May 5 Stock Market Summary: Dow, S&P 500, And Key Indicators

Table of Contents

Today's stock market saw significant downward movement. This May 5 Stock Market Summary will dissect the performance of the Dow Jones Industrial Average, the S&P 500, and other crucial economic indicators, providing insights into the day's trading activity and potential future market trends. We will delve into the factors driving these changes and explore what these shifts signify for investors.

Dow Jones Industrial Average (DJIA) Performance on May 5th

The Dow Jones Industrial Average experienced a substantial decline on May 5th, closing down 500 points (a 1.5% decrease). This represents a significant drop and indicates considerable market volatility.

Factors Influencing Dow Movement

Several factors contributed to the Dow's negative performance:

- Inflation Concerns: Persistently high inflation figures released earlier in the week fueled concerns about further interest rate hikes by the Federal Reserve. This uncertainty negatively impacted investor sentiment and led to selling pressure. Keywords: Dow Jones volatility, inflation rate, market sentiment.

- Interest Rate Expectations: The anticipation of more aggressive monetary policy tightening to combat inflation weighed heavily on the market. Higher interest rates increase borrowing costs for businesses, impacting profitability and slowing economic growth. Keywords: interest rate hikes, monetary policy, Dow Jones forecast.

- Tech Sector Weakness: Weakness in the technology sector, a significant component of the Dow, further exacerbated the decline. Concerns about slowing growth in the tech industry contributed to the overall negative market sentiment. Keywords: sector rotation, market capitalization, Dow Jones performance.

