Is Palantir Stock A Good Buy Before May 5th? Risks And Rewards

Table of Contents

Palantir's Current Market Position and Recent Performance

Palantir's recent performance has been a mixed bag. While the company continues to demonstrate strong revenue growth fueled by its government and commercial contracts, profitability remains a key focus for investors. Analyzing Palantir's current market capitalization and valuation relative to competitors in the big data analytics space is essential for assessing its overall value. Key partnerships and contract wins can significantly impact the Palantir share price, so keeping track of these is vital.

- Revenue Growth: Palantir has consistently shown growth in its revenue, although the rate of growth might fluctuate from quarter to quarter. (Insert specific revenue figures and growth percentages here, citing your source).

- Market Share: Compared to established players like Microsoft and Amazon Web Services (AWS), Palantir holds a smaller but rapidly growing market share in specific niches of the data analytics market. (Include data comparing Palantir's market share to competitors' market share in relevant segments).

- Key Partnerships and Contracts: Recent large-scale government contracts, as well as strategic partnerships with major commercial enterprises, significantly bolster Palantir's revenue streams and contribute to its market valuation. (Mention specific examples of significant contracts or partnerships, highlighting their impact).

Factors Suggesting Palantir Stock Could Rise Before May 5th

Several factors could contribute to a rise in Palantir share price before May 5th. Positive earnings reports exceeding analyst expectations, successful new product launches, or securing substantial new government contracts, particularly in areas experiencing increased government spending on data analytics and AI, could all trigger positive market sentiment. Furthermore, positive analyst predictions and ratings act as additional catalysts.

- Upcoming Events: Any upcoming product announcements, earnings reports, or contract wins in the period leading up to May 5th could substantially influence the Palantir stock price. (Specifically mention any upcoming events and their potential impact).

- Analyst Sentiment: Positive analyst ratings and price target increases can significantly impact investor confidence and drive up demand for Palantir stock. (Include specific examples of positive analyst predictions and their reasoning).

- Government Spending: Increased government spending on data analytics and AI initiatives presents a substantial opportunity for Palantir to secure lucrative contracts, potentially boosting its share price.

