Impact Of Reduced Margins On Westpac (WBC) Profitability

Table of Contents

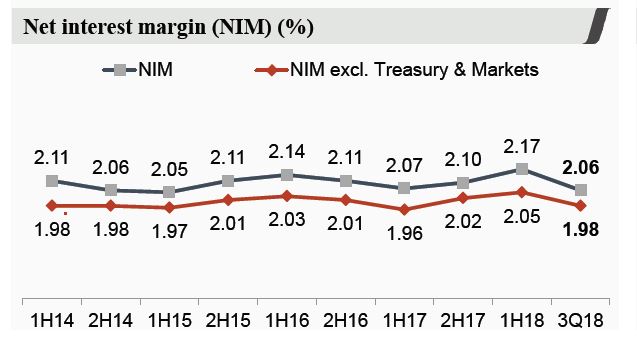

The Impact of Interest Rate Changes on Westpac's Net Interest Margin (NIM)

Net Interest Margin (NIM) is a key indicator of a bank's profitability, representing the difference between the interest income it earns on loans and the interest it pays on deposits and borrowings, expressed as a percentage of earning assets. Rising interest rates, while seemingly beneficial, present a complex picture for banks like Westpac. Increased interest rates on borrowing costs directly impact the bank's expenses. The ability to successfully pass these increases onto lending rates to customers directly influences the NIM. A slower pass-through rate can significantly squeeze margins.

-

Impact of RBA rate hikes on WBC's lending and borrowing costs: The Reserve Bank of Australia (RBA) has implemented several interest rate hikes recently. These hikes increase the cost of funds for Westpac, affecting their borrowing costs. The speed at which these increased costs are passed on to customers impacts the NIM.

-

Analysis of WBC's ability to pass on rate increases to customers: Westpac, like its competitors, faces pressure to maintain customer loyalty in a competitive environment. This can limit the extent to which they can fully pass on interest rate increases to borrowers, affecting profitability.

-

Comparison of WBC's NIM performance with industry benchmarks: Comparing Westpac's NIM performance against its major competitors, ANZ, CBA, and NAB, provides crucial context. Analysis of these comparisons reveals Westpac’s competitive positioning and its ability to manage interest rate fluctuations effectively.

Increased Competition and its Effect on Westpac's Profitability

The Australian banking sector is increasingly competitive. The emergence of fintech companies offering innovative digital banking solutions and disrupting traditional banking models poses a significant challenge to established players like Westpac. This intense competition puts downward pressure on fees and charges, further impacting profitability.

-

Analysis of market share trends for WBC and its competitors: Analyzing market share data helps to understand Westpac's competitive position and the impact of new entrants. A declining market share can indicate a loss of customers and revenue.

-

Impact of fintech disruption on WBC's customer base and revenue streams: Fintech's focus on customer experience and digital convenience presents a threat to Westpac’s traditional customer base, affecting revenue streams from fees and services.

-

Strategies employed by WBC to compete effectively in a challenging market: Westpac is actively investing in technology and digital transformation to remain competitive. Analyzing these strategies – including their effectiveness – is critical to understanding the bank's future profitability.

Rising Operational Costs and their Contribution to Margin Compression

Westpac, like any large financial institution, faces significant operational costs. These encompass technology investments required for digital transformation, staffing costs, and increasingly stringent regulatory compliance requirements. The efficiency ratio – operating expenses as a percentage of revenue – is a critical metric for assessing operational efficiency and its impact on profitability.

-

Breakdown of WBC's major operational expenditure categories: A detailed examination of Westpac's spending across various categories provides insights into cost drivers and potential areas for optimization.

-

Analysis of WBC's cost-to-income ratio compared to competitors: Comparing Westpac’s cost-to-income ratio to its competitors reveals its relative efficiency and areas where cost-cutting measures might be implemented.

-

Discussion on WBC's strategies to improve operational efficiency: Evaluating Westpac's initiatives aimed at improving efficiency, such as automation and streamlining processes, reveals its ability to control costs and protect margins.

The Role of Regulatory Changes in Shaping Westpac's Profitability

The Australian financial services industry is subject to rigorous regulatory oversight. Changes in regulations, such as those implemented by AUSTRAC (Australian Transaction Reports and Analysis Centre) and APRA (Australian Prudential Regulation Authority), directly affect Westpac's operational costs and risk management practices. Increased compliance requirements and the risk of penalties significantly impact profitability.

