Navigating Home Buying With Existing Student Loan Payments

Table of Contents

Assessing Your Financial Situation

Before you even start browsing properties, a realistic assessment of your finances is crucial. This involves understanding two key metrics: your debt-to-income ratio (DTI) and your credit score.

Understanding Your Debt-to-Income Ratio (DTI)

Your debt-to-income ratio is a critical factor in mortgage pre-approval. Lenders use your DTI to assess your ability to manage monthly debt payments alongside a new mortgage. The formula is simple:

DTI = (Total Monthly Debt Payments / Gross Monthly Income) x 100

- Calculate your DTI: Add up all your monthly debt payments (student loans, credit cards, car payments, etc.) and divide by your gross monthly income (before taxes).

- Impact of high DTI on mortgage approval: A high DTI can significantly reduce your chances of mortgage approval or limit the loan amount you qualify for. Lenders prefer a DTI below 43%, and ideally below 36%.

- Strategies to lower DTI:

- Aggressively pay down high-interest student loans.

- Consider refinancing your student loans to lower your monthly payments.

- Increase your income through a raise, side hustle, or additional employment.

Evaluating Your Credit Score

Your credit score is another crucial element in securing a favorable mortgage rate. A higher credit score typically translates to lower interest rates and better loan terms.

- Importance of a good credit score: Aim for a credit score above 700 for the best mortgage rates.

- Impact of late student loan payments: Late or missed student loan payments can severely damage your credit score, making it harder to qualify for a mortgage.

- Strategies to improve credit score:

- Make all student loan payments on time.

- Pay down existing credit card debt.

- Monitor your credit report regularly for errors.

Exploring Mortgage Options

Understanding different mortgage options is key to finding one that fits your financial situation and student loan obligations.

FHA Loans and Other Government-Backed Loans

Government-backed loans, such as FHA loans, USDA loans, and VA loans, are often more accessible to borrowers with student loan debt.

- FHA loan eligibility: FHA loans typically require a lower down payment (as low as 3.5%) and have more lenient DTI requirements than conventional loans.

- USDA loans: These loans are designed for rural properties and often offer attractive terms.

- VA loans: Offered to eligible veterans and military personnel, these loans often require no down payment.

- Benefits of government-backed mortgages: Lower down payment requirements, potentially more lenient DTI standards, and access to down payment assistance programs.

Conventional Mortgages and Private Mortgage Insurance (PMI)

Conventional mortgages are not backed by the government. If your down payment is less than 20%, you'll likely need Private Mortgage Insurance (PMI).

- Conventional loan requirements: These loans usually require a higher credit score and a lower DTI than government-backed loans.

- PMI explanation: PMI protects the lender in case you default on your loan. It's an added monthly expense.

- Understanding mortgage insurance premiums: PMI premiums vary depending on your credit score and down payment.

- Comparing conventional and government-backed loans: Carefully weigh the pros and cons of each option based on your specific financial circumstances.

Strategies for Managing Student Loans and Mortgage Payments

Once you've secured a mortgage, managing both student loan and mortgage payments effectively is critical.

Refinancing Student Loans

Refinancing your student loans could potentially lower your monthly payments, freeing up more cash flow for your mortgage.

- Benefits of student loan refinancing: Lower interest rates, lower monthly payments, and potentially a shorter repayment term.

- Factors affecting refinancing rates: Your credit score, income, and the type of student loans you have.

- Risks and considerations: Shop around for the best rates and carefully review the terms before refinancing.

Budgeting and Financial Planning

Creating a realistic budget is paramount to successfully managing both your student loan and mortgage payments.

- Budgeting apps and tools: Utilize budgeting apps like Mint or YNAB to track your expenses and create a comprehensive budget.

- Tracking expenses: Monitor your spending habits to identify areas where you can cut back.

- Creating a debt repayment plan: Develop a strategy to pay down your student loans and mortgage as efficiently as possible.

- Emergency fund importance: Build an emergency fund to cover unexpected expenses and prevent further debt accumulation.

Conclusion

Successfully navigating home buying while managing existing student loan payments requires careful planning and a thorough understanding of your financial situation. By assessing your DTI, improving your credit score, exploring various mortgage options, and implementing effective budgeting strategies, you can achieve your dream of homeownership. Remember to thoroughly research and seek professional advice from financial advisors and mortgage lenders to make informed decisions. Start planning your journey toward homeownership – begin navigating home buying with existing student loan payments today!

