Is Bitcoin At A Critical Juncture? Analyzing Key Price Points

Table of Contents

Historical Bitcoin Price Analysis: Identifying Past Critical Junctures

Analyzing past Bitcoin price points helps us understand potential future movements. By identifying previous critical junctures, we can gain valuable insights into current market behavior.

Major Price Peaks and Troughs

Bitcoin's history is marked by significant price swings. Let's examine some key moments:

- 2017 Bull Run: The price surged from under $1,000 to nearly $20,000, fueled by increased mainstream adoption and speculation. This period highlights the rapid growth potential of Bitcoin, but also its inherent volatility.

- 2018 Bear Market: Following the 2017 peak, a sharp correction saw Bitcoin's price plummet, reaching lows of around $3,000. This demonstrates the risks associated with investing in cryptocurrencies.

- 2021 Peak: Bitcoin reached an all-time high of over $64,000, driven by institutional adoption, macroeconomic uncertainty, and renewed investor interest. This peak was followed by another significant correction.

[Insert chart showing Bitcoin price from 2017 to present]

These historical Bitcoin price points illustrate the cyclical nature of the market, characterized by periods of explosive growth followed by substantial corrections.

Support and Resistance Levels

Understanding support and resistance levels is crucial for Bitcoin price analysis. Support levels represent prices where buying pressure is strong enough to prevent further declines, while resistance levels represent prices where selling pressure halts upward momentum.

- Identifying Support and Resistance: These levels are often identified by analyzing past price action and using technical indicators like moving averages (MA), Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD).

- Current Key Levels: [Insert analysis of current support and resistance levels, with relevant chart]. For example, $20,000 might act as a significant support level, while $30,000 could represent a crucial resistance level.

Current Macroeconomic Factors Influencing Bitcoin's Price

Global economic conditions significantly impact Bitcoin's price.

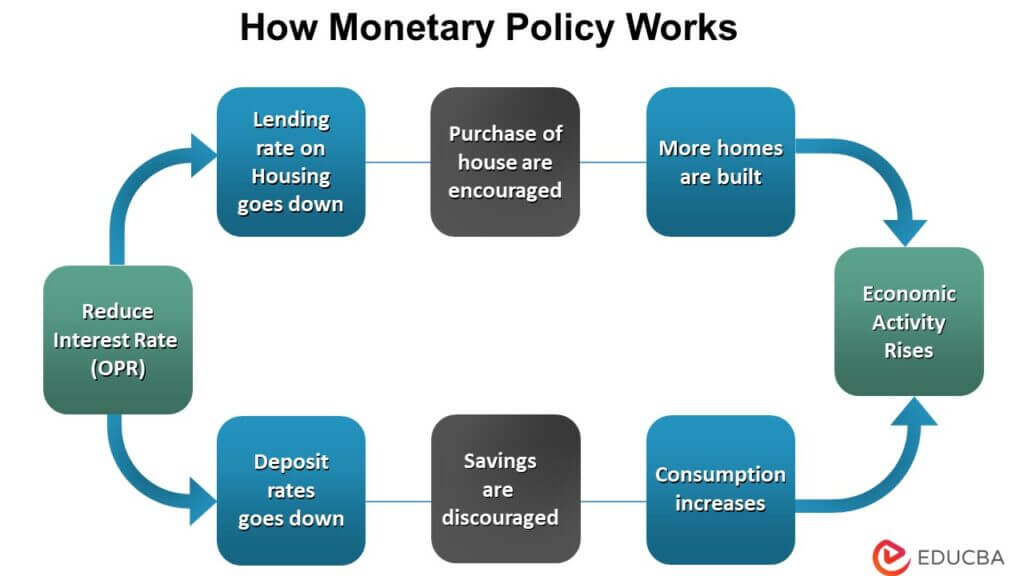

Inflation and Interest Rates

- Inflationary Hedge: Bitcoin is often touted as a hedge against inflation. However, the correlation isn't always direct. High inflation can increase demand for Bitcoin as investors seek to preserve their purchasing power, but rising interest rates can make holding Bitcoin less attractive compared to interest-bearing assets.

