Moody's 30-Year Yield At 5%: Is 'Sell America' Back?

Table of Contents

H2: The Significance of the 5% 30-Year Treasury Yield

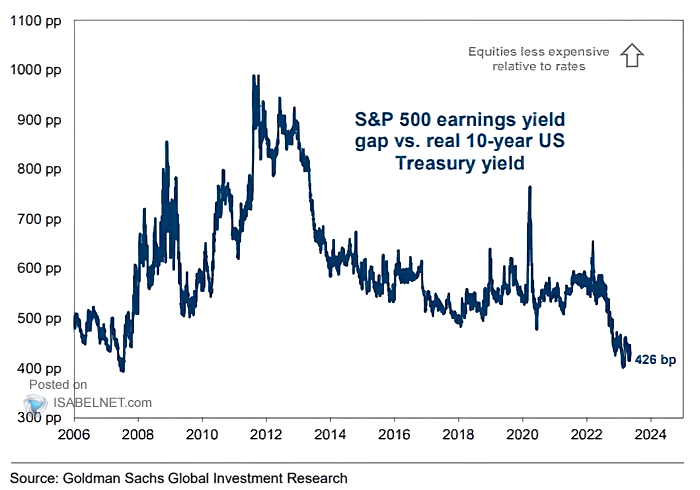

A 5% 30-year Treasury yield is a noteworthy event. Historically, such high yields have often coincided with periods of economic uncertainty and inflation. Reaching this level signals a significant increase in borrowing costs for both the government and businesses. This impacts various aspects of the US economy:

- Increased cost of infrastructure projects: Higher interest rates make financing large-scale infrastructure projects, crucial for long-term economic growth, considerably more expensive. This could lead to delays or cancellations of vital initiatives.

- Higher mortgage rates impacting housing market: The increase in the 30-year Treasury yield directly influences mortgage rates, making homeownership less accessible and potentially cooling down the already slowing housing market.

- Reduced corporate investment due to higher borrowing costs: Businesses will be less inclined to invest in expansion or new projects when the cost of borrowing is elevated, impacting job creation and economic growth.

- Potential impact on the national debt: The US government faces increased costs in servicing its massive national debt, potentially leading to further fiscal challenges. Managing the national debt becomes significantly harder with elevated interest rates, impacting future government spending.

H2: Understanding the "Sell America" Narrative

The "Sell America" narrative describes a scenario where investors lose confidence in the US economy and begin divesting from US assets, leading to capital flight to other markets. Historically, this sentiment has been fueled by economic crises, political instability, or concerns about the long-term sustainability of US debt. Factors currently contributing to this sentiment include:

-

Economic uncertainty and global competition: The global economic landscape is increasingly complex, with geopolitical tensions and rising competition from emerging economies putting pressure on the US economy.

-

Concerns about US debt and fiscal policy: The ever-growing national debt and concerns about the sustainability of US fiscal policy contribute to investor apprehension. This is especially true when considering the implications of the high 30-year Treasury yield on debt servicing.

-

Geopolitical risks: Global instability and geopolitical risks further exacerbate the anxieties surrounding the US economy and increase the appeal of alternative investment destinations.

-

Bullet Points:

- Capital flight to other markets: Investors may shift their investments towards perceived safer havens like government bonds in more stable economies.

- Decline in US asset valuations: Reduced investor confidence can lead to a decrease in the value of US assets, including stocks and real estate.

- Weakening of the US dollar: A loss of confidence in the US economy can negatively impact the value of the US dollar.

H3: Is the Current Situation Justifying "Sell America"?

While the 5% 30-year Treasury yield is a significant development, it's premature to definitively conclude that a full-blown "Sell America" scenario is underway. While concerns are valid, there are counterarguments:

- Strengths of the US economy (e.g., innovation, consumer spending): The US economy continues to demonstrate resilience in certain sectors, driven by innovation and consumer spending.

- Potential for future economic growth: The long-term potential of the US economy, fueled by technological advancements and a large consumer market, remains a key factor influencing investment decisions. This potential counteracts the negative implications of a high 30-year Treasury yield.

- International investment in the US market: Despite the challenges, the US continues to attract significant foreign investment, demonstrating continued faith in the long-term potential of the US economy. Global investors see long-term opportunities.

H2: Alternative Interpretations of the 5% Yield

The 5% yield doesn't solely reflect a "Sell America" sentiment. Other factors are at play:

- Inflationary pressures and Federal Reserve policy: The primary driver behind the rising yield is likely the Federal Reserve's efforts to combat inflation through interest rate hikes. This is a necessary, albeit painful, measure.

