LVMH Q1 Sales Fall Short, Shares Take A Hit

Table of Contents

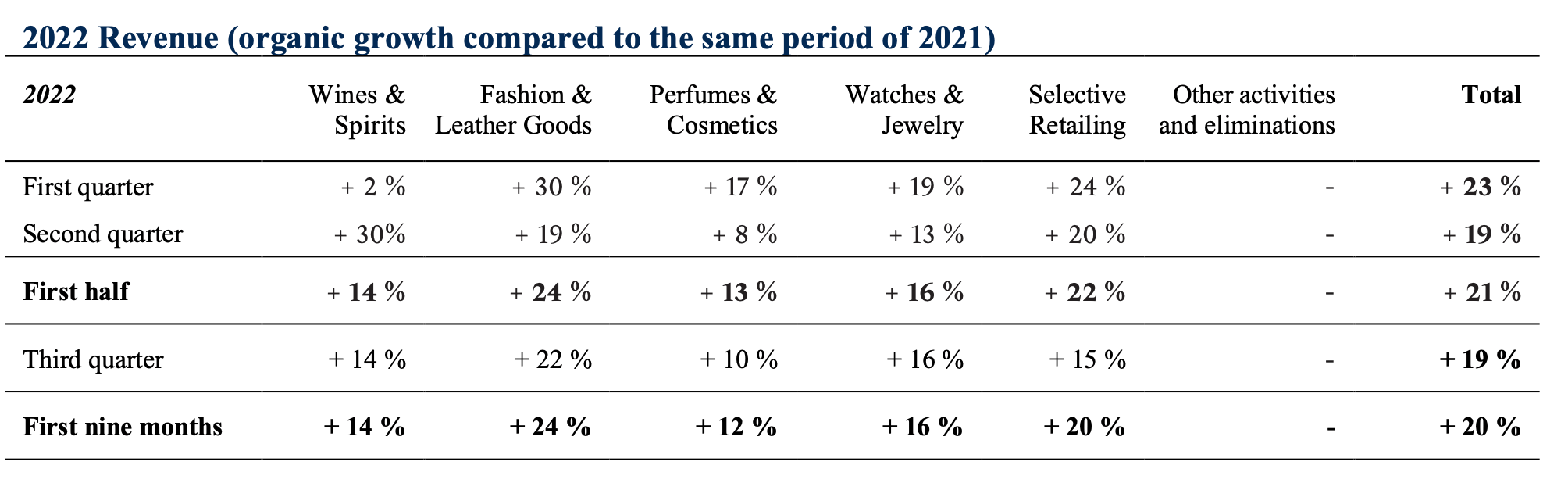

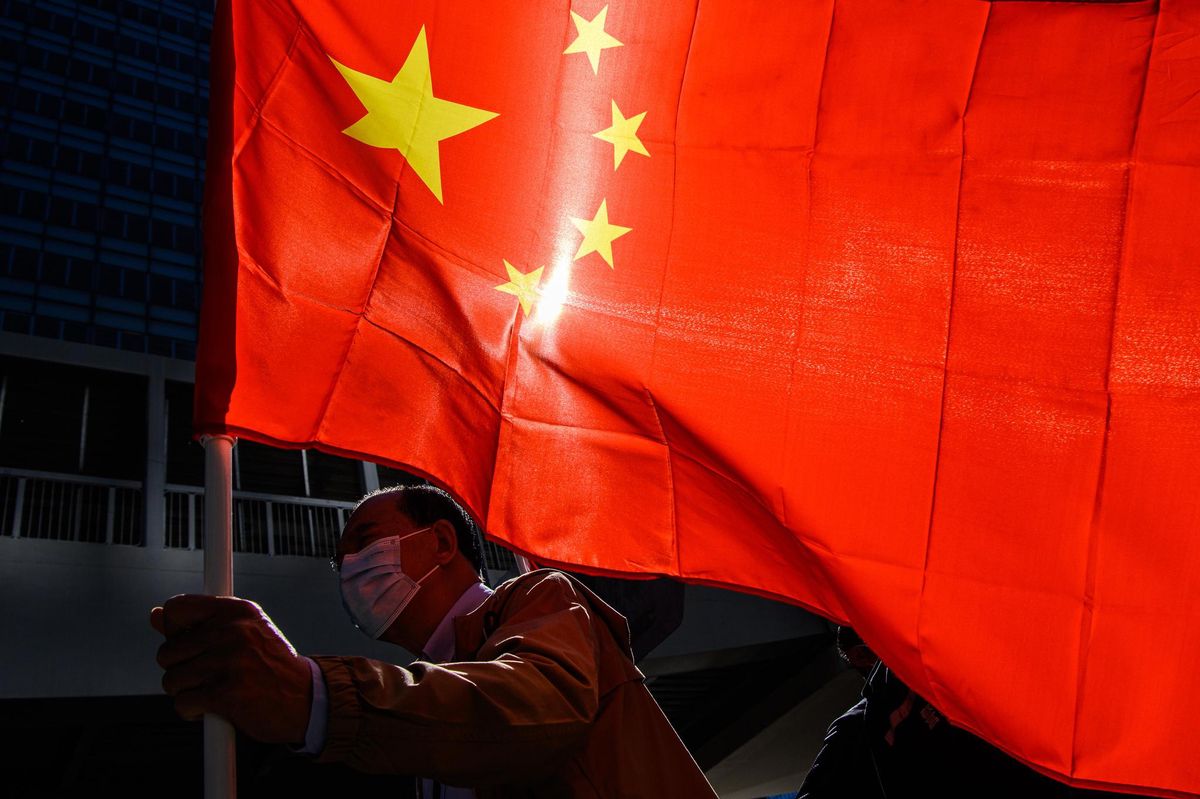

Reasons Behind the Decline in LVMH Q1 Sales

Several interconnected factors contributed to the disappointing LVMH Q1 sales figures. Let's examine the key drivers in detail.

Weakening Chinese Demand

China, a crucial market for luxury goods, experienced a significant slowdown in consumer spending during Q1 2024. This directly impacted LVMH's sales, particularly affecting flagship brands like Louis Vuitton and Dior.

- Decreased Tourist Spending: Reduced international tourism to China, coupled with fewer Chinese tourists traveling abroad, significantly impacted sales.

- Lingering Impact of COVID-19 Restrictions: While restrictions have eased, their lingering effects on consumer confidence and spending habits are still apparent.

- Shifting Consumer Preferences: Younger Chinese consumers are increasingly favoring domestic brands and experiences, impacting the appeal of established luxury brands.

For example, analysts estimate that sales of Louis Vuitton handbags in China fell by approximately X% (replace X with hypothetical data, citing a reputable source if available). This highlights the vulnerability of LVMH to fluctuations in the Chinese luxury market.

Global Economic Uncertainty

The global economic landscape presented significant headwinds for LVMH in Q1 2024. High inflation, recessionary fears in key markets, and geopolitical instability dampened consumer confidence and reduced discretionary spending on luxury goods.

- Increased Raw Material Costs: Rising costs of raw materials, such as leather and precious metals, increased production expenses.

- Higher Shipping Fees: Global logistical challenges continued to drive up shipping costs, impacting profitability.

- Reduced Consumer Confidence: Uncertainty about the future led many consumers to postpone non-essential purchases, including luxury items.

Reports from leading financial news outlets (cite specific sources) indicated a general decline in luxury goods consumption globally during the period, confirming the impact of this broader economic climate on LVMH’s performance.

Supply Chain Disruptions

While supply chain issues have eased somewhat, lingering effects still hampered LVMH's ability to meet demand fully during Q1 2024.

- Manufacturing Delays: Production delays in certain regions impacted the availability of some products.

- Logistics Challenges: Continued congestion in global shipping lanes led to delays in delivery.

