Meta Faces FTC: Key Developments In The Instagram And WhatsApp Case

Table of Contents

The FTC's Allegations Against Meta

The Federal Trade Commission (FTC) alleges that Meta engaged in anti-competitive practices by acquiring Instagram and WhatsApp. Their case hinges on the assertion that these acquisitions stifled competition and allowed Meta to maintain a monopolistic grip on the social media market.

-

Monopolization through Acquisitions: The FTC argues that Meta, aware of the competitive threat posed by Instagram and WhatsApp, strategically acquired them to eliminate potential rivals and consolidate its dominance. This, they claim, violates antitrust laws designed to prevent monopolies.

-

Stifling Competition through Integration: Beyond acquisition, the FTC contends that Meta actively stifled competition by integrating Instagram and WhatsApp into its existing ecosystem. This integration, they argue, created insurmountable barriers to entry for new competitors and limited consumer choice. Key examples cited often include data sharing practices and cross-promotion strategies.

-

Harm to Consumers: The core of the FTC's argument rests on the claim that Meta's actions harmed consumers. This harm allegedly manifests in reduced innovation, less choice, and potentially higher prices (though pricing in social media is often zero-cost). The FTC highlights a lack of competitive pressure as the root cause of this alleged consumer harm.

-

Violation of Antitrust Laws: The FTC specifically cites violations of the Clayton Act and the Federal Trade Commission Act, alleging that Meta's acquisitions and subsequent actions substantially lessened competition or tended to create a monopoly in the social networking market. They assert that this violates the spirit and letter of existing antitrust regulations.

Meta's Defense Strategies

Meta vehemently denies the FTC's allegations, employing a multi-pronged defense strategy.

-

Competitive Landscape Argument: Meta argues that the social media landscape is highly competitive, with numerous platforms vying for users' attention. They point to the rise of TikTok and other social media services as evidence against claims of monopolistic control.

-

Benefits of Integration: Meta highlights the benefits of integrating its platforms for users. They emphasize features like interoperability and cross-platform communication, arguing that these integrations enhance user experience and don't stifle competition.

-

Challenging FTC Jurisdiction: Meta’s legal team has also challenged the FTC's jurisdiction and legal standing in some aspects of the case, questioning the scope and authority of the commission in this specific instance.

-

Procedural Challenges: Meta has also raised procedural challenges, questioning the timing and methods of the FTC's investigation and subsequent legal actions.

Key Developments and Court Proceedings

The "Meta faces FTC" case has been marked by several key developments:

-

Timeline: The FTC filed its complaint in [Insert Date], initiating the legal proceedings. [Insert subsequent key dates of filings, hearings, etc., keeping it concise.]

-

Court Decisions: [Summarize any significant court rulings or decisions made thus far, noting the judge’s reasoning if available.]

-

Settlements/Agreements: [Mention any attempted settlements or agreements, and their outcomes if applicable. If there are none, state that explicitly.]

-

Appeals: [If appeals are underway or anticipated, detail that information here.]

Implications and Future Outlook

The outcome of the "Meta faces FTC" case carries significant weight for the future of the tech industry and social media.

-

Potential Penalties: Meta could face substantial fines and penalties if found guilty of anti-competitive practices. This could impact its financial performance and future investment plans.

-

Impact on Acquisitions: A ruling against Meta could significantly alter its future acquisition strategies and potentially lead to stricter regulatory scrutiny of future mergers and acquisitions in the tech sector.

-

Broader Social Media Landscape: The case sets a precedent for how antitrust laws apply to large technology companies and could influence the competitive dynamics within the social media industry. It could also pave the way for further regulatory oversight and potential breakups of large tech companies.

-

Regulatory Changes: The case may lead to changes in antitrust laws and regulations aimed at better addressing the unique challenges presented by the rapid growth and consolidation of the tech sector.

Conclusion:

The ongoing legal battle between Meta and the FTC highlights the complexities of antitrust law in the digital age. The "Meta faces FTC" case raises fundamental questions about the power and influence of large tech companies and their acquisition strategies. The FTC's allegations, Meta's defenses, and the eventual court decisions will profoundly shape the future of social media and the regulation of large tech companies. To stay informed about the latest developments in this crucial case, and the broader implications of Meta facing the FTC, continue to follow reputable news sources and legal analyses. Understanding the implications of this case is crucial for anyone interested in the evolving landscape of digital platforms and their regulation.