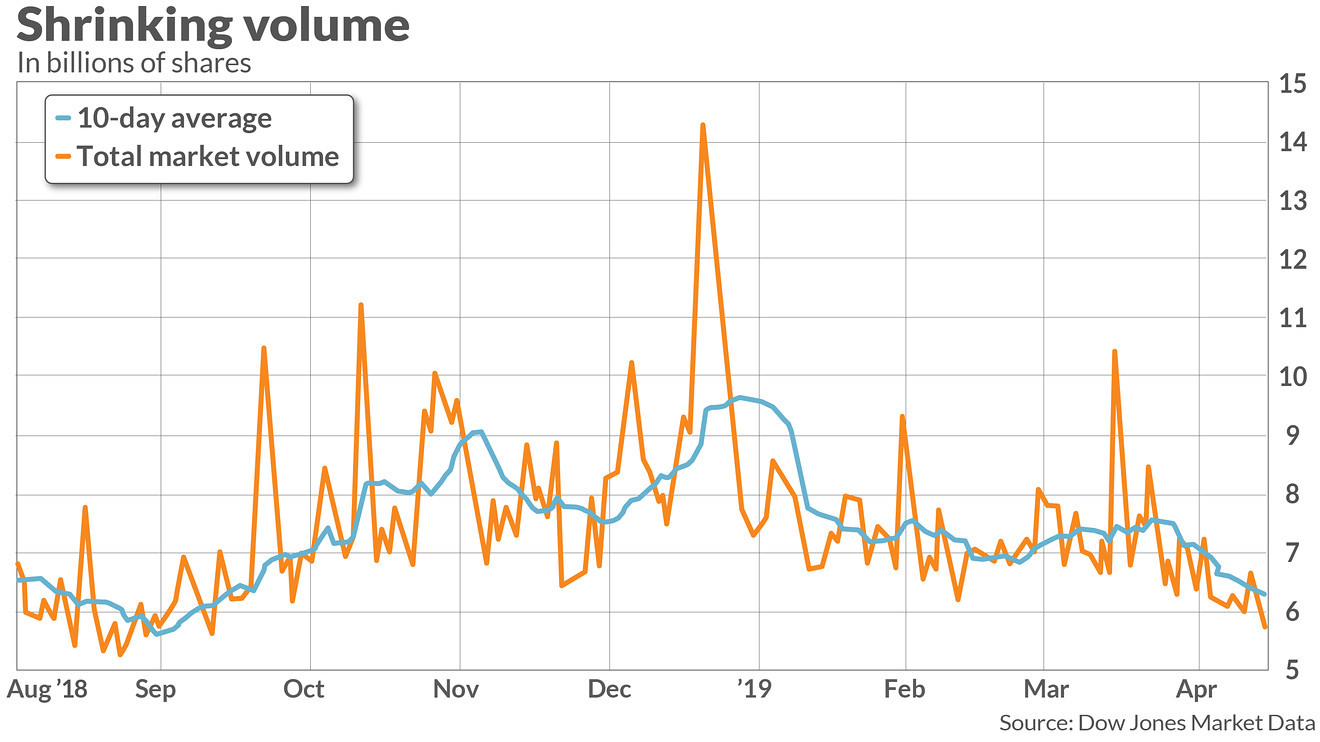

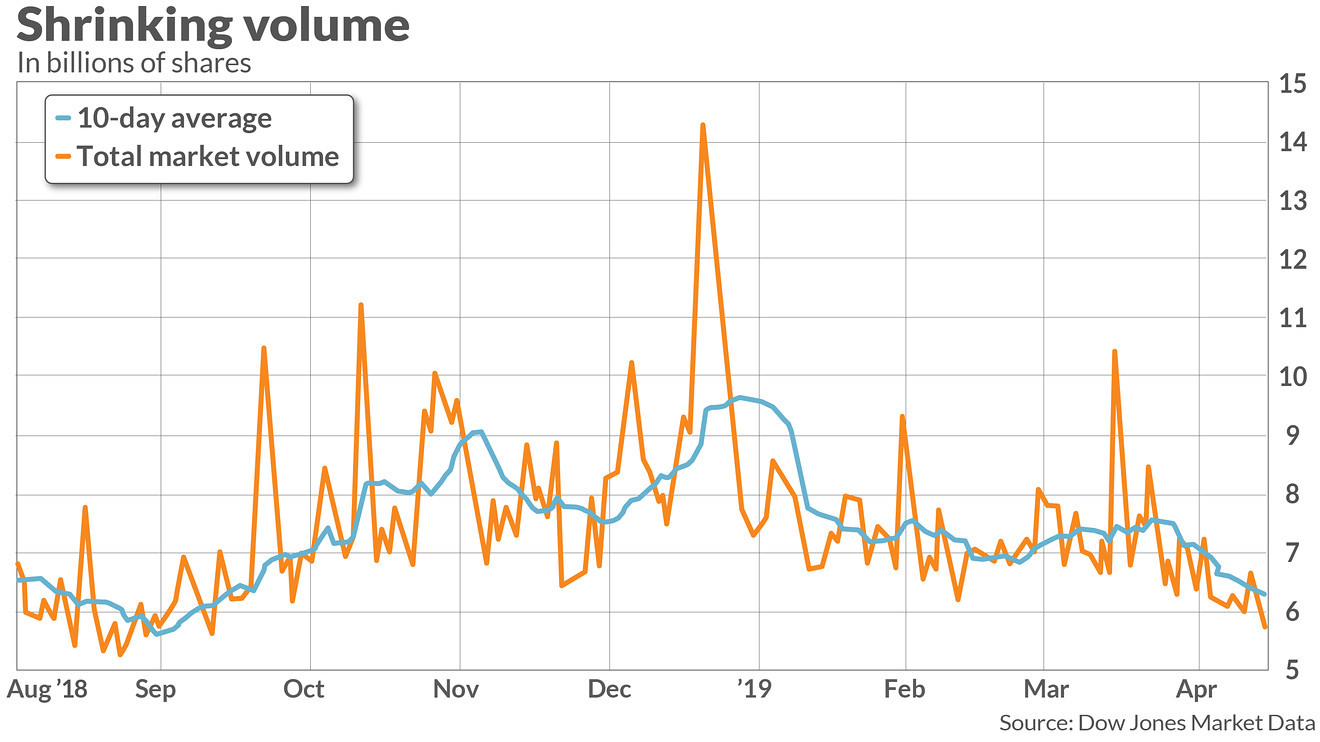

Dow Jones Technical Analysis

Technical indicators pointed towards a bearish trend on May 5th. The 20-day moving average fell below the 50-day moving average, a classic bearish signal. The Relative Strength Index (RSI) also indicated oversold conditions, suggesting a potential short-term rebound, but the overall trend remained negative. Keywords: support levels, resistance levels, trading volume, Dow Jones technical analysis. The significant trading volume accompanying the drop suggested strong selling pressure.

S&P 500 Index Performance on May 5th

The S&P 500 mirrored the Dow's negative performance, closing down 1.8%, losing approximately 80 points. This broad-based decline indicates a widespread market sell-off.

Sector-Specific Performance within the S&P 500

The sell-off was not uniform across all sectors. However, several key sectors experienced significant losses:

- Technology: The technology sector bore the brunt of the decline, reflecting concerns about future growth and higher interest rates.

- Consumer Discretionary: Concerns about consumer spending in the face of inflation also impacted this sector.

