Is XRP The Next Big Cryptocurrency? Trading Volume Surge And ETF Prospects

Table of Contents

The Recent Surge in XRP Trading Volume

The increased trading volume of XRP is a significant development that warrants close examination. Several factors contribute to this upward trend, influencing both institutional and retail investor participation in the XRP cryptocurrency market.

Analyzing the Increase

Several key factors are driving the recent uptick in XRP trading volume:

- Increased Institutional Interest: Larger financial institutions are increasingly exploring XRP's potential for cross-border payments, leading to higher trading volumes. This institutional interest signals growing confidence in XRP's technology and future prospects.

- Growing Adoption by Payment Providers: More payment providers are integrating XRP into their systems, facilitating faster and cheaper international transactions. This increased adoption fuels demand and contributes to higher trading volume.

- Speculation Surrounding Ripple's Legal Battle: The ongoing legal battle between Ripple and the SEC has created significant market volatility. This uncertainty, while risky, also attracts speculators who bet on different potential outcomes, impacting trading volume.

- Positive Price Action Attracting Retail Investors: Positive price movements, even if temporary, often attract retail investors, leading to increased buying and selling activity, further boosting trading volume.

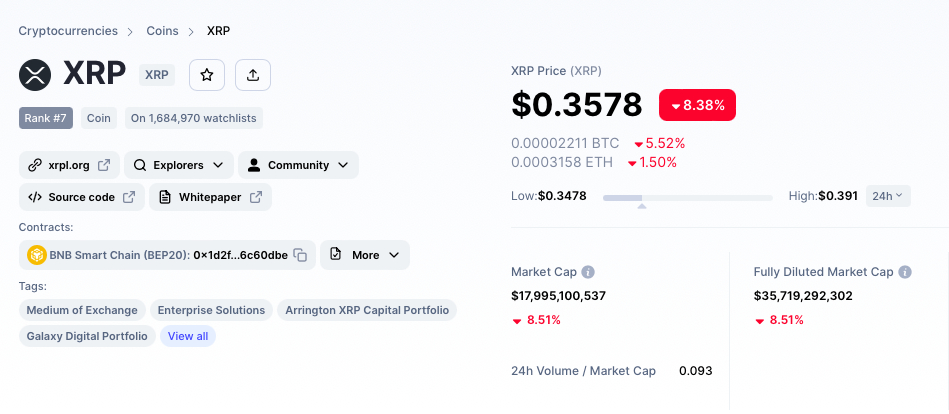

Comparing XRP Volume to Other Cryptocurrencies

Benchmarking XRP's trading volume against established cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) provides valuable context. While XRP's volume surge is noteworthy, it's crucial to analyze its sustainability and significance within the broader crypto landscape.

- Charts Illustrating XRP's Trading Volume Compared to BTC and ETH: [Insert relevant charts and graphs here, comparing XRP trading volume to BTC and ETH over a specific time period. Clearly label axes and data sources.]

- Analysis of Market Capitalization and Dominance: While XRP's trading volume might increase, its market capitalization and market dominance compared to BTC and ETH need to be considered to assess its overall importance in the cryptocurrency market.

- Discussion on the Significance of the Volume Increase: The significance of the volume increase depends on whether it's driven by genuine adoption or speculative trading. Sustained, organic growth fueled by real-world use cases would be a more positive indicator than short-lived spikes due to speculation.

The Potential Impact of an XRP ETF

The potential approval of an XRP ETF could be a game-changer, significantly altering the landscape for XRP and the broader cryptocurrency market. Understanding ETFs and their implications is essential for investors.

Understanding Exchange Traded Funds (ETFs)

ETFs provide a crucial mechanism for broader investor access to asset classes, including cryptocurrencies.

- Definition of ETFs and How They Work: ETFs are investment funds that trade on stock exchanges, offering diversified exposure to a specific asset class. They offer a convenient and regulated way for investors to gain exposure to cryptocurrencies.

- Advantages of ETFs for Investors: ETFs offer diversification, liquidity, and regulatory oversight, making them attractive investment vehicles for risk-averse investors compared to directly purchasing cryptocurrencies.

