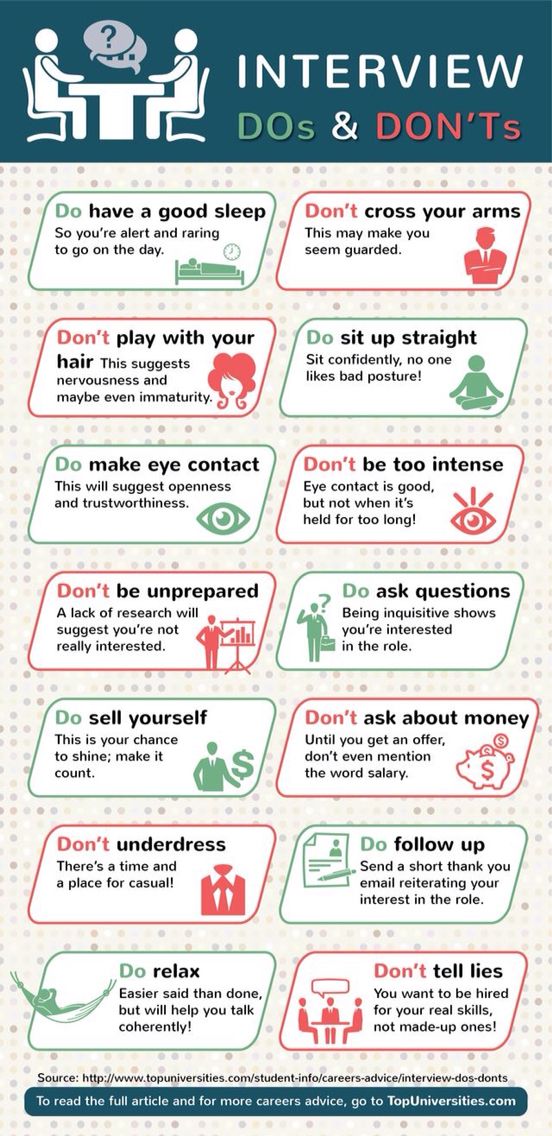

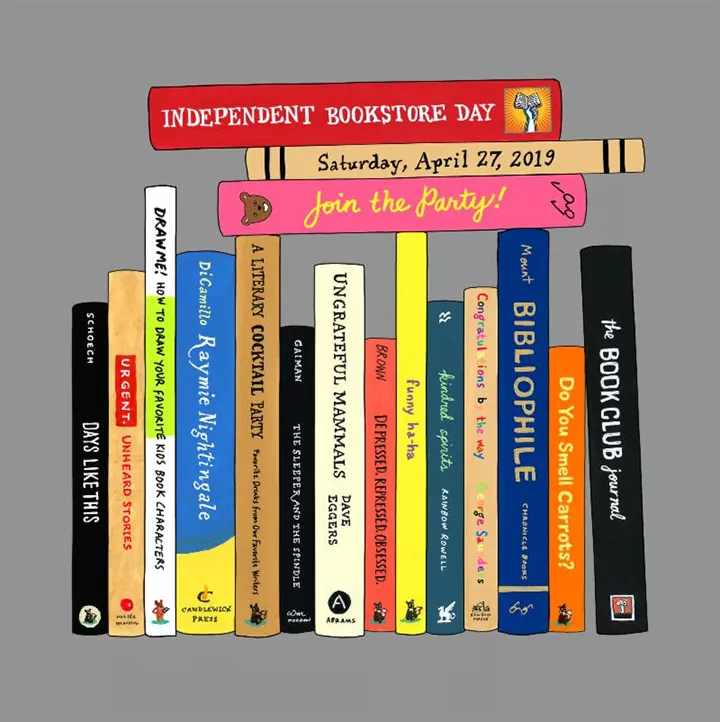

Navigate The Private Credit Boom: 5 Do's & 5 Don'ts For Job Seekers

Table of Contents

5 Do's for Securing Private Credit Jobs

Do 1: Network Strategically

Finding the right private credit job often relies heavily on networking. Don't underestimate the power of connections in this industry.

- Attend Industry Events: SuperReturn, PEI events, and other industry conferences are prime networking opportunities. These events bring together key players in private credit, providing excellent chances to meet potential employers and learn about open positions.

- Leverage LinkedIn: LinkedIn is an invaluable tool for connecting with professionals in private credit. Actively engage with posts, join relevant groups, and reach out to individuals working at firms you admire.

- Target Specific Firms: Research private equity firms, credit funds, and debt funds that align with your career goals. Identify key individuals within these organizations and build relationships with them.

- Informational Interviews: Request informational interviews with professionals in private credit to gain valuable insights into the industry and learn about potential career paths. These conversations can open doors to unexpected opportunities.

- Cultivate Genuine Connections: Networking isn't just about collecting business cards; focus on building genuine relationships based on mutual respect and shared interests.

