Minority Government: Potential Implications For The CAD

Table of Contents

Increased Political Uncertainty and Volatility

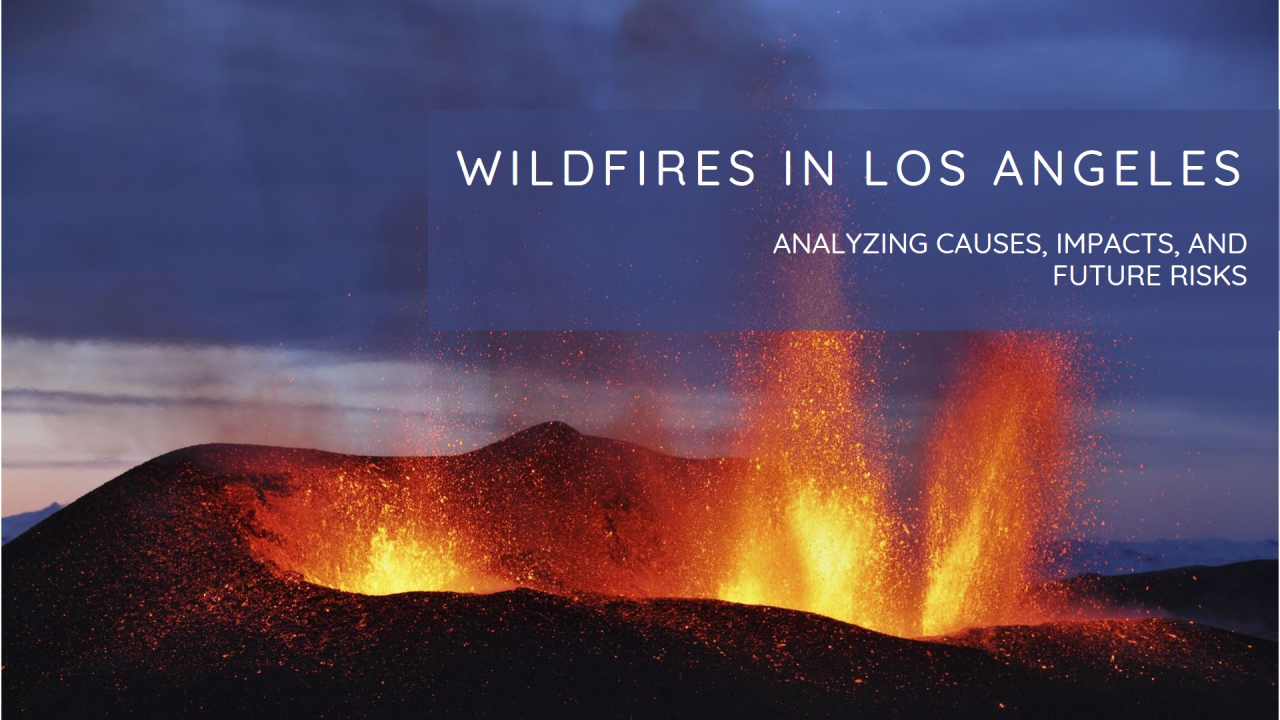

A minority government often leads to greater political instability and unpredictability. The reliance on opposition support for the passage of legislation creates an inherently fragile political environment. This inherent instability directly impacts investor confidence and the stability of the CAD.

- Frequent snap elections: The threat of snap elections is ever-present, injecting significant uncertainty into the markets. Investors hesitate to commit capital in such an unpredictable climate.

- Difficulty passing key economic legislation: Passing budgets and crucial economic legislation becomes a drawn-out and challenging process, potentially delaying or derailing important economic initiatives. This lack of decisive action can harm long-term economic growth prospects.

- Policy gridlock: Disagreements between the governing party and opposition parties can lead to policy gridlock, hindering progress on essential economic reforms and impacting investor sentiment negatively.

- Increased CAD exchange rate volatility: The heightened uncertainty surrounding a minority government directly translates into increased volatility in the CAD exchange rate. This makes it more difficult for businesses to plan and invest.

Historically, minority governments in Canada have demonstrated a correlation between political instability and market uncertainty. Credit rating agencies closely monitor the situation, potentially issuing downgrades if the government's ability to manage the economy effectively is called into question. This, in turn, can further weaken the CAD.

Impact on Fiscal Policy and Government Spending

Minority governments often face constraints on their fiscal policy options. The need for compromise and consensus-building with opposition parties can significantly limit the scope of government spending and economic initiatives.

- Reduced government spending: Ambitious infrastructure projects and other significant government spending programs might face delays or reductions in funding due to the need for negotiation and compromise.

- Delays or cancellations of economic initiatives: Key economic policies and initiatives may experience delays or even cancellations as a result of political deadlock. This uncertainty hampers investment and economic growth.

- Difficulty implementing tax reforms: Implementing substantial tax reforms or changes to major social programs becomes significantly more challenging in a minority government setting, creating uncertainty for businesses and consumers.

