Is Betting On Wildfires The New Normal? The LA Case

Table of Contents

The Increasing Cost of Wildfire Insurance in LA

Homeowners in Los Angeles, particularly those residing in areas designated as high-risk wildfire zones, are facing a dramatic surge in insurance premiums. This increase isn't just a minor adjustment; it represents a significant financial burden for many residents. Several factors contribute to this escalating cost:

- Increased Wildfire Frequency and Intensity: The sheer number and intensity of wildfires in recent years have led to a massive increase in insurance claims, significantly impacting insurers' bottom lines. Climate change is exacerbating this trend, leading to longer fire seasons and drier conditions.

- Rising Claims: The cost of rebuilding homes destroyed by wildfires is astronomical, pushing claims to record highs. The expense of replacing infrastructure and addressing the environmental consequences of these fires further contributes to this rising cost.

- Reinsurance Market Volatility: Reinsurance, which protects insurance companies against catastrophic losses, is becoming increasingly expensive and unstable due to the escalating wildfire risk. This instability is passed down to consumers in the form of higher premiums.

Here are some concrete examples:

- Premiums in areas like the Santa Monica Mountains have increased by as much as 50% in the last five years.

- Several major insurance companies have either drastically reduced their coverage in high-risk areas or pulled out of the market entirely.

- A substantial portion of Los Angeles properties, particularly older homes in vulnerable areas, are now underinsured or completely uninsured against wildfire damage.

Predictive Modeling and Wildfire Risk Assessment in Los Angeles

Insurance companies heavily rely on predictive modeling and risk assessment tools to determine premiums. These models utilize various data points, including:

- Satellite Imagery: High-resolution satellite images provide detailed information about vegetation density, fuel load, and topography.

- Weather Data: Historical and real-time weather data, including wind patterns, humidity levels, and temperature, are crucial in assessing fire risk.

- Building Codes and Vegetation Management: The adherence to building codes designed to enhance fire resistance and the implementation of effective vegetation management practices significantly influence risk assessment.

However, these models have limitations:

- Dynamic Environment: Predictive models struggle to fully account for the dynamic nature of wildfire behavior and the unpredictable impacts of climate change.

- Accuracy Concerns: While improving, these models are not perfect, sometimes leading to discrepancies in risk assessment and unfair premium increases for certain communities.

- Data Gaps: Comprehensive and accurate data, particularly regarding the fine-grained details of fuel loads in specific areas, can be challenging to obtain.

The Role of Government and Mitigation Efforts in LA

Local, state, and federal governments play a crucial role in mitigating wildfire risk. Efforts include:

- Defensible Space Regulations: Mandatory defensible space ordinances require homeowners to maintain a buffer zone around their properties, reducing the risk of wildfire spread.

- Community Wildfire Protection Plans: These plans involve community collaboration to assess risks, prioritize mitigation actions, and educate residents about wildfire preparedness.

- Funding for Fire Prevention: Significant funding is allocated towards wildfire prevention and suppression, including investments in firefighting resources, forest management, and community education programs.

However, the effectiveness of these efforts is constantly being challenged:

- Funding limitations: Resources are often stretched thin, making comprehensive mitigation across the vast expanse of Los Angeles challenging.

- Enforcement Challenges: Ensuring compliance with defensible space regulations across a large and diverse population can be problematic.

- Impact on Premiums: While these efforts aim to reduce risk, their overall effect on lowering insurance premiums is often debated.

The Future of Wildfire Insurance and Risk in Los Angeles

The future of wildfire insurance in Los Angeles is fraught with uncertainty. Population growth, coupled with the projected intensification of climate change, suggests escalating risks. This necessitates innovative approaches:

- New Insurance Products: The development of specialized insurance products tailored to the unique wildfire risks faced in Los Angeles is crucial.

- Risk-Sharing Mechanisms: Exploring alternative risk-sharing models, such as public-private partnerships or community-based risk pools, may offer potential solutions.

- Technological Advancements: Investing in advanced technologies for wildfire detection, prediction, and suppression can significantly improve risk management.

- Community Preparedness: Empowering communities to engage in proactive wildfire preparedness is vital.

Navigating the Uncertain Future of Wildfire Risk in LA

In conclusion, betting on wildfires in Los Angeles is a risky proposition. The increasing cost of insurance, the limitations of predictive modeling, and the uncertainties of future climate impacts underscore the gravity of the situation. While government efforts play a vital role, a multifaceted approach involving technological innovation, community involvement, and innovative insurance products is essential. To mitigate the high-stakes gamble of "betting on wildfires," learn more about wildfire risk in your specific neighborhood by consulting resources like the LA County Fire Department website and comparing insurance options through reputable comparison sites. Proactive wildfire risk management is not just an individual responsibility—it's a collective endeavor crucial for securing the future of Los Angeles.