Featured Posts

-

Voyage A Velo Trois Jeunes Du Bocage Ornais Relevent Un Defi De 8000 Km

May 01, 2025

Voyage A Velo Trois Jeunes Du Bocage Ornais Relevent Un Defi De 8000 Km

May 01, 2025 -

Kort Geding Kampen Vs Enexis Probleem Stroomnetaansluiting

May 01, 2025

Kort Geding Kampen Vs Enexis Probleem Stroomnetaansluiting

May 01, 2025 -

Plan Your Culinary Cruise Windstars Gourmet Experiences

May 01, 2025

Plan Your Culinary Cruise Windstars Gourmet Experiences

May 01, 2025 -

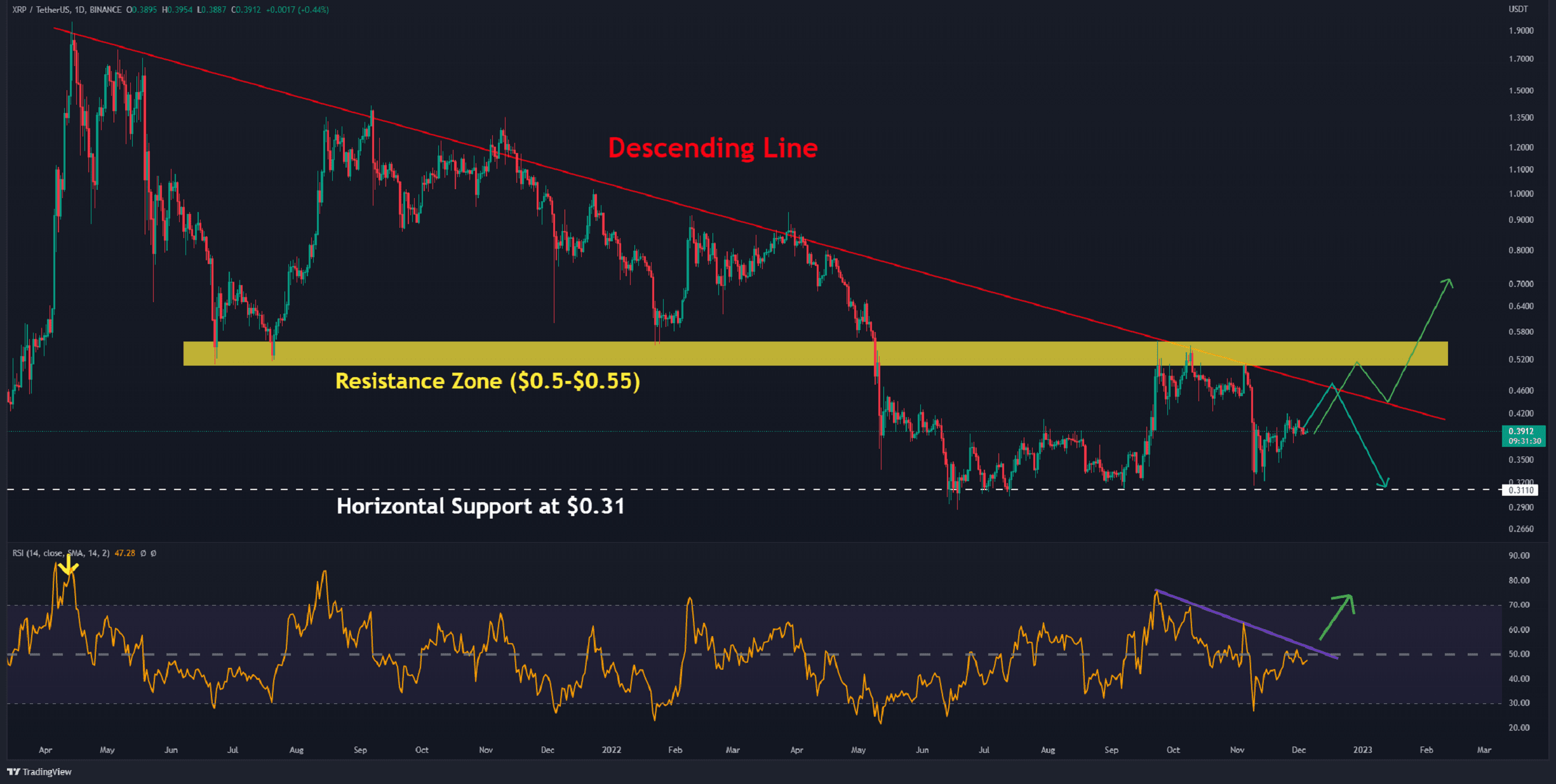

Xrp Price Surge Ripple Sec Case Update And Etf Speculation

May 01, 2025

Xrp Price Surge Ripple Sec Case Update And Etf Speculation

May 01, 2025 -

Farmers And Foragers Owner Selling Historic Charlotte Old Lantern Barn

May 01, 2025

Farmers And Foragers Owner Selling Historic Charlotte Old Lantern Barn

May 01, 2025

Latest Posts

-

Alqdae Yudyn Ryys Shbab Bn Jryr Tfasyl Alhkm Wtdaeyath

May 01, 2025

Alqdae Yudyn Ryys Shbab Bn Jryr Tfasyl Alhkm Wtdaeyath

May 01, 2025 -

Tien Linh Dai Su Tinh Nguyen Binh Duong Hanh Trinh Lan Toa Yeu Thuong

May 01, 2025

Tien Linh Dai Su Tinh Nguyen Binh Duong Hanh Trinh Lan Toa Yeu Thuong

May 01, 2025 -

Passo In Avanti Per La Flaminia Ripescaggio Dalla Quinta Alla Seconda Posizione

May 01, 2025

Passo In Avanti Per La Flaminia Ripescaggio Dalla Quinta Alla Seconda Posizione

May 01, 2025 -

Atff Nin Stuttgart Taki Bueyuek Futbol Altyapi Projesi

May 01, 2025

Atff Nin Stuttgart Taki Bueyuek Futbol Altyapi Projesi

May 01, 2025 -

Almanya Da Futbol Hayali Stuttgart Atff Secmeleriyle Baslayin

May 01, 2025

Almanya Da Futbol Hayali Stuttgart Atff Secmeleriyle Baslayin

May 01, 2025