Japan's Q1 Economic Contraction: A Deeper Look At The Data

Table of Contents

Weakening Consumer Spending: A Key Driver of the Contraction

The significant decline in consumer spending played a crucial role in Japan's Q1 economic contraction. This weakening can be attributed to several factors, primarily the impact of rising prices and shifting consumption patterns.

Impact of Rising Prices

Inflation significantly eroded consumer purchasing power during Q1 2024. The rising cost of living, particularly energy and food prices, forced households to tighten their belts. Japan's inflation rate reached [Insert Actual Q1 2024 Inflation Rate]% in Q1 2024, according to the [Source, e.g., Japanese Cabinet Office], impacting consumer confidence significantly. The consumer confidence index fell to [Insert Actual Q1 2024 Consumer Confidence Index], reflecting the anxieties of consumers facing increased living expenses.

- Rising cost of energy and food: The surge in global energy prices, exacerbated by geopolitical events, directly impacted household budgets, leaving less disposable income for other purchases.

- Decreased discretionary spending: Consumers reduced spending on non-essential goods and services, prioritizing essential purchases like food and utilities. This shift towards essential spending is evident in the decreased sales figures across various sectors.

- Official statistics: Data from the Bank of Japan and the Cabinet Office corroborate this trend, showing a marked decrease in consumer spending across various sectors during Q1 2024.

Shifting Consumption Patterns

Beyond the direct impact of inflation, changes in consumer behavior further contributed to the slowdown. The lingering effects of the COVID-19 pandemic and evolving economic anxieties have influenced spending habits.

- Increased saving and decreased spending on non-essentials: Consumers are increasingly prioritizing saving for unforeseen circumstances, leading to a decrease in spending on discretionary items.

- Long-term impact of the pandemic: The pandemic altered long-term consumption patterns, with some consumers adopting more cautious spending habits.

- Supply chain disruptions: Persistent supply chain disruptions contributed to shortages and higher prices, further discouraging consumer spending and impacting consumer confidence in the availability of goods.

Export Slowdown: The Global Economic Headwinds

The slowdown in global economic growth significantly impacted Japan's export sector, contributing to the Q1 contraction. Global recession fears and ongoing supply chain issues played a major role in this decline.

Impact of Global Recession Fears

Global economic uncertainty and fears of a recession dampened demand for Japanese exports. Businesses worldwide became more cautious, reducing their investment and imports, directly impacting Japan's export-oriented economy.

- Slowdown in global demand: Decreased global demand for Japanese goods, particularly in key export markets, led to a significant reduction in export volumes.

- Performance of key export sectors: The automobile and electronics sectors, key contributors to Japan's export economy, experienced notable declines in Q1 2024.

- Geopolitical instability: Geopolitical instability and trade tensions further added to the uncertainty and contributed to the export slowdown.

Supply Chain Disruptions and Their Lingering Effects

The ongoing global supply chain disruptions continued to hinder Japan's export capacity. Difficulties in procuring raw materials and components led to production bottlenecks and hampered the ability to meet global demand.

- Challenges in procuring raw materials and components: The ongoing impact of supply chain issues resulted in delays and increased costs for procuring essential materials.

- Impact on production and export capacity: Production was hampered, leading to a reduction in the volume of goods available for export.

- Government policies: The Japanese government has implemented several policies aimed at strengthening supply chain resilience, but their full impact is yet to be seen.

Government Policy Response and Future Outlook

The Japanese government responded to the economic contraction with various policy measures. However, the effectiveness of these interventions and the overall outlook for the remainder of the year remain uncertain.

Government Stimulus Measures

The government introduced fiscal stimulus packages aimed at boosting economic activity and supporting businesses. The Bank of Japan also adjusted its monetary policy to stimulate growth.

- Fiscal stimulus packages: Details of the fiscal stimulus packages, including their size and intended beneficiaries, should be included here.

- Monetary policy adjustments: The Bank of Japan's actions, such as interest rate changes or quantitative easing measures, should be described here.

- Effectiveness of measures: An analysis of the effectiveness of these measures in stimulating growth should be provided, considering factors like the speed of implementation and the overall economic climate.

Predictions and Forecasts for the Remainder of the Year

Forecasts for Japan's economic performance for the remainder of 2024 vary, with some economists predicting a recovery while others highlight ongoing risks.

- Expert opinions: Summarize predictions from leading economic institutions and experts, including their rationale.

- Potential for recovery: Discuss the possibility of a recovery in later quarters, considering factors like global economic growth and the effectiveness of government policies.

- Potential risks and uncertainties: Highlight potential risks and uncertainties that could impact future growth, such as further global economic slowdowns, persistent inflation, or unexpected geopolitical events.

