Is The DAX Party Over? The Threat Of A Wall Street Recovery

Table of Contents

2. Main Points:

2.1 The Interdependence of Global Markets: How Wall Street Impacts the DAX

H3: The Ripple Effect: The global economy is a complex web, and the performance of one major market significantly influences others. A robust Wall Street recovery, fueled by strong US economic growth, creates a ripple effect across the globe. This interdependence is particularly pronounced between the US and Germany, two of the world's largest economies.

- German Exports: A strengthening US economy generally boosts demand for German goods and services, particularly in sectors like automotive manufacturing and machinery. Increased exports translate to higher revenues and profits for German companies listed on the DAX. Conversely, a US slowdown can negatively impact these exports.

- Investor Confidence: Positive sentiment on Wall Street often spills over into European markets, attracting foreign investment to the DAX. Conversely, a downturn in the US can lead to capital flight from Europe as investors seek safer havens.

- Currency Exchange Rates: The Euro/Dollar exchange rate is a crucial factor. A strengthening US dollar can make German exports more expensive in the US, potentially hurting DAX companies' profitability.

Data from the past decade shows a strong positive correlation between the performance of the S&P 500 and the DAX, highlighting the significant influence of Wall Street on the German stock market.

H3: Sectoral Impacts: Not all DAX sectors are equally affected by a Wall Street recovery. Some are more exposed to the US market than others.

- Automotive: German automakers, major components of the DAX, are heavily reliant on US sales. A US economic boom could lead to increased car sales, benefiting these companies. However, a slowdown could have a devastating impact.

- Technology: German technology companies, while increasingly global, often have significant US exposure, whether through sales, partnerships, or supply chains. A Wall Street recovery could boost their performance, but a downturn could significantly affect their growth.

- Luxury Goods: Companies in this sector are sensitive to high-end consumer spending in the US. A thriving US economy could significantly benefit these luxury brands.

Experts like Dr. [Insert Name and Affiliation of a Financial Analyst], argue that "[Insert quote from the expert regarding the interconnectedness of the markets and the impact of Wall Street on the DAX]."

2.2 Signs of a Wall Street Recovery and Their Potential Implications for the DAX

H3: Economic Indicators: Several key US economic indicators can signal a potential recovery, and investors should closely monitor these:

- GDP Growth: A sustained increase in US GDP indicates economic expansion, potentially leading to increased demand for German goods and services.

- Inflation Rates: Decreasing inflation rates suggest improved economic stability, potentially attracting investors back to riskier assets like stocks, including those in the DAX.

- Consumer Confidence: High consumer confidence indicates a willingness to spend, driving demand for goods and services and positively impacting DAX companies' performance.

[Insert a chart or graph illustrating the correlation between these indicators and DAX performance].

H3: Investor Sentiment Shift: A shift in investor sentiment towards Wall Street can lead to significant capital flows.

- Portfolio Rebalancing: Investors may choose to reallocate funds from European markets (including the DAX) to the US, seeking higher returns or perceived lower risk in a recovering US market.

- Flight to Safety: Conversely, a sudden downturn on Wall Street could trigger a flight to safety, leading to capital outflow from the DAX as investors seek safer investments.

The dot-com bubble burst in the early 2000s and the 2008 financial crisis serve as case studies demonstrating how shifts in investor sentiment can dramatically impact global markets, including the DAX.

2.3 Strategies for Navigating Uncertainty in the DAX Market

H3: Diversification: Diversification is crucial to mitigate risk in a volatile market. Over-reliance on the DAX can significantly expose investors to the potential negative impact of a Wall Street recovery.

- Global Diversification: Investing across various global markets and asset classes reduces dependence on any single market's performance.

- Alternative Investments: Consider alternative investments like bonds, real estate, or commodities to balance exposure to equities.

Effective risk management strategies, such as stop-loss orders, are crucial during periods of market uncertainty.

H3: Monitoring Key Indicators: Staying informed is crucial for making informed investment decisions.

- Economic Data: Regularly monitor key economic indicators from both the US and Germany, paying close attention to their interrelationship.

- Market Analysis: Consult reliable financial news sources and market analysis to understand prevailing sentiment and anticipate potential shifts.

