Japan's GDP Decline In First Quarter: Trump Tariffs Loom

Table of Contents

The Severity of Japan's Q1 GDP Decline

Japan's Q1 2023 GDP experienced a contraction of 1.6%, a sharper decline than the initially projected 1%. This represents a significant setback after several quarters of relatively stable, albeit slow, growth. The year-on-year decline is even more concerning, signaling a worrying trend for the Japanese economy. This substantial decrease in GDP represents the largest quarterly contraction in several years, exceeding expectations and highlighting the fragility of the Japanese economy. A visual representation of this decline, comparing it to previous quarters and years, is crucial in understanding the severity of the situation. (Insert graph/chart here showing Q1 2023 GDP decline compared to previous quarters and years).

- Specific percentage drop in GDP: 1.6%

- Comparison to previous quarters' performance: Significantly lower than the previous quarter's 0.2% growth.

- Analysis of year-on-year growth/decline: Shows a considerable year-on-year decrease, indicating a sustained negative trend.

- Mention any revisions to the initial GDP figures: The initial projections were revised downwards reflecting a more pessimistic outlook.

The Role of Trump Tariffs and Trade Tensions

While the impact of Trump's tariffs is now somewhat lessened, the lingering effects on US-Japan trade continue to hamper Japan's economic recovery. The threat of protectionist measures, even if not fully implemented, created uncertainty and negatively impacted business investment and export-oriented industries. The ripple effect extended beyond directly targeted sectors, influencing broader consumer confidence and spending.

- Specific examples of tariffs imposed on Japanese goods: While many tariffs have been reversed, lingering anxieties remain about future protectionist policies.

- Impact on key export sectors (e.g., automobiles, electronics): These industries experienced a decline in exports to the US, impacting overall revenue and production.

- Analysis of reduced export volumes and revenue: Data indicates a clear correlation between the tariff threats and the reduction in export volumes.

- Discussion of retaliatory measures by Japan: While not as pronounced as those of other nations, Japan's response included some retaliatory measures.

Other Contributing Factors to the GDP Decline

Beyond the lingering effects of trade tensions, several other factors contributed to Japan's Q1 GDP decline. These include weakening domestic demand, a global economic slowdown, and several regional natural disasters that disrupted supply chains and hampered industrial activity.

- Analysis of consumer confidence and spending patterns: Consumer sentiment dipped noticeably, leading to reduced consumer spending across various sectors.

- Trends in business investment and capital expenditure: Uncertainty about the future, coupled with slow global growth, led to decreased business investment.

- Impact of global economic slowdown on Japanese exports: Reduced global demand further dampened export performance.

- Mention of any significant natural disasters and their economic consequences: Specific instances of typhoons or earthquakes in certain regions impacted infrastructure and production.

The Outlook for the Japanese Economy

Forecasting Japan's economic future remains challenging. While the government has implemented stimulus packages and the Bank of Japan continues its monetary easing policies, the road to recovery remains uncertain. The volatility of the Japanese yen further complicates the situation. Experts offer varying predictions for subsequent quarters, highlighting the prevailing uncertainty.

- Predictions for GDP growth in subsequent quarters: Predictions vary, with some predicting a modest recovery and others warning of further contraction.

- Analysis of government stimulus packages or policy changes: The effectiveness of these measures remains to be seen, needing longer-term observation.

- The potential impact of monetary policy changes by the Bank of Japan: The efficacy of further monetary easing is currently debated among economists.

- Discussion of the volatility of the Japanese yen and its implications: Yen fluctuations impact export competitiveness and overall economic stability.

Conclusion

The significant decline in Japan's Q1 2023 GDP underscores a concerning trend, driven by a combination of lingering trade tensions, weak domestic demand, and global economic headwinds. While the direct impact of Trump-era tariffs might be reduced, the uncertainty they generated continues to weigh on the Japanese economy. The outlook for the future remains uncertain, dependent on both domestic policy responses and global economic developments. To stay informed about the latest developments impacting Japan's GDP and the ongoing effects of trade tensions, follow reputable financial news sources and subscribe to economic analysis newsletters. Understanding the fluctuations in Japan's GDP is key to navigating the complexities of the global economy.

