XRP's 400% Rise: A Realistic Look At Potential Future Growth

Table of Contents

Factors Contributing to XRP's Recent Surge

Increased Institutional Adoption

- Growing partnerships with major financial institutions: RippleNet, Ripple's global payment network utilizing XRP, has seen significant expansion, partnering with numerous banks and financial institutions worldwide. These partnerships facilitate faster, cheaper, and more transparent cross-border transactions. For example, major banks like Banco Santander and SBI Remit are already leveraging XRP for their international payment solutions.

- Increased transaction volume: The growing adoption of XRP by institutions directly translates into a higher volume of transactions on the XRP Ledger. This increased demand contributes to a higher price, as the supply of XRP remains relatively constant. Data indicates a significant uptick in daily XRP transaction volume over the past year, mirroring the price increase.

- Ripple's strategic initiatives: Ripple actively engages in fostering partnerships and integrating XRP into various financial systems. This proactive approach significantly contributes to its increasing adoption and influences the XRP price prediction positively.

Positive Regulatory Developments (or lack of negative ones)

- Ongoing Ripple vs. SEC lawsuit: While the ongoing legal battle between Ripple and the SEC presents uncertainty, recent developments have been interpreted positively by many in the XRP community. Favorable court rulings or settlements could significantly boost investor confidence and drive up the price.

- Regulatory clarity in other jurisdictions: While the US regulatory landscape remains uncertain, several other countries have shown more welcoming attitudes toward cryptocurrencies, including XRP. This global regulatory divergence can create opportunities for XRP adoption in friendlier regions.

- Reduced regulatory uncertainty: Even the absence of negative news can positively impact XRP's price. A period of relative quiet from regulators can alleviate investor concerns and lead to increased confidence in the long-term prospects of XRP investment.

Growing Use Cases Beyond Cross-Border Payments

- Expansion into Decentralized Finance (DeFi): XRP is increasingly being integrated into DeFi protocols, expanding its utility beyond traditional finance. This diversification of use cases reduces reliance on a single application and strengthens its overall value proposition.

- Utilization in NFTs and the Metaverse: XRP's speed and low transaction fees make it attractive for NFT transactions and metaverse interactions, opening up new avenues for growth and increasing demand.

- Integration with other blockchain networks: The potential for XRP to act as a bridge between different blockchain networks, facilitating interoperability, could significantly broaden its appeal and utility. This could further improve the XRP price prediction outlook.

Assessing the Sustainability of XRP's Growth

Market Sentiment and Speculation

- Influence of social media: Social media platforms play a significant role in shaping market sentiment towards XRP. Positive news and hype can quickly lead to price increases, while negative sentiment can trigger sell-offs. Understanding this dynamic is crucial for navigating the market.

- FOMO (Fear of Missing Out): Rapid price increases can trigger FOMO, leading to further buying pressure and potentially unsustainable price hikes. Investors should be wary of basing investment decisions solely on short-term market hype.

- Distinguishing short-term gains from long-term growth: It's essential to differentiate between short-term speculative price movements and sustained, long-term growth driven by fundamental factors. Long-term XRP investment should be based on a thorough understanding of the project's fundamentals.

Technological Advancements and Ripple's Roadmap

- Ongoing development of the XRP Ledger: Ripple continuously improves the XRP Ledger, enhancing its speed, scalability, and security. These ongoing advancements strengthen the long-term viability of XRP and its ability to compete with other cryptocurrencies.

- Innovation and new features: The introduction of new features and improvements to the XRP Ledger can enhance its utility and attract new users and developers, leading to increased demand and price appreciation.

- Community engagement and transparency: Ripple’s engagement with the XRP community and its commitment to transparency contribute to building trust and confidence, vital elements for long-term growth.

Risks and Challenges

- Ongoing legal challenges: The ongoing legal battle with the SEC remains a significant risk to XRP’s price. An unfavorable outcome could negatively impact investor confidence and suppress the price.

- Cryptocurrency market volatility: The cryptocurrency market is inherently volatile, subject to sharp price swings and market manipulation. Investors should be prepared for significant price fluctuations.

- Responsible investing and risk management: It’s crucial to practice responsible investing, diversifying your portfolio and only investing what you can afford to lose. Understanding the risks associated with XRP investment is paramount.