-

Specific examples of regulatory changes impacting WBC: Identifying specific instances of regulatory changes and their consequences on Westpac’s operations reveals the direct financial impact.

-

Analysis of the financial impact of compliance efforts and potential penalties: Assessing the costs of compliance and the potential for fines due to non-compliance demonstrates the significance of regulatory pressure on profitability.

-

Discussion of how regulatory changes influence WBC's strategic decisions: Analyzing how regulatory changes shape Westpac's strategic decisions, including its risk appetite and investment priorities, provides insights into its future performance.

Conclusion: Understanding the Challenges and Future Outlook for Westpac's Profitability

This analysis has highlighted the multifaceted challenges impacting Westpac's profitability. Interest rate changes, intense competition, rising operational costs, and increasingly stringent regulatory requirements are all contributing to margin compression. The future outlook for Westpac's margins depends on the bank's ability to effectively manage these pressures, innovate, and adapt to the evolving financial landscape. Understanding the Impact of Reduced Margins on Westpac (WBC) Profitability is crucial for investors and stakeholders. We encourage readers to delve deeper into Westpac's financial reports and stay informed about industry news to gain a comprehensive understanding of the ongoing impact of reduced margins on Westpac (WBC) profitability and make informed investment decisions. Continue to monitor the Impact of Reduced Margins on Westpac (WBC) Profitability for a complete financial picture.

Featured Posts

-

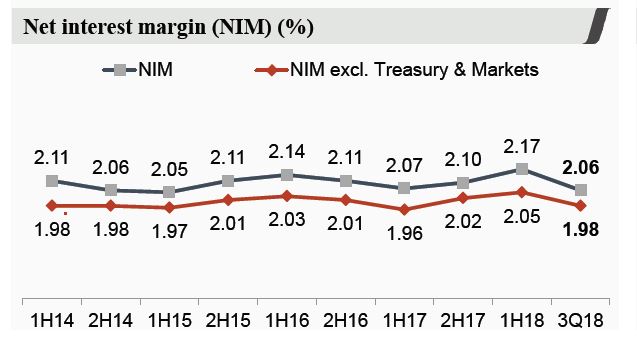

Asian Currencies In Turmoil The Impact Of A Weakening Dollar

May 06, 2025

Asian Currencies In Turmoil The Impact Of A Weakening Dollar

May 06, 2025 -

Princess Dianas Met Gala Gown A Risque Revelation

May 06, 2025

Princess Dianas Met Gala Gown A Risque Revelation

May 06, 2025 -

Anchor Brewing Company To Close After 127 Years The End Of An Era

May 06, 2025

Anchor Brewing Company To Close After 127 Years The End Of An Era

May 06, 2025 -

Dow Jones And S And P 500 Stock Market News For May 5

May 06, 2025

Dow Jones And S And P 500 Stock Market News For May 5

May 06, 2025 -

Deep In Abandoned Gold Mines A Toxic Legacy

May 06, 2025

Deep In Abandoned Gold Mines A Toxic Legacy

May 06, 2025

Latest Posts

-

Patrick Schwarzeneggers Nude Scene Arnold Schwarzeneggers Response

May 06, 2025

Patrick Schwarzeneggers Nude Scene Arnold Schwarzeneggers Response

May 06, 2025 -

Razdelis Li Patrik Shvartsenegger I Ebbi Chempion Dlya Kim Kardashyan

May 06, 2025

Razdelis Li Patrik Shvartsenegger I Ebbi Chempion Dlya Kim Kardashyan

May 06, 2025 -

Egy Apa Bueszkesege Arnold Schwarzenegger Es Joseph Baena Toertenete

May 06, 2025

Egy Apa Bueszkesege Arnold Schwarzenegger Es Joseph Baena Toertenete

May 06, 2025 -

Arnold Schwarzeneggers Son Patrick A Nude Scene And Fathers Reaction

May 06, 2025

Arnold Schwarzeneggers Son Patrick A Nude Scene And Fathers Reaction

May 06, 2025 -

Arnold Schwarzenegger Bueszke Lehet Fiara Joseph Baena Karrierje Es Joevoje

May 06, 2025

Arnold Schwarzenegger Bueszke Lehet Fiara Joseph Baena Karrierje Es Joevoje

May 06, 2025