LVMH's Q1 Sales Results Send Shares Down 8.2%

Table of Contents

Declining Sales Growth in Key Sectors

LVMH's Q1 results revealed a slowdown in several key sectors, contributing significantly to the overall decline.

Slowdown in Fashion and Leather Goods

The fashion and leather goods division, traditionally a powerhouse for LVMH, experienced a notable slowdown. Key brands like Louis Vuitton and Dior, usually drivers of strong revenue growth, showed signs of weakening sales momentum.

- Reduced Consumer Spending: A global economic slowdown and increased inflation impacted consumer confidence, leading to reduced discretionary spending on luxury goods.

- Inventory Adjustments: LVMH may have made adjustments to its inventory levels, impacting reported sales figures in the short term.

- Increased Competition: The luxury fashion market is increasingly competitive, with emerging brands and established players vying for market share. Louis Vuitton sales, while still substantial, demonstrated a slower growth rate than in previous quarters. Similarly, Dior revenue, although still positive, failed to meet initial market expectations.

Preliminary data suggests a sales decrease of approximately 5% in this sector, compared to the same period last year. This figure requires official confirmation from LVMH's financial reports.

Weakening Performance in Wines and Spirits

The performance of LVMH's wines and spirits division also fell short of expectations. Iconic brands such as Moët & Chandon and Hennessy, known for their premium positioning, experienced reduced sales growth.

- Shifting Consumer Preferences: Changing consumer preferences and a move towards more sustainable and ethically sourced products may have impacted sales.

- Economic Slowdown Impact: The global economic uncertainty impacted the premium alcohol market, with consumers potentially trading down to less expensive options.

- Geopolitical Factors: Geopolitical instability and trade tensions in certain key markets could have negatively influenced sales in specific regions. For instance, Moët & Chandon sales in certain Asian markets showed a slight decline, while Hennessy cognac sales remained relatively stable, albeit with slower growth.

Analysts predict a minimal growth of less than 2% in this sector compared to Q1 2023.

Impact of Geopolitical and Economic Factors

The global economic climate played a significant role in LVMH's Q1 performance.

- Global Economic Uncertainty: The threat of recession in several key markets influenced consumer behavior, impacting demand for luxury goods.

- High Inflation: Persistent high inflation eroded purchasing power, limiting consumer spending on non-essential items.

- Strong US Dollar: The strength of the US dollar against other currencies negatively impacted international sales for LVMH, reducing the value of revenues earned outside the US.

The interconnectedness of the global economy highlights the vulnerability of even the most successful luxury brands to macroeconomic trends.

Investor Reaction and Market Analysis

The 8.2% drop in LVMH shares immediately following the Q1 earnings announcement underscored the market's negative reaction.

Stock Market Response

The sharp decline in LVMH stock price triggered a wider sell-off in the luxury goods sector, reflecting investor concerns about the overall health of the market. The market capitalization of LVMH experienced a considerable decrease, indicating a significant loss of investor confidence.

Analyst Opinions and Predictions

Financial analysts offered varied opinions on the decline, with some attributing it to temporary factors, while others expressed more long-term concerns. Predictions for LVMH's future performance range from cautious optimism to more pessimistic outlooks, depending on the analyst's assessment of the broader economic conditions.

Comparison to Competitors

Comparing LVMH's Q1 performance against its main competitors, such as Kering and Richemont, revealed a mixed picture. While some competitors also reported slower growth, LVMH's decline was more pronounced, raising questions about its specific challenges.

LVMH's Response and Future Outlook

LVMH's management addressed the Q1 results in an official statement, acknowledging the challenges faced but expressing confidence in the company's long-term prospects.

Management Commentary

LVMH's management emphasized the resilience of the luxury goods market and highlighted the company's commitment to long-term growth. They acknowledged the impact of macroeconomic factors but reiterated their belief in the enduring appeal of their brands.

Strategies for Growth

To address the decline, LVMH is likely to focus on several strategic initiatives, including enhancing its digital presence, expanding into new markets, and further developing its sustainable practices.

Long-Term Prospects

Despite the short-term challenges, the long-term prospects for LVMH remain positive. The luxury goods market, while cyclical, is expected to continue its growth trajectory in the long run, offering LVMH significant opportunities for expansion and revenue generation. The luxury market forecast remains positive, albeit with cautious optimism in the near term.

Conclusion: Understanding the LVMH Q1 Results and What's Next

The significant drop in LVMH shares following the announcement of its Q1 2024 sales results is attributable to a combination of factors, including reduced consumer spending, inventory adjustments, increased competition, and broader macroeconomic headwinds. Weakening sales in key sectors like fashion and leather goods, as well as wines and spirits, further contributed to the decline. While the short-term outlook presents challenges, LVMH's long-term prospects remain strong, given its established brand portfolio and ongoing strategic initiatives. To stay informed about LVMH's performance and future announcements, follow LVMH stock and subscribe to reputable financial news sources for regular luxury goods market updates.