Conclusion

This analysis of Japan's Q1 economic contraction reveals a complex interplay of factors, including weakened consumer spending fueled by inflation, a slowdown in exports due to global economic headwinds, and lingering supply chain disruptions. While government policies aim to mitigate these challenges, the outlook remains uncertain. Understanding the intricacies of Japan's Q1 economic contraction is crucial for investors and policymakers alike. Stay informed on further developments concerning Japan's Q1 economic contraction and its potential long-term implications by regularly consulting reputable economic news sources and analyzing future economic data releases. Continue to monitor the situation and subscribe to our newsletter for further updates on Japan's economic performance.

Featured Posts

-

The Nature Of Trumps Relationships With Middle Eastern Leaders

May 17, 2025

The Nature Of Trumps Relationships With Middle Eastern Leaders

May 17, 2025 -

Open Ai Facing Ftc Probe Examining The Future Of Ai

May 17, 2025

Open Ai Facing Ftc Probe Examining The Future Of Ai

May 17, 2025 -

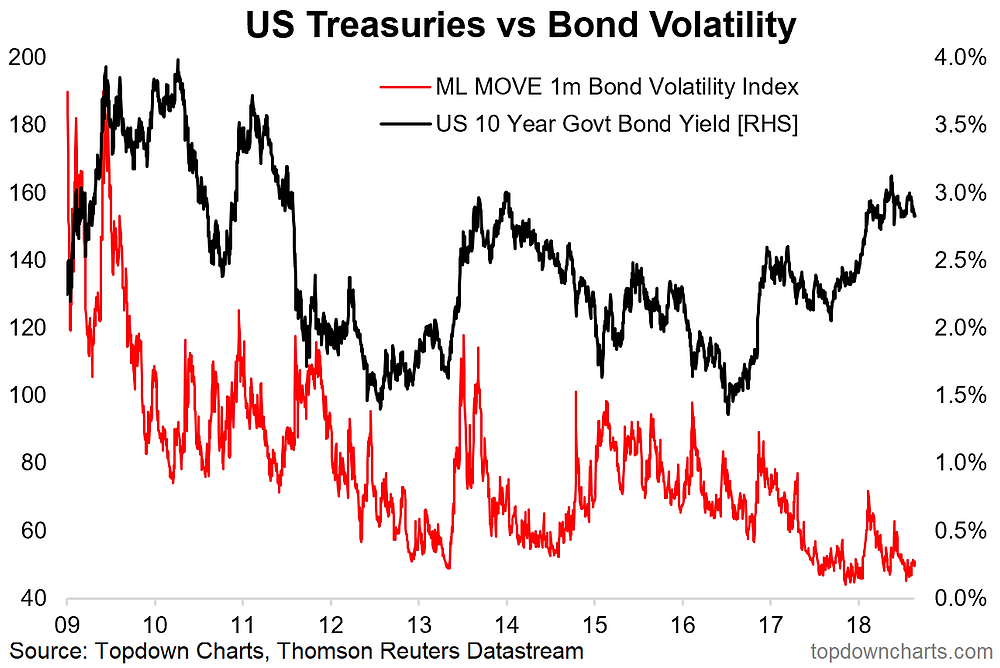

Japanese Bond Market Volatility The Steep Yield Curves Economic Effects

May 17, 2025

Japanese Bond Market Volatility The Steep Yield Curves Economic Effects

May 17, 2025 -

Quality On A Shoestring Smart Shopping Tips

May 17, 2025

Quality On A Shoestring Smart Shopping Tips

May 17, 2025 -

Tom Thibodeaus Pope Joke Unraveling The Knicks Connection

May 17, 2025

Tom Thibodeaus Pope Joke Unraveling The Knicks Connection

May 17, 2025

Latest Posts

-

Josh Cavallo Challenging Norms And Fostering Acceptance In Football

May 17, 2025

Josh Cavallo Challenging Norms And Fostering Acceptance In Football

May 17, 2025 -

From The Pitch To The Podium Josh Cavallos Post Coming Out Activism

May 17, 2025

From The Pitch To The Podium Josh Cavallos Post Coming Out Activism

May 17, 2025 -

The Josh Cavallo Effect A New Era For Lgbtq Athletes

May 17, 2025

The Josh Cavallo Effect A New Era For Lgbtq Athletes

May 17, 2025 -

Josh Cavallo Inspiration And Advocacy After Publicly Coming Out

May 17, 2025

Josh Cavallo Inspiration And Advocacy After Publicly Coming Out

May 17, 2025 -

Footballs Evolution Josh Cavallo And The Fight For Lgbtq Inclusion

May 17, 2025

Footballs Evolution Josh Cavallo And The Fight For Lgbtq Inclusion

May 17, 2025