- Impact on budget deficits and government debt: The limitations on fiscal maneuvering may affect the government's ability to control budget deficits and manage its debt levels, potentially impacting investor confidence and the CAD's value.

Different fiscal policies implemented by a minority government can have varying effects on the CAD. For instance, expansionary fiscal policies aimed at stimulating the economy could lead to inflation, potentially weakening the CAD. Conversely, austerity measures could increase investor confidence, strengthening the CAD but potentially hindering economic growth.

Influence on Monetary Policy and the Bank of Canada

While the Bank of Canada operates independently, a minority government’s actions can indirectly influence monetary policy. The political climate can impact the Bank of Canada's ability to make independent decisions based solely on economic indicators.

- Political pressure on interest rate decisions: A minority government might face pressure to influence the Bank of Canada's interest rate decisions, potentially compromising its independence.

- Conflicts between fiscal and monetary policy: Disagreements between the government's fiscal policies and the Bank of Canada's monetary policy objectives can create inconsistencies and market uncertainty.

- Uncertainty regarding inflation targets: Political instability could affect the long-term commitment to inflation targets, leading to further uncertainty in the markets.

- Impact on investor expectations: The overall uncertainty regarding the government's economic management can negatively affect investor expectations and consequently, the CAD's exchange rate.

The relationship between government stability and central bank independence is crucial. Political interference in monetary policy can severely undermine investor confidence, leading to a weakened CAD and increased volatility.

Effects on Foreign Investment and Trade

Political instability inherent in a minority government can significantly deter foreign investment and negatively impact Canada's trade relations. The uncertainty surrounding the government's policies and its longevity can make Canada a less attractive investment destination.

- Reduced investor confidence: International investors are often hesitant to commit significant capital in a politically unstable environment. This lack of confidence negatively affects investment flows.

- Potential for capital flight: Uncertainty can lead to capital flight, as investors seek safer havens for their money, further weakening the CAD.

- Uncertainties surrounding trade agreements: Negotiating and maintaining trade agreements becomes more complex and unpredictable under a minority government, potentially harming export-oriented industries.

- Weakening of the CAD: Reduced foreign investment and increased uncertainty invariably contribute to a weaker CAD.

Investor confidence is paramount for a strong CAD. Historical examples clearly demonstrate how political uncertainty has negatively impacted foreign investment in Canada, resulting in a weaker currency and slower economic growth.

Conclusion

The implications of a minority government for the Canadian dollar (CAD) are complex and multifaceted. While a minority government might lead to increased political volatility and potentially impact fiscal and monetary policies, the ultimate effects on the CAD will depend on several factors, including the government's ability to maintain a degree of stability and the overall global economic climate. Understanding these potential impacts is crucial for investors and businesses navigating the Canadian economic landscape. Therefore, continued monitoring of the political situation and its impact on economic policy is vital for effectively managing risk and opportunity within the context of a minority government and its potential effects on the CAD. Stay informed about the evolving political dynamics and their implications for the minority government and the CAD.

Featured Posts

-

Cleveland Cavaliers Assessing The Week 16 Trade And Its Implications

May 01, 2025

Cleveland Cavaliers Assessing The Week 16 Trade And Its Implications

May 01, 2025 -

Bbcs Dragons Den Airs Old Episode Leaving Viewers Bewildered

May 01, 2025

Bbcs Dragons Den Airs Old Episode Leaving Viewers Bewildered

May 01, 2025 -

Betting On Tragedy Analyzing The Los Angeles Wildfires And The Implications Of Disaster Gambling

May 01, 2025

Betting On Tragedy Analyzing The Los Angeles Wildfires And The Implications Of Disaster Gambling

May 01, 2025 -

Will A Minority Government Weaken The Canadian Dollar

May 01, 2025

Will A Minority Government Weaken The Canadian Dollar

May 01, 2025 -

Mercedes Mones Plea To Momo Watanabe Tbs Championship In Jeopardy

May 01, 2025

Mercedes Mones Plea To Momo Watanabe Tbs Championship In Jeopardy

May 01, 2025

Latest Posts

-

Unlock 150 With Bet Mgm Bonus Code Rotobg 150 Nba Playoffs Betting

May 01, 2025

Unlock 150 With Bet Mgm Bonus Code Rotobg 150 Nba Playoffs Betting

May 01, 2025 -

Nba Skills Challenge 2025 Understanding The Rules And Tiebreaker Procedures

May 01, 2025

Nba Skills Challenge 2025 Understanding The Rules And Tiebreaker Procedures

May 01, 2025 -

Nba Skills Challenge 2025 Players Teams And Competition Details

May 01, 2025

Nba Skills Challenge 2025 Players Teams And Competition Details

May 01, 2025 -

Cleveland Cavaliers Assessing The Week 16 Trade And Its Implications

May 01, 2025

Cleveland Cavaliers Assessing The Week 16 Trade And Its Implications

May 01, 2025 -

Cleveland Cavaliers Week 16 Big Trade Much Needed Break

May 01, 2025

Cleveland Cavaliers Week 16 Big Trade Much Needed Break

May 01, 2025