Featured Posts

-

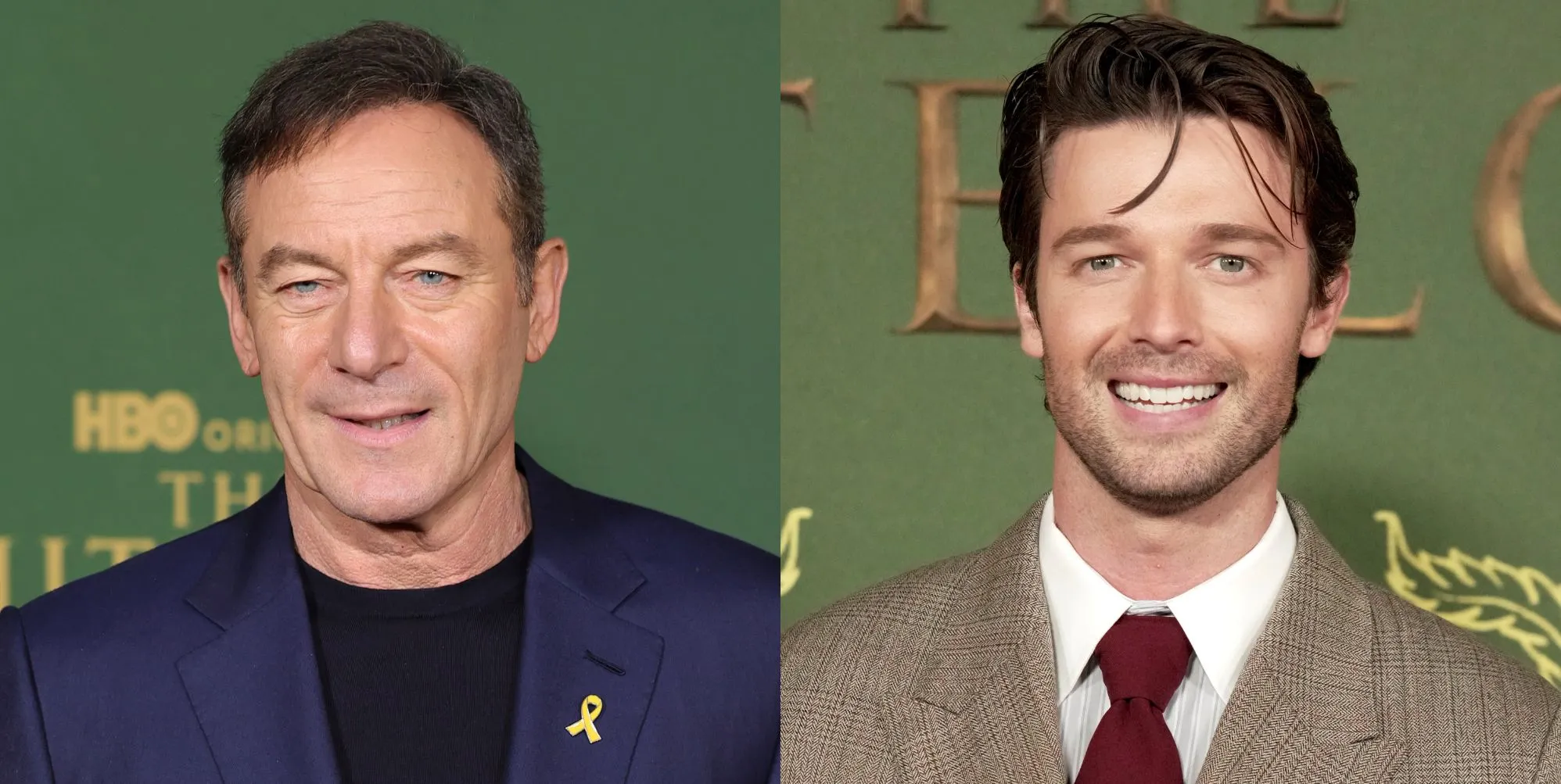

Patrick Schwarzenegger Lands Key Role In Luca Guadagninos New Film

May 06, 2025

Patrick Schwarzenegger Lands Key Role In Luca Guadagninos New Film

May 06, 2025 -

Kilauea Erupts Rare Volcanic Activity After Four Decades

May 06, 2025

Kilauea Erupts Rare Volcanic Activity After Four Decades

May 06, 2025 -

Federal Investigation Millions Stolen Via Office365 Breaches

May 06, 2025

Federal Investigation Millions Stolen Via Office365 Breaches

May 06, 2025 -

Crypto Entrepreneurs Father Freed Following Kidnapping Injury

May 06, 2025

Crypto Entrepreneurs Father Freed Following Kidnapping Injury

May 06, 2025 -

Chris Pratt Praises Patrick Schwarzeneggers Full Frontal Scene

May 06, 2025

Chris Pratt Praises Patrick Schwarzeneggers Full Frontal Scene

May 06, 2025

Latest Posts

-

Actor Chris Pratts Response To Patrick Schwarzeneggers White Lotus Scene

May 06, 2025

Actor Chris Pratts Response To Patrick Schwarzeneggers White Lotus Scene

May 06, 2025 -

Chris Pratt On Patrick Schwarzeneggers White Lotus Nude Appearance

May 06, 2025

Chris Pratt On Patrick Schwarzeneggers White Lotus Nude Appearance

May 06, 2025 -

The Truth About Patrick Schwarzeneggers White Lotus Role A Mothers Perspective Maria Shriver

May 06, 2025

The Truth About Patrick Schwarzeneggers White Lotus Role A Mothers Perspective Maria Shriver

May 06, 2025 -

Patrick Schwarzenegger And White Lotus Maria Shrivers Revelation

May 06, 2025

Patrick Schwarzenegger And White Lotus Maria Shrivers Revelation

May 06, 2025 -

Chris Pratt Responds To Brother In Laws White Lotus Nudity

May 06, 2025

Chris Pratt Responds To Brother In Laws White Lotus Nudity

May 06, 2025