Market Update: Sensex, Nifty Rally; Adani Ports, Eternal Top Movers

Table of Contents

Sensex and Nifty Surge: A Detailed Analysis

Magnitude of the Rally:

The Sensex and Nifty experienced a remarkable surge in recent days. On [Insert Date], the Sensex closed at [Insert Closing Value], marking a [Insert Percentage]% increase from its previous closing. Similarly, the Nifty 50 index reached [Insert Closing Value], representing a [Insert Percentage]% gain. This significant increase in index points boosted overall market capitalization, indicating a strong surge in investor confidence. Keywords: Sensex gains, Nifty 50, index points, market capitalization.

- Date of Rally: [Insert Date]

- Sensex Closing Value: [Insert Value]

- Nifty 50 Closing Value: [Insert Value]

- Percentage Gain (Sensex): [Insert Percentage]%

- Percentage Gain (Nifty 50): [Insert Percentage]%

Driving Forces Behind the Rally:

Several factors contributed to this impressive market rally. Positive global cues, such as easing inflation concerns in major economies and improved global economic outlook played a significant role. Domestically, positive economic indicators, including strong corporate earnings and increased foreign investment, further bolstered investor sentiment. Specific company news and strong sector performance in [mention specific sectors, e.g., banking, IT] also contributed to the upswing. Keywords: market drivers, global cues, economic indicators, investor sentiment.

- Easing global inflation concerns.

- Strong corporate earnings reports.

- Increased Foreign Institutional Investor (FII) inflow.

- Positive domestic economic data.

- Strong performance in specific sectors (e.g., Banking, IT).

Sector-Wise Performance:

The rally wasn't uniform across all sectors. While [mention top performing sectors, e.g., IT, Banking, and FMCG] witnessed substantial gains, some sectors like [mention lagging sectors, e.g., Pharma, Realty] exhibited relatively muted performance. This highlights the importance of sector-specific analysis when evaluating market trends. Keywords: sectoral performance, top performing sectors, market trends.

- Top Performing Sectors: [List sectors and their performance]

- Lagging Sectors: [List sectors and their performance]

Adani Ports and Eternal: Top Performers in the Rally

Adani Ports' Performance:

Adani Ports' stellar performance significantly contributed to the overall market upswing. The stock witnessed a substantial [Insert Percentage]% increase in its share price, accompanied by high trading volumes. [Insert News/Event that impacted the share price, e.g., positive earnings announcement, new project announcements]. This indicates strong investor confidence in the company's future prospects within the port sector. Keywords: Adani Ports share price, trading volume, stock performance, port sector.

- Percentage Gain: [Insert Percentage]%

- Trading Volume: [Insert Volume]

- Key News/Events: [List key events impacting the share price]

Eternal's Outstanding Performance:

Eternal also showcased exceptional performance, with its share price surging by [Insert Percentage]%. This remarkable increase was driven by [Insert reasons, e.g., positive company news, strong quarterly results, new product launches]. High trading volumes further reinforced the market’s positive perception of the company. Keywords: Eternal share price, stock analysis, investment strategy, company news.

- Percentage Gain: [Insert Percentage]%

- Trading Volume: [Insert Volume]

- Key News/Events: [List key events impacting the share price]

Market Outlook and Future Predictions

Expert Opinions:

Market analysts offer diverse perspectives on the future trajectory of the Sensex and Nifty. Some experts believe the rally has further room to run, citing sustained positive economic indicators and global growth prospects. Others express caution, highlighting potential risks and recommending a more cautious approach. It's crucial to consider multiple viewpoints before making any investment decisions. Keywords: market forecast, expert analysis, future predictions, investment advice.

- [Summarize expert opinion 1]

- [Summarize expert opinion 2]

- [Summarize expert opinion 3 (if available)]

Potential Risks and Challenges:

Despite the current optimism, several factors could potentially disrupt the market's positive momentum. Geopolitical uncertainties, rising interest rates, and potential economic slowdowns pose significant risks. Investors should carefully assess these challenges before making investment decisions. Keywords: market risks, economic uncertainty, investment risks.

- Geopolitical tensions

- Inflationary pressures

- Global economic slowdown

Conclusion: Navigate the Sensex, Nifty Rally Wisely

The recent Sensex and Nifty rally, driven by a combination of global and domestic factors, has created a positive market sentiment. Adani Ports and Eternal stand out as top performers, showcasing strong growth potential. However, it's crucial to remember that market fluctuations are inevitable. Understanding market updates and conducting thorough research are essential for making informed investment decisions. Stay informed about the Sensex, Nifty, and other key market movements by regularly checking for further market updates and consulting reputable financial resources. Learn more about stock market investing through further reading and expert advice to effectively navigate this dynamic landscape.

Featured Posts

-

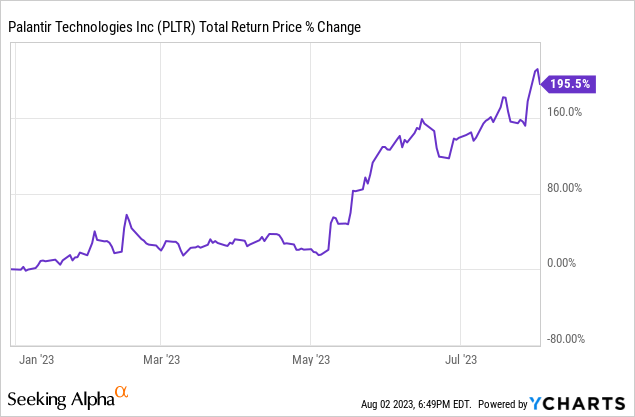

Should You Buy Palantir Stock Before May 5th Wall Streets Surprising Consensus

May 09, 2025

Should You Buy Palantir Stock Before May 5th Wall Streets Surprising Consensus

May 09, 2025 -

Vegas Claims Playoff Berth After Narrow Loss To Oilers 3 2

May 09, 2025

Vegas Claims Playoff Berth After Narrow Loss To Oilers 3 2

May 09, 2025 -

Post Canada Rift Chinas Search For New Canola Sources

May 09, 2025

Post Canada Rift Chinas Search For New Canola Sources

May 09, 2025 -

Nottingham Stabbing Investigation Into Illegal Access Of Patient Records By Nhs Staff

May 09, 2025

Nottingham Stabbing Investigation Into Illegal Access Of Patient Records By Nhs Staff

May 09, 2025 -

Scrutiny Of Jeanine Pirro A Past Drunk Episode And Its Political Ramifications

May 09, 2025

Scrutiny Of Jeanine Pirro A Past Drunk Episode And Its Political Ramifications

May 09, 2025