Moody's Downgrade Of US Debt: Criticism Mounts From The White House

Table of Contents

Moody's Rationale Behind the Downgrade

Moody's Investors Service cited a confluence of factors in its decision to downgrade the US government's credit rating from AAA to Aa1. Their official statement highlighted a deteriorating fiscal strength trajectory over the next few years, driven by increasing challenges to the government's fiscal strength.

-

Fiscal challenges facing the US government: The US faces significant fiscal challenges, including persistently high levels of debt, a growing budget deficit, and ongoing political gridlock hindering the implementation of effective long-term fiscal solutions. The looming debt ceiling crisis further exacerbated these concerns. The high debt-to-GDP ratio is a major factor contributing to the downgrade. The US government’s debt is substantial and continues to grow.

-

Erosion of governance strength: Moody's pointed to the repeated debt ceiling standoffs and the erosion of the government's ability to manage its finances effectively as significant factors. The lack of bipartisan agreement on fiscal policy, leading to near-defaults, underscores a weakening of governance strength.

-

Potential for further deterioration of US fiscal strength: The rating agency expressed concerns that the trajectory of fiscal strength will continue to deteriorate over the next few years, unless significant policy changes are enacted. The projected growth of entitlement spending and the aging population add to this concern.

-

Comparison to other countries with similar ratings: Moody's likely compared the US fiscal situation to other countries with similar ratings, highlighting the US's relative weakening in comparison. This comparative analysis provides context for the downgrade decision.

-

Impact of the downgrade on US Treasury yields: The downgrade is expected to increase borrowing costs for the US government, potentially leading to higher interest rates on US Treasury bonds. This will impact the cost of servicing the national debt.

The White House's Fierce Rebuttal

The White House vehemently rejected Moody's assessment, issuing a statement criticizing the rating agency's methodology and emphasizing the underlying strength of the US economy.

-

Specific criticisms leveled against Moody's methodology: The White House questioned the methodology used by Moody's, arguing that it did not adequately reflect the resilience of the US economy and its capacity to manage its debt. They argued the assessment was short-sighted.

-

Arguments emphasizing the strength of the US economy: Administration officials pointed to positive economic indicators, such as low unemployment and robust job growth, to counter Moody's negative assessment. This focus highlighted the positive aspects of the current economic performance.

-

Highlight of positive economic indicators to counter the downgrade: The administration emphasized the strength of the US economy, citing strong job growth and low unemployment as indicators of economic health not fully considered by Moody's.

-

Political implications and potential blame-shifting: The political implications of the downgrade are significant. The White House may attempt to shift blame to the opposing party for the fiscal challenges faced by the country.

-

Mention of any planned countermeasures or legislative responses: The administration may announce plans to address the fiscal issues raised by Moody's, potentially through legislative initiatives to improve fiscal responsibility and strengthen the economy.

Economic Implications of the Downgrade

The Moody's downgrade of US debt carries significant economic implications, both domestically and internationally.

-

Increased borrowing costs for the US government: The downgrade will likely increase borrowing costs for the US government, making it more expensive to finance the national debt. This increases the burden on taxpayers.

-

Impact on investor confidence and market volatility: The downgrade could negatively impact investor confidence, leading to increased market volatility and potentially lower investment in US assets. A decrease in investor confidence could negatively affect the economy.

-

Potential effects on the dollar's exchange rate: The downgrade could weaken the US dollar's exchange rate, impacting international trade and increasing the cost of imports. The value of the dollar in relation to other currencies is affected.

-

Implications for future government spending and programs: The increased borrowing costs could force the government to make difficult choices regarding future government spending and programs. It could lead to cuts in spending or increased taxes.

-

Ripple effects on global financial markets and international relations: The downgrade will likely have ripple effects on global financial markets and international relations, potentially affecting global economic stability. The impact extends beyond US borders.

Impact on Interest Rates and Inflation

The Moody's downgrade is expected to impact interest rates and inflation, albeit indirectly.

-

Explain how the downgrade could affect borrowing costs for consumers and businesses: Higher government borrowing costs may translate into higher interest rates for consumers and businesses, making borrowing more expensive and potentially slowing economic growth. This affects consumer and business loans.

