Is CoreWeave Stock A Good Investment? Current Market Analysis

Table of Contents

H2: CoreWeave's Business Model and Competitive Advantage

CoreWeave has carved a niche for itself by focusing on providing specialized infrastructure for AI workloads. This specialization forms the cornerstone of its competitive advantage.

H3: Specialized Infrastructure for AI

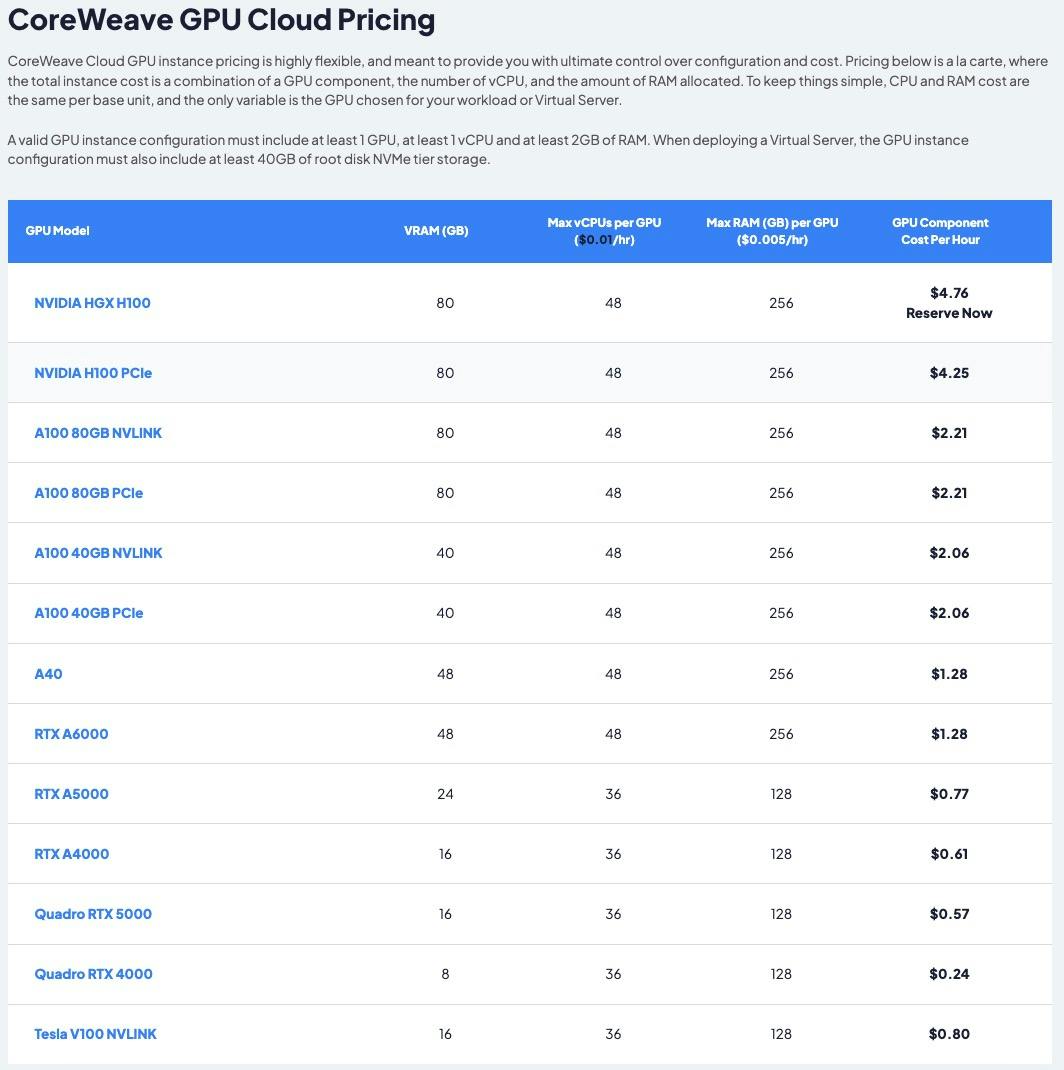

CoreWeave's strength lies in its utilization of high-performance computing resources, particularly its extensive network of NVIDIA GPUs. This allows them to offer unparalleled processing power for demanding AI applications.

- Scalability: CoreWeave's infrastructure allows for easy scaling of resources to meet fluctuating demands, a crucial advantage in the dynamic AI landscape.

- Performance: The power of NVIDIA GPUs translates directly into faster training times and improved performance for AI models, a key selling point for clients.

- Cost-Effectiveness: By optimizing its infrastructure and leveraging cloud-based efficiencies, CoreWeave aims to offer competitive pricing compared to traditional high-performance computing solutions. This is achieved through efficient resource allocation and utilization.

These advantages position CoreWeave strongly within the competitive landscape of GPU cloud computing and AI infrastructure providers.

H3: Target Market and Growth Potential

The AI market is experiencing hyper-growth, and CoreWeave is well-positioned to capitalize on this expansion.

- Key Customer Segments: CoreWeave targets both burgeoning AI startups needing scalable computing power and large enterprises seeking to enhance their AI capabilities. This diversification reduces reliance on any single customer segment.

- Market Projections: Industry analysts predict continued explosive growth in the AI market, creating significant opportunities for companies like CoreWeave. The increasing demand for AI-powered solutions across various industries supports this optimistic outlook.