Do 2: Tailor Your Resume and Cover Letter

Your resume and cover letter are your first impression. Make them count by highlighting your relevant skills and experience within the context of private credit.

- Highlight Relevant Skills: Emphasize skills such as financial modeling, credit analysis, due diligence, leveraged loan underwriting, and distressed debt analysis.

- Quantify Your Accomplishments: Use numbers to demonstrate the impact you've made in previous roles. Instead of saying "Improved efficiency," say "Improved efficiency by 15% resulting in X cost savings."

- Incorporate Keywords: Review job descriptions for common keywords (e.g., mezzanine financing, senior secured loans, subordinated debt) and incorporate them naturally into your resume and cover letter.

- Customize Each Application: Avoid generic applications. Tailor your resume and cover letter to each specific job and company to show genuine interest. Demonstrate you understand their specific needs and challenges.

Do 3: Master the Technical Skills

Private credit roles demand a strong technical foundation. Continuous learning and skill development are crucial for success.

- Financial Modeling Proficiency: Become highly proficient in Excel and other financial modeling software. Master advanced techniques like discounted cash flow (DCF) analysis and LBO modeling.

- Credit Analysis Expertise: Develop a deep understanding of credit analysis principles, including financial statement analysis, credit risk assessment, and covenant compliance.

- Debt Instrument Knowledge: Familiarize yourself with various debt instruments, including senior secured loans, subordinated debt, mezzanine financing, and distressed debt.

- Industry-Specific Software: Gain experience with industry-specific software and databases used in private credit analysis and portfolio management.

- Continuous Learning: Stay updated on industry trends and new technologies through professional development courses, conferences, and industry publications.

Do 4: Prepare for Behavioral Interviews

Behavioral interviews assess your soft skills and how you've handled past situations. Practice your responses to common questions.

- STAR Method: Use the STAR method (Situation, Task, Action, Result) to structure your answers and provide concrete examples of your skills and experiences.

- Highlight Key Skills: Emphasize teamwork, problem-solving, communication, and analytical skills, demonstrating their relevance to private credit roles.

- Showcase Passion: Express your genuine interest in the private credit industry and articulate your long-term career goals.

- Research the Firm: Thoroughly research the firm and the interviewer before the interview. Prepare insightful questions to demonstrate your engagement and understanding.

Do 5: Follow Up Effectively

After each interview, maintain communication and express your continued interest.

- Send Thank-You Notes: Send personalized thank-you notes to each interviewer, reiterating your interest and highlighting key discussion points from the interview.

- Periodic Follow-Up: Follow up with recruiters and hiring managers periodically to express your continued interest and enthusiasm for the position.

- Professionalism is Key: Maintain professionalism throughout the hiring process, responding promptly and courteously to all communications.

5 Don'ts for Securing Private Credit Jobs

Don't 1: Neglect Networking

Don't underestimate the importance of building relationships within the private credit industry. Networking is a crucial element of a successful job search.

Don't 2: Submit Generic Applications

Avoid generic applications. Take the time to tailor your resume and cover letter to each specific job and company.

Don't 3: Underestimate Technical Skills

Mastering the necessary technical skills is crucial for success in the competitive private credit job market. Don't underestimate the importance of these skills.

Don't 4: Underprepare for Interviews

Thorough preparation is key to a successful interview. Practice your answers, research the company, and prepare insightful questions.

Don't 5: Be Passive in Your Job Search

Actively pursue opportunities and don't hesitate to reach out to potential employers. A proactive approach significantly increases your chances of success.

Conclusion

The private credit job market is competitive, but rewarding. By following these five "dos" and avoiding the five "don'ts," you can significantly increase your chances of landing your dream job in this booming sector. Remember to network strategically, tailor your application materials, master the necessary skills, prepare thoroughly for interviews, and follow up effectively. Don't delay – start navigating the private credit boom today and find your perfect private credit job!

Featured Posts

-

George Santos Facing 87 Month Prison Sentence Recommendation

Apr 26, 2025

George Santos Facing 87 Month Prison Sentence Recommendation

Apr 26, 2025 -

Benson Boone Biografia Musica E Sucesso No Lollapalooza Brasil

Apr 26, 2025

Benson Boone Biografia Musica E Sucesso No Lollapalooza Brasil

Apr 26, 2025 -

Turning Poop Into Podcast Gold An Ai Powered Approach To Repetitive Document Analysis

Apr 26, 2025

Turning Poop Into Podcast Gold An Ai Powered Approach To Repetitive Document Analysis

Apr 26, 2025 -

Uk Fans Rejoice Kendrick Lamar And Sza Tour Dates Announced

Apr 26, 2025

Uk Fans Rejoice Kendrick Lamar And Sza Tour Dates Announced

Apr 26, 2025 -

Indie Bookstore Day Dutch Kings Day And Tumbleweeds Film Fest Your April Events Guide

Apr 26, 2025

Indie Bookstore Day Dutch Kings Day And Tumbleweeds Film Fest Your April Events Guide

Apr 26, 2025