XRP Price Prediction: A Cautious Outlook

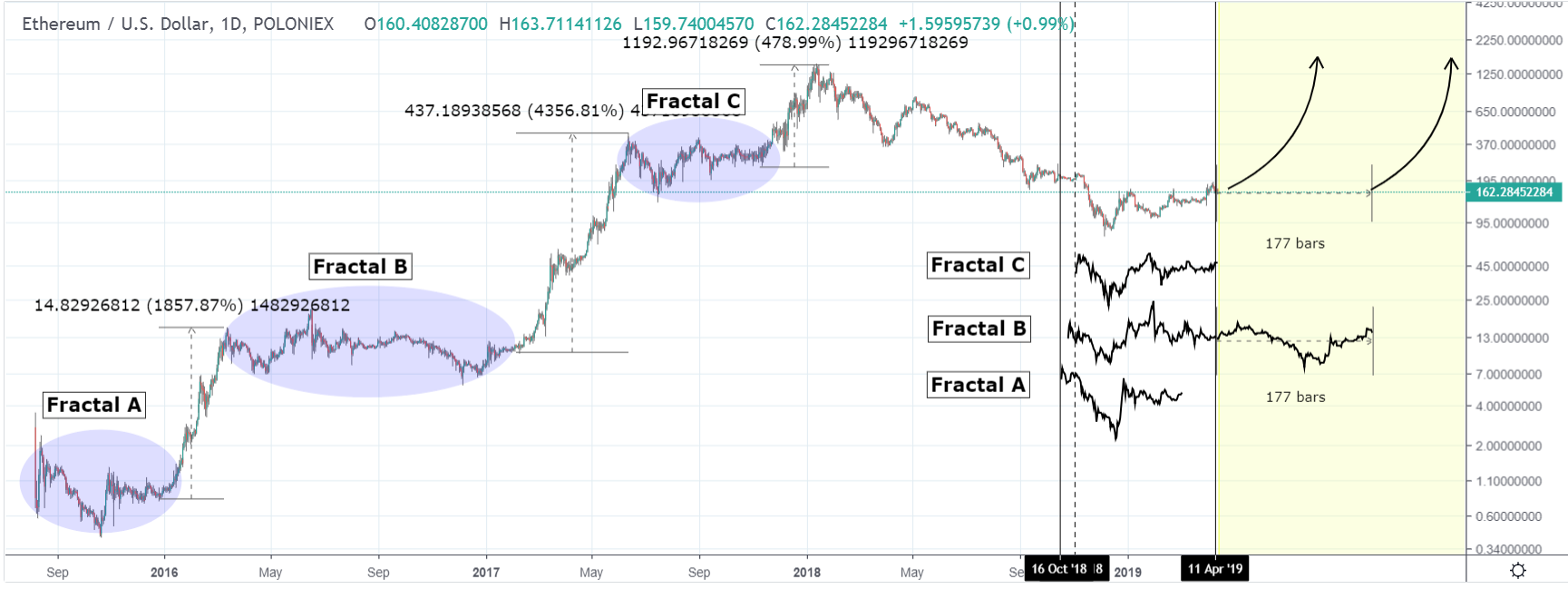

Analyzing Historical Price Trends

Analyzing XRP's historical price data reveals periods of significant volatility, interspersed with periods of relative stability. Understanding these past patterns can help in forming a more realistic XRP price prediction, though it's crucial to remember that past performance is not indicative of future results.

