MicroStrategy Vs. Bitcoin: A Comparative Investment Outlook For 2025

Table of Contents

H2: MicroStrategy's Bitcoin Strategy: A Corporate Play

MicroStrategy's significant Bitcoin holdings have made it a unique entity in the investment world. Understanding their strategy is crucial for anyone considering investing in the company.

H3: Understanding MicroStrategy's Bitcoin Holdings:

MicroStrategy's adoption of Bitcoin as a treasury reserve asset began in August 2020. Their rationale centers on Bitcoin's potential as an inflation hedge and a store of value in a time of increasing monetary expansion. This bold move has significantly impacted their balance sheet.

- Total Bitcoin holdings: (This needs to be updated with current data close to publication). This number fluctuates as MicroStrategy continues to buy and potentially sell Bitcoin.

- Average purchase price: (This needs to be updated with current data close to publication). Tracking the average purchase price is crucial to understanding their overall profit or loss on their Bitcoin holdings.

- Percentage of assets in Bitcoin: (This needs to be updated with current data close to publication). A significant portion of MicroStrategy's assets are tied to Bitcoin, highlighting their commitment to this digital asset.

- Impact on stock price volatility: MicroStrategy's stock price has shown a correlation with Bitcoin's price, indicating increased volatility for investors.

H3: Analyzing MicroStrategy's Stock Performance:

While MicroStrategy's stock price is influenced by Bitcoin's performance, it's not solely dependent on it. Other factors influence its valuation.

- Stock price volatility: Investing in MicroStrategy inherently involves greater volatility than investing in a more diversified company.

- Analyst ratings: Keep an eye on analyst ratings and reports to understand the broader market sentiment towards MicroStrategy.

- Financial performance (excluding Bitcoin): Assess MicroStrategy's core business performance independently of its Bitcoin holdings.

- Impact of regulatory changes: Changes in regulations concerning Bitcoin or publicly traded companies holding cryptocurrencies can significantly impact MicroStrategy's stock price.

H3: Risks and Rewards of Investing in MicroStrategy:

Investing in MicroStrategy offers indirect exposure to Bitcoin, but with inherent risks.

- Potential for high returns: If Bitcoin's price appreciates significantly, MicroStrategy's stock price could follow suit, leading to high returns for investors.

- Risk of company-specific issues overshadowing Bitcoin's performance: Poor financial performance in MicroStrategy's core business could negatively impact the stock price, regardless of Bitcoin's price.

- Regulatory risks: Changes in regulations could negatively impact MicroStrategy's ability to hold or trade Bitcoin.

H2: Bitcoin: The Decentralized Digital Gold

Bitcoin, the first and most established cryptocurrency, holds a unique position in the digital asset landscape.

H3: Bitcoin's Market Position and Adoption:

Bitcoin maintains a dominant market share in the cryptocurrency space, characterized by its robust technology and growing global adoption.

- Market capitalization: (This needs to be updated with current data close to publication). Bitcoin's market cap reflects its overall value and standing in the cryptocurrency market.

- Network effects: The larger Bitcoin's network grows, the more secure and valuable it becomes.

- Institutional adoption: Increased adoption by institutional investors further validates Bitcoin as a legitimate asset class.

- Regulatory landscape (global variations): The regulatory environment surrounding Bitcoin varies across countries, influencing its accessibility and usage.

H3: Bitcoin's Price Volatility and Long-Term Potential:

Bitcoin's price has historically been volatile, but its long-term potential remains a subject of debate.

- Historical price charts: Analyzing past price movements can offer insights, but should not be used for future predictions.

- Factors influencing price volatility: News events, regulatory changes, market sentiment, and halving events all impact Bitcoin's price.

- Predictions for future price movements (with caveats): Predicting future prices is speculative. Any forecasts should be treated with extreme caution.

- Comparison to traditional assets: Comparing Bitcoin's performance to traditional assets like gold can help assess its potential as a store of value.

H3: Risks and Rewards of Direct Bitcoin Investment:

Direct Bitcoin investment offers substantial potential rewards but also significant risks.

- High reward, high risk profile: Bitcoin's price can fluctuate dramatically, resulting in substantial gains or losses.

- Security concerns: Safeguarding Bitcoin requires robust security measures to protect against theft or loss.

- Tax implications: Tax laws surrounding Bitcoin vary by jurisdiction and are complex.

- Regulatory uncertainty: The regulatory landscape for Bitcoin is still evolving and presents uncertainty for investors.

H2: MicroStrategy vs. Bitcoin: A Direct Comparison for 2025

Choosing between MicroStrategy and direct Bitcoin investment depends on individual circumstances.

H3: Risk Tolerance and Investment Goals:

Investors with higher risk tolerance and longer investment horizons may favor direct Bitcoin investment. More risk-averse investors might prefer the indirect exposure offered by MicroStrategy.

H3: Diversification Strategies:

Both MicroStrategy and Bitcoin can be part of a diversified portfolio, but it's crucial to consider asset allocation carefully. Over-exposure to either is risky.

H3: Considering Transaction Costs and Fees:

Trading fees and brokerage commissions vary between investing in MicroStrategy stock and buying and holding Bitcoin. These costs should be factored into your investment decision.

3. Conclusion:

MicroStrategy and Bitcoin present distinct investment avenues. MicroStrategy offers indirect Bitcoin exposure through a publicly traded company, mitigating some risk but introducing company-specific vulnerabilities. Direct Bitcoin investment provides higher potential returns but carries significantly greater risk, demanding a thorough understanding of cryptocurrency markets. In 2025, the best choice depends on your risk tolerance, investment timeline, and broader portfolio strategy. Carefully weigh the risks and rewards of both MicroStrategy and Bitcoin before committing your capital. Conduct thorough research and consider seeking professional financial advice tailored to your individual needs before investing in either MicroStrategy or Bitcoin.

Featured Posts

-

Williams F1 Team Principals Comments On Doohan And Colapinto

May 09, 2025

Williams F1 Team Principals Comments On Doohan And Colapinto

May 09, 2025 -

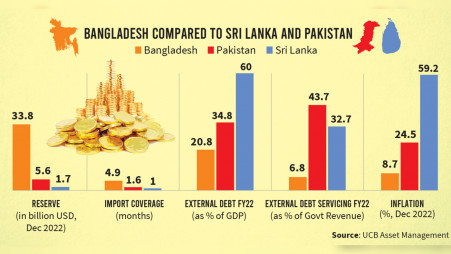

Pakistan Sri Lanka Bangladesh Pledge To Strengthen Capital Market Ties

May 09, 2025

Pakistan Sri Lanka Bangladesh Pledge To Strengthen Capital Market Ties

May 09, 2025 -

Is Jayson Tatums Ankle Injury Serious Celtics Face Uncertainty

May 09, 2025

Is Jayson Tatums Ankle Injury Serious Celtics Face Uncertainty

May 09, 2025 -

Oilers Favored To Win Analyzing Edmontons Chances Against The Kings

May 09, 2025

Oilers Favored To Win Analyzing Edmontons Chances Against The Kings

May 09, 2025 -

Lidery Stran Boykotiruyut Parad V Kieve 9 Maya Starmer Makron Merts Tusk

May 09, 2025

Lidery Stran Boykotiruyut Parad V Kieve 9 Maya Starmer Makron Merts Tusk

May 09, 2025