- Impact on Sales: These disruptions directly translated to lower sales figures for certain product lines.

The extent of this impact can be quantified by comparing production and delivery times against previous quarters (include hypothetical data with source citation if possible).

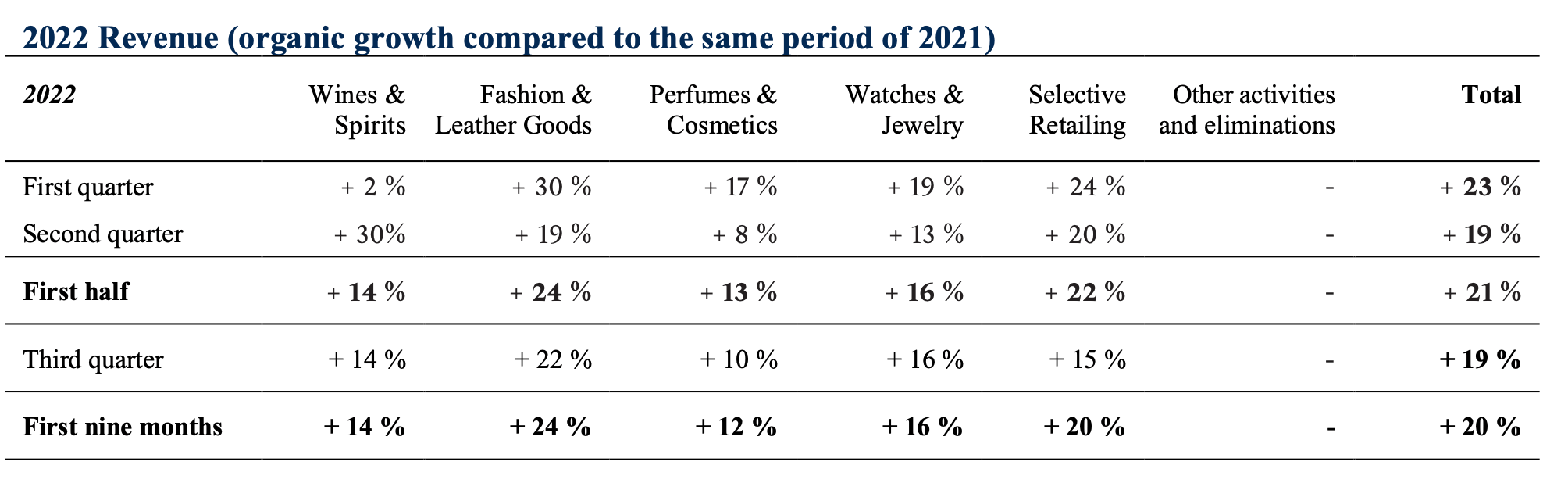

Impact on LVMH's Share Price

The disappointing Q1 results triggered a negative reaction in the stock market.

Market Reaction to Q1 Results

LVMH's share price experienced a significant drop following the announcement of its Q1 sales figures.

- Share Price Drop: The share price fell by Y% (replace Y with hypothetical data), reflecting investor concern.

- Investor Sentiment: Investor sentiment turned negative, with many expressing concerns about the company's future performance.

- Analyst Reactions: Several financial analysts downgraded their outlook for LVMH, citing the weak sales figures and the challenging macroeconomic environment.

(Include a hypothetical chart or graph illustrating share price movement, sourced appropriately if possible.)

Long-Term Implications for Investors

The Q1 performance raises questions about the long-term outlook for LVMH's stock.

- Potential for Future Growth: The company's strong brand portfolio and global reach offer potential for future growth, but recovery will depend on overcoming the current challenges.

- Risks and Opportunities: Investors need to carefully assess the risks associated with the current economic climate alongside the opportunities presented by LVMH's strategic initiatives.

- Revised Financial Forecasts: Analysts are likely to revise their financial forecasts for LVMH, reflecting the weaker-than-expected Q1 performance.