Featured Posts

-

The Knicks Revival Analyzing Thibodeaus Improved Coaching Strategies

May 17, 2025

The Knicks Revival Analyzing Thibodeaus Improved Coaching Strategies

May 17, 2025 -

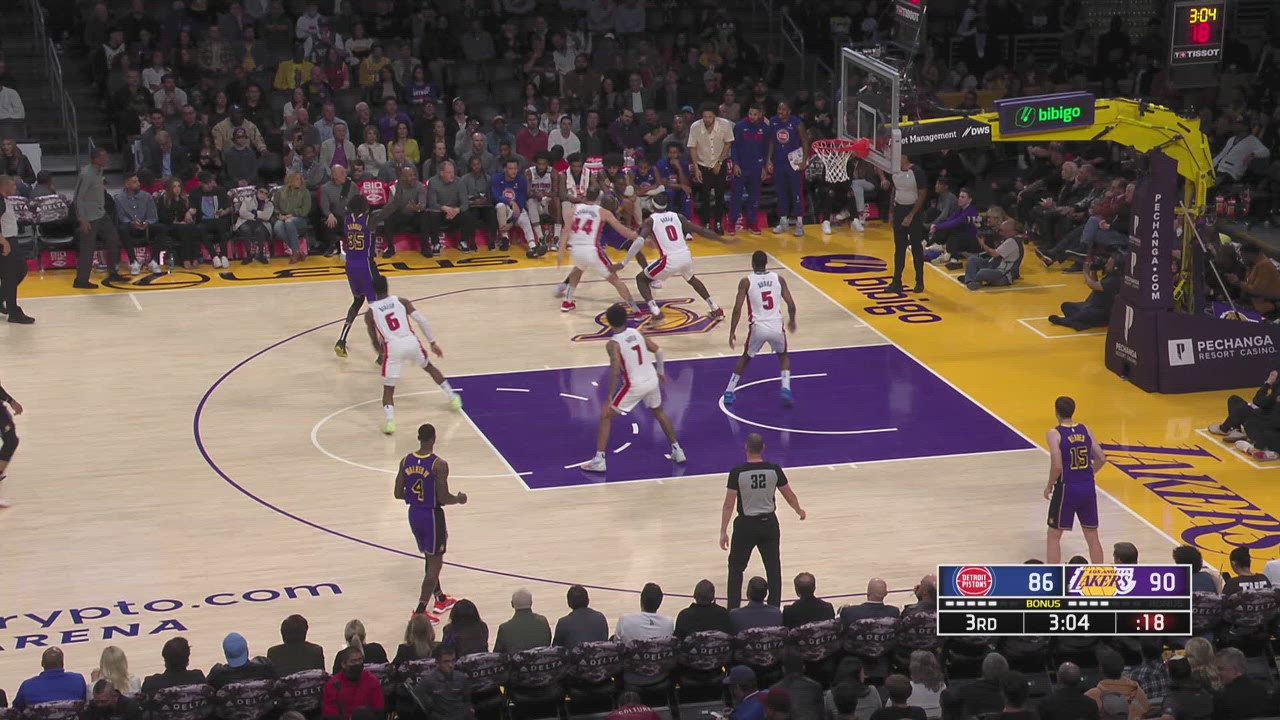

Nba Officials Acknowledge Crucial Missed Call In Knicks Vs Pistons Game

May 17, 2025

Nba Officials Acknowledge Crucial Missed Call In Knicks Vs Pistons Game

May 17, 2025 -

Tam Krwz Ke Jwte Pr Mdah Ka Hmlh Swshl Mydya Pr Bhth

May 17, 2025

Tam Krwz Ke Jwte Pr Mdah Ka Hmlh Swshl Mydya Pr Bhth

May 17, 2025 -

Voennaya Agressiya Rf Masshtabnaya Ataka Na Ukrainu Bolee 200 Raket

May 17, 2025

Voennaya Agressiya Rf Masshtabnaya Ataka Na Ukrainu Bolee 200 Raket

May 17, 2025 -

Oil Market News And Analysis May 16 2024 Update

May 17, 2025

Oil Market News And Analysis May 16 2024 Update

May 17, 2025

Latest Posts

-

