MicroStrategy's Competitor: Analyzing The Hot New SPAC Stock For Investors.

Table of Contents

Understanding the New Competitor's Business Model

This section will delve into the business model of the unnamed SPAC-backed company (for illustrative purposes, let's call it "DataSpark"). We'll compare it directly to MicroStrategy's established model to highlight key differences and potential advantages.

Core Business Operations:

DataSpark focuses on cloud-based data analytics and visualization, offering a suite of tools designed for large enterprises. Unlike MicroStrategy's broader approach encompassing both business intelligence and significant cryptocurrency holdings, DataSpark's laser focus is on providing advanced analytics capabilities through a subscription-based Software-as-a-Service (SaaS) model.

- Specific features: Real-time data dashboards, predictive analytics, custom reporting, data integration with various sources.

- Target market: Primarily large corporations and government agencies requiring sophisticated data analysis tools.

- Technology used: Leverages cutting-edge cloud technologies like AWS and Azure, employing machine learning algorithms for improved data processing and insights.

- Key differentiators: DataSpark emphasizes intuitive user interfaces, seamless integrations, and strong customer support, aiming to improve user experience compared to MicroStrategy's potentially more complex offerings.

Revenue Streams & Growth Potential:

DataSpark's primary revenue stream is its SaaS subscription model, offering tiered pricing based on usage and features. This recurring revenue model offers greater predictability than MicroStrategy's revenue stream, which is subject to fluctuations in both software sales and Bitcoin prices.

- Subscription models: Various tiers cater to different customer needs and budgets, allowing for scalable growth.

- One-time sales: Potential for one-time sales of specialized consulting services and custom integrations.

- Potential for expansion into new markets: DataSpark could expand into adjacent markets like IoT data analytics and AI-powered business solutions.

Technology & Innovation:

DataSpark invests heavily in Research & Development (R&D), focusing on AI-powered analytics and the integration of machine learning into its core platform.

- AI capabilities: Utilizes AI to automate data analysis tasks, identify patterns, and provide actionable insights.

- Machine learning integration: Employs machine learning algorithms for predictive modelling and improved forecasting accuracy.

- Proprietary algorithms: Development of proprietary algorithms for data processing and visualization that are faster and more efficient than competitors.

- Use of cloud services: Leverages leading cloud providers for scalability, reliability, and cost efficiency.

Competitive Analysis: MicroStrategy vs. the SPAC Stock (DataSpark)

This section directly compares MicroStrategy and DataSpark, highlighting their strengths and weaknesses to assess DataSpark's potential to challenge MicroStrategy's market position.

Market Share & Positioning:

MicroStrategy holds a significant share in the enterprise business intelligence market, but DataSpark aims to carve out a niche by focusing on cloud-based analytics and leveraging advanced AI capabilities.

- Specific market segments: DataSpark targets large enterprises needing real-time, cloud-based analytics, a segment showing rapid growth.

- Customer acquisition strategies: DataSpark employs targeted marketing campaigns and strategic partnerships to reach its target audience.

- Brand recognition: MicroStrategy enjoys higher brand recognition, but DataSpark aims to build its brand through successful product delivery and customer testimonials.

Financial Performance Comparison:

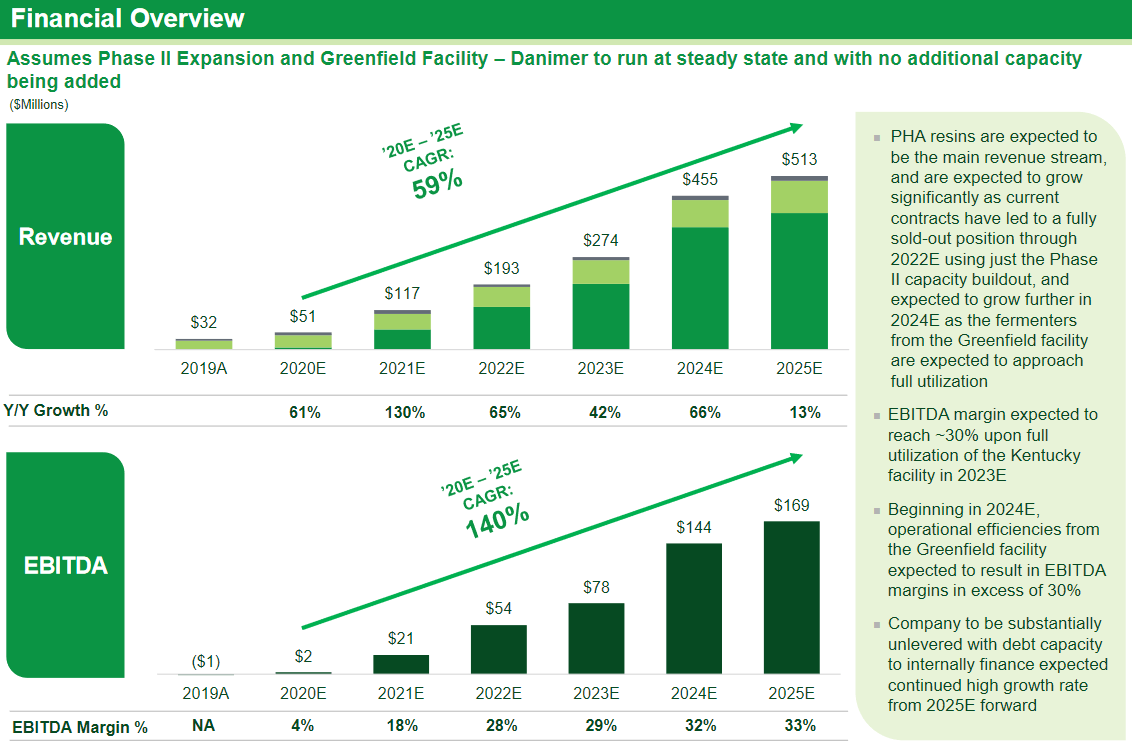

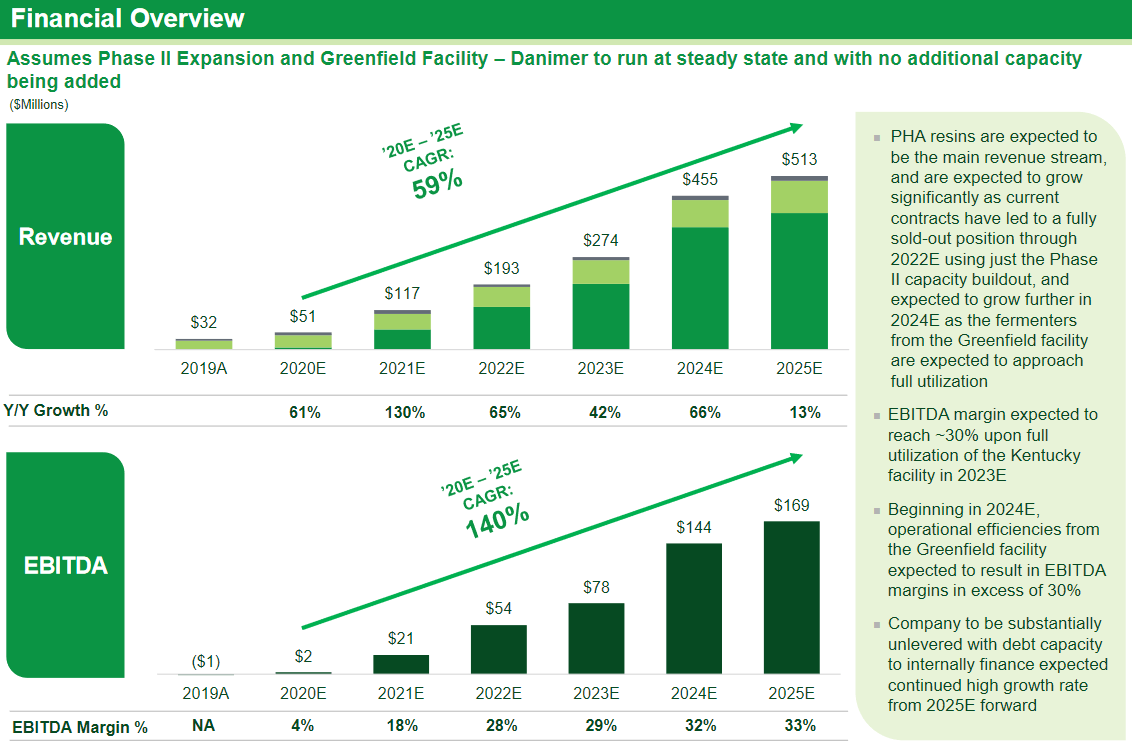

While precise financial comparisons require access to DataSpark's pre-merger financials and post-merger performance, we can use available information to assess potential trends. (Note: Hypothetical data would be included here in a real-world analysis using charts and graphs).

