Is Palantir Stock A Buy Before May 5th? Analyst Ratings And Future Outlook

Table of Contents

Recent Analyst Ratings and Price Targets for Palantir Stock

Understanding analyst sentiment is crucial when considering a stock like Palantir. Analyst ratings provide valuable insights into the overall market perception of Palantir's potential. Let's examine recent ratings from key players:

-

Summarizing Recent Ratings: As of [Insert Date - ensure this is updated before publishing], the sentiment on Palantir stock is mixed. While some investment banks like [Insert Bank Name, e.g., Goldman Sachs] maintain a "Buy" rating with a price target of [Insert Price Target], others hold a more cautious stance. [Insert Bank Name, e.g., Morgan Stanley] might have issued a "Hold" rating with a lower price target of [Insert Price Target]. [Insert another Bank Name and Rating, if available]

-

Consensus Rating: The consensus rating among analysts currently leans towards [Insert - Neutral, Positive, or Negative, depending on the data]. This indicates a degree of uncertainty within the analyst community regarding Palantir's near-term prospects.

-

Rationale Behind Ratings: The divergence in ratings stems from differing perspectives on Palantir's growth trajectory. Bullish analysts point to the increasing adoption of Palantir's platform by government agencies and commercial clients, highlighting its potential for significant revenue growth. Bearish analysts, however, raise concerns about profitability and the sustainability of Palantir's high growth rate, especially considering competition in the data analytics space.

-

Recent Rating Changes: [Mention any significant changes in analyst ratings in the recent past. For example: "Recently, [Bank Name] upgraded their rating from 'Hold' to 'Buy', citing [Reason for upgrade]."]

Palantir's Financial Performance and Growth Trajectory

Analyzing Palantir's financial performance is key to assessing its investment potential. Let's examine the key figures:

-

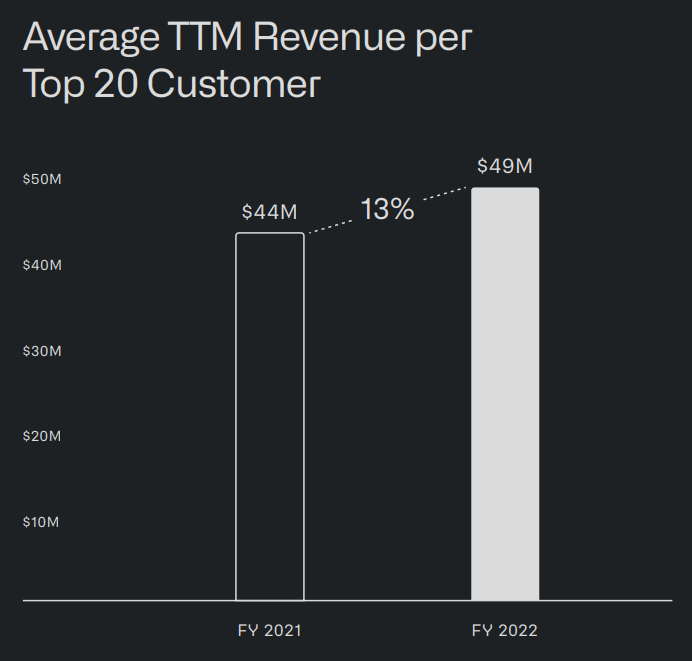

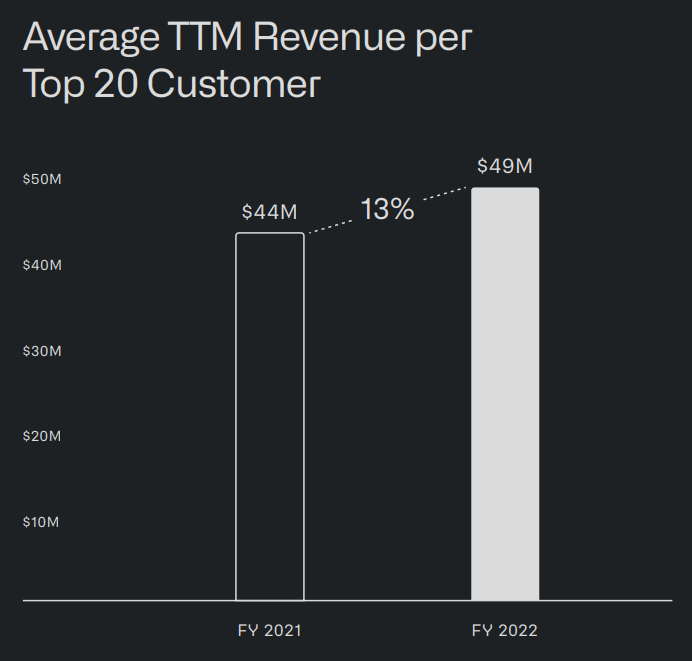

Recent Financial Reports: Palantir's recent financial reports show [Summarize key data points like revenue growth percentage, earnings per share, and profit margins. Use specific numbers to support your claims. For example: "Revenue increased by X% year-over-year, reaching $Y billion."].

-

Key Growth Drivers: Palantir's growth is primarily driven by strong demand for its data analytics platform from both government and commercial clients. Government contracts, particularly in defense and intelligence, constitute a significant portion of their revenue. Their expanding commercial partnerships across various sectors, like healthcare and finance, also contribute substantially to their revenue streams.

-

Sustainability of Growth: The sustainability of Palantir's growth rate is a point of contention. While the company has demonstrated strong growth in recent years, maintaining this trajectory requires continuous innovation, successful expansion into new markets, and securing substantial long-term contracts.

-

Potential Financial Risks: Potential risks include increased competition, dependence on large government contracts, and the potential for slower-than-expected adoption of its platform in the commercial sector. These factors could impact Palantir's profitability and overall financial performance.

Key Factors Influencing Palantir Stock Price Before May 5th

Several factors could influence the Palantir stock price before May 5th. We need to consider both internal and external elements:

-

Upcoming News and Events: Any upcoming earnings reports, product launches, or major contract wins could significantly impact the stock price. Monitor news releases carefully for any announcements that could affect investor sentiment.

-

Market Conditions: The overall market conditions, including broader economic trends and investor risk appetite, play a significant role. A downturn in the overall market could negatively impact Palantir's stock price, regardless of its internal performance.

-

Geopolitical Factors and Industry Trends: Geopolitical events and broader industry trends (like the increased focus on data security and artificial intelligence) can also influence investor sentiment towards Palantir.

-

Potential Catalysts: Positive catalysts could include exceeding revenue expectations, securing major new contracts, or announcements of strategic partnerships. Conversely, negative catalysts could be disappointing financial results, missed projections, or negative regulatory developments.

Assessing the Risk and Reward of Investing in Palantir

Investing in Palantir stock involves weighing the potential rewards against the inherent risks:

-

Risk vs. Reward: Palantir offers high growth potential, especially considering its position in the rapidly expanding data analytics market. However, the stock's volatility poses a significant risk, as its price can fluctuate significantly based on news and market sentiment.

-

Investment Strategies: Investors with a high-risk tolerance and a long-term investment horizon might find Palantir appealing, while more risk-averse investors should consider diversifying their portfolios.

-

Diversification: To mitigate risk, consider diversifying your investment portfolio to reduce reliance on any single stock, including Palantir.

Conclusion

Determining whether Palantir stock is a buy before May 5th requires careful consideration of various factors. The analyst consensus currently [Reiterate consensus - positive, negative, or neutral] with some analysts highlighting its high-growth potential while others express concern about its profitability and sustainability. The upcoming weeks could see significant price fluctuations depending on market conditions, announcements regarding new contracts, and overall financial performance. The analysis suggests that Palantir stock involves substantial risk; potential investors should carefully consider their own risk tolerance and diversification strategies before investing.

Call to Action: Should you buy Palantir stock before May 5th? This decision depends entirely on your individual investment goals and risk tolerance. This in-depth look at analyst ratings and the future outlook for Palantir provides valuable insights, but conducting your own thorough research and consulting a financial advisor are crucial steps before making any investment decisions related to Palantir stock.

Featured Posts

-

Dispute On Bbc Show Joanna Pages Critique Of Wynne Evans Performance

May 10, 2025

Dispute On Bbc Show Joanna Pages Critique Of Wynne Evans Performance

May 10, 2025 -

Palantir Stock Buy The Dip After 30 Fall

May 10, 2025

Palantir Stock Buy The Dip After 30 Fall

May 10, 2025 -

Navigating The Elizabeth Line A Guide To Wheelchair Accessibility

May 10, 2025

Navigating The Elizabeth Line A Guide To Wheelchair Accessibility

May 10, 2025 -

Aoc Vs Trump A Fox News Perspective

May 10, 2025

Aoc Vs Trump A Fox News Perspective

May 10, 2025 -

Nyt Strands April 9 2025 Complete Guide To Solving Todays Puzzle

May 10, 2025

Nyt Strands April 9 2025 Complete Guide To Solving Todays Puzzle

May 10, 2025