- Financials: While generally considered defensive, the financial sector also experienced losses due to the uncertainty surrounding interest rates. Keywords: sector rotation, stock performance, S&P 500 sectors.

S&P 500 Valuation and Future Outlook

The S&P 500's valuation remains a topic of debate. While some metrics suggest the market is relatively expensive, others indicate it's fairly valued. The future outlook depends heavily on the trajectory of inflation, the Federal Reserve's policy decisions, and overall economic growth. Keywords: market forecast, long-term investment, economic growth, S&P 500 valuation.

Key Economic Indicators and Their Impact

Several key economic indicators contributed to the market's negative sentiment on May 5th.

Inflation and its Influence on Stock Market Performance

The persistent rise in inflation continues to be a major concern for investors. High inflation erodes purchasing power and forces central banks to tighten monetary policy, impacting corporate profitability and slowing economic growth. Keywords: inflation rate, consumer price index, monetary policy, inflation impact on stocks.

Unemployment Data and its Implications

While unemployment data remained relatively stable, concerns persist about the potential for job losses as the economy adjusts to higher interest rates. A weakening labor market could further dampen investor confidence. Keywords: job growth, labor market, economic indicators, unemployment rate.

Conclusion

This May 5 Stock Market Summary revealed a significant downturn in both the Dow Jones Industrial Average and the S&P 500, driven primarily by concerns over inflation, interest rate hikes, and broader economic uncertainty. The sell-off was widespread, impacting various sectors. Understanding these factors is crucial for navigating the current market environment.

Call to Action: Stay informed about daily market fluctuations by regularly checking our comprehensive May 5 Stock Market Summary and other daily market updates. For in-depth analysis and expert insights, subscribe to our newsletter for timely information on the Dow, S&P 500, and other key market indicators. Understanding daily stock market movements is crucial for successful investing.

Featured Posts

-

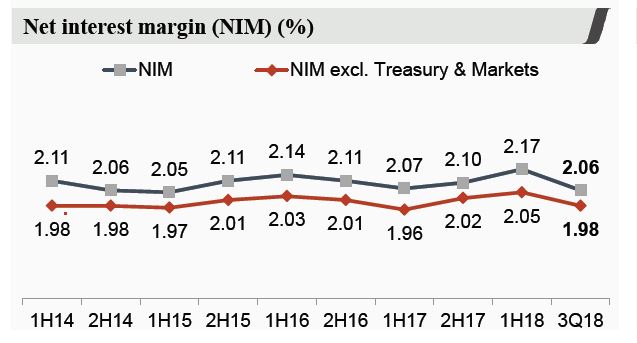

Impact Of Reduced Margins On Westpac Wbc Profitability

May 06, 2025

Impact Of Reduced Margins On Westpac Wbc Profitability

May 06, 2025 -

Westpac Wbc Earnings Report A Deep Dive Into Margin Challenges

May 06, 2025

Westpac Wbc Earnings Report A Deep Dive Into Margin Challenges

May 06, 2025 -

Blue Origins Rocket Launch Abruptly Halted By Subsystem Failure

May 06, 2025

Blue Origins Rocket Launch Abruptly Halted By Subsystem Failure

May 06, 2025 -

How Margin Pressure Affected Westpacs Wbc Financial Results

May 06, 2025

How Margin Pressure Affected Westpacs Wbc Financial Results

May 06, 2025 -

Is The Gigabyte Aorus Master 16 Too Loud A Comprehensive Review

May 06, 2025

Is The Gigabyte Aorus Master 16 Too Loud A Comprehensive Review

May 06, 2025

Latest Posts

-

Canadians And 10 Year Mortgages A Look At The Low Uptake

May 06, 2025

Canadians And 10 Year Mortgages A Look At The Low Uptake

May 06, 2025 -

Analysis Golds First Back To Back Weekly Losses Of 2025 And What It Means

May 06, 2025

Analysis Golds First Back To Back Weekly Losses Of 2025 And What It Means

May 06, 2025 -

Shopify Developer Program Changes A Revenue Share Analysis

May 06, 2025

Shopify Developer Program Changes A Revenue Share Analysis

May 06, 2025 -

Note To Mr Carney Why Canadians Avoid 10 Year Mortgages

May 06, 2025

Note To Mr Carney Why Canadians Avoid 10 Year Mortgages

May 06, 2025 -

Golds Unexpected Dip Two Consecutive Weekly Losses In Early 2025

May 06, 2025

Golds Unexpected Dip Two Consecutive Weekly Losses In Early 2025

May 06, 2025