National Average Gas Price Jumps By 20 Cents

Table of Contents

Reasons Behind the 20-Cent Surge in Gas Prices

Several factors contribute to this substantial increase in gasoline prices. Understanding these underlying causes is crucial to comprehending the current situation and anticipating future trends in fuel prices.

-

Increased Crude Oil Prices: A major driver of the 20-cent surge is the recent increase in crude oil prices. OPEC+ production cuts, coupled with geopolitical instability in several oil-producing regions, have significantly reduced the global supply of crude oil, pushing prices higher. This directly impacts the cost of gasoline, as crude oil is the primary raw material.

-

Reduced Refinery Capacity: Lower refinery capacity in the United States is exacerbating the situation. Planned and unplanned maintenance at several refineries has reduced the amount of gasoline being produced, further tightening the supply and driving up prices at the pump. This reduced output directly contributes to the higher gasoline prices consumers are facing.

-

Unexpectedly High Gasoline Demand: The summer travel season, combined with a stronger-than-expected economic recovery, has led to unexpectedly high gasoline demand. This increased demand, coupled with the reduced supply discussed above, creates a perfect storm for higher prices at the pump. This surge in demand puts upward pressure on fuel prices.

-

Ongoing Supply Chain Disruptions: Lingering supply chain disruptions continue to impact the transportation and distribution of gasoline, adding to the overall cost. Increased transportation costs are passed on to consumers, adding to the price at the pump. These disruptions affect the entire supply chain, impacting prices throughout.

-

Seasonal Factors: The shift to summer-blend gasoline, which is more expensive to produce, also plays a role in the price increase. These seasonal changes in fuel formulations can contribute to the price fluctuations observed each year.

Impact on Consumers and the Economy

The 20-cent jump in the national average gas price has significant ramifications for both consumers and the broader economy. The ripple effects are widespread and potentially far-reaching.

-

Increased Transportation Costs: Higher fuel prices directly translate to increased transportation costs for commuters and businesses. This can impact everything from daily commutes to the cost of transporting goods, potentially leading to higher prices for consumers.

-

Reduced Consumer Spending: With more of their disposable income allocated to filling up their gas tanks, consumers are likely to reduce spending on other goods and services. This decreased consumer spending can negatively impact economic growth.

-

Potential Impact on Inflation: The rising cost of gas can contribute to overall inflation, potentially eroding purchasing power further. Inflationary pressures are amplified by the increase in fuel prices, impacting the overall cost of living.

-

Strain on Household Budgets: The increased cost of gas places a strain on household budgets, particularly for lower-income families who spend a larger proportion of their income on transportation. This can force families to make difficult choices regarding other essential expenses.

-

Ripple Effects Across Sectors: The impact of higher gas prices extends beyond individual consumers. Businesses, especially those in transportation and logistics, will face increased operating costs, potentially impacting prices across various sectors of the economy.

Potential Future Trends and Predictions

Predicting future gas prices with certainty is challenging, but several factors could influence the trend in the coming months and years.

-

Gas Price Forecast: Industry experts offer varying short-term and long-term gas price predictions. Some predict further increases, citing ongoing geopolitical uncertainty and potential supply disruptions. Others foresee a potential stabilization or even slight decrease, depending on factors such as crude oil prices and global demand.

-

Oil Price Outlook: The outlook for crude oil prices remains a key determinant of future gasoline prices. Geopolitical events, OPEC+ policy decisions, and unexpected supply disruptions will significantly impact oil prices and subsequently the price of gasoline.

-

Future Gas Prices: Several variables will influence future gas prices including weather events (hurricanes impacting refineries), changes in government regulations, and potential economic slowdowns or growth spurts that affect demand.

-

Mitigating the Impact: Consumers can mitigate the impact of high gas prices by driving less, carpooling, choosing fuel-efficient vehicles, and comparing prices at different gas stations.

Conclusion

The 20-cent jump in the national average gas price represents a significant challenge for consumers and the economy. The confluence of increased crude oil prices, reduced refinery capacity, high demand, and ongoing supply chain disruptions has created a perfect storm for higher fuel costs. The impact on household budgets and the broader economy is substantial, and the potential for further price increases remains a significant concern. The future trajectory of gas prices depends on several interconnected factors, demanding close monitoring of these trends.

The 20-cent jump in the national average gas price underscores the importance of staying informed about fuel price trends. Keep monitoring gas price fluctuations by regularly checking reputable sources like AAA and GasBuddy to budget effectively and plan your travel accordingly. Understanding the factors driving these changes is crucial in navigating the rising cost of gas.