Regularly reviewing your investment portfolio and adjusting your strategy based on market conditions is crucial for success.

3. Conclusion: Is the DAX Party Truly Over? Preparing for the Future

This article explored the potential impact of a Wall Street recovery on the DAX, highlighting the significant interdependence between the US and German economies. We've examined key economic indicators, investor sentiment, and the sectoral impacts of a potential shift. The interconnectedness of global markets necessitates diversified investment strategies.

Key Takeaways:

- The DAX and Wall Street are significantly interconnected.

- A Wall Street recovery could lead to both opportunities and risks for DAX investors.

- Diversification and active monitoring of key indicators are essential for navigating market uncertainty.

Don't get caught off guard by a potential shift in the market. Stay informed about the interplay between Wall Street and the DAX, and develop a robust investment strategy to navigate the coming changes. Conduct thorough research and consult with financial advisors to make informed decisions about your investments in the DAX and beyond.

Featured Posts

-

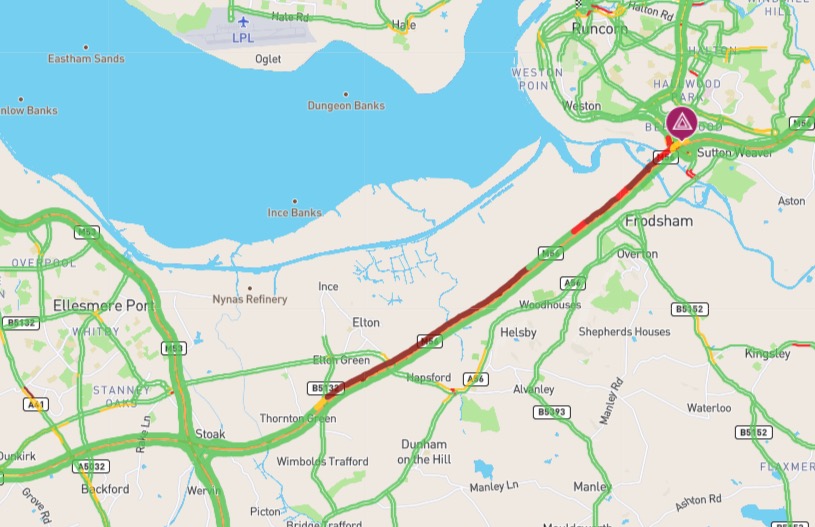

Significant Delays On M56 Near Cheshire Deeside After Collision

May 25, 2025

Significant Delays On M56 Near Cheshire Deeside After Collision

May 25, 2025 -

