Low Institutional Interest And High Supply: Challenges Facing XRP ETFs

Table of Contents

Low Institutional Interest in XRP

Institutional investors, with their vast capital and risk-averse strategies, are crucial for the success of any ETF. However, XRP's journey to attract significant institutional investment has been hampered by several key factors.

Regulatory Uncertainty

The regulatory landscape surrounding XRP remains murky, significantly impacting institutional investor confidence. The ongoing SEC lawsuit against Ripple Labs, the creator of XRP, casts a long shadow over the cryptocurrency's future.

- Uncertainty about XRP's classification as a security: This ambiguity deters institutional investors who prioritize regulatory compliance.

- Risk of future regulatory actions deterring large-scale investments: The potential for further regulatory crackdowns creates considerable uncertainty and risk.

- Lack of clear regulatory framework for crypto assets: The absence of a consistent and well-defined regulatory framework for cryptocurrencies globally adds to the hesitation.

Reputation and Market Perception

The SEC lawsuit has undeniably tarnished XRP's reputation, impacting institutional trust. Negative press and ongoing legal battles create a perception of risk that many institutional investors are unwilling to accept.

- Concerns about XRP's decentralized nature and governance: Questions surrounding XRP's governance structure and decentralization contribute to negative sentiment.

- Negative sentiment impacting institutional investor appetite: The overall negative media coverage surrounding XRP has significantly reduced investor interest.

- Comparison to other cryptocurrencies with stronger institutional support: Bitcoin and Ethereum, for example, enjoy far greater institutional acceptance and a more established regulatory framework.

Lack of Proven Utility

Compared to other cryptocurrencies with established use cases, XRP's real-world applications remain limited. This lack of demonstrable utility is a major deterrent for institutional investors seeking tangible value and long-term growth potential.

- Limited adoption by businesses and financial institutions: The relatively low adoption rate by major players hinders the widespread acceptance of XRP.

- Competition from established payment networks: XRP faces stiff competition from well-established and trusted payment networks like Visa and Mastercard.

- Need for increased market adoption and use cases to boost institutional interest: To attract substantial institutional investment, XRP needs to demonstrate its utility and value proposition in the real world.

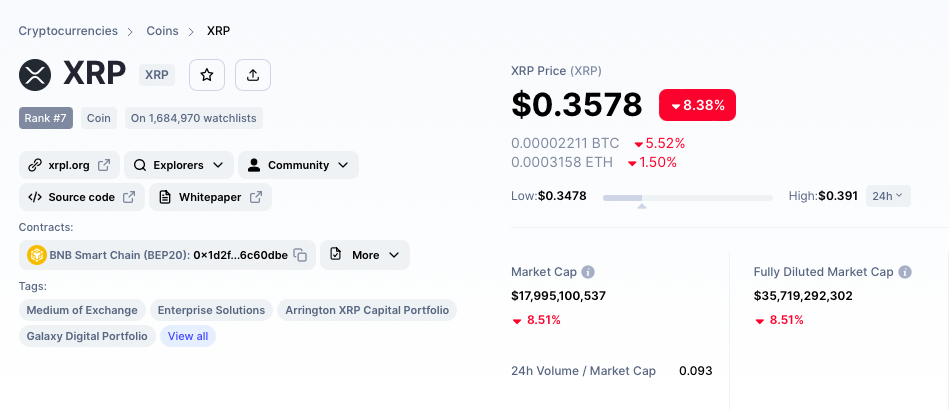

High XRP Supply and its Impact on Price Volatility

XRP's exceptionally high circulating supply presents another major obstacle for potential XRP ETFs. This large supply poses significant challenges to price stability and long-term investment viability.

Inflated Supply

The sheer volume of XRP in circulation significantly impacts its potential for price appreciation. This contrasts sharply with cryptocurrencies with capped or limited supplies, which often benefit from scarcity-driven price increases.

- Comparison to other cryptocurrencies with limited supply: Bitcoin's limited supply, for example, is often cited as a factor driving its value.

- Potential for price deflation due to high supply: The large supply of XRP increases the risk of deflationary pressure on its price.

- Impact on long-term investment viability: The potential for long-term price stagnation makes XRP a less attractive investment for institutions seeking substantial returns.

Price Volatility and Risk

The high supply significantly contributes to XRP's price volatility. This volatility represents a significant risk for institutional investors who typically favor more stable assets.

- Impact of market sentiment on XRP's price: XRP's price is highly sensitive to market sentiment and news events, leading to sharp price swings.

- High risk/reward profile deterring conservative investors: The high volatility makes XRP an unsuitable investment for conservative investors seeking lower risk.

- Difficulty in predicting long-term price movements: The unpredictable nature of XRP's price makes it challenging to forecast long-term returns.

Conclusion

The approval and success of XRP ETFs are significantly hampered by a confluence of factors. Low institutional interest, stemming from regulatory uncertainty, reputational damage, and limited utility, is compounded by XRP's high circulating supply, which fuels price volatility and investment risk. These factors significantly hinder the development of a successful XRP ETF.

While significant hurdles remain, the potential for XRP ETFs remains. Further developments in regulation, increased adoption, and a clearer demonstration of XRP's utility are crucial for overcoming these challenges and paving the way for future success in the XRP ETF market. Further research and monitoring of the situation surrounding XRP and its regulatory landscape are encouraged for investors interested in exploring the potential of XRP and XRP ETFs.

Featured Posts

-

Blue Origin Cancels Launch Vehicle Subsystem Malfunction

May 08, 2025

Blue Origin Cancels Launch Vehicle Subsystem Malfunction

May 08, 2025 -

Champions League Final Inter Milan Defeats Barcelona In Epic Encounter

May 08, 2025

Champions League Final Inter Milan Defeats Barcelona In Epic Encounter

May 08, 2025 -

Is Xrp The Next Big Cryptocurrency Trading Volume Surge And Etf Prospects

May 08, 2025

Is Xrp The Next Big Cryptocurrency Trading Volume Surge And Etf Prospects

May 08, 2025 -

Check The Latest Lotto Plus 1 And Lotto Plus 2 Results

May 08, 2025

Check The Latest Lotto Plus 1 And Lotto Plus 2 Results

May 08, 2025 -

Xrp Trading Volume Overtakes Solana Amidst Etf Speculation

May 08, 2025

Xrp Trading Volume Overtakes Solana Amidst Etf Speculation

May 08, 2025