-

Discuss the potential impact on inflation, considering the increased cost of government borrowing: The increased cost of government borrowing could contribute to inflationary pressures. Government spending and inflation are connected.

-

Analyze potential Federal Reserve responses to mitigate the economic fallout: The Federal Reserve may respond to the downgrade by adjusting its monetary policy to mitigate the potential negative effects on the economy, potentially through interest rate adjustments. The Fed’s response is crucial in managing the economic impact.

Conclusion

The Moody's downgrade of US debt marks a significant moment in US economic history. The White House's strong criticism highlights the political sensitivity of the issue, while the potential economic consequences are far-reaching. Understanding the implications of this Moody's downgrade US debt is crucial. Increased borrowing costs, potential inflation, and decreased investor confidence all pose challenges. The ripple effects on global markets and international relations add to the complexity of this situation. Staying informed about further developments concerning the Moody's downgrade US debt and its impact on the economy is paramount. Follow reputable news sources and economic analysis to navigate the uncertain economic landscape ahead. Understanding the intricacies of this US debt downgrade and its implications is crucial for making informed decisions.

Featured Posts

-

Ego Nwodims Controversial Snl Weekend Update Bowen Yangs Response

May 18, 2025

Ego Nwodims Controversial Snl Weekend Update Bowen Yangs Response

May 18, 2025 -

