Mangalia Shipyard's Future Hangs In Balance As Turkish Desan Considers Acquisition

Table of Contents

Mangalia Shipyard's Current Situation: A Detailed Overview

Financial Performance and Challenges

Mangalia Shipyard's recent financial performance has been a cause for concern. While precise financial data remains partially undisclosed, reports suggest declining profitability, increasing debt levels, and struggles with operational efficiency. These challenges are not unique to Mangalia; the global shipbuilding industry faces intense competition and fluctuating demand. However, Mangalia's specific difficulties, including outdated technology and a need for modernization, have exacerbated its financial instability. The shipyard's ability to secure new contracts has also been hampered, contributing to its precarious financial situation. The long-term financial stability of Mangalia Shipyard is directly tied to its ability to adapt to these challenges and attract new investment. Keywords: financial stability, shipbuilding industry, Romanian economy, Mangalia Shipyard performance.

- Reports indicate a significant decrease in profitability over the past three years.

- The shipyard has struggled to secure large-scale contracts in recent times.

- Outdated infrastructure and technology hamper competitiveness.

- A skilled workforce is available, but retaining and training them is a ongoing concern.

Turkish Desan Shipyard: A Potential Savior or Threat?

Desan Shipyard's Profile and Capabilities

Desan Shipyard, a major player in the Turkish shipbuilding sector, boasts a considerable history, significant financial strength, and substantial expertise in various shipbuilding projects. Its involvement in numerous large-scale projects, both domestically and internationally, highlights its capabilities within the global shipbuilding market. Desan's acquisition strategy often involves revitalizing and modernizing acquired shipyards, injecting capital and expertise to enhance their competitiveness. Keywords: Desan Shipyard, Turkish shipbuilding, global shipbuilding market, acquisition strategy.

- Desan Shipyard has a proven track record of successful large-scale projects, including naval vessels and commercial ships.

- It holds a strong position in the Turkish shipbuilding market and is actively expanding its global reach.

- Desan has a history of successful mergers and acquisitions, demonstrating its capacity for integration and restructuring.

Potential Outcomes of the Acquisition

Benefits of a Successful Acquisition for Mangalia

A successful acquisition by Desan Shipyard could offer several significant benefits for Mangalia. Access to Desan's advanced technologies and financial resources could lead to much-needed modernization of the shipyard's infrastructure and equipment. This investment could foster improved efficiency, increased productivity, and ultimately, enhanced competitiveness within the global shipbuilding market. Furthermore, the acquisition could open doors to new markets and lucrative contracts, ensuring the long-term viability of Mangalia Shipyard and contributing to Romania's economic growth. Keywords: synergy, investment, modernization, Mangalia Shipyard future, economic growth.

- Improved infrastructure and technology through Desan's investment.

- Access to Desan's global network of clients and contracts.

- Potential for job creation and workforce expansion due to increased activity.

Potential Risks and Challenges

Despite the potential benefits, several risks and challenges are associated with the Desan acquisition. Concerns exist regarding potential job displacement, especially if Desan opts for restructuring and streamlining operations. There's also the broader issue of foreign investment risks and the potential loss of Romanian control over a strategically important national asset. The potential for exploitation of resources, environmental concerns, and the overall impact on local communities are also crucial considerations. Keywords: job displacement, foreign investment risks, national security, Mangalia Shipyard privatization, economic impact.

- Potential for job losses due to restructuring and automation.

- Concerns about the transfer of sensitive technology and intellectual property.

- Potential negative impact on local communities dependent on the shipyard.

The Romanian Government's Role and Public Opinion

Government Involvement and Policies

The Romanian government's stance on the potential Desan acquisition is crucial. Its policies and regulatory involvement will significantly influence the outcome. The government needs to carefully weigh the potential economic benefits against the risks, particularly concerning national security and potential job losses. Its overall economic strategy regarding the shipbuilding industry and the future of Mangalia Shipyard will play a decisive role in shaping the acquisition process. Keywords: Romanian government policy, economic strategy, state intervention, Mangalia Shipyard acquisition, political implications.

- The government is likely to scrutinize the acquisition closely to ensure compliance with regulations.

- Negotiations may involve conditions aimed at protecting Romanian interests and workers.

- Government support could significantly facilitate the acquisition and subsequent modernization.

Public Sentiment and Media Coverage

Public sentiment and media coverage surrounding the potential Desan acquisition are highly significant. Local communities and stakeholders have expressed concerns about job security, potential environmental impacts, and the loss of national control. Media reports reflect these concerns, often highlighting the importance of Mangalia Shipyard to the local economy and the need for transparent and responsible decision-making. Keywords: public opinion, media coverage, social impact, Mangalia Shipyard public perception, community concerns.

- Public protests or demonstrations are a possibility if concerns are not adequately addressed.

- Media coverage will be crucial in shaping public opinion and influencing government policy.

- Open dialogue and transparency are essential for managing public concerns effectively.

Conclusion: The Future of Mangalia Shipyard Remains Uncertain

The future of Mangalia Shipyard remains uncertain, hanging in the balance as the potential Desan acquisition unfolds. While the acquisition offers the prospect of modernization, investment, and access to new markets, it also presents risks related to job security, national control, and the well-being of local communities. The Romanian government's role and public opinion will be instrumental in shaping the outcome. The success of this potential acquisition hinges on a careful balancing of economic benefits and potential social costs. Staying informed about developments concerning Mangalia Shipyard is crucial, as this story significantly impacts Romania's economy and its shipbuilding industry. Follow reputable Romanian and international news sources for the latest updates on the Mangalia Shipyard's future.