- Growth Potential: CoreWeave's focus on specialized AI infrastructure, combined with the burgeoning demand for high-performance computing, suggests considerable growth potential. This is contingent upon maintaining innovation and efficient operations.

H2: Financial Performance and Valuation

Assessing CoreWeave's investment potential requires a careful examination of its financial performance and current valuation. While precise financial details may not be publicly available for a private company, available information should be reviewed to the best of one's ability.

H3: Revenue Growth and Profitability

Analyzing CoreWeave's revenue growth and profitability is crucial in determining its long-term viability. This requires accessing publicly available financial statements and reports (if any), comparing its performance with competitors providing similar services, identifying key financial metrics, such as customer acquisition cost and average revenue per user, and understanding the factors influencing its revenue generation. Understanding the current profitability of the company, the margins earned, and the costs associated with infrastructure maintenance are crucial for understanding the financial health of the company.

H3: Stock Valuation and Investment Risks

Even with promising prospects, investing in CoreWeave stock (once publicly traded) carries inherent risks.

- Market Sentiment: Investor sentiment towards the technology sector and AI-related stocks can significantly impact CoreWeave's stock price. Market volatility is a significant risk.

- Competition: The cloud computing market is highly competitive, with established players and emerging startups vying for market share. Competitive pressures will need careful monitoring.

- Regulatory Changes: Changes in regulations governing data privacy and cloud computing could influence CoreWeave's operations and profitability. Regulatory risks need to be assessed.

H2: Industry Trends and Future Outlook

Understanding the broader industry trends is vital to predicting CoreWeave's future trajectory.

H3: The Future of Cloud Computing and AI

The future of cloud computing is inextricably linked to AI. The increasing reliance on AI-powered solutions across all sectors implies sustained demand for powerful cloud infrastructure.

- Emerging Technologies: Advancements in areas such as quantum computing and edge AI could present both opportunities and challenges for CoreWeave. Adapting to changing technology will be key.

- Potential Disruptions: Technological disruptions are inherent in the tech industry, and CoreWeave's ability to adapt and innovate will be critical to its long-term success. Adaptability is essential.

H3: CoreWeave's Strategic Initiatives and Partnerships

Analyzing CoreWeave's strategic initiatives, such as partnerships and acquisitions, offers further insight into its future prospects. Monitoring for new partnerships, technological advancements, successful product launches, and acquisitions is crucial for predicting future performance. These actions indicate the company's growth strategy and its ability to compete in the market.

3. Conclusion

CoreWeave presents a compelling investment proposition, leveraging its specialization in AI infrastructure within a rapidly expanding market. However, its relatively young age and the inherent risks associated with high-growth technology stocks necessitate caution. The financial performance, competitive landscape, and regulatory environment will be key to its future success.

Investment Recommendation: Based on the current analysis, investing in CoreWeave stock (once publicly traded) presents both significant potential and considerable risk. A thorough due diligence process, including independent research and expert consultation, is strongly recommended before making any investment decisions.

Call to Action: Before considering investing in CoreWeave stock, conduct comprehensive research into its financial performance, competitive landscape, and future prospects. Consult with financial advisors and utilize reputable financial resources to make informed investment decisions concerning CoreWeave stock, evaluating CoreWeave investment opportunities carefully. Remember that investing in CoreWeave, or any stock, carries risk.

Featured Posts

-

Peppa Pig Online Streaming Finding Free And Paid Episodes

May 22, 2025

Peppa Pig Online Streaming Finding Free And Paid Episodes

May 22, 2025 -

Wordle 1384 Solution April 3 2025 Wordle Hints And Answer

May 22, 2025

Wordle 1384 Solution April 3 2025 Wordle Hints And Answer

May 22, 2025 -

Analyzing The Current State Of Core Weave Stock

May 22, 2025

Analyzing The Current State Of Core Weave Stock

May 22, 2025 -

Unexplained Red Lights Appear In France Investigating The Aerial Mystery

May 22, 2025

Unexplained Red Lights Appear In France Investigating The Aerial Mystery

May 22, 2025 -

Siren Review Julianne Moore Meghann Fahy And Milly Alcock Deliver Beachy Thrills

May 22, 2025

Siren Review Julianne Moore Meghann Fahy And Milly Alcock Deliver Beachy Thrills

May 22, 2025

Latest Posts

-

Andriy Sibiga Zustrivsya Z Markom Rubio Ta Lindsi Gremom Detali Zustrichi

May 22, 2025

Andriy Sibiga Zustrivsya Z Markom Rubio Ta Lindsi Gremom Detali Zustrichi

May 22, 2025 -

Siren Review A Closer Look At Moore Fahy And Alcocks Performances

May 22, 2025

Siren Review A Closer Look At Moore Fahy And Alcocks Performances

May 22, 2025 -

Siren Review Julianne Moore Meghann Fahy And Milly Alcock Deliver Beachy Thrills

May 22, 2025

Siren Review Julianne Moore Meghann Fahy And Milly Alcock Deliver Beachy Thrills

May 22, 2025 -

Us Sanctions On Russia Grahams Ultimatum Following Ceasefire Rejection

May 22, 2025

Us Sanctions On Russia Grahams Ultimatum Following Ceasefire Rejection

May 22, 2025 -

Siren Netflix Meet The Cast Of The Dark Comedy Limited Series

May 22, 2025

Siren Netflix Meet The Cast Of The Dark Comedy Limited Series

May 22, 2025