Dutch Public Favors Avoiding Trade War Escalation With Us Over Tariffs

May 18, 2025

Dutch Public Favors Avoiding Trade War Escalation With Us Over Tariffs

May 18, 2025 -

Gridlock On Capitol Hill Gop Tax Bill Snagged By Conservative Demands

May 18, 2025

Gridlock On Capitol Hill Gop Tax Bill Snagged By Conservative Demands

May 18, 2025 -

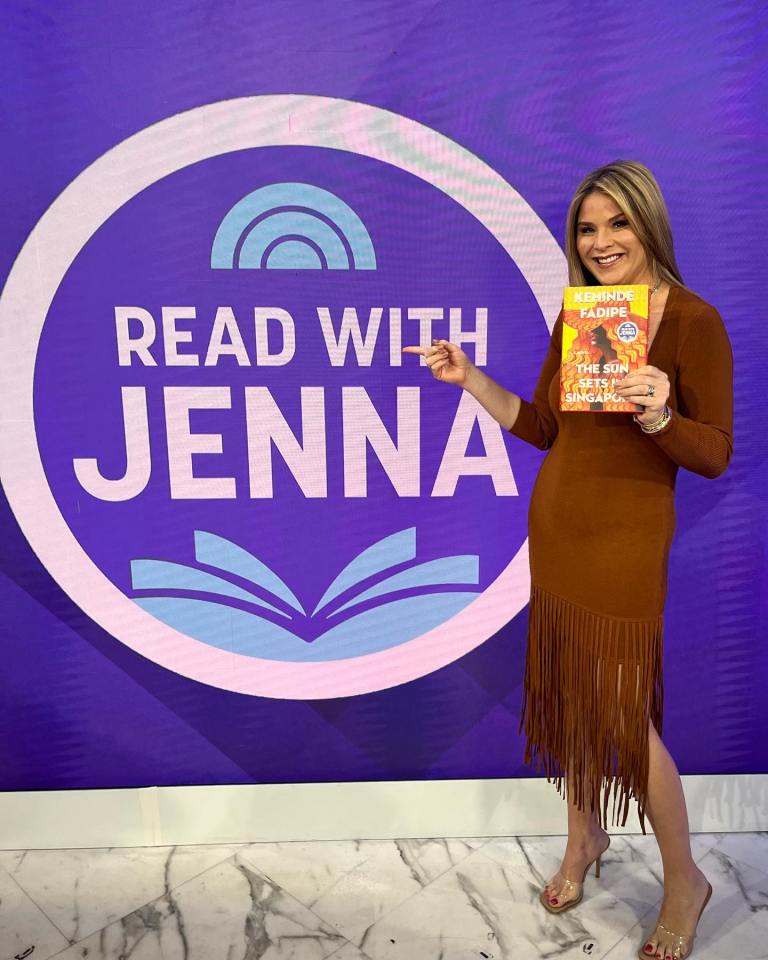

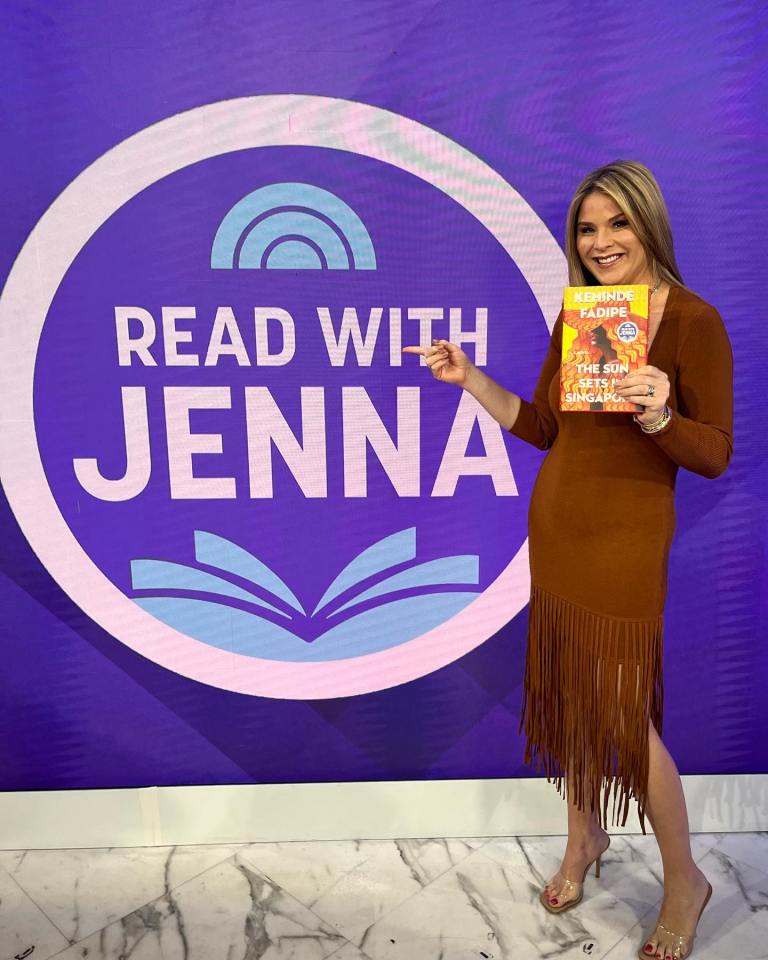

Persistent Today Show Segment Featuring Jenna Bush Hager Sparks Viewer Debate

May 18, 2025

Persistent Today Show Segment Featuring Jenna Bush Hager Sparks Viewer Debate

May 18, 2025 -

Identifying And Analyzing The Countrys Fastest Growing Business Areas

May 18, 2025

Identifying And Analyzing The Countrys Fastest Growing Business Areas

May 18, 2025

Latest Posts

-

Following Split Claims Kanye West And Bianca Censori Dine In Spain

May 18, 2025

Following Split Claims Kanye West And Bianca Censori Dine In Spain

May 18, 2025 -

Kanye West Bianca Censoris Spanish Dinner Date Amidst Relationship Speculation

May 18, 2025

Kanye West Bianca Censoris Spanish Dinner Date Amidst Relationship Speculation

May 18, 2025 -

Kanye West And Bianca Censori A Spanish Restaurant Reunion

May 18, 2025

Kanye West And Bianca Censori A Spanish Restaurant Reunion

May 18, 2025 -

Persistent Today Show Segment Featuring Jenna Bush Hager Sparks Viewer Debate

May 18, 2025

Persistent Today Show Segment Featuring Jenna Bush Hager Sparks Viewer Debate

May 18, 2025 -

Instruktsiya Kane Uesta K Sobstvennym Pokhoronam Vdokhnovenie Ot Pashi Tekhnikom

May 18, 2025

Instruktsiya Kane Uesta K Sobstvennym Pokhoronam Vdokhnovenie Ot Pashi Tekhnikom

May 18, 2025