Market Timing And Risk: The Case Of Leveraged Semiconductor ETFs

Table of Contents

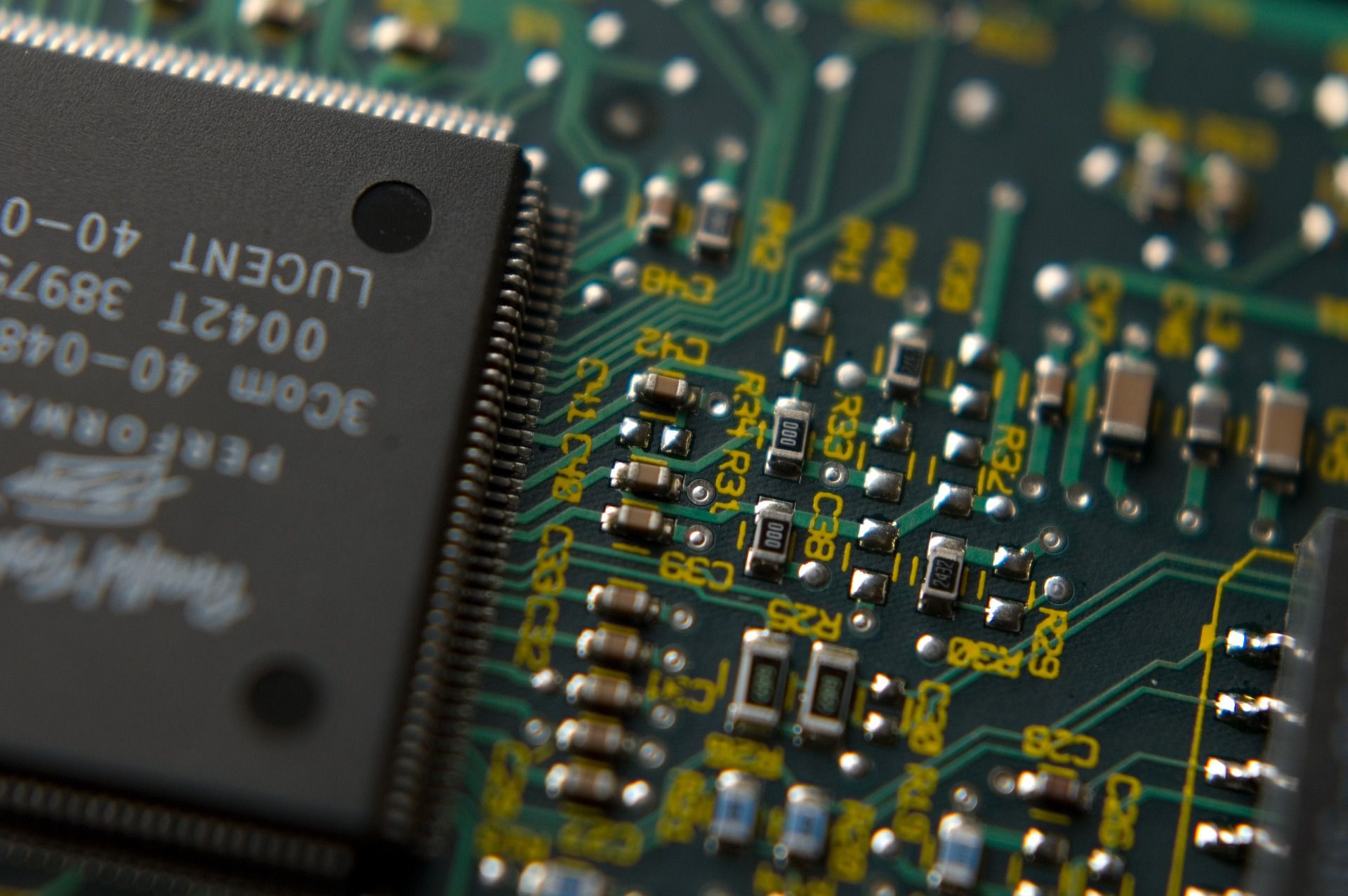

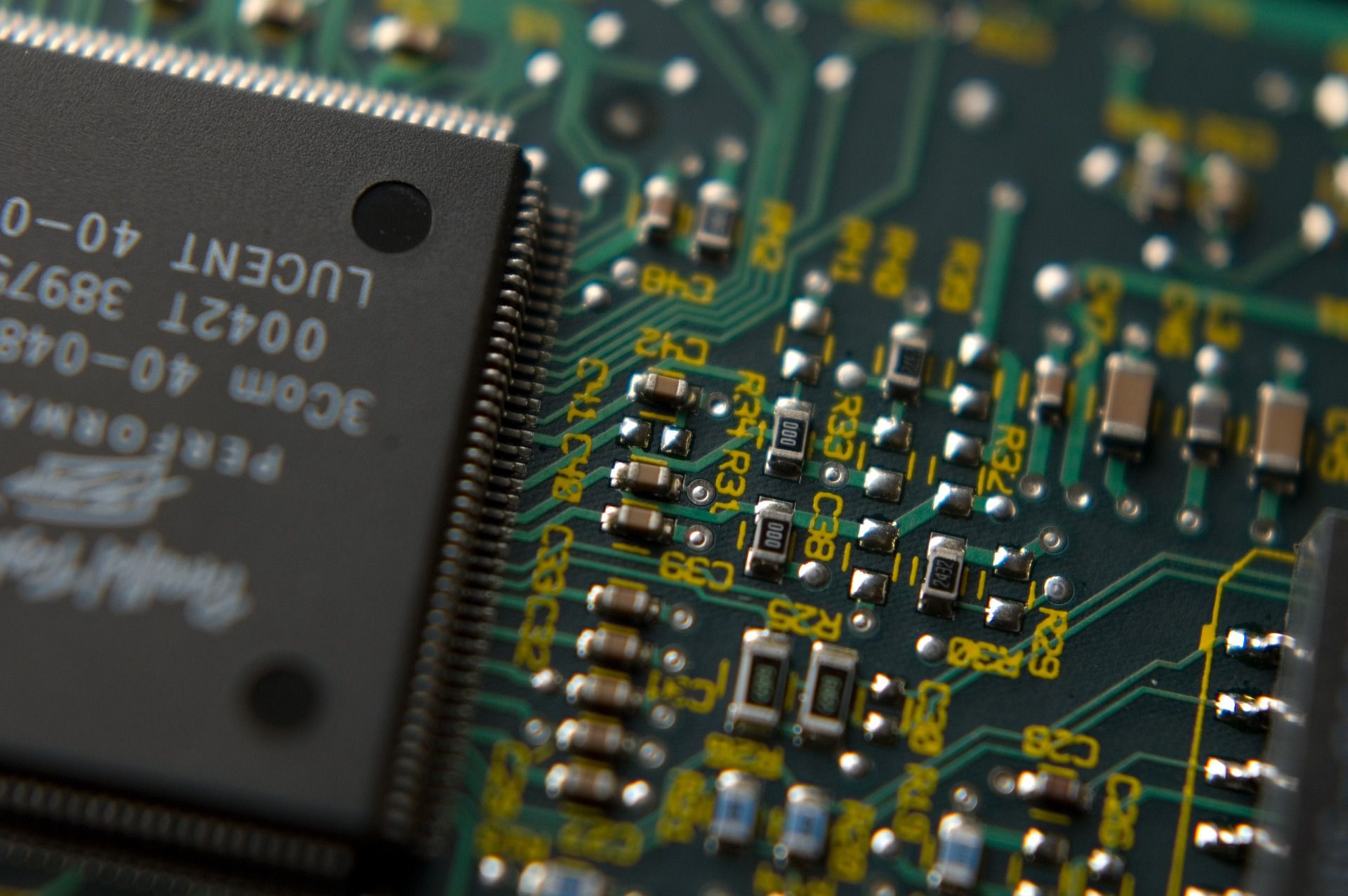

Understanding Leveraged Semiconductor ETFs

What are Leveraged ETFs?

Leveraged exchange-traded funds (ETFs) aim to deliver a multiple of the daily performance of an underlying index. For example, a 2x leveraged semiconductor ETF aims to provide double the daily return of a specific semiconductor index. This is achieved through the use of derivatives and financial engineering techniques, such as swaps and futures contracts.

The crucial thing to understand is the daily rebalancing. This means the leverage is reset each day. While this might seem beneficial, it can lead to significant discrepancies over longer periods, especially in volatile markets. The effects of compounding work differently with leveraged ETFs than with traditional investments. Consistent daily gains lead to amplified returns, but consistent daily losses can result in substantial capital erosion.

Popular examples of leveraged semiconductor ETFs (though specific tickers can change, always check current offerings) might include funds focused on the PHLX Semiconductor Index or similar benchmarks. Remember to always perform your own due diligence before investing in any specific ETF.

The Semiconductor Industry's Volatility

The semiconductor industry is inherently cyclical, experiencing periods of boom and bust driven by various factors. Global economic conditions, consumer demand for electronics, technological advancements, and geopolitical events significantly influence semiconductor stock prices.

- Global Demand: A surge in demand for smartphones or computers will boost semiconductor sales, leading to higher stock prices. Conversely, a downturn in the global economy can severely impact demand.