- Interest Rate Hikes: Central bank interest rate hikes tend to negatively impact risk assets, including Bitcoin. This is because higher rates make borrowing more expensive and reduce the attractiveness of speculative investments.

- [Include relevant economic data and expert opinions on the correlation between inflation, interest rates, and Bitcoin's price.]

Global Geopolitical Events

Geopolitical instability can significantly influence Bitcoin's price.

- Safe Haven Asset?: Bitcoin is sometimes considered a safe haven asset during times of political or economic turmoil. However, its price can still be highly volatile even in such situations.

- Examples: The war in Ukraine and increased global tensions have previously impacted Bitcoin's price, reflecting investor uncertainty and risk aversion.

- [Provide examples of past geopolitical events and their impact on Bitcoin's price].

Technological Advancements and Bitcoin's Future

Technological advancements play a crucial role in shaping Bitcoin's long-term trajectory.

The Lightning Network and Scalability

- Increased Transaction Speed: The Lightning Network is a layer-2 scaling solution designed to improve Bitcoin's transaction speed and reduce fees. Wider adoption could significantly boost Bitcoin's usability and potentially increase its price.

- Improved Efficiency: As the Lightning Network matures, it could address some of the limitations of Bitcoin's base protocol, making it more competitive with other cryptocurrencies.

Bitcoin's Role in the DeFi Ecosystem

- Wrapped Bitcoin (WBTC): Bitcoin's integration into the DeFi ecosystem, through wrapped versions like WBTC, allows it to be used in various DeFi applications, expanding its utility and potential market.

- Increased Demand: This increased usage within DeFi could lead to higher demand and potentially push Bitcoin's price higher.

Market Sentiment and Investor Behavior

Market psychology plays a substantial role in Bitcoin price fluctuations.

Whale Activity and Institutional Investment

- Whale Manipulation: Large investors ("whales") can significantly influence Bitcoin's price through their buying and selling activities.

- Institutional Adoption: Increased institutional investment can provide stability and potentially drive prices up, but large sell-offs can also trigger substantial corrections.

- [Include data on institutional investment and whale wallet activity].

Social Media Sentiment and News Coverage

- News Impact: Positive news coverage and social media trends tend to boost investor sentiment and drive prices up, while negative news can have the opposite effect.

- FOMO and Fear: Fear of missing out (FOMO) and fear-based selling can amplify price swings.

- [Provide examples of how social media and news have influenced Bitcoin's price].

Conclusion

Analyzing Bitcoin's price requires considering a multitude of factors. Historical Bitcoin price points reveal cyclical patterns, while current macroeconomic conditions, technological advancements, and market sentiment all contribute to its volatility. Whether Bitcoin is at a critical juncture depends on the interplay of these elements. A combination of positive macroeconomic developments, increased institutional adoption, and continued technological improvements could signal a bullish trend. Conversely, a deterioration of global economic conditions or a significant negative shift in market sentiment could lead to a further correction. Understanding these key Bitcoin price points is crucial for navigating this potentially volatile market. Continue your Bitcoin price analysis and stay updated on market developments to make informed investment decisions. Monitoring key Bitcoin price points and remaining aware of broader market trends will help you understand Bitcoin’s future price trajectory.

Featured Posts

-

Jayson Tatum Takes A Hilarious Hit From Tnt Announcers In Abc Promo

May 08, 2025

Jayson Tatum Takes A Hilarious Hit From Tnt Announcers In Abc Promo

May 08, 2025 -

Chinas Economic Strategy Combating Tariffs Through Monetary Policy

May 08, 2025

Chinas Economic Strategy Combating Tariffs Through Monetary Policy

May 08, 2025 -

Bitcoin In Son Durumu Guencel Degeri Ve Analizi

May 08, 2025

Bitcoin In Son Durumu Guencel Degeri Ve Analizi

May 08, 2025 -

Agresion Masiva Jugadores De Flamengo Y Botafogo En Una Batalla Campal Post Partido

May 08, 2025

Agresion Masiva Jugadores De Flamengo Y Botafogo En Una Batalla Campal Post Partido

May 08, 2025 -

Is 3 40 The Next Target For Xrp Analyzing Ripples Potential

May 08, 2025

Is 3 40 The Next Target For Xrp Analyzing Ripples Potential

May 08, 2025