Featured Posts

-

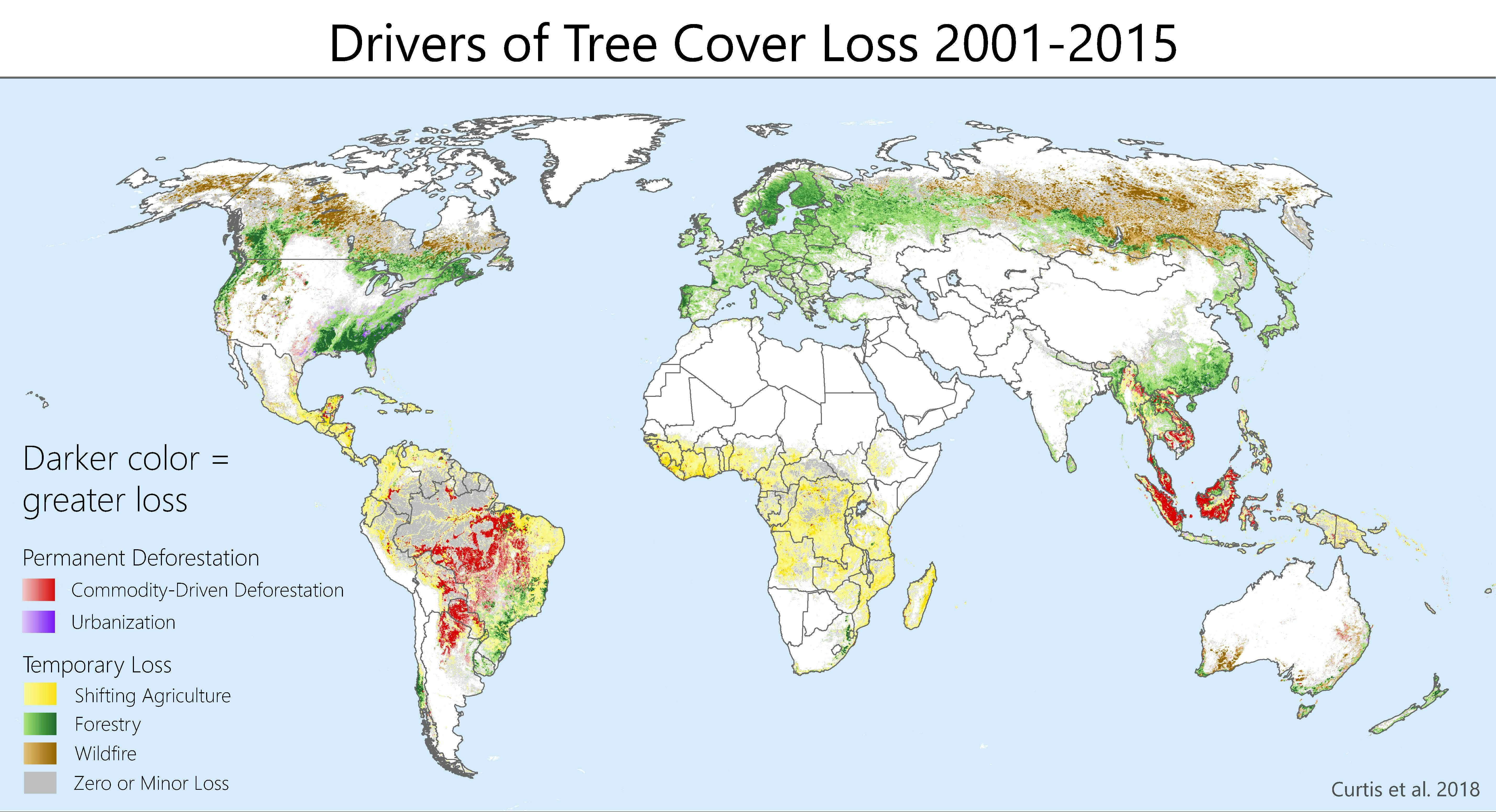

Unprecedented Global Forest Loss The Impact Of Wildfires

May 22, 2025

Unprecedented Global Forest Loss The Impact Of Wildfires

May 22, 2025 -

Original Sins Ending A Re Evaluation Of Dexters Debra Morgan Handling

May 22, 2025

Original Sins Ending A Re Evaluation Of Dexters Debra Morgan Handling

May 22, 2025 -

Catch Vapors Of Morphine In Northcote

May 22, 2025

Catch Vapors Of Morphine In Northcote

May 22, 2025 -

Trinidad Defence Minister Weighs Age Limit And Song Ban For Kartel Concert

May 22, 2025

Trinidad Defence Minister Weighs Age Limit And Song Ban For Kartel Concert

May 22, 2025 -

Steelers Pickett Proves Himself In Emotional Pittsburgh Homecoming

May 22, 2025

Steelers Pickett Proves Himself In Emotional Pittsburgh Homecoming

May 22, 2025

Latest Posts

-

Senatori Vklyuchayuchi Lindsi Grema Vimagayut Vid Trampa Konfiskatsiyi Rosiyskikh Aktiviv

May 22, 2025

Senatori Vklyuchayuchi Lindsi Grema Vimagayut Vid Trampa Konfiskatsiyi Rosiyskikh Aktiviv

May 22, 2025 -

Ukrayina Ta Viyskova Dopomoga Klyuchova Rol Linsi Grema

May 22, 2025

Ukrayina Ta Viyskova Dopomoga Klyuchova Rol Linsi Grema

May 22, 2025 -

Lindsi Grem Ta Senatori Zaklikayut Do Konfiskatsiyi Aktiviv Rf Vimogi Do Trampa

May 22, 2025

Lindsi Grem Ta Senatori Zaklikayut Do Konfiskatsiyi Aktiviv Rf Vimogi Do Trampa

May 22, 2025 -

Viyskova Dopomoga Ukrayini Linsi Grem Vistupaye Za Yiyi Vidnovlennya

May 22, 2025

Viyskova Dopomoga Ukrayini Linsi Grem Vistupaye Za Yiyi Vidnovlennya

May 22, 2025 -

Viyskova Dopomoga Ukrayini Grem Zaklikaye Do Yiyi Vidnovlennya

May 22, 2025

Viyskova Dopomoga Ukrayini Grem Zaklikaye Do Yiyi Vidnovlennya

May 22, 2025