- Geopolitical Events: Trade wars, sanctions, and disruptions to supply chains can create significant volatility.

- Technological Advancements: The rapid pace of technological change in the semiconductor sector can make older technologies obsolete quickly, impacting the value of companies focused on those areas.

This inherent volatility interacts dangerously with the leverage of ETFs. A small daily drop in the underlying index translates to a larger daily loss in a leveraged ETF. Over time, even small daily fluctuations can accumulate, leading to significant underperformance compared to the unleveraged index. [Insert relevant chart/graph here showing historical volatility of a semiconductor index].

Market Timing Strategies and Leveraged Semiconductor ETFs

Challenges of Market Timing

Accurately predicting market movements is notoriously difficult. Even seasoned professionals struggle to consistently time the market. Several psychological biases can hinder effective market timing:

- Confirmation Bias: Seeking out information that confirms pre-existing beliefs.

- Overconfidence: Believing one's predictions are more accurate than they actually are.

- Fear of Missing Out (FOMO): Investing impulsively to avoid missing potential gains.

Furthermore, the transaction costs associated with frequent trading can significantly eat into profits, making market timing even more challenging.

Strategies for Employing Leveraged Semiconductor ETFs

While timing the market perfectly is near impossible, some strategies can help mitigate risk when using leveraged semiconductor ETFs:

- Dollar-Cost Averaging (DCA): Investing a fixed amount of money at regular intervals, regardless of market fluctuations. This reduces the risk of investing a large sum at a market peak.

- Technical Analysis: Using charts and indicators to identify potential entry and exit points. However, technical analysis is not foolproof.

- Fundamental Analysis: Evaluating the financial health and future prospects of companies within the ETF to identify potentially strong underlying holdings.

It's crucial to avoid short-term trading with leveraged ETFs. Their inherent volatility makes them unsuitable for frequent buy-and-sell strategies. A longer-term, more patient approach is generally recommended.

Risk Management with Leveraged Semiconductor ETFs

Effective risk management is critical when investing in leveraged semiconductor ETFs:

- Diversification: Never put all your eggs in one basket. Diversify your portfolio across different asset classes to reduce overall risk.

- Stop-Loss Orders: Set stop-loss orders to automatically sell your ETF holdings if the price falls below a predetermined level. This limits potential losses.

- Due Diligence: Thoroughly research the ETF's holdings, expense ratio, and investment strategy before investing.

- Volatility Decay: Be aware that prolonged periods of sideways or slightly negative movement will significantly erode the value of leveraged ETFs due to the daily rebalancing.

Alternative Investment Options

Unleveraged Semiconductor ETFs

Unleveraged semiconductor ETFs offer a less risky alternative. They track the performance of the underlying index without amplification. While returns may be lower, the risk is significantly reduced. Comparing the risk/reward profiles of leveraged and unleveraged ETFs is crucial for making informed investment decisions.

Direct Stock Investing

Investing directly in individual semiconductor companies offers another approach. This allows for more targeted exposure but requires more in-depth research and carries higher risk. It can be a more active and potentially higher-reward investment strategy than ETFs, but it demands more time and expertise.

Conclusion

Leveraged semiconductor ETFs offer the potential for significant returns, but they are not without substantial risks. The amplified nature of leverage means market timing and risk management are paramount. The challenges of consistently accurate market timing, combined with the inherent volatility of the semiconductor industry and the unique characteristics of leveraged investments, should always be kept in mind. While potentially lucrative, these investment vehicles demand careful planning and a solid understanding of their risks.

Before investing in leveraged semiconductor ETFs, conduct thorough research, consider your risk tolerance carefully, and develop a well-defined investment strategy. Learn more about managing risk with leveraged semiconductor ETFs by [link to relevant resource/further reading].

Featured Posts

-

Natsionalni Savet Roma Analiza Iz Ava Marinike Tepi I Pitanje Govora Mrzhnje

May 13, 2025

Natsionalni Savet Roma Analiza Iz Ava Marinike Tepi I Pitanje Govora Mrzhnje

May 13, 2025 -

Eva Longoria Sizzles In A Tiny Leopard Bikini

May 13, 2025

Eva Longoria Sizzles In A Tiny Leopard Bikini

May 13, 2025 -

Sabalenkas Miami Open Win 19th Wta Title Secured

May 13, 2025

Sabalenkas Miami Open Win 19th Wta Title Secured

May 13, 2025 -

Gibraltar Industries Rock Earnings Preview What To Expect

May 13, 2025

Gibraltar Industries Rock Earnings Preview What To Expect

May 13, 2025 -

Doom The Dark Ages Gameplay Story And More

May 13, 2025

Doom The Dark Ages Gameplay Story And More

May 13, 2025