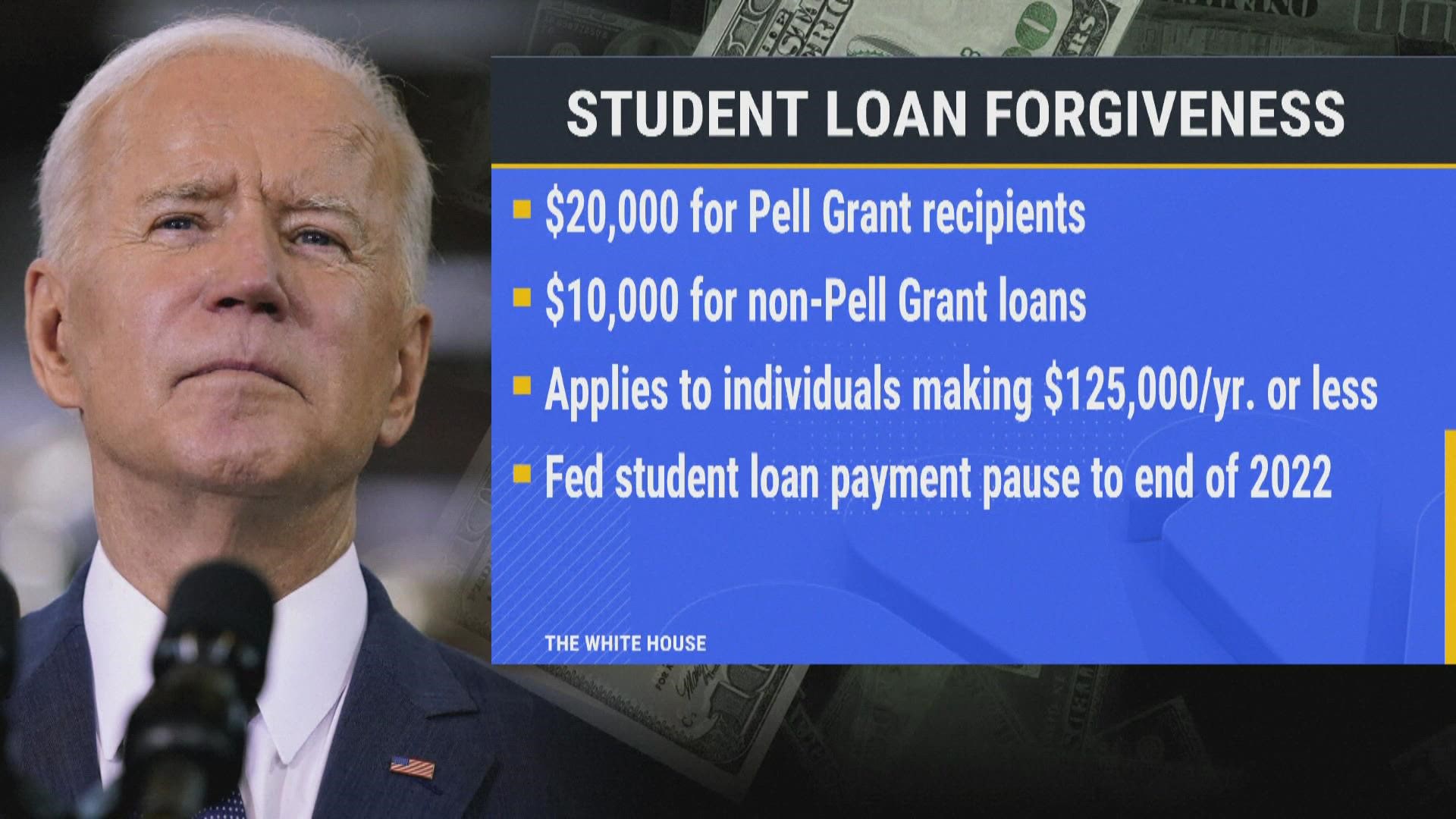

El Impacto De Trump En Los Deudores De Prestamos Estudiantiles Analisis Y Perspectivas

May 17, 2025

El Impacto De Trump En Los Deudores De Prestamos Estudiantiles Analisis Y Perspectivas

May 17, 2025 -

Pistons Season On The Line After Disputed Foul Call In Game 4

May 17, 2025

Pistons Season On The Line After Disputed Foul Call In Game 4

May 17, 2025 -

Privatizing Federal Student Loans A Look At Trumps Potential Plan

May 17, 2025

Privatizing Federal Student Loans A Look At Trumps Potential Plan

May 17, 2025 -

Segundo Mandato De Trump El Futuro De Los Prestamos Estudiantiles En Riesgo

May 17, 2025

Segundo Mandato De Trump El Futuro De Los Prestamos Estudiantiles En Riesgo

May 17, 2025 -

Missed Foul Call Fuels Pistons Anger After Game 4 Defeat

May 17, 2025

Missed Foul Call Fuels Pistons Anger After Game 4 Defeat

May 17, 2025