- Global economic slowdown: A global economic slowdown can increase demand for safe-haven assets like US Treasury bonds, pushing yields higher. This is independent of investor sentiment towards the US economy itself.

- Increased demand for safe haven assets: In times of global uncertainty, investors often flock to US Treasuries, considered a safe haven asset, increasing demand and pushing yields higher.

3. Conclusion:

The Moody's 30-year yield at 5% is a significant development with far-reaching implications for the US economy. While concerns about a "Sell America" scenario are understandable given the high yield and the current economic climate, it's too early to declare a full-blown crisis. The increase is likely a complex interplay of inflationary pressures, Federal Reserve policy, and global economic uncertainty, rather than solely a reflection of a loss of confidence in the US economy. The long-term potential of the US remains a significant factor.

However, staying informed about economic developments and understanding the implications of the Moody's 30-year yield at 5% is crucial for making informed financial decisions. Continue researching interest rate forecasting, global economic trends, and the potential implications of this high yield on various asset classes. Understanding the evolving dynamics of the 30-year Treasury yield will help you navigate the complexities of the current market.

Featured Posts

-

Live Tv Chaos Bbc Breakfast Guest Interrupts Broadcast

May 21, 2025

Live Tv Chaos Bbc Breakfast Guest Interrupts Broadcast

May 21, 2025 -

Lack Of Funds Holding Me Back Overcoming Financial Barriers

May 21, 2025

Lack Of Funds Holding Me Back Overcoming Financial Barriers

May 21, 2025 -

How To Watch Peppa Pig Cartoons Online Free Streaming Services

May 21, 2025

How To Watch Peppa Pig Cartoons Online Free Streaming Services

May 21, 2025 -

Flavio Cobollis Triumph Bucharest Tiriac Open Win

May 21, 2025

Flavio Cobollis Triumph Bucharest Tiriac Open Win

May 21, 2025 -

Appeal Rejected Councillors Wifes Social Media Post On Migrants After Southport Attack

May 21, 2025

Appeal Rejected Councillors Wifes Social Media Post On Migrants After Southport Attack

May 21, 2025

Latest Posts

-

Investigating The Reasons Behind D Wave Quantum Qbts S Stock Fall On Monday

May 21, 2025

Investigating The Reasons Behind D Wave Quantum Qbts S Stock Fall On Monday

May 21, 2025 -

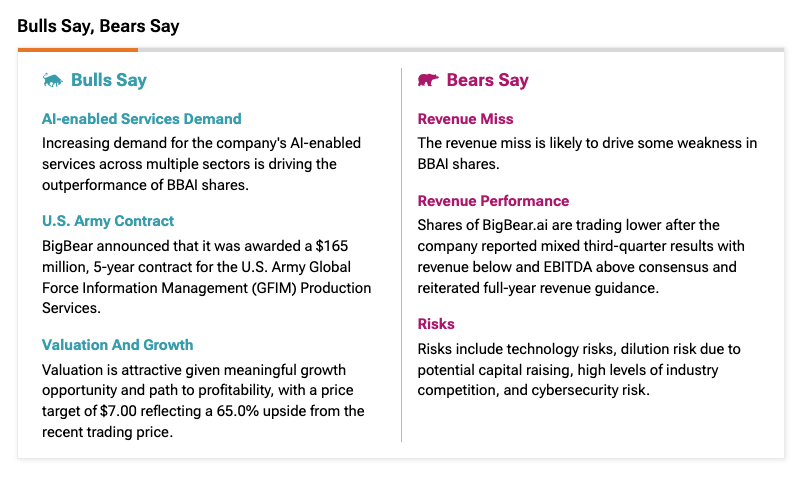

Bbai Investment Outlook Buy Rating Holds Despite Market Volatility

May 21, 2025

Bbai Investment Outlook Buy Rating Holds Despite Market Volatility

May 21, 2025 -

The D Wave Quantum Qbts Stock Market Movement On Monday A Comprehensive Review

May 21, 2025

The D Wave Quantum Qbts Stock Market Movement On Monday A Comprehensive Review

May 21, 2025 -

Big Bear Ai Bbai Defense Sector Investment Boosts Buy Rating

May 21, 2025

Big Bear Ai Bbai Defense Sector Investment Boosts Buy Rating

May 21, 2025 -

Understanding The Big Bear Ai Bbai Stock Drop Revenue And Leadership Issues

May 21, 2025

Understanding The Big Bear Ai Bbai Stock Drop Revenue And Leadership Issues

May 21, 2025