- Examples of Successful Cryptocurrency ETFs: [Cite examples of successfully launched cryptocurrency ETFs and their impact on the market. This adds credibility and context.]

The Implications of an XRP ETF Approval

The approval of an XRP ETF would likely have significant implications:

- Increased Mainstream Investor Participation: An ETF would make XRP more accessible to institutional and retail investors who might otherwise be hesitant to invest directly in cryptocurrencies.

- Enhanced Price Stability (or Volatility, Depending on Perspective): Increased liquidity from ETF trading could potentially stabilize XRP's price or, conversely, lead to increased volatility depending on market demand and supply dynamics.

- Potential for Higher Trading Volume: The influx of new investors through an ETF could significantly boost XRP's trading volume, further solidifying its position in the market.

- Impact on the Overall Cryptocurrency Market: The success of an XRP ETF could encourage the development of other cryptocurrency ETFs, potentially transforming the entire cryptocurrency investment landscape.

Ripple's Ongoing Legal Battle and its Effect on XRP

The ongoing legal battle between Ripple and the SEC casts a long shadow over XRP's future. Understanding the lawsuit's implications is crucial for any investor considering XRP.

The SEC Lawsuit and its Implications

The SEC lawsuit against Ripple alleges that XRP is an unregistered security.

- Brief Overview of the SEC Lawsuit: The SEC alleges that Ripple sold XRP as an unregistered security, violating federal securities laws.

- Impact on XRP Price During Various Stages of the Lawsuit: The lawsuit has caused significant price volatility for XRP, with periods of sharp declines and rebounds depending on legal developments and court decisions.

- Analysis of Legal Arguments from Both Sides: [Provide a balanced summary of the arguments presented by both Ripple and the SEC. Mention key legal precedents and expert opinions.]

Potential Outcomes and Their Impact on XRP's Future

The outcome of the Ripple lawsuit will significantly impact XRP's future:

- Scenario Analysis (Positive, Negative, Neutral Outcomes): [Outline three plausible scenarios: a favorable ruling for Ripple, an unfavorable ruling, and a settlement. Discuss the potential impact of each scenario on XRP's price and adoption.]

- Potential Regulatory Clarity and its Effects: Regardless of the outcome, the lawsuit could bring much-needed regulatory clarity to the cryptocurrency space, which would benefit XRP and other cryptocurrencies.

- Impact on Investor Confidence and Market Sentiment: A favorable ruling could boost investor confidence and propel XRP's price upwards. An unfavorable ruling could severely dampen investor sentiment and negatively affect the price.

Conclusion

The question, "Is XRP the next big cryptocurrency?" remains complex. While a recent surge in trading volume and the potential approval of an XRP ETF are bullish indicators, the ongoing legal battle with the SEC introduces significant uncertainty. Investors should carefully weigh the potential risks and rewards before investing in XRP. Conduct thorough research and understand the intricacies of the cryptocurrency market before making any investment decisions related to XRP Cryptocurrency. Remember to diversify your portfolio and only invest what you can afford to lose. Stay informed about the latest developments regarding XRP and its legal status to make informed decisions about your XRP cryptocurrency investments.

Featured Posts

-

Rusya Merkez Bankasi Kripto Para Piyasasini Uyariyor Guevenlik Ve Riskler

May 08, 2025

Rusya Merkez Bankasi Kripto Para Piyasasini Uyariyor Guevenlik Ve Riskler

May 08, 2025 -

Is Jayson Tatum Overlooked Colin Cowherds Take And The Ongoing Debate

May 08, 2025

Is Jayson Tatum Overlooked Colin Cowherds Take And The Ongoing Debate

May 08, 2025 -

Low Institutional Interest And High Supply Challenges Facing Xrp Etfs

May 08, 2025

Low Institutional Interest And High Supply Challenges Facing Xrp Etfs

May 08, 2025 -

Can Cryptocurrencies Survive A Trade War One Potential Winner

May 08, 2025

Can Cryptocurrencies Survive A Trade War One Potential Winner

May 08, 2025 -

Rethinking Middle Management Their Contribution To Company Growth

May 08, 2025

Rethinking Middle Management Their Contribution To Company Growth

May 08, 2025