Is Gold's 2025 Bull Run Over? Two Weeks Of Negative Returns

Table of Contents

Analyzing the Two-Week Negative Return in the Gold Market

Factors Contributing to the Recent Gold Price Decline:

Several intertwined factors contributed to the recent gold price decline. Understanding these elements is crucial for making informed investment decisions.

-

Increased US Dollar Strength: A strengthening US dollar typically exerts downward pressure on gold prices, as gold is priced in dollars. A stronger dollar makes gold more expensive for holders of other currencies, reducing demand. Recent economic data pointing towards a resilient US economy has bolstered the dollar.

-

Rising Interest Rates: Higher interest rates increase the attractiveness of yield-bearing assets like US Treasury bonds, diverting investment away from non-yielding assets such as gold. The opportunity cost of holding gold increases as interest rates climb.

-

Shifting Investor Sentiment: Economic data releases, such as inflation figures and employment reports, can significantly sway investor sentiment. Negative surprises can trigger sell-offs in gold, as investors reassess their risk appetite.

-

Technical Analysis Showing Potential Short-Term Resistance Levels: Chart patterns and technical indicators sometimes suggest short-term resistance levels in gold's price trajectory. These levels can trigger profit-taking by some investors, leading to temporary price declines.

-

Specific Economic Indicators: For instance, a higher-than-expected inflation reading might initially boost gold prices (as a hedge against inflation), but if it leads the Federal Reserve to increase interest rates more aggressively, the subsequent stronger dollar could negate that initial positive effect.

Is this a temporary correction or a significant shift?

The recent downturn is likely a short-term correction within a longer-term trend. Historical data reveals that gold markets often experience periods of volatility and price corrections even during bull runs. These corrections are often opportunities for long-term investors to accumulate more gold at lower prices. Market speculation also plays a role; fear and uncertainty can drive short-term price swings, while fundamental factors ultimately dictate long-term trends. Analyzing past gold price charts shows similar patterns of dips and rebounds within longer-term upward trends.

Examining the Long-Term Outlook for Gold in 2025

Factors Still Supporting a Potential 2025 Gold Bull Run:

Despite the recent dip, several fundamental factors still support the potential for a gold bull run in 2025.

-

Persistent Inflation and Potential Inflationary Pressures: While inflation may be cooling in some regions, persistent inflationary pressures in many parts of the world continue to make gold an attractive hedge against the erosion of purchasing power.

-

Geopolitical Uncertainties and Safe-Haven Demand: Ongoing geopolitical tensions and global uncertainties continue to fuel demand for gold as a safe-haven asset. Investors seek refuge in gold during times of market instability.

-

Increasing Central Bank Gold Reserves: Many central banks globally continue to increase their gold reserves, signaling their confidence in gold as a valuable store of value and a safeguard against financial risks.

-

Potential Supply Constraints: Challenges in gold mining production, including rising costs and permitting complexities, could constrain supply and support higher prices.

-

Long-Term Growth in Emerging Markets: The continued growth of emerging economies is expected to boost demand for gold, particularly for jewelry and investment purposes.

Re-evaluating the 2025 Predictions in Light of Recent Events:

While the recent price drop might cause some to question previous predictions, it's important to remember that forecasting market behavior is inherently complex. The drop could simply adjust the timing of the projected bull run rather than negating its potential altogether. Different analysts have varying perspectives, with some suggesting a delayed but ultimately robust bull run, while others suggest a more moderate price increase. Thorough research and analysis are essential to develop a personalized investment strategy.

Investment Strategies in the Face of Market Volatility

Adjusting your Gold Investment Strategy:

Navigating market volatility requires a robust investment strategy.

-

Diversification: Diversifying your investment portfolio across various asset classes reduces overall risk. Don't put all your eggs in one basket.

-

Dollar-Cost Averaging (DCA): DCA involves investing a fixed amount of money at regular intervals, regardless of price fluctuations. This mitigates the risk of buying high and helps to average out the cost per unit.

-

Averaging Down: If you believe in the long-term potential of gold, strategically buying more during price dips can lower your average cost basis.

-

Long-Term Holding: Holding gold investments over the long term can help you ride out short-term volatility and benefit from potential long-term appreciation.

-

Alternative Precious Metals: Consider diversifying within the precious metals sector by investing in silver, platinum, or palladium.

Monitoring Key Indicators for Future Decisions:

Staying informed is key. Monitor these indicators:

-

Inflation Rates: Track inflation rates to assess the ongoing need for gold as an inflation hedge.

-

Interest Rates: Monitor interest rate changes to assess their impact on the relative attractiveness of gold compared to yield-bearing assets.

-

US Dollar Index: Observe the US dollar's strength and its influence on gold pricing.

-

Resources for Tracking: Use reputable financial news websites and market analysis platforms to stay updated.

Continuous monitoring and adapting your strategy based on market conditions is crucial for successful gold investment.

Conclusion: Navigating the Gold Market – Is the 2025 Bull Run Still On?