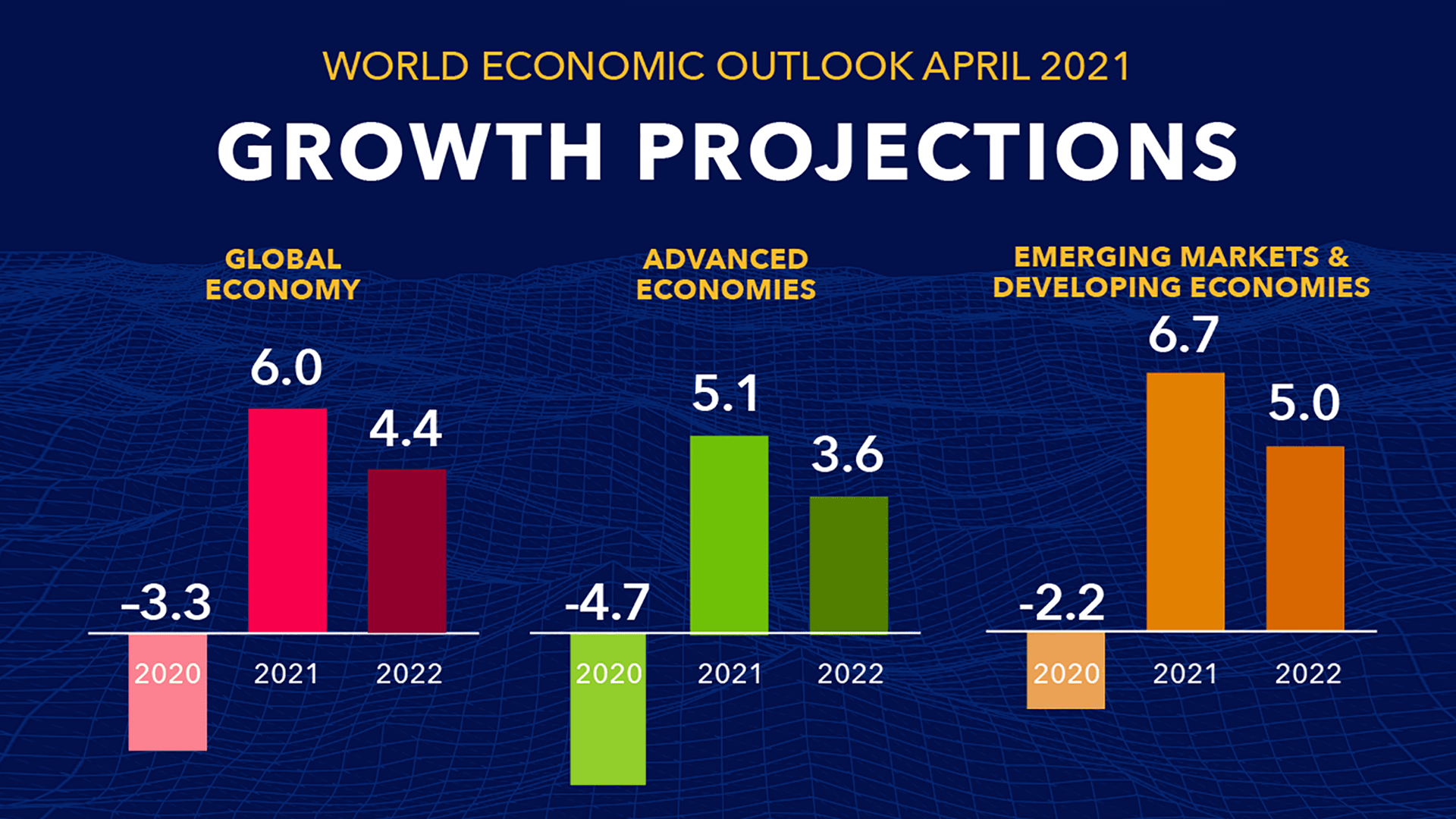

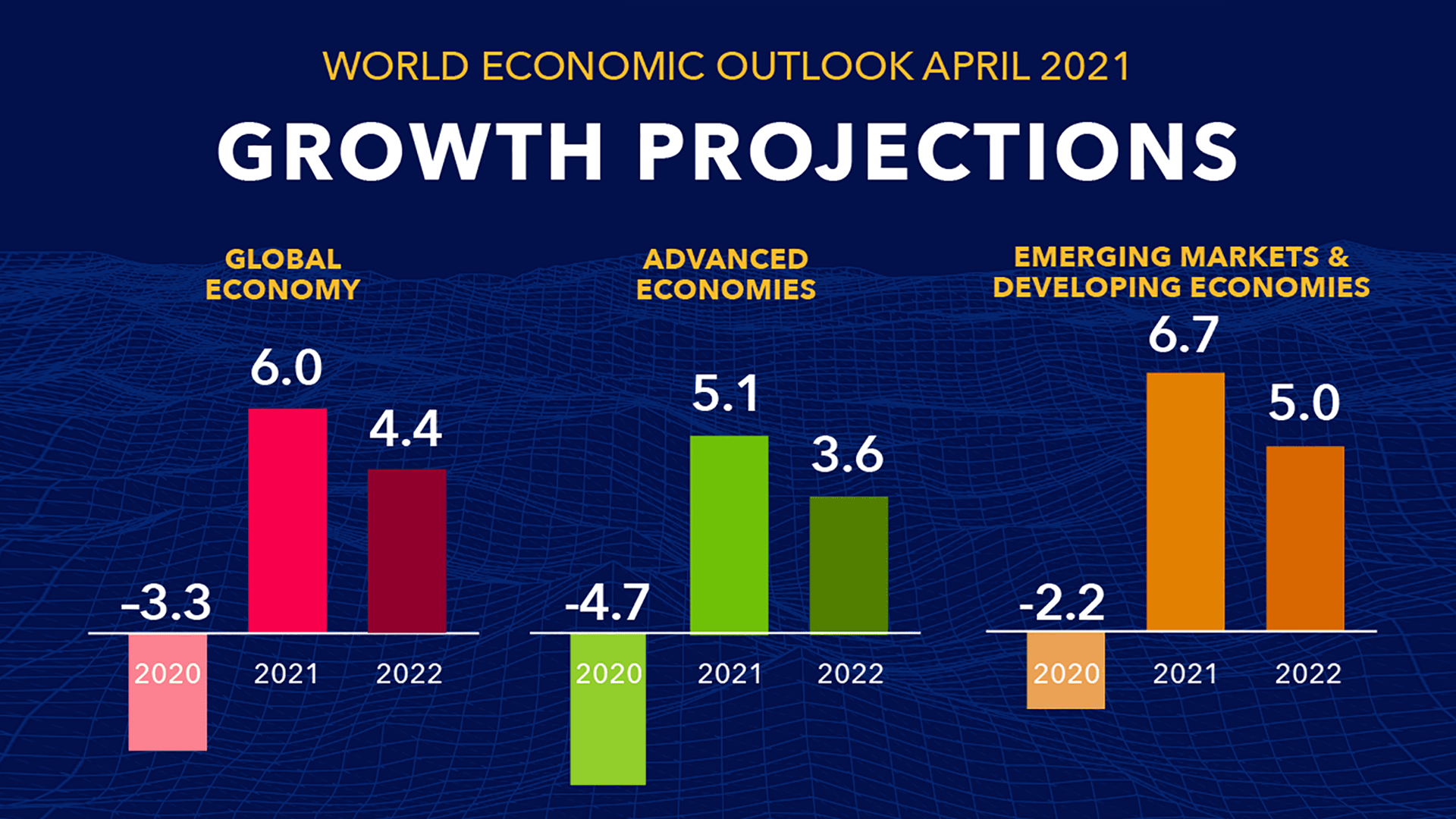

Considering Market Factors

Macroeconomic factors like inflation, interest rates, and overall market sentiment significantly influence cryptocurrency prices, including XRP. A bullish overall market is more likely to support higher XRP prices, while a bearish market may lead to declines.

Long-term vs. Short-term Projections

Offering a definitive XRP price prediction is impossible. However, considering the factors discussed above, a range of possible outcomes can be envisioned. Short-term price movements are highly susceptible to market sentiment and news events. Long-term projections are more dependent on the success of Ripple’s initiatives and the broader adoption of XRP across various sectors.

Conclusion:

XRP's recent 400% price surge is a noteworthy development, driven by factors such as increased institutional adoption, positive regulatory developments (or lack thereof), and expanding use cases. However, sustained growth hinges on navigating market sentiment, technological advancements, and regulatory challenges. While the future of XRP remains uncertain, a cautious and informed approach is essential for anyone considering XRP investment. Before making any investment decisions, conduct thorough research and consider consulting a financial advisor. Remember, understanding the factors influencing XRP price prediction is key to making informed decisions about XRP investment and XRP future growth.

Featured Posts

-

Arsenal Ps Zh Statistika I Rezultaty Evrokubkovykh Matchey

May 08, 2025

Arsenal Ps Zh Statistika I Rezultaty Evrokubkovykh Matchey

May 08, 2025 -

Counting Crows And Cyndi Lauper Live At Jones Beach

May 08, 2025

Counting Crows And Cyndi Lauper Live At Jones Beach

May 08, 2025 -

Choosing The Right Surface Pro Comparing Sizes And Prices

May 08, 2025

Choosing The Right Surface Pro Comparing Sizes And Prices

May 08, 2025 -

Xrp Price Prediction After A 400 Jump Where Does It Go From Here

May 08, 2025

Xrp Price Prediction After A 400 Jump Where Does It Go From Here

May 08, 2025 -

Is An Ethereum Price Breakout On The Horizon

May 08, 2025

Is An Ethereum Price Breakout On The Horizon

May 08, 2025