- Revenue growth: DataSpark projects strong revenue growth based on its subscription model and market demand.

- Profit margins: DataSpark aims for higher profit margins than MicroStrategy by utilizing a cloud-based infrastructure.

- Return on investment (ROI): Potential for high ROI for early investors depending on market acceptance and execution.

- Debt-to-equity ratio: This needs to be analyzed in DataSpark's financials upon merger completion.

Management Team & Expertise:

The experience and expertise of DataSpark's management team will be crucial for its success. A strong track record in data analytics and cloud computing is essential. (Again, specific information about the management team would be included here in a real-world article).

- Experience in the industry: A strong leadership team with deep experience is essential for navigating the competitive market.

- Track record of success: Demonstrated success in previous ventures is crucial for investor confidence.

- Key hires: Experienced hires in sales, marketing, and engineering will be pivotal.

Risk Assessment of the SPAC Stock Investment

Investing in SPACs comes with inherent risks, and DataSpark is no exception. Let’s analyze the key risk factors.

SPAC-Specific Risks:

SPAC mergers often face delays, and there's always a risk the merger might fail entirely. Furthermore, dilution of existing shares can occur, impacting investor returns.

- Merger failure: The deal might not close, resulting in the return of investor capital.

- Lack of transparency before merger: Limited information is typically available before the merger, increasing uncertainty.

- Potential for stock price volatility: SPAC stocks are often highly volatile, leading to significant price swings.

Market Competition & Disruption:

DataSpark faces competition from established players like MicroStrategy and emerging startups in the data analytics space.

- New technologies: Rapid technological advancements can quickly render existing technologies obsolete.

- Changing market trends: Shifts in market demand or preferences can impact the company's growth trajectory.

- Regulatory changes: New regulations could impose significant costs and operational challenges.

Financial & Operational Risks:

DataSpark, like any young company, faces financial and operational risks.

- Dependence on key clients: Losing a major client could severely impact revenue.

- Potential for litigation: Legal disputes can lead to significant financial liabilities.

- Supply chain disruptions: Disruptions in the supply chain can affect the delivery of services.

Conclusion:

This analysis of the hot new SPAC stock (DataSpark) competing with MicroStrategy reveals both substantial opportunities and significant challenges. While DataSpark possesses a promising business model and innovative technology, investing in SPACs carries inherent risks that require careful consideration. Investors should conduct thorough due diligence, analyzing the SPAC's financial statements, business plan, and management team before making any investment decision. Remember to assess your personal risk tolerance before investing in this or any other MicroStrategy competitor. Further research into this new player in the data analytics market is essential to making an informed investment decision about this potentially lucrative yet risky SPAC investment opportunity.

Featured Posts

-

Municipales Dijon 2026 L Ecologie Au C Ur Du Scrutin

May 09, 2025

Municipales Dijon 2026 L Ecologie Au C Ur Du Scrutin

May 09, 2025 -

Wall Streets 110 Prediction Why Billionaires Are Investing In This Black Rock Etf

May 09, 2025

Wall Streets 110 Prediction Why Billionaires Are Investing In This Black Rock Etf

May 09, 2025 -

Snls Harry Styles Impression His Disappointed Response

May 09, 2025

Snls Harry Styles Impression His Disappointed Response

May 09, 2025 -

Trump Appoints Jeanine Pirro As Dcs Top Prosecutor A Fox News Connection

May 09, 2025

Trump Appoints Jeanine Pirro As Dcs Top Prosecutor A Fox News Connection

May 09, 2025 -

Woman 23 Claims To Be Madeleine Mc Cann Dna Test Results Unveiled

May 09, 2025

Woman 23 Claims To Be Madeleine Mc Cann Dna Test Results Unveiled

May 09, 2025