Featured Posts

-

Fatal Nightcliff Stabbing Arrest Made In Darwin Robbery Investigation

May 25, 2025

Fatal Nightcliff Stabbing Arrest Made In Darwin Robbery Investigation

May 25, 2025 -

Hollywood Star Sean Penn Makes Headlining Claims Public Response

May 25, 2025

Hollywood Star Sean Penn Makes Headlining Claims Public Response

May 25, 2025 -

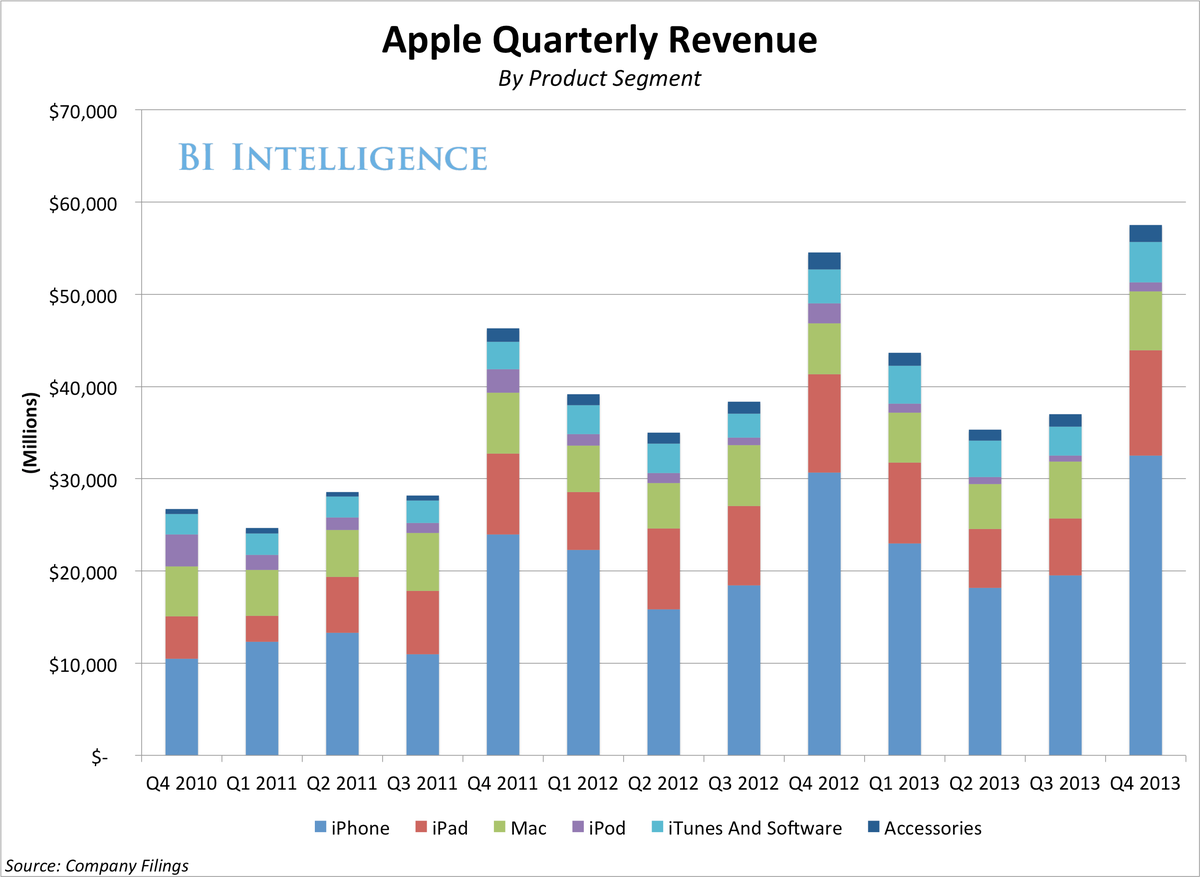

Apple Stock Forecast Q2 Earnings And Beyond

May 25, 2025

Apple Stock Forecast Q2 Earnings And Beyond

May 25, 2025 -

Amsterdam Accueille Le Ces Unveiled Europe Les Technologies De Demain

May 25, 2025

Amsterdam Accueille Le Ces Unveiled Europe Les Technologies De Demain

May 25, 2025 -

Experience The Ferrari Challenge Racing Days In South Florida

May 25, 2025

Experience The Ferrari Challenge Racing Days In South Florida

May 25, 2025

Latest Posts

-

Analysis Of Sean Penns Stance On Dylan Farrows Accusations Against Woody Allen

May 25, 2025

Analysis Of Sean Penns Stance On Dylan Farrows Accusations Against Woody Allen

May 25, 2025 -

The Sean Penn Woody Allen Dylan Farrow Controversy A Deeper Look

May 25, 2025

The Sean Penn Woody Allen Dylan Farrow Controversy A Deeper Look

May 25, 2025 -

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 25, 2025

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 25, 2025 -

Understanding Frank Sinatras Four Marriages Wives Love And Legacy

May 25, 2025

Understanding Frank Sinatras Four Marriages Wives Love And Legacy

May 25, 2025 -

Sean Penns Response To Dylan Farrows Sexual Assault Claims Against Woody Allen

May 25, 2025

Sean Penns Response To Dylan Farrows Sexual Assault Claims Against Woody Allen

May 25, 2025