Land Your Dream Private Credit Role: 5 Do's And Don'ts To Follow

Table of Contents

5 Do's to Land Your Dream Private Credit Role

Do #1: Network Strategically

Building a strong network is paramount in the private credit world. It's not just about who you know, but about cultivating meaningful relationships.

- Attend industry events: Conferences, seminars, and networking events provide invaluable opportunities to meet professionals and learn about current trends in private credit investment.

- Leverage LinkedIn: Optimize your LinkedIn profile, actively engage in relevant groups, and connect with recruiters and professionals working in private credit firms. Showcase your experience and expertise related to private debt, leveraged loans, and other private credit strategies.

- Informational interviews: Reach out to people working in roles you aspire to. These conversations provide valuable insights into the industry and can lead to unexpected opportunities. Focus your questions on their career path, their experience within specific private credit strategies, and the key skills necessary for success.

Do #2: Tailor Your Resume and Cover Letter

Your resume and cover letter are your first impression. Make them count!

- Highlight relevant skills: Emphasize skills essential for private credit, including financial modeling, credit analysis, due diligence, and portfolio management within your private debt experience.

- Quantify accomplishments: Use metrics and numbers to demonstrate your impact in previous roles. For example, instead of "Improved efficiency," say "Improved efficiency by 15% resulting in cost savings of $X."

- Customize for each application: Don't send a generic resume. Tailor it to each specific job description, incorporating keywords and highlighting the skills most relevant to the position. This shows the employer you're genuinely interested.

- Optimize for ATS: Applicant Tracking Systems (ATS) scan resumes for keywords. Use keywords directly from the job description to ensure your resume gets noticed.

Do #3: Master the Interview Process

The interview is your chance to shine. Preparation is key.

- Practice common interview questions: Prepare for behavioral questions ("Tell me about a time you failed"), technical questions ("Explain the concept of discounted cash flow"), and questions about market knowledge in private credit, leveraged finance, and other relevant fields.

- Prepare insightful questions: Asking thoughtful questions demonstrates your interest and understanding of the firm and the private credit industry. Show you have researched the fund's investment strategies, recent deals, and the current private credit market landscape.

- Research the firm and interviewer: Understanding the firm's investment philosophy, recent transactions, and the interviewer's background shows initiative and professionalism.

- Showcase your personality: Let your enthusiasm for private credit shine through.

Do #4: Develop In-Demand Skills

Continuously upgrading your skills is crucial in this dynamic field.

- Master financial modeling: Proficiency in financial modeling software like Excel is non-negotiable. Familiarize yourself with advanced modeling techniques used in private credit valuation.

- Credit underwriting expertise: Develop a deep understanding of credit risk assessment, due diligence processes, and structuring of private credit deals.

- Obtain relevant certifications: Certifications like the CFA (Chartered Financial Analyst) or CAIA (Chartered Alternative Investment Analyst) can significantly boost your credentials.

- Stay updated on market trends: Keep abreast of regulatory changes, market dynamics, and emerging trends in the private credit landscape.

Do #5: Showcase Your Passion for Private Credit

Genuine enthusiasm is contagious.

- Demonstrate genuine interest: Let your passion for private credit be evident throughout the application process.

- Stay informed: Follow industry news, read publications, and attend webinars to stay updated.

- Gain experience: Volunteer for relevant roles, pursue internships, or take on projects that expand your knowledge in areas such as private debt, leveraged loans, and other private credit instruments.

- Understand private credit strategies: Demonstrate knowledge of various private credit strategies, such as direct lending, mezzanine financing, and distressed debt investing.

5 Don'ts to Avoid When Pursuing a Private Credit Role

Don't #1: Neglect Networking

Networking is not optional; it's essential.

- Don't rely solely on online applications: Actively network with people in the industry.

- Don't underestimate informal connections: Casual conversations can often lead to valuable opportunities.

Don't #2: Submit Generic Applications

Every application should be tailored.

- Avoid sending the same resume and cover letter: Show you've taken the time to understand the specific requirements of each role.

- Tailoring demonstrates genuine interest: A personalized approach shows you're serious about the opportunity.

Don't #3: Underprepare for Interviews

Thorough preparation is crucial.

- Avoid winging it: Practice your responses to common interview questions.

- Research the firm thoroughly: Demonstrate your knowledge of their investment strategy and recent deals.

Don't #4: Ignore Skill Development

Continuous learning is key to staying competitive.