Featured Posts

-

Diminished Optimism Strategists Reassess European Stocks Following Trumps Trade Actions

Apr 26, 2025

Diminished Optimism Strategists Reassess European Stocks Following Trumps Trade Actions

Apr 26, 2025 -

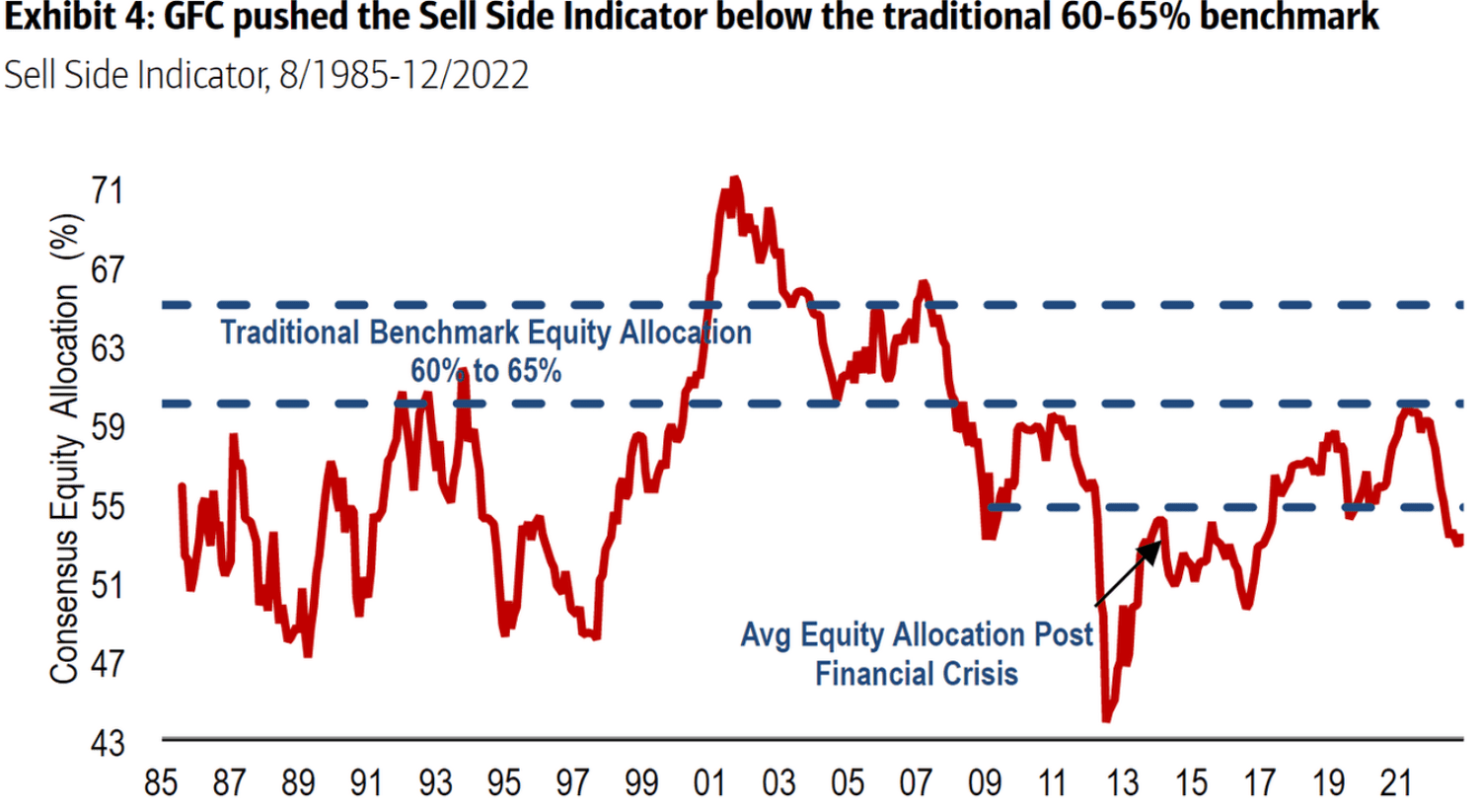

Bof A On Stock Market Valuations A Rationale For Investor Confidence

Apr 26, 2025

Bof A On Stock Market Valuations A Rationale For Investor Confidence

Apr 26, 2025 -

Oscars 2024 The Rise Of Nepo Babies And The Public Reaction

Apr 26, 2025

Oscars 2024 The Rise Of Nepo Babies And The Public Reaction

Apr 26, 2025 -

Are Food Dyes Being Banned Dr Sanjay Gupta Explains

Apr 26, 2025

Are Food Dyes Being Banned Dr Sanjay Gupta Explains

Apr 26, 2025 -

Lollapalooza Brasil 2024 Conheca Benson Boone O Cantor De Beautiful Thing

Apr 26, 2025

Lollapalooza Brasil 2024 Conheca Benson Boone O Cantor De Beautiful Thing

Apr 26, 2025