The recent dip in gold prices, driven by factors such as a stronger US dollar and rising interest rates, has understandably raised concerns. However, the fundamental factors supporting a long-term bull run remain. While the timing might shift, the overall potential for a 2025 gold bull run remains a viable possibility. Short-term fluctuations are a normal part of market dynamics and shouldn't overshadow the long-term perspective. Informed decision-making, based on careful analysis of market indicators and a well-diversified investment strategy, is crucial. Continue researching the gold market, monitor key indicators, and develop a well-informed strategy for gold investment and navigating the potential 2025 gold bull run. Remember to consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

Two Days Of Crypto Chaos A Wild Party Recap

May 05, 2025

Two Days Of Crypto Chaos A Wild Party Recap

May 05, 2025 -

Ny Nj Ct Snow Forecast Predicting The Next Winter Storm

May 05, 2025

Ny Nj Ct Snow Forecast Predicting The Next Winter Storm

May 05, 2025 -

Hollywood Premiere Blake Lively And Anna Kendrick Address Feud Speculation

May 05, 2025

Hollywood Premiere Blake Lively And Anna Kendrick Address Feud Speculation

May 05, 2025 -

Ufc 314 Full Bout Order Announced For Main Card And Prelims

May 05, 2025

Ufc 314 Full Bout Order Announced For Main Card And Prelims

May 05, 2025 -

Ufc 314 Volkanovski Lopes Main Event And Full Fight Card Preview

May 05, 2025

Ufc 314 Volkanovski Lopes Main Event And Full Fight Card Preview

May 05, 2025

Latest Posts

-

Alleged Torture Starvation And Beatings Lead To Murder Charge Against Stepfather Of 16 Year Old

May 05, 2025

Alleged Torture Starvation And Beatings Lead To Murder Charge Against Stepfather Of 16 Year Old

May 05, 2025 -

Stepfather Charged With Murder After Alleged Torture And Starvation Of 16 Year Old Stepson

May 05, 2025

Stepfather Charged With Murder After Alleged Torture And Starvation Of 16 Year Old Stepson

May 05, 2025 -

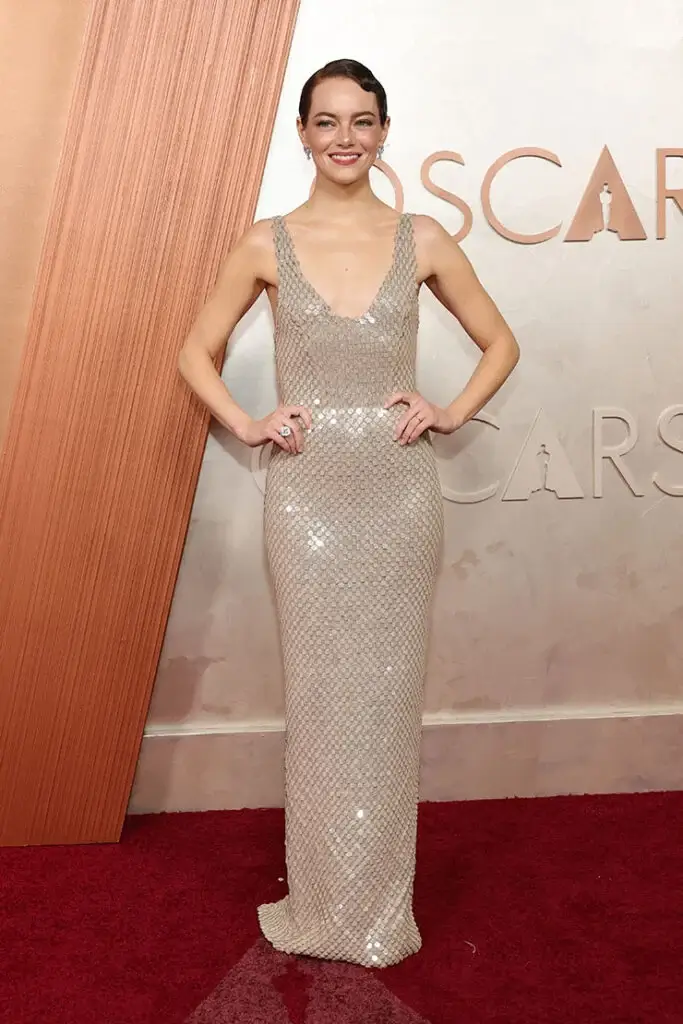

Emma Stones Oscars 2025 Style A Stunning Sequin Louis Vuitton Dress And Classic Pixie

May 05, 2025

Emma Stones Oscars 2025 Style A Stunning Sequin Louis Vuitton Dress And Classic Pixie

May 05, 2025 -

Oscars 2025 Emma Stones Bold Sequin Louis Vuitton Gown And Retro Hairstyle

May 05, 2025

Oscars 2025 Emma Stones Bold Sequin Louis Vuitton Gown And Retro Hairstyle

May 05, 2025 -

Emma Stones Daring Oscars 2025 Look Sequin Louis Vuitton And Pixie Cut

May 05, 2025

Emma Stones Daring Oscars 2025 Look Sequin Louis Vuitton And Pixie Cut

May 05, 2025