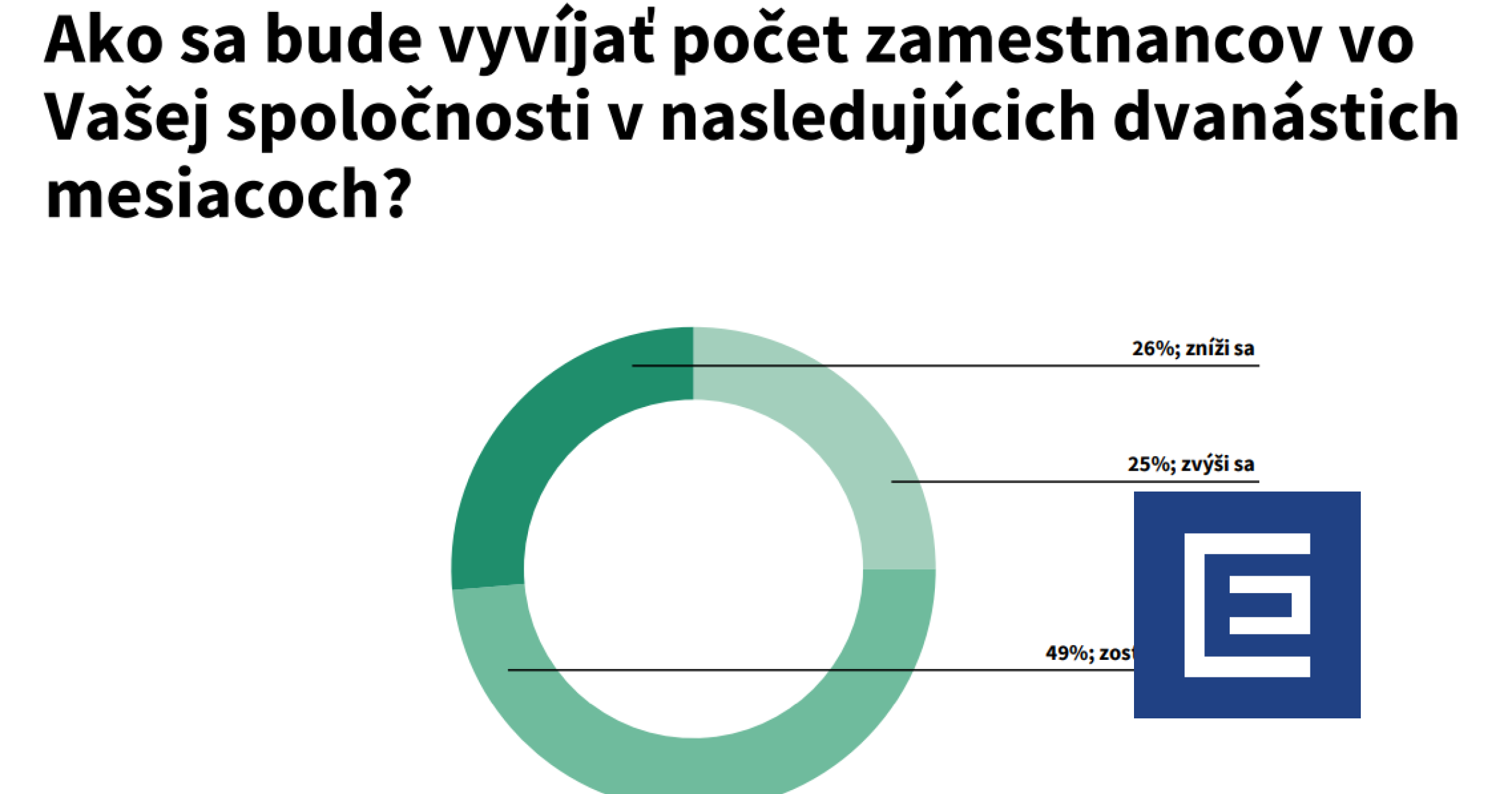

Nemecke Firmy A Masivne Prepustanie Analyza H Nonline Sk

May 25, 2025

Nemecke Firmy A Masivne Prepustanie Analyza H Nonline Sk

May 25, 2025 -

Esc 2025 Conchita Wurst And Jjs Joint Concert In Eurovision Village

May 25, 2025

Esc 2025 Conchita Wurst And Jjs Joint Concert In Eurovision Village

May 25, 2025 -

Muezede Porsche 956 Nin Tavan Sergilemesi Teknik Aciklamalar

May 25, 2025

Muezede Porsche 956 Nin Tavan Sergilemesi Teknik Aciklamalar

May 25, 2025 -

Joy Crookes Drops New Track Carmen

May 25, 2025

Joy Crookes Drops New Track Carmen

May 25, 2025

Latest Posts

-

Weekly Cac 40 Performance Slight Decline Stable Trend 07 03 2025

May 25, 2025

Weekly Cac 40 Performance Slight Decline Stable Trend 07 03 2025

May 25, 2025 -

Change At The Top Guccis Chief Industrial And Supply Chain Officer Resigns

May 25, 2025

Change At The Top Guccis Chief Industrial And Supply Chain Officer Resigns

May 25, 2025 -

Analisi Dell Impatto Dei Dazi Di Trump Del 20 Sul Settore Moda

May 25, 2025

Analisi Dell Impatto Dei Dazi Di Trump Del 20 Sul Settore Moda

May 25, 2025 -

Cac 40 Index End Of Week Report March 7 2025

May 25, 2025

Cac 40 Index End Of Week Report March 7 2025

May 25, 2025 -

Gucci Faces Supply Chain Leadership Change With Vians Departure

May 25, 2025

Gucci Faces Supply Chain Leadership Change With Vians Departure

May 25, 2025