians Texas Longhorns Spring Football Injury Update

May 08, 2025