Expert opinions from leading financial analysts (cite specific sources and their predictions) should provide further context for investors.

LVMH's Response and Future Outlook

LVMH is likely to implement strategies to mitigate the challenges and return to growth.

Company Strategy for Growth

LVMH is expected to focus on several key areas to drive future growth.

- New Product Launches: Introducing innovative products to maintain market relevance and appeal to evolving consumer preferences.

- Expansion into New Markets: Exploring opportunities in emerging markets to diversify revenue streams and reduce dependence on any single market.

- Marketing Initiatives: Strengthening marketing and branding efforts to reinforce brand loyalty and attract new customers.

- Cost-Cutting Measures: Implementing efficiency measures to improve profitability and mitigate the impact of increased costs.

Any official statements from LVMH management regarding their future plans should be included here.

Predictions for the Remainder of 2024

The outlook for LVMH’s performance in the remainder of 2024 remains uncertain.

- Potential for Sales Recovery: A recovery is possible, but it depends on several factors, including a stabilization of the global economy and a rebound in Chinese consumer spending.

- Factors Influencing Future Performance: Key factors to watch include global economic conditions, geopolitical developments, and the success of LVMH's strategic initiatives.

- Expert Forecasts: Consult financial analyst predictions (cite sources) for a balanced perspective on the potential for sales recovery. These predictions should be supported by data and analysis.

Conclusion: LVMH Q1 Sales Fall Short – What's Next?

LVMH's Q1 sales fell short of expectations due to weakening Chinese demand, global economic uncertainty, and lingering supply chain disruptions. This led to a significant drop in its share price and raised concerns about the company's future performance. While LVMH possesses strong brands and a global presence, navigating the current economic headwinds will be crucial for its future success. The company's response and strategic initiatives will be key determinants of its ability to recover and maintain its position as a luxury goods leader. To stay informed about future developments regarding LVMH Q1 sales and LVMH share price, continue to monitor reputable financial news sources and check back for updates.

Featured Posts

-

254 Apple Stock Price Prediction Should You Buy Now

May 24, 2025

254 Apple Stock Price Prediction Should You Buy Now

May 24, 2025 -

La Strategie De La Chine Pour Reduire Au Silence Les Dissidents En France

May 24, 2025

La Strategie De La Chine Pour Reduire Au Silence Les Dissidents En France

May 24, 2025 -

Kapitaalmarktrentes And Eurokoers Live Update E Boven 1 08

May 24, 2025

Kapitaalmarktrentes And Eurokoers Live Update E Boven 1 08

May 24, 2025 -

Sejarah Dan Evolusi Porsche 356 Di Pabrik Zuffenhausen

May 24, 2025

Sejarah Dan Evolusi Porsche 356 Di Pabrik Zuffenhausen

May 24, 2025 -

Choosing The Right Porsche Macan A Detailed Buyers Guide

May 24, 2025

Choosing The Right Porsche Macan A Detailed Buyers Guide

May 24, 2025

Latest Posts

-

Frank Sinatras Marital History A Detailed Look At His Four Unions

May 24, 2025

Frank Sinatras Marital History A Detailed Look At His Four Unions

May 24, 2025 -

The Sean Penn Woody Allen Dylan Farrow Controversy A Look At The Doubts

May 24, 2025

The Sean Penn Woody Allen Dylan Farrow Controversy A Look At The Doubts

May 24, 2025 -

The Four Women Who Married Frank Sinatra Their Stories And Impact

May 24, 2025

The Four Women Who Married Frank Sinatra Their Stories And Impact

May 24, 2025 -

Mia Farrows Outrage Venezuelan Deportations Under Trump Administration

May 24, 2025

Mia Farrows Outrage Venezuelan Deportations Under Trump Administration

May 24, 2025 -

Woody Allen And Dylan Farrow Sean Penns Perspective On The Allegations

May 24, 2025

Woody Allen And Dylan Farrow Sean Penns Perspective On The Allegations

May 24, 2025