- Avoid stagnation: Constantly upgrade your skills and knowledge.

- Industry certifications are valuable assets: They demonstrate your commitment to the field.

Don't #5: Lack Enthusiasm

Your passion should be evident.

- Avoid appearing apathetic: Show genuine interest in the role and the firm.

- Passion sets you apart: Enthusiasm is a valuable asset in a competitive field.

Secure Your Dream Private Credit Position

This guide highlighted the essential dos and don'ts for securing your dream private credit role. Remember, strategic networking, continuous skill development, and meticulous interview preparation are key to success. By focusing on these aspects and showcasing your passion for private credit investment, you significantly increase your chances of landing your ideal private credit career. Start networking today, update your skills, and begin your journey to secure your dream private credit job!

Featured Posts

-

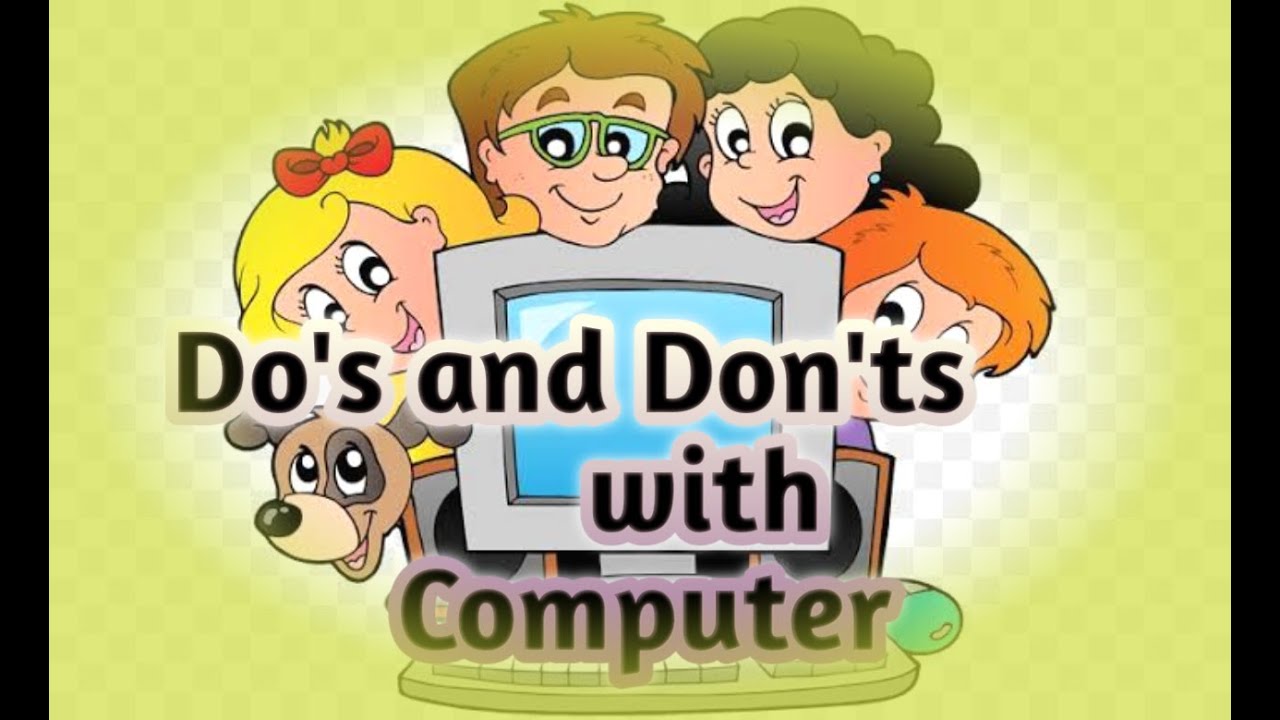

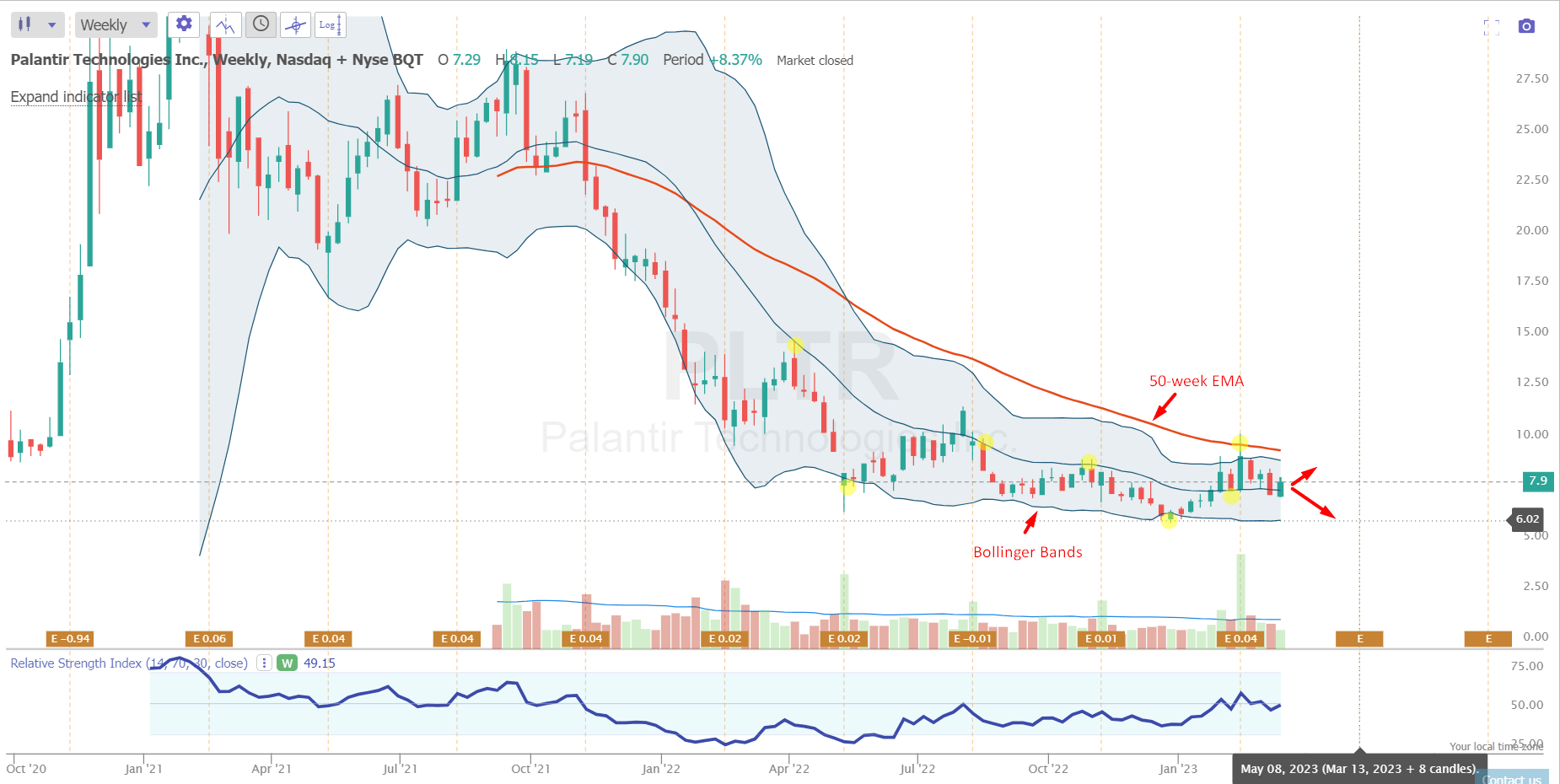

Is Palantir Technologies Stock A Buy Now A Comprehensive Analysis

May 09, 2025

Is Palantir Technologies Stock A Buy Now A Comprehensive Analysis

May 09, 2025 -

Vozmozhnye Zaderzhki Reysov V Aeroportu Permi

May 09, 2025

Vozmozhnye Zaderzhki Reysov V Aeroportu Permi

May 09, 2025 -

Hoe Brekelmans India Zo Veel Mogelijk Aan Zijn Zijde Wil Houden

May 09, 2025

Hoe Brekelmans India Zo Veel Mogelijk Aan Zijn Zijde Wil Houden

May 09, 2025 -

Edmonton Oilers Draisaitls Expected Return Date For The Playoffs

May 09, 2025

Edmonton Oilers Draisaitls Expected Return Date For The Playoffs

May 09, 2025 -

Lidery Frantsii Britanii Germanii I Polshi Ne Posetyat Kiev 9 Maya

May 09, 2025

Lidery Frantsii Britanii Germanii I Polshi Ne Posetyat Kiev 9 Maya

May 09, 2025