Potential Risks and Downsides of Investing in Palantir Stock Before May 5th

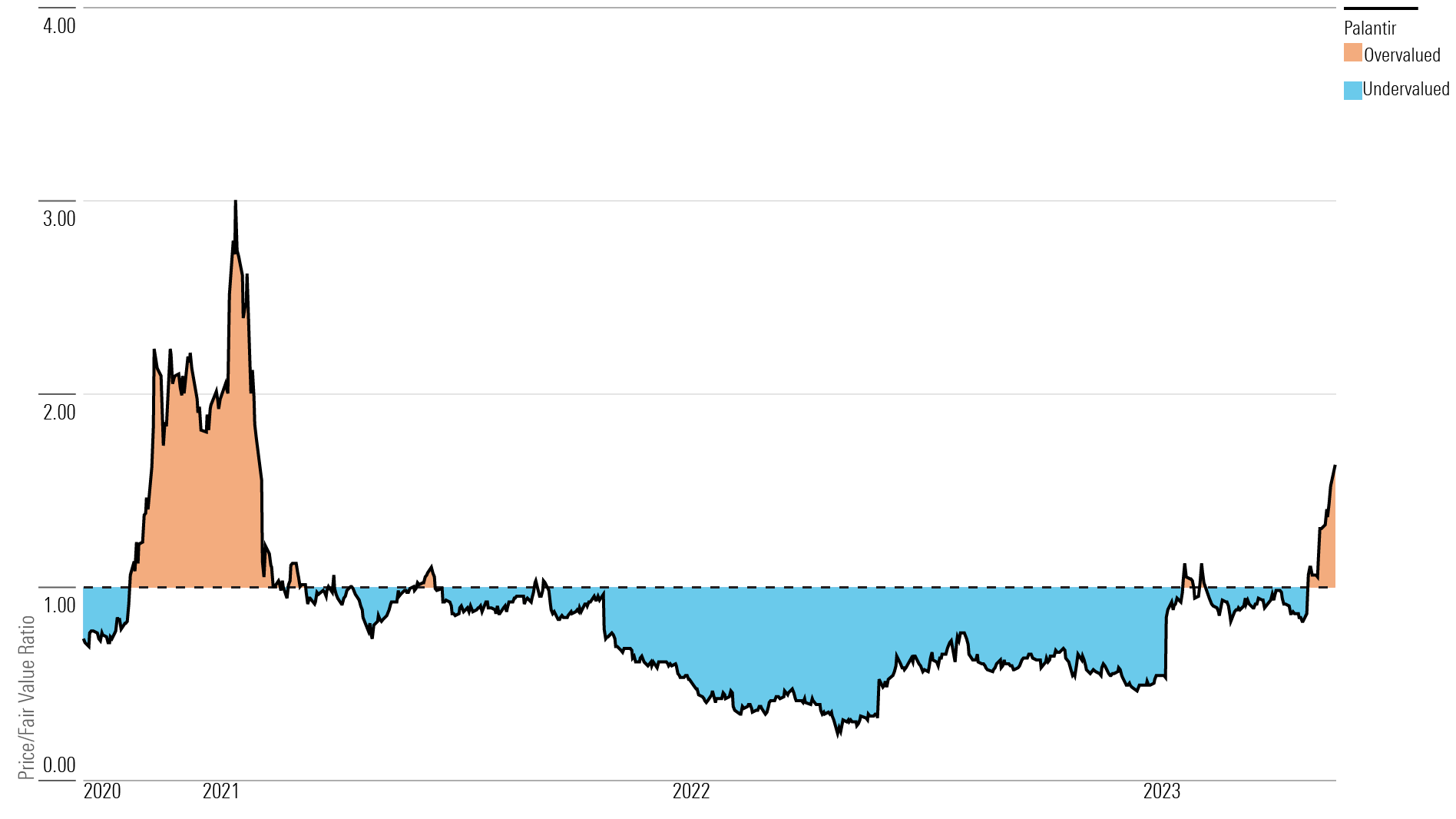

Despite the potential for upside, investing in Palantir stock before May 5th comes with inherent risks. Disappointing earnings reports, intensified competition from larger tech companies, and macroeconomic factors like inflation or recessionary pressures could all negatively affect Palantir's share price. The historical volatility of Palantir stock also needs to be considered. Additionally, investors should assess any potential regulatory or legal risks associated with Palantir's operations.

- Competitive Threats: Intense competition from established players in the big data analytics space poses a significant threat to Palantir's market share and profitability. (Provide specific examples of competitive threats, such as price wars or innovative new solutions).

- Macroeconomic Factors: Economic downturns often impact technology spending, which could negatively affect Palantir's revenue growth and valuation. (Explain how macroeconomic factors like inflation or recession could affect Palantir's performance).

- Regulatory Risks: The regulatory landscape for data analytics and AI is constantly evolving, and any significant changes could impact Palantir's operations. (Explain any potential regulatory risks impacting Palantir).

Analyzing Palantir's Long-Term Growth Potential

The long-term outlook for the data analytics market is positive, with projections indicating continued strong growth. Palantir’s ability to leverage this growth depends on its capacity for innovation and its ability to adapt to evolving market demands. Assessing the sustainability of its business model—particularly its reliance on government contracts versus its commercial sector growth—is crucial for evaluating its long-term viability.

- Market Growth: The data analytics market is expected to experience significant growth in the coming years, providing Palantir with ample opportunity for expansion. (Include market growth projections and cite your source).

- Innovation and Adaptability: Palantir’s ongoing investments in research and development and its efforts to adapt its platform to emerging technologies will significantly impact its long-term competitiveness. (Provide examples of Palantir's innovation and technological advancements).

- Business Model Sustainability: The long-term viability of Palantir's business model depends on a balanced portfolio of government and commercial contracts, ensuring diversification and resilience. (Discuss the long-term viability of Palantir's revenue streams, highlighting any potential risks or opportunities).

Conclusion: Should You Buy Palantir Stock Before May 5th?

Deciding whether to buy Palantir stock before May 5th requires careful consideration of the potential rewards and risks. While the company demonstrates strong revenue growth and has significant long-term potential within the expanding data analytics market, inherent volatility and competitive pressures must be acknowledged. Positive catalysts could drive the price upward before May 5th, but potential disappointments could equally lead to a price decrease. Ultimately, a thorough understanding of Palantir’s financial performance, competitive landscape, and the broader macroeconomic environment is crucial. Make an informed decision about your Palantir stock investment strategy before May 5th by conducting your own thorough research and consulting with a qualified financial advisor. Remember, this analysis is for informational purposes only and does not constitute financial advice.

Featured Posts

-

Dijon Bilel Latreche Boxeur Convoque Pour Violences Conjugales

May 09, 2025

Dijon Bilel Latreche Boxeur Convoque Pour Violences Conjugales

May 09, 2025 -

Nhl Playoffs Oilers Vs Kings Game 1 Prediction And Betting Analysis

May 09, 2025

Nhl Playoffs Oilers Vs Kings Game 1 Prediction And Betting Analysis

May 09, 2025 -

Dakota Dzhonson I Nominatsii Na Zolotuyu Malinu Analiz Provalnykh Filmov

May 09, 2025

Dakota Dzhonson I Nominatsii Na Zolotuyu Malinu Analiz Provalnykh Filmov

May 09, 2025 -

Should You Buy Palantir Stock Before May 5th A Pre Earnings Analysis

May 09, 2025

Should You Buy Palantir Stock Before May 5th A Pre Earnings Analysis

May 09, 2025 -

Explore The New Queen Elizabeth 2 A Post Makeover Tour For Cruise Enthusiasts

May 09, 2025

Explore The New Queen Elizabeth 2 A Post Makeover Tour For Cruise Enthusiasts

May 09, 2025