Featured Posts

-

Pga Championship Upset In Round One As Unexpected Leader Emerges

May 17, 2025

Pga Championship Upset In Round One As Unexpected Leader Emerges

May 17, 2025 -

The Red Carpets Rules Why Guests Continuously Violate Them

May 17, 2025

The Red Carpets Rules Why Guests Continuously Violate Them

May 17, 2025 -

Tom Hanks And Tom Cruise The 1 Debt That Wont Go Away

May 17, 2025

Tom Hanks And Tom Cruise The 1 Debt That Wont Go Away

May 17, 2025 -

The Josh Cavallo Effect A New Era For Lgbtq Athletes

May 17, 2025

The Josh Cavallo Effect A New Era For Lgbtq Athletes

May 17, 2025 -

May 16th Oil Market Report Prices Trends And Analysis

May 17, 2025

May 16th Oil Market Report Prices Trends And Analysis

May 17, 2025

Latest Posts

-

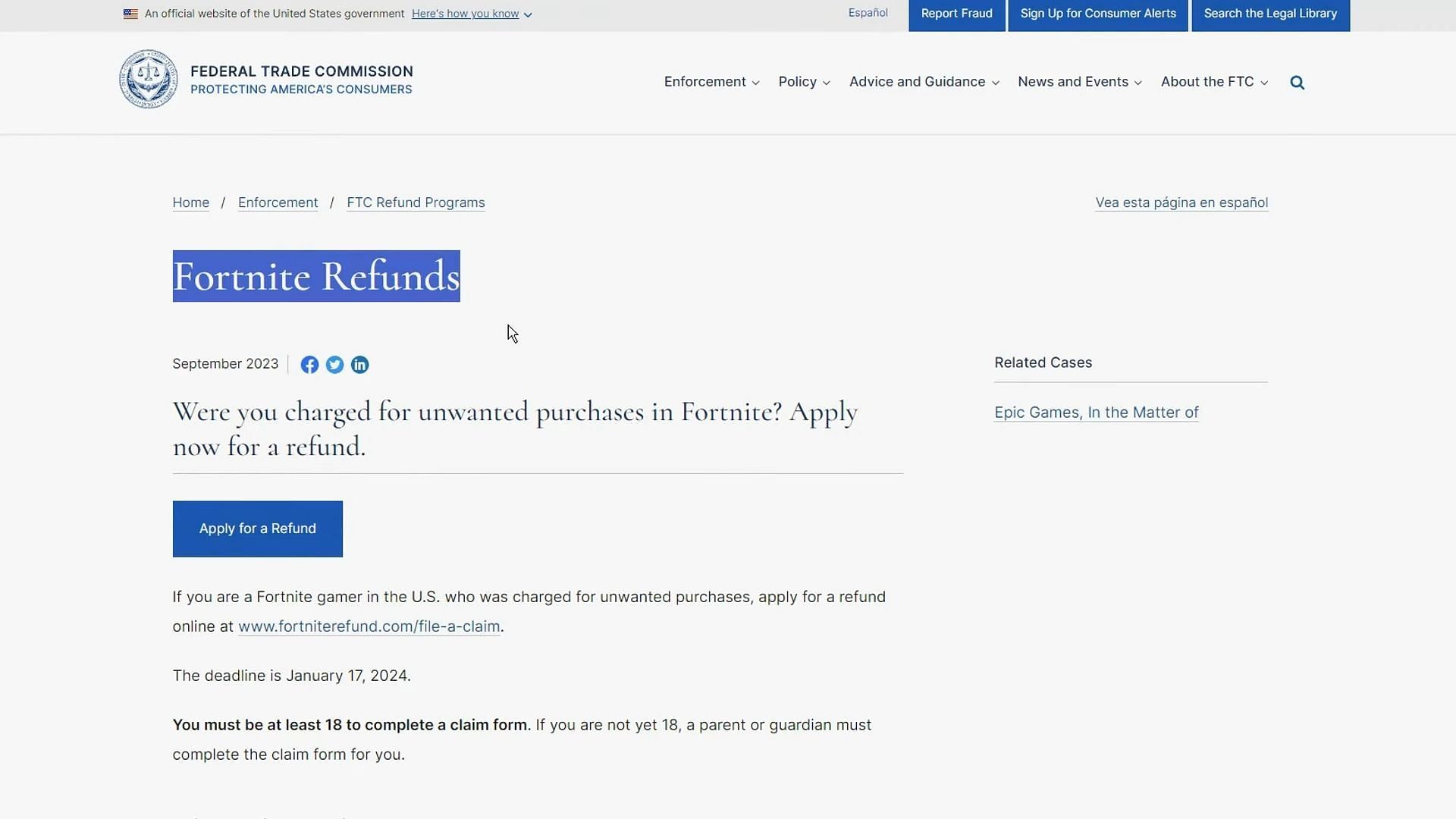

Major Fortnite Cosmetic Changes Suggested By Recent Refunds

May 17, 2025

Major Fortnite Cosmetic Changes Suggested By Recent Refunds

May 17, 2025 -

Lawsuit Claims Fortnite Maker Epic Games Employed Deceptive Practices On A Large Scale

May 17, 2025

Lawsuit Claims Fortnite Maker Epic Games Employed Deceptive Practices On A Large Scale

May 17, 2025 -

Fortnite Refund Policy Update Implications For Cosmetic Purchases

May 17, 2025

Fortnite Refund Policy Update Implications For Cosmetic Purchases

May 17, 2025 -

Epic Games Hit With Major Lawsuit For Allegedly Deceptive Business Practices In Fortnite

May 17, 2025

Epic Games Hit With Major Lawsuit For Allegedly Deceptive Business Practices In Fortnite

May 17, 2025 -

Fortnite Cosmetic Changes Refund Indicates Policy Shift

May 17, 2025

Fortnite Cosmetic Changes Refund Indicates Policy Shift

May 17, 2025