Is BigBear.ai (BBAI) Stock A Buy After The Analyst Downgrade?

Table of Contents

Understanding the Analyst Downgrade

On [Date], [Analyst Firm Name], a reputable investment research firm, downgraded BigBear.ai (BBAI) stock from [Previous Rating] to [New Rating], adjusting its target price from [Previous Target Price] to [New Target Price]. The primary reasoning behind the downgrade centered on [Reason 1, e.g., slower-than-expected revenue growth], [Reason 2, e.g., increased competition in the AI sector], and [Reason 3, e.g., concerns about the company's dependence on government contracts].

- Key Concerns Raised:

- Concerns about revenue growth trajectory.

- Increased competitive pressure from established players.

- Potential challenges in securing future government contracts.

However, it's important to note a counterpoint. Some argue that the downgrade is overly pessimistic, citing [Positive Factor 1, e.g., the company's strong pipeline of potential contracts] and [Positive Factor 2, e.g., recent technological advancements]. This highlights the inherent uncertainty surrounding BBAI's future performance.

BigBear.ai's (BBAI) Fundamentals and Recent Performance

BigBear.ai operates in the rapidly expanding artificial intelligence (AI) market, focusing on [mention specific areas like AI-powered analytics, cybersecurity, and geospatial intelligence]. Analyzing the company's financials reveals [mention key financial metrics, e.g., a revenue of X in the last quarter, showing a Y% increase/decrease compared to the previous quarter]. While the company has demonstrated growth in certain areas, profitability remains a challenge.

- Key Financial Highlights:

- Revenue growth [positive or negative percentage and comparison to previous periods].

- Earnings per share (EPS) [positive or negative and comparison to previous periods].

- Debt levels and their impact on the company's financial health.

BigBear.ai's recent contracts and partnerships, including [mention specific examples if available], suggest a potential for future growth. However, the success of these ventures remains uncertain. The company's competitive position within the AI sector is [strong/weak/mixed], facing competition from [mention key competitors].

Assessing the Risks and Rewards of Investing in BBAI Stock

Investing in BBAI stock presents a high-risk, high-reward proposition.

-

Potential Risks:

- High stock price volatility.

- Dependence on government contracts for a significant portion of revenue.

- Intense competition within the AI industry.

- Potential for slower-than-expected revenue growth.

-

Potential Rewards:

- Significant growth potential in the rapidly expanding AI market.

- First-mover advantage in certain niche AI applications.

- Potential for significant returns if the company successfully executes its strategic plans.

Current market conditions, including [mention relevant market factors like overall market sentiment and interest rates], may also significantly influence BBAI’s performance.

Comparing BBAI to Competitors

Compared to its competitors, such as [mention key competitors and their market capitalization, revenue, etc.], BBAI holds [mention relative strengths, e.g., a strong position in a specific niche market] but also faces challenges in terms of [mention relative weaknesses, e.g., scalability and market share]. A direct comparison requires a detailed analysis of their respective financial performance, market share, and technological capabilities.

- Competitive Advantages: [List key advantages].

- Competitive Disadvantages: [List key disadvantages].

Technical Analysis of BBAI Stock

A brief look at the technical charts shows [mention key chart patterns, support/resistance levels, or relevant indicators]. However, relying solely on technical analysis for investment decisions is risky. It's crucial to combine technical analysis with fundamental analysis and a thorough understanding of the company's business model.

Conclusion

Investing in BigBear.ai (BBAI) stock after the recent analyst downgrade requires careful consideration of both the risks and rewards. While the downgrade raises valid concerns about revenue growth and competition, the company’s potential in the AI sector and its strategic initiatives could lead to significant returns. The key takeaway is the inherent uncertainty.

Is BigBear.ai (BBAI) stock right for your portfolio? Do your own due diligence before investing. Remember to consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

Charles Leclercs New Partnership With Chivas Regal Details Revealed

May 20, 2025

Charles Leclercs New Partnership With Chivas Regal Details Revealed

May 20, 2025 -

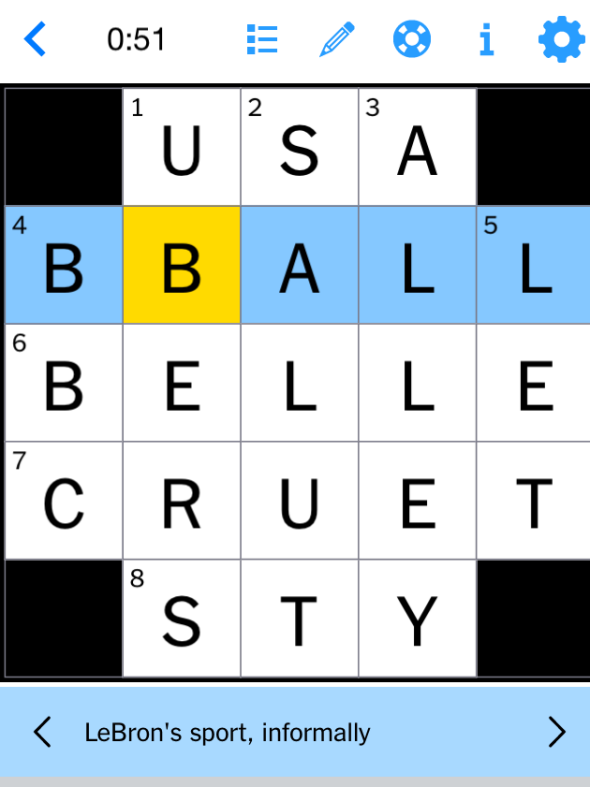

Find The Answers Nyt Mini Crossword March 20 2025

May 20, 2025

Find The Answers Nyt Mini Crossword March 20 2025

May 20, 2025 -

Big Bear Ai Holdings Inc Bbai A Top Ai Penny Stock Pick

May 20, 2025

Big Bear Ai Holdings Inc Bbai A Top Ai Penny Stock Pick

May 20, 2025 -

Jennifer Lawrence Drugo Dijete Stiglo

May 20, 2025

Jennifer Lawrence Drugo Dijete Stiglo

May 20, 2025 -

Little Known Postman Features To Boost Your Workflow

May 20, 2025

Little Known Postman